RiverNorthPhotography/iStock Unreleased via Getty Images

Introduction

Alpine Income Property Trust (NYSE:PINE) is a U.S. based, retail focused REIT with 137 net lease properties spread across 34 different states. As of Q2 FY2024, they reported a 99.1% occupancy rate. This stacks up well against peers, as the average occupancy rate for publicly traded U.S. retail REITs was only 96.5% as of April this year.

Since their IPO back in 2019, they have grown their property count by nearly 7x and expanded from $13.3mn in annualized base rent (ABR) to $39.8mn. Additionally, through expansion they have diversified their tenant base as their top tenant as a percentage of annualized base rent has fallen from 21% at IPO to 12% as of Q2 FY2024.

Most of their tenants are also credit rated, which bodes well for the reliability of rent payments moving forward. The percentage of ABR that comes from investment grade rated tenants hit a new high at 67% this quarter, which again is a positive for the reliability of rent payments going into the future. This number can fluctuate over time, as evidenced by the fact that over seven years, 29.4% of A-rated companies and 42.5% of BBB-rated companies lost their investment grade status.

Many of their properties are also located in densely populated areas such as Houston, Atlanta, Chicago, and New York. Properties within these cities have a weighted average 5-mile average household income of $117k, which means the businesses who rent from Alpine are less susceptible to economic slowdowns.

PINE currently presents a very interesting investment opportunity given their strong projected growth in addition to their well staggered maturity ladder. There also appears to be very little downside risk due to the shares being undervalued relative to the rest of the sector. Finally, their dividend yield is currently very high relative to the rest of the REIT sector, and they currently are distributing their cash flow at a conservative rate that leaves room for dividend hikes in the future. Considering all of this, I currently believe that shares of Alpine Income Property Trust to be a BUY.

Q2 Growth/Strategy

In the second quarter, PINE sold two properties that housed investment grade tenants for $6.6mn at a weighted-average cap rate of 7%. The proceeds from this deal and excess free cash flow from previous quarters were then used to acquire a $14.6mn property that was accretive to AFFO per share.

Management also highlighted how they are “actively pursuing a reduction in Walgreens exposure”, with two Walgreens (WBA) properties currently in the sales process. Walgreens has been the second worst performing stock in the S&P 500 this year, behind only Intel. Detaching themselves from this brand is ideal, as it should mitigate potential risks going forward. Walgreens was also downgraded two notches to ‘BB’ by S&P a few weeks ago, highlighting potential default risk in the future. Unfortunately, Walgreens is currently their largest tenant as a percentage of ABR at 12%. Considering Walgreens has not defaulted on any of their debt obligations thus far, and Alpine has begun the process of distancing themselves from the brand, I believe the risk here is relatively minor.

Management is also focused on future growth as their AFFO payout ratio is only 68.32% in the TTM compared to the sector median of 73.39%. This conservative payout structure allows them to pursue more accretive deals, such as the one mentioned a few paragraphs above. Given their 3-year AFFO per share CAGR of 12.73%, this is clearly the best method of allocating capital. It is also much easier for firms of this size (market cap $231mn) to pursue accretive deals that will grow AFFO per share.

Guidance was also raised for both FFO and AFFO by 4.2%, mainly due to the acquisitions and divestitures mentioned earlier. PINEs 2024 estimates AFFO per share growth is the second highest among its peers, while their multiple is the lowest. This divergence represents an opportunity for investors, as prices should correct over time. As the famous investor Benjamin Graham says, “in the short run, the market is a voting machine, but in the long run, the market is a weighing machine.”

Alpine Investor Relations

Balance Sheet

PINE currently has no debt maturing until May of 2026. Considering the extremely high likelihood of the FED reducing its target rate over the coming months, the cost of borrowing debt should reduce drastically. This gives PINE financial flexibility and the ability to borrow and invest in properties that are accretive to shareholder value.

In their investor presentation they also highlight how they have “minimal floating interest rate exposure” which further reduces risk. Additionally, they have access to over $184mn of liquidity through cash and undrawn revolving credit facilities. If retail properties begin to fall in value or existing owners begin to default when debt matures, PINE is in a fantastic position to potentially acquire these properties at a discount to their intrinsic value.

Many of their debt ratios also compare favorably against peers. For example, their debt to EBITDA ratio of 7x is in the middle of their peer group. This puts PINE in a less vulnerable financial position if inflation begins to rise again and the FED decides to maintain elevated rates over the next few years.

YCharts

Dividend

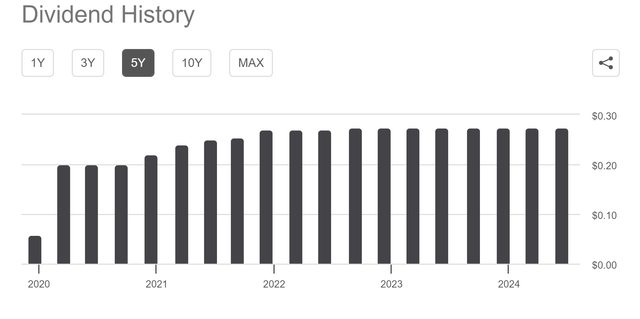

As mentioned earlier, the current AFFO payout ratio is very conservative at 68%, which leaves room for dividend hikes in the future. The dividend yield over the TTM is already extremely solid at 6.48%, which is 50% higher than the sector median. Dividend per share growth, however, has been relatively muted (0% in the TTM). This appears to be a trend, as the quarterly dividend has remained in the $0.27-$0.28 per share range since the end of FY2021.

While this may scare away some REIT investors who are all about chasing the fastest growing, highest yielding dividend stocks, I would like to remind you all that this company is reinvesting to grow their AFFO per share. Paying out a conservative portion of their cash flow is intelligent and shows that management believes in growing the firm to compete with some of the other net lease retail giants in the market. This should excite investors, not scare them.

Seeking Alpha

Risks

One of the primary risks to my investment thesis is the reliance on dollar store brands. The dollar store sector currently represents the highest portion of PINE’s ABR, which is worrisome. Considering the recent underwhelming jobs report that triggered the Sahm rule, there is growing concern amongst economists that we may be on the brink of a recession. Recessions tend to disproportionately impact lower income consumers, and this is the demographic of consumer that tends to shop at dollar stores.

If consumer spending slows, these businesses will be under pressure and will potentially have their credit ratings downgraded. The risk of insolvency during periods of economic distress is much greater, especially for businesses that are reliant on consumer discretionary spending.

Alpine Investor Relations

There are also many experts who believe that there is a much greater chance that the FED has executed the often elusive “soft-landing” which would be fantastic news for PINE and its tenants. I tend to be an optimist, and considering the resiliency of the U.S. consumer throughout the past few quarters, I don’t believe this poses a massive risk to PINE.

Valuation

I want to begin by discussing prominent analysts and their opinion on the stock. PINE currently has a “STRONG BUY” rating from both Wall Street analysts and Seeking Alpha quant scores, which aids my investment thesis. Of the 10 analysts covering this company, 7 have issued a “STRONG BUY”, 2 a “BUY” rating, and only one believes shares are currently a “HOLD”, which shows how bullish analysts currently are on the firm’s future prospects.

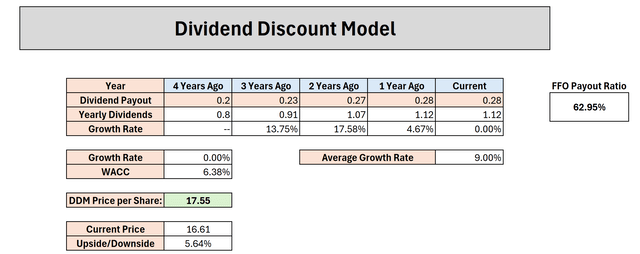

I decided to build a dividend discount model to try and obtain an intrinsic value of the stock.

To calculate the weighted average cost of debt, I began by looking at their balance sheet to find all of their interest-bearing liabilities. The first portion was their current portion of leases, which amounted to $1.315mn. The weighted average cost of debt on these leases was 2%. I then looked at their long-term debt, which was $269.6mn as of the end of the second quarter. The weighted average interest rate on these loans was 3.75%. Combining these two sections, I obtained a weighted average cost of debt of 3.74%.

SEC

Our final WACC figure came out to 5.33% which I used as the discount rate in the dividend discount model. Seeking Alpha analysts’ consensus estimate for the next 3 years of dividend growth is 1.61%, which I view as a realistic growth rate going forward considering management’s focus on reinvesting FFO into new properties.

The implied price per share using these inputs is $30.56 which represents 83.97% upside from current share price levels. If we use a more conservative discount rate by applying the average cost of debt (4.5%) and cost of equity (8.63%) for the sector, we get an implied share price of $23.84 (43.55% upside).

Using the same average discount rate and a dividend growth rate of 0% moving forward, we still get an implied price per share of $17.55, 5.64% upside from the current share price. Regardless of the inputs used, it appears that the stock is currently undervalued.

Dividend Discount Model (Author)

Takeaways

PINE currently presents a great opportunity for investors who want exposure to the small-cap REIT sector. I believe that stock-picking, especially amongst small-cap names, can be a winning strategy over the long run. The strong growth projected in AFFO along with the accretive acquisitions recently carried out show that management is working diligently to increase shareholder value and I believe that as rates go down and more investors begin to reallocate capital from treasuries to REITs that this name should be a beneficiary.

As highlighted above, there are some risks as some of Alpine’s tenants are more exposed to macroeconomic conditions and a deterioration of such conditions could lead to issues down the line. I believe that these risks are unlikely to materially impact PINE; however, they must be considered when evaluating the stock.

Finally, the attractive valuation, even using conservative inputs, gives investors a larger than average margin of safety. The upside potential is high given the small size of the firm and the conservative FFO payout ratio. Patience is key when trying to invest in seemingly undervalued firms; therefore, one must have strong conviction before buying into a name like PINE. I, personally, believe the upside potential is very high, and downside risk is muted, and therefore I am rating PINE a BUY.