In June 2025, we at the MarketWatch Guides team surveyed 1,000 travelers who purchased travel insurance to protect their trip. This survey gave us critical insights into why travelers purchase insurance, how they choose coverage, average costs and more. Here is what we learned.

Key Findings

- 78% of survey respondents have purchased travel insurance more than once.

- Nearly half of the surveyed travelers bought their travel insurance policy through the booking site from which they purchased their flight or cruise.

- 29% of participants paid $51 to $100 for travel protection and another 29% paid $101 to $200.

Protecting Expenses Is the Primary Reason People Buy Travel Insurance

Reasons for purchasing a travel insurance policy vary by traveler. However, budget protection was the standout reason amongst 40% of our survey participants. Other primary reasons included buying a plan for trip cancellation coverage (28%) or international health insurance medical coverage (22%).

Survey respondents also mentioned purchasing travel insurance due to concern over baggage and travel delays and injuries associated with extreme sports.

Travel Insurance is Rarely a One-Time Purchase

Based on our research, travel insurance can offer a financial safety net in various scenarios, taking care of non-refundable trip expenses, medical bills and more. We found that most travelers purchase it multiple times. Only around 20% of travelers in our survey purchased a travel insurance policy once. Almost 50% of travelers bought policies two or three times, and 30% of other travelers bought four to 10 or more plans to protect themselves over their years of jetsetting.

The U.S. Department of State highly recommends purchasing travel insurance before you travel overseas since U.S. Medicare and Medicaid won’t pay for medical care outside of the country. Also, the majority (55%) of our survey participants noted that they’d recommend a comprehensive travel insurance policy with coverages such as medical, cancellation and baggage coverage for their friends. The second most popular recommendation was a standard travel insurance policy with lower benefit amounts (27%).

Although travel insurance could initially save you money and help you stay within a more modest travel budget, we recommend taking the time to weigh the pros and cons of opting for a cheaper plan. We also encourage you to check out our recommendations for the cheapest travel insurance companies that offer robust coverage and travel benefits.

The Most Popular Travel Insurance Providers

We asked our survey participants who their most recent travel insurer was. USAA took the top spot, with almost 17% of respondents opting to purchase a policy from the company. The second most popular provider was Nationwide (15%), followed by Allianz (14%) and Costco (11%).

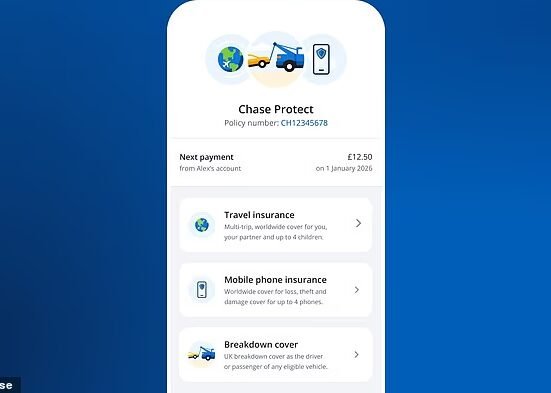

Results also showed that 4% of travelers participating in our survey chose to insure their flight through their credit card account. Well-known credit card companies such as American Express and Chase offer complimentary travel insurance when you pay for your travel expenses using the card.

Travelers Prefer Purchasing Travel Insurance With Their Flights

When we asked participants how they found their travel insurance provider, almost half noted that they purchased their policies through the same booking site from which they bought their flight or cruise. Just over 20% of respondents chose to use a travel agent or agency, which likely involved booking their trip as well. Just 16% of respondents researched companies and chose their coverage on their own.

While purchasing a travel insurance policy when booking your trip may be convenient, it may not provide all the coverage necessary to protect your trip. For example, if you have a pre-existing medical condition and are concerned about medical protections while abroad, you’ll likely want a policy with travel medical, emergency medical evacuation and pre-existing condition coverage. If you’re worried that you might need to cancel your trip unexpectedly, you might opt for cancel for any reason coverage, which doesn’t come standard with most travel policies.

Taking the time to conduct your own research can help save you from unnecessary stress in the event of a travel snafu or medical issue abroad, ensuring that you have the right coverage that suits your unique travel needs. However, if you’d prefer to let a travel agent do the research, let them know your biggest travel concerns. Whether you’re worried about cutting your trip short, canceling it altogether or getting sick and incurring medical bills abroad, knowing what you need can help an agent point you in the direction of the best policy for you.

Travel Insurance Claims: Delays and Cancellations Take the Lead

Out of the 20% of respondents in our survey who have filed a travel insurance claim, the most common reason for claims was trip delay, accounting for 20% of responses. According to data from the U.S. Department of Transportation, from January to August 2024, there were a total of 1.4 million hours worth of flight delays, with over 465,000 of these hours related to the fault of the air carrier. With these delays accounting for almost 7% of total airline operations, delay coverage could prove handy.

Another popular response was filing a claim for trip cancellation due to traveler or family illness and baggage delay or loss (11%). Almost half of the respondents purchased CFAR coverage, making it the most popular add-on in our survey.

What Our Survey Reveals About Travel Insurance Costs

Cost was the second most crucial factor survey respondents considered when purchasing a policy. While our research team has spent hours collecting quotes from over two dozen of the most popular travel insurers on the market to determine the average cost of travel insurance, we asked our survey participants how much they paid for their policies to gain further insight into general plan costs.

Results showed that nearly 30% of participants paid between $51 to $100 on their travel insurance policy, while 29% paid $101 to $200. We gathered quotes from several providers for trips with low, medium and high costs and found that the average cost was about 3% to 5% of a trip’s total value, with the average price across providers we’ve rated and reviewed amounting to $204. Like any insurance product, there are various factors that affect the cost of a travel plan, which we didn’t ask participants in our survey to disclose. Therefore, your actual costs will likely vary based on your age, travel destination, level of coverage, total trip value and more.

Is Travel Insurance Worth It?

Our survey showed that 98% of our 1,000 respondents who bought travel insurance felt it was worth it.. While financial protection was the biggest reason travelers decided to buy coverage, 84% of respondents noted peace of mind was the top reason a policy was worth purchasing.

If you’re on the fence about buying a policy, we encourage you to read more about our top travel insurance companies and the benefits they can provide you and your family as you plan your next trip. This way, you’ll make the best decision on whether or not to purchase coverage that suits your needs.

Our Travel Insurance Survey Methodology

We at the MarketWatch Guides team surveyed 1,000 travelers in the U.S. who have previously purchased one or more travel insurance policies. Conducted using Pollfish in February of 2024, our objective in surveying these travelers was to learn more about the following:

- The most popular travel insurance providers

- How travelers found their chosen travel insurer

- The types of coverage travelers opted to purchase

- Why travelers bought travel insurance protection

- Factors considered by travelers when buying a policy

- How much travelers paid for insurance

- If travelers filed claims and what for

We surveyed travelers residing in all 50 U.S. states that had previously purchased travel insurance, with 53% of respondents identifying as male and 47% female. The largest number of respondents resided in California (9%), Florida (9%), Texas (6%) and New York (6%).

Note: Figures represented in percentages were rounded to the nearest whole number.