By Josh Nye

Bad news is bad news again

A number of dynamics were at play during the recent equity selloff and

bond rally, from disappointing corporate earnings reports to market

positioning, but we think growing concern about the health of the U.S.

labour market was central to this recent bout of volatility.

The surprise jump in the jobless rate in July wasn’t exactly an outlier as

far as data misses go, and most have been taken in stride to this point.

Cooling in the U.S. labour market was previously seen by investors as a

positive development–a “bad news is good news” dynamic–as it would allow

the U.S. Federal Reserve to gradually lower interest rates and relieve

pressure on businesses and households.

But with unemployment trending higher and the Fed yet to budge from its

restrictive stance, there is increasing concern among investors that the

central bank’s monetary policy is behind the curve and it’s too late to

prevent a further rise in the jobless rate. You know “bad news is bad

news” again when a disappointing jobs report leads to calls for

policymakers to make an emergency, inter-meeting rate cut.

“Rules are made to be broken”

Adding to the handwringing, the upside surprise in July’s unemployment

rate triggered the Sahm Rule, a reliable recession indicator that

investors have been keeping a close eye on. The Sahm Rule, named after

Claudia Sahm, a macroeconomist who worked at the Fed, states that “when

the three-month moving average of the national unemployment rate is 0.5

percentage point or more above its low over the prior twelve months, we

are in the early months of recession.”

The math sounds a bit convoluted (it was dreamed up by an economist, after

all) but it essentially says that, historically, when the jobless rate

increases meaningfully in a one-year period, it doesn’t tend to stop

there. When the Sahm Rule has been triggered in the past, the unemployment

rate has gone on to increase by at least two percentage points from its

cycle lows and the U.S. economy has experienced a recession.

But the Sahm Rule was never meant as a recession predictor, and Claudia

Sahm herself calls it “a historical pattern, not a law of nature.” She

adds that “rules are made to be broken” and if her eponymous rule is to

break, this unusual post-pandemic cycle could be the occasion.

Indeed, there are reasons to think this time is different. The current

unemployment rate is the lowest at which the Sahm Rule has been triggered

since 1953. Thus far, the U.S. labour market has simply eased from

previously tight levels to conditions that could still be characterised as

consistent with “full employment.” Despite rising joblessness, there

continue to be more vacancies than unemployed persons.

The concern, though–and the dynamic captured in the Sahm Rule–is that

layoffs will beget more layoffs as a precautionary pullback in consumer

spending causes businesses to reduce headcount. But as RBC Capital Markets

points out, the Sahm Rule has been triggered without the usual increase in

job losses. At this point, the rise in unemployment has been driven more

by new entrants into the labour force having difficulty finding a job,

resulting in a loss of potential income rather than actual income.

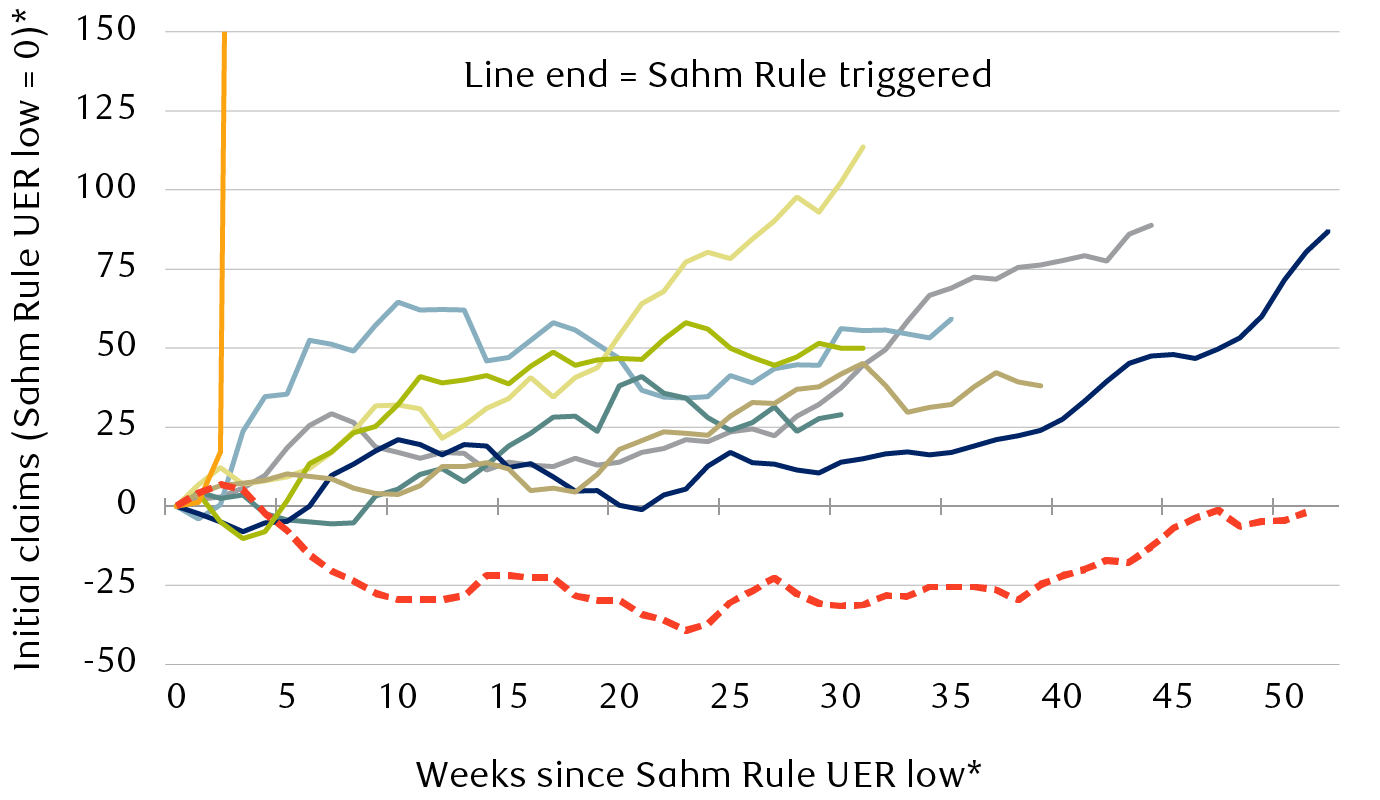

The Sahm Rule has been triggered without the usual increase in jobless

claims

Change in initial jobless claims (thousands) between unemployment rate low

and Sahm Rule trigger

The line chart shows the change in the weekly U.S. unemployment rate

for nine periods, each of which begins with a low point in the

unemployment rate and ends with the triggering of the Sahm Rule. In

all previous periods (1970, 1974, 1980, 1981, 1990, 2001, 2008, and

2020), the change in jobless claims was largely positive, and followed

a generally upward trend. In 2024, however, the change remained

negative for more than 50 weeks until the Sahm Rule was triggered.

-

1970

-

1974

-

1980

-

1981

-

1990

-

2001

-

2008

-

2020

-

2024

*UER stands for unemployment rate.

Source – RBC Capital Markets

Consumer spending has held up thus far and there are few signs of an

increase in precautionary savings as households brace for a slowdown. The

Q2 earnings season saw some management teams express concern about the

health of the U.S. consumer. But with the economy growing by 2.8 percent

in Q2 and the Atlanta Fed tracking a similar increase in Q3, we think

there’s reason to doubt we’re in the early months of a recession.

Sahm story in Canada?

Sahm proposes a similar rule for Canada using a slightly higher 0.6

percentage point trigger for the increase in the unemployment rate. But

the Canadian version doesn’t have as spotless a record as in the U.S.,

which could be why it attracts less attention. There was little fanfare

when it was triggered late last year, and certainly no calls for an

emergency rate cut by the Bank of Canada.

Layoffs account for a larger share of the increase in unemployment

compared with the U.S., but other factors are also at play in Canada. In

the two years since Canada’s unemployment rate troughed, students entering

the labour force and failing to find a job have accounted for as much of

the increase in unemployment as have permanent layoffs.

Immigration has boosted Canadian labour force growth to an even greater

degree than in the U.S. But the economy has had difficulty creating enough

jobs to absorb all of these new entrants, and nearly half of the increase

in unemployment has been among recent immigrants and non-permanent

residents.

Unlike in the U.S., Canada’s household savings rate is trending higher and

consumer spending has been sluggish, slowing on a per capita basis over

the past two years. Canada has avoided two consecutive quarterly declines

in headline GDP but could be said to be in a “per capita recession” with

population-adjusted GDP down more than 3.5 percent from its cycle highs. A

1.6 percentage point increase in the unemployment rate from its cycle lows

is also consistent with past “mild” recessions.

It pays to be defensive

Unusual post-pandemic labour market dynamics leave room for hope that this

time will indeed be different. But leaving room for hope is much different

than positioning entirely for a soft landing, and we think some of the

recent financial market volatility reflects investors in the latter camp

being caught by weaker-than-expected economic data.

Whether the current period will prove to be a growth scare or the early

stages of a recession is still unknown. But we think investors should

evaluate defensive options in their portfolios, as advocated in the August

Global Insight. We recently examined some of the

nagging questions

facing equity markets and suggested holding no higher than a Market Weight

position in U.S. and global equities.

While fixed income has rallied amid deteriorating economic data and

growing rate cut expectations, current yields remain attractive relative

to much of the past two decades. Tight corporate bond spreads mean

investors are receiving limited compensation for taking on credit risk,

leading us to favour higher-quality corporate and government bonds. In our

assessment, investors who haven’t already taken the opportunity to add

some duration and lock in today’s high yields for longer should consider

doing so on market pullbacks.

This publication has been issued by Royal Bank of Canada on behalf of certain RBC ® companies that form part of the international network of RBC Wealth Management. You should carefully read any risk warnings or regulatory disclosures in this publication or in any other literature accompanying this publication or transmitted to you by Royal Bank of Canada, its affiliates or subsidiaries.

The information contained in this report has been compiled by Royal Bank of Canada and/or its affiliates from sources believed to be reliable, but no representation or warranty, express or implied is made to its accuracy, completeness or correctness. All opinions and estimates contained in this report are judgments as of the date of this report, are subject to change without notice and are provided in good faith but without legal responsibility. This report is not an offer to sell or a solicitation of an offer to buy any securities. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. Every province in Canada, state in the U.S. and most countries throughout the world have their own laws regulating the types of securities and other investment products which may be offered to their residents, as well as the process for doing so. As a result, any securities discussed in this report may not be eligible for sale in some jurisdictions. This report is not, and under no circumstances should be construed as, a solicitation to act as a securities broker or dealer in any jurisdiction by any person or company that is not legally permitted to carry on the business of a securities broker or dealer in that jurisdiction. Nothing in this report constitutes legal, accounting or tax advice or individually tailored investment advice.

This material is prepared for general circulation to clients, including clients who are affiliates of Royal Bank of Canada, and does not have regard to the particular circumstances or needs of any specific person who may read it. The investments or services contained in this report may not be suitable for you and it is recommended that you consult an independent investment advisor if you are in doubt about the suitability of such investments or services. To the full extent permitted by law neither Royal Bank of Canada nor any of its affiliates, nor any other person, accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or the information contained herein. No matter contained in this document may be reproduced or copied by any means without the prior consent of Royal Bank of Canada.

Clients of United Kingdom companies may be entitled to compensation from the UK Financial Services Compensation Scheme if any of these entities cannot meet its obligations. This depends on the type of business and the circumstances of the claim. Most types of investment business are covered for up to a total of £85,000. The Channel Island subsidiary is not covered by the UK Financial Services Compensation Scheme; the office of Royal Bank of Canada (Channel Islands) Limited is a participant in the Jersey Bank Depositors Compensation Scheme. The Scheme offers protection for ‘eligible deposits’ up to £50,000 per individual claimant, subject to certain limitations. The maximum total amount of compensation is capped at £100,000,000 in any 5 year period. Full details of the Scheme and banking groups covered are available on the Government of Jersey’s website www.gov.je/dcs or on request.