LUBBOCK, Texas (KCBD) – If your home insurance premium has skyrocketed, you’re not alone.

It’s a trend seen across the state.

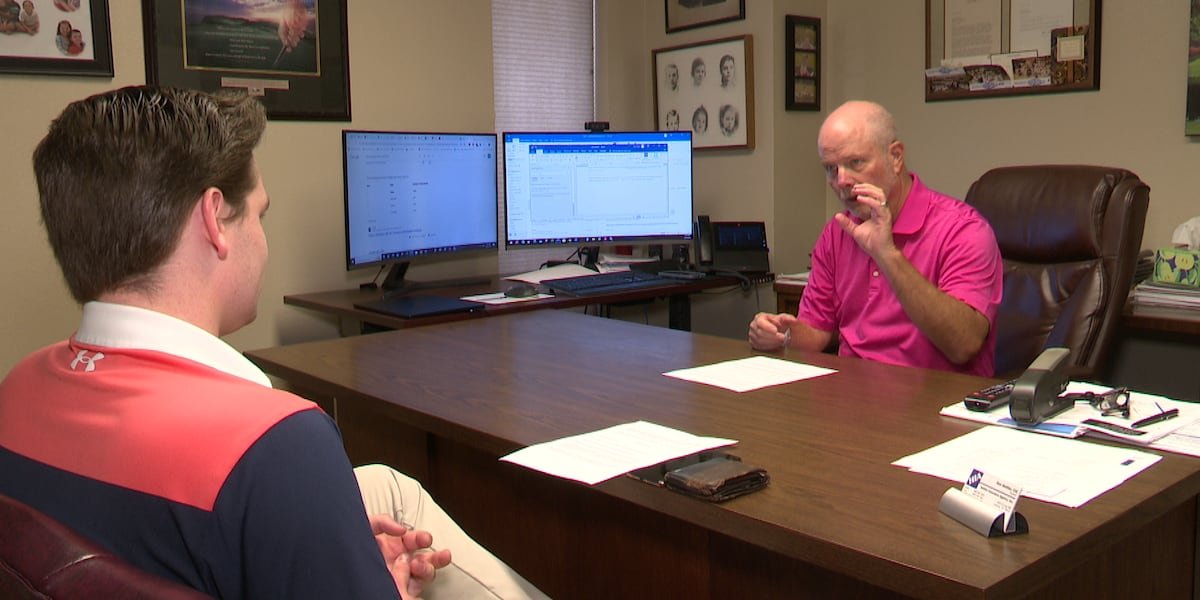

“If someone’s got a rate decrease, they are a very lucky and very rare individual,” Ronald Hettler said, president of Hettler Insurance Agency.

According to the Texas Department of Insurance, the average homeowner’s annual premium in 2013 was $1,646.

In 2022, that number jumped to $2,374.

Average Homeowner’s Insurance Annual Premium

| Year | Average Premium |

|---|---|

| 2013 | $1,646 |

| 2014 | $1,746 |

| 2015 | $1,782 |

| 2016 | $1,792 |

| 2017 | $1,860 |

| 2018 | $1,916 |

| 2019 | $1,961 |

| 2020 | $1,987 |

| 2021 | $2,124 |

| 2022 | $2,374 |

“Probably in the top three, depending on where you live in the state. We might be the top one in increases percentage wise,” Hettler said.

Ronald Hettler, an independent insurance agent in Lubbock, says the increases are due to a couple of factors.

“Weather catastrophes and inflation, those are the only, those are the two drivers of what is going on right now,” Hettler said.

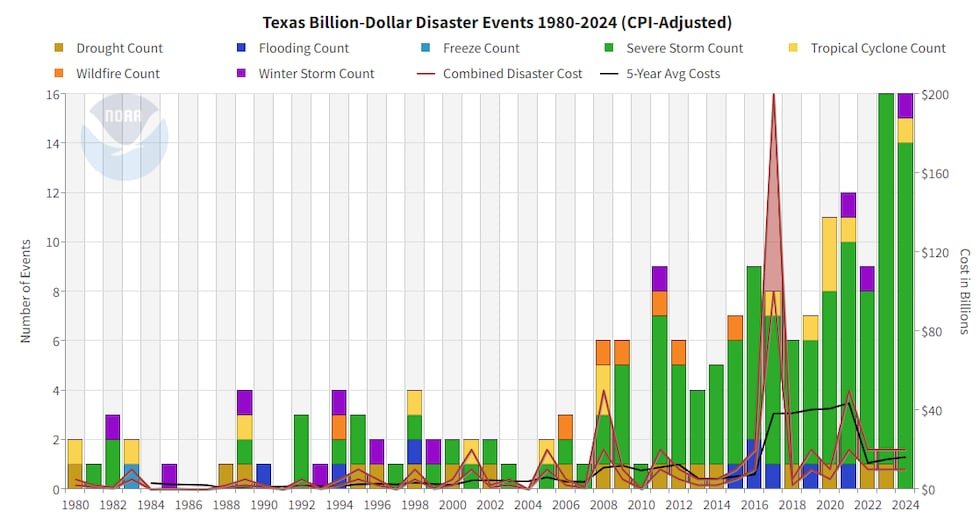

Since 1980, there have been 179 weather disasters in Texas that have each totaled more than a billion dollars in damage. 32 of those were this year and last year alone.

More are expected as hurricane season doesn’t end until November 30.

“Insurance companies don’t worry about the million-dollar claims, I mean they worry about them because they are big deals, but billion-dollar claims are really attention getters,” Hettler said.

That’s because reinsurance costs are up as well, which are what insurance companies pay to help cover those billion-dollar claims.

“They actually buy insurance to cover the really big claims, well the claims the primary carriers are seeing are being felt by the carriers they employ called reinsurers, and reinsurers are saying ‘Oh we need more money too,’” Hettler said.

Inflation isn’t helping either. Hettler says the cost of roofing materials alone has risen by 40% in the last 3 years.

“You’ve got weather combined with increased cost of materials and you just add them together and it’s an ugly picture,” Hettler said.

Thankfully, there are things you can do to lower your rates.

Including increasing your deductible, improving your credit score, and calling your agent to make sure you’re getting all the discounts you’re eligible for.

“Every once in a while, you might be with the wrong company, every once in a while. I’m not saying that is a common thing. Right now, everyone is going up, you’re not getting picked on, but comparing time to time and going to the marketplace is always a good idea,” Hettler said.

Texas Lieutenant Governor Dan Patrick and House Speaker Dade Phelan have ordered committees to hold hearings on insurance premiums before the legislature meets in January. The focus will be on the effect of rising costs and a search for ways increase consumer transparency.

Copyright 2024 KCBD. All rights reserved.