Town hall bosses suspect a businessman has set up a ‘tactical’ snail farm in a city centre office block as part of a bizarre scam to avoid paying tax.

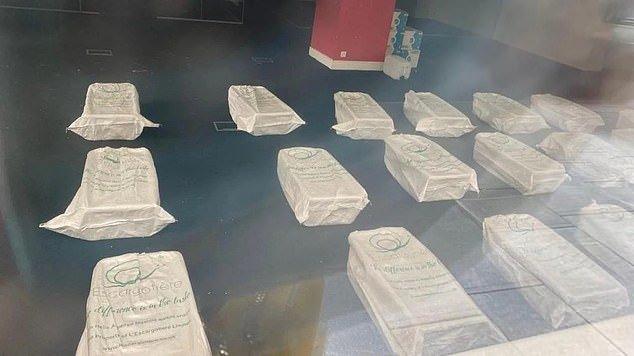

Around 30 snails are allegedly being kept in 15 crates on the ground floor at Imperial Buildings, in Dale Street – a main thoroughfare in the business district of Liverpool city centre.

Under current legislation this means the office could qualify as being used for agriculture, meaning it could be exempt from expensive business rates.

Unlike tax evasion, tax avoidance is not a criminal offence. But it is estimated that schemes to minimise and avoid tax across the UK cost about £1.8bn last year.

According to the BBC, the firm renting the space is named Snai1 Primary Products 2023 Ltd, which is run by sole director Terence Ball.

Around 30 snails are allegedly being kept in 15 crates on the ground floor at Imperial Buildings, Dale Street – a main thoroughfare in the business district of Liverpool city centre

Mr Ball is also the director of BoyceBrook, which describes itself as an ’empty property rates solutions’ firm.

It’s website states it has a ‘proven track record of minimising the liability for empty property rates’ and also boasts ‘no empty property rates payable – BoyceBrook, Canceller of the Exchequer.’

Business rates for Imperial Buildings would be around £61,000 a year, although it is not known whether the snail farm lease is for the entire complex or just the lower ground floor.

Mr Ball also runs two other snail firms, including L’Escargotiere. All three are based in Ribchester, a village in the Ribble Valley, near Preston, Lancashire.

Mr Ball insists the snail farm is a legitimate business.

He told BBC News that 15 crates containing two snails each could ‘create 1000 snail eggs, in the right environment’.

Other snail farmers around the UK, however, told the BBC so few snails would not make a viable trade.

‘You need thousands of snails, otherwise there’s no business,’ one said.

Although no agricultural exemption has been applied for, a spokesman for Liverpool city council said the use of snail farms to avoid paying business rates was a ‘tactic that has been attempted’ in the city.

Sources told the Mail that if Snai1 Primary Products 2023 Ltd attempted to apply for an exemption it would likely be refused and investigated.

Business rates for Imperial Buildings (pictured) would be around £61,000 a year, although it is not known whether the snail farm lease is for the entire complex or just the lower ground floor

Mr Ball did not respond to the council’s suggestion the snail farm was a tax avoidance scheme, but claimed he had informed the council and the Valuation Office Agency (VOA) when it rented the space and ‘provided full details of the current legislation required for exemption, which unfortunately is mostly ignored’.

According to the L’Escargotiere website, the firm breeds and sells Helix Aspersa Muller – common European garden snails – to ‘superior restaurants, prestigious hotels and gastro pubs’ in 1kg bags for £14 each.

In 2021, the High Court ruled that a snail farm tenancy deal between a landlord in Leeds and the management company Crusader, where Mr Ball was also a director, was a ‘sham’.

The landlord agreed to pay 20 per cent of the business rates to Crusader, and in return Crusader agreed to implement a scheme to help them achieve their ‘rate avoidance objective.’

A spokesman for Liverpool City Council said, to date, no commercial firm had been exempted from paying business rates in the city on the basis of agricultural use.

He added: ‘The council’s Business Rates Team continues to monitor the situation closely and will not hesitate to take further action and challenge such tactics to protect public funds and maintain a fair and efficient tax system for all ratepayers.’

Advertisement