The frozen income tax thresholds have led to more than a million extra tax letters, new figures reveal – primarily affecting pensioners and savers

The freezing of income tax thresholds has resulted in over a million additional tax demands, according to recent statistics. The Conservatives initiated the freeze in 2021, and it has since been prolonged, with current Chancellor Rachel Reeves declaring in her November budget that it will persist until 2031.

There’s mounting worry that ‘fiscal drag’ has pulled millions more people, including many of the country’s lowest earners, into the tax net. This situation has arisen as the lowest income tax threshold has remained static at £12,570 since 2021, while wages have steadily risen due to inflation.

These thresholds dictate how much individuals can earn before they start paying tax, currently set at £12,570 for the basic 20 per cent band, £50,270 for the higher 40 per cent band, and £125,140 for the additional 45 per cent band.

The Times disclosed that the number of pensioners and savers hit by end-of-year tax bills has doubled in two years, figures reveal. Experts attribute this increase to frozen tax thresholds and the escalating state pension, leading to a surge in simple assessment letters from HM Revenue and Customs (HMRC).

Over 1.32 million people received brown letters informing them of their tax dues in the 2023-24 financial year, a significant rise from 675,000 in 2021-22, based on data from a freedom of information request to HMRC.

HMRC conducts a straightforward assessment for individuals who owe tax on their income but no longer have a PAYE code to deduct tax at the source. This mainly affects pensioners, but can also impact savers who owe tax on their interest if it exceeds the £1,000 personal allowance.

The sums demanded in simple assessments are typically small. Nearly a quarter of those issued in 2023-24 were for less than £100, and half of all demands were for less than £300, according to HMRC.

This comes as more retirees find themselves paying income tax for the first time since they stopped working, due to static tax thresholds colliding with the rising state pension.

The full state pension will increase to £12,548 per year in April thanks to the triple lock, which ensures the benefit rises each year by the highest of inflation, wage growth or 2.5 per cent.

As a result, the payment will be just shy of surpassing the tax-free personal allowance, which is frozen at £12,570 until at least 2031. The allowance has remained unchanged since April 2021.

The state pension is projected to exceed the personal allowance in April 2027. Of the 13 million state pensioners, around 9 million receive the old version (pre-2016), which can be significantly more advantageous than the new version.

This is due to an additional earnings-related system from the 1970s, as well as generous increases for deferring the pension by a year or more.

These extra payments might leave a pensioner facing a tax bill.

Steve Webb, a former pensions minister now working as a partner at consultancy firm LCP, said: “The continued freezing of the income tax personal allowance means that the numbers getting unwelcome end-of-year tax demands have soared.”

Numerous individuals affected will be pensioners whose sole source of income is the state pension, and they’re now receiving an annual tax bill, with the sums increasing each year.

“Although the government has indicated it may address this issue for a subset of pensioners from 2027, a much wider-ranging solution is needed.”

LCP predicts that the figure of people receiving simple assessments will surpass two million when figures for 2024-25 emerge in the coming tax year.

During last year’s autumn budget, Chancellor Rachel Reeves revealed that, from April 2027 onwards, those whose only income is the full new state pension will be relieved from paying income tax. The details of how this measure will be rolled out remain to be revealed.

HMRC confirmed that the matter was one for the Treasury, as it relates to governmental decisions. HM Treasury was contacted for comment.

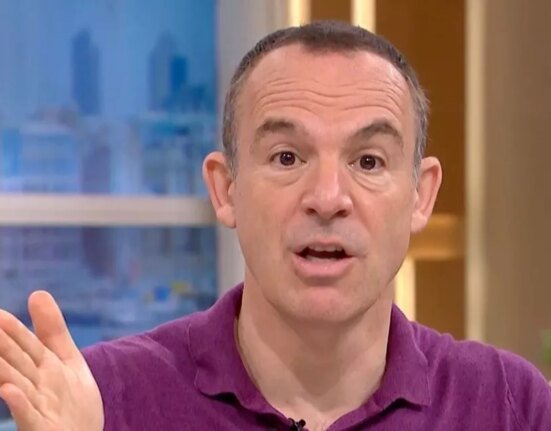

Personal finance guru Martin Lewis quizzed the Chancellor following last November’s budget about pensioners who will find themselves just above the threshold. Mr Lewis highlighted that the full new State Pension stands at £12,558 whilst the personal allowance remains frozen at £12,570 until 2031 – the sum an individual can earn without paying tax each year.

Mr Lewis has pointed out that from April 2026, the new state pension will sit £30 beneath the allowance. He went on to say: “So anyone who’s got any other form of earnings – well you’re going to go over it if you’ve got the full new state pension you will have to pay tax.

“But from 2027 because we know the state pension has to rise by a minimum 2.5 per cent because of the triple lock here’s a projection. The minimum it could rise because of the triple lock 2027 it’s going to be about £12,861, £300 more than the tax free allowance as that’s staying stable and it will go more and more and more.”

Based on forecasts from the Martin Lewis Money Show Live, the minimum new state pensions calculated on the smallest increase would reach £12,861 in 2027, £13,183 in 2028, £13,512 in 2029 and £13,850 in 2030. He went on to say: “So you can see the issue that’s going on. My main concern was the admin. How are we going to have 90-year-olds doing self assessment forms when they’re only earning £50 over the limit?” Mr Lewis harked back to his chat with Chancellor Rachel Reeves post-budget, where he posed a question from a viewer named Rebecca: “Does my 85-year-old father who is living with dementia now have to complete a tax return as his state pension will take him over the personal allowance.”

Ms Reeves replied: “So if you just have a state pension and you don’t have any other pension you don’t have to fill in a tax return. I make that commitment for this Parliament. You’re right 2027 looks like the time it will cross over. We are working on a solution as we speak to ensure we’re not going after tiny amounts of money.”

Mr Lewis questioned: “People will have to pay the tax, they just won’t have to do a return or will they not have to pay the tax?” Ms Reeves responded: “In this Parliament they won’t have to pay the tax. Further out I’m not able to make any commitments.”

On his ITV programme, he further commented: “What I find interesting is imagine someone who is a little bit off the full state pension. And they had a very small private pension but they still earned less than the full state pension. Under those rules they would have to pay tax and therefore they would be punished for having a private pension. Which is why I think the thing isn’t fully thought through yet.”