Giulio Fornasar/iStock via Getty Images

SPG Stock: I used to like it too

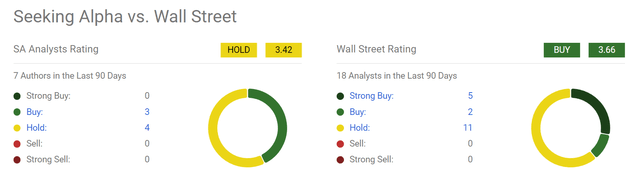

Wall Street analysts are currently bullish on Simon Property Group (NYSE:SPG). More specifically, the chart below summarizes the current sentiment on SPG stock from Wall Street. As seen, SPG stock currently receives a solid buy rating (with an average rating of 3.66). In the last 90 days, 18 Wall Street analysts have weighed in on the stock, with 5 strong buy ratings, 2 buy ratings, 11 hold ratings, and no sell or strong sell ratings.

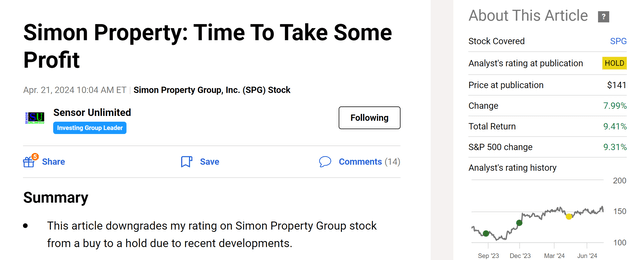

I used to love the stock too – with “used to” being the operative word. As you can see from the chart below, I wrote two articles in 2023 to argue for a bullish position on the stock. Then recently (about 3 months ago), I changed my bullish thesis in an article entitled, “Simon Property: Time to Take Some Profit“. In that article, I downgraded my rating from a buy to a hold. To wit, the downgrade was based on the following considerations:

This article downgrades my rating on Simon Property Group stock from a buy to a hold due to recent developments. The bullish catalysts I saw in 2023 have largely run their course. The performance rebound has already occurred, with occupancy levels reaching my expected range. Valuation discounts have disappeared and the company’s leverage has become more concerning.

That article’s focus was thus on the closing of the valuation gap, especially on a leverage-adjusted basis. In this article, I want to examine the downgrade from a different perspective: the dividend payouts. I think its current debt obligations will limit the dividend growth potential going forward and may even force it to reduce the quarterly payout if operating conditions were to take a downturn. Given its REIT status and the sizable role of the dividends in its investment thesis, I think Wall Street’s buying rating substantially underestimated the risks on this front.

SPG stock: dividend in focus

As a REIT stock, SPG pays out a large portion of its earnings as dividends. And its generous dividends are indeed a strong draw for income-oriented investors and provide sizable downside protection. To illustrate my point, the chart below shows SPG’s stock price changes (top panel) and total return levels (bottom panel) for the past 5 years. As seen, SPG stock prices experienced significant volatility from 2020 to 2021 due to the COVID-19 pandemic. All told, the stock prices essentially moved sideways with a slight decline of 3.8%. Despite the price volatility and lack of an overall upward trend, SPG’s total return has been a respectable 28.75% during this period – all thanks to its generous dividend payouts.

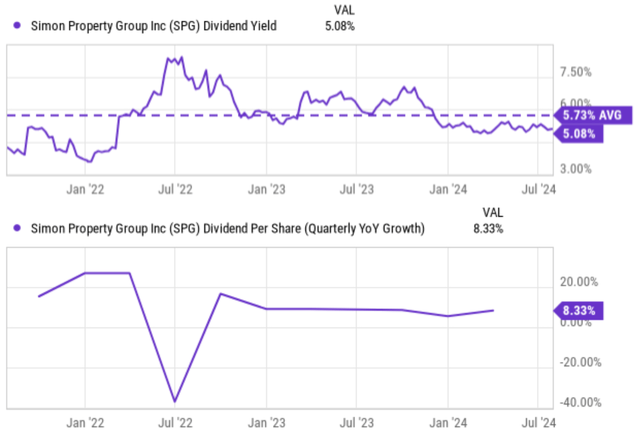

As seen in the next chart below (top panel), the stock has provided an average yield of 5.73% in the past few years, an attractive level both compared to bond yields or other peers. As a further positive, the bottom panel of the chart shows that SPG’s dividend per share has been growing steadily after the deep cut amid the pandemic. In recent quarters, the year-over-year growth rate is about ~8% on a per-share basis.

Given the large role of its dividends in its return profile, I will next argue that Wall Street’s buying rating substantially underestimated the risks involved with the growth prospects and safety of its dividends.

SPG stock: limited dividend growth potential

The chart below shows the cash from operations and net debt for SPY. As seen, the cash flow from operations has recovered strongly from the COVID pandemic (the reason for my earlier bull thesis). There was a significant drop in cash from operations in 2020 due to the COVID-19 pandemic to a bottom of $2.3 billion. Since then, the figure has rebounded to the current $3.8, on par with its pre-pandemic level. However, the bad news is that net debt has also increased over this period. Its current net debt sits at $24.8 billion, in comparison to $24B in 2019 before the pandemic.

The change in debt levels seems small enough. However, the borrowing rates have gone up substantially since then. As a result, the combination of higher debt and higher borrowing rates has made it much harder for SPG to service its debt. More specifically, the chart below shows the interest expenses for SPG stock in recent years. As seen, its total interest expenses were about $789 M in 2019 before the pandemic. The figure now hovers around $885 M, more than 12% higher compared to the 2019 level. On a TTM basis, SPG paid a total of $2.48 billion in dividends. Thus, the sum of its interest expenses and dividends is around $3.36 billion. Recall that its TTM operating cash flow is about $3.87 billion, this does not leave much elbow room should its operations hit any bump down the road (let alone increasing the payouts at the pace it used to in recent years).

Other risks and final thoughts

There are a few other risks, both in the upward and downward directions, which are worth mentioning before closing. Besides the issues mentioned above, SPG also faces risks inherent to the real estate industry such as economic downturns, interest rate uncertainties, and the ongoing shift in consumer shopping habits towards online e-commerce. I commented earlier that SPG’s dividends are generous and have played a large role in its overall return profile. But if you recall from an earlier chart, its current dividend yield of 5.08% is well below its historical average of 5.73%, indicating overvaluation risks (the focus of my last article).

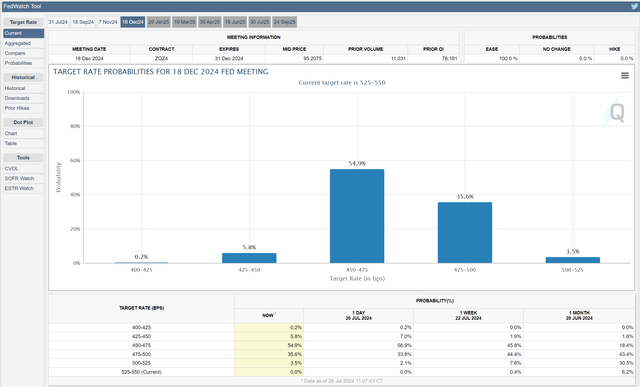

In terms of upside risks, the most important and immediate one is the potential of an interest cut (or cuts). Judging by the federal funds’ futures contracts monitored by the CME Group (see the next chart below), there are large odds for the Fed to cut interest rates in the near future. For example, the data below shows a 3.5% probability for interest rates to remain unchanged by the end of 2024 and zero probability for an interest rate increase, thus translating into a dominant probability of 96.5% for at least one cut of 25 basis points by 2024. A rate cut (or cuts) would ameliorate the interest expense issue for SPG and provide it with more capital allocation flexibility.

To conclude, I do not see anything horrible wrong with holding SPG shares under current conditions, even at some valuation premium. However, most of the bullish catalysts I considered earlier have run their course by this time. As such, I do not see a compelling reason to buy anymore. My last article examined this change in terms of the close of the valuation gap. This article examined the dividend payouts, a substantial source for its total return potential. My assessment shows very limited growth potential here and a non-negligible chance of a dividend cut given the tight cash allocation.