Richard Drury

Old Republic International (NYSE:ORI) is one of the exclusive members of the “Dividend Insurance Champion” club. The insurance carrier is the third-largest title insurer in the U.S. and also provides commercial insurance coverages.

Since 2022, the company’s insurance margins have deteriorated, suffering from margin reductions in the title insurance portfolio and claims inflation affecting the commercial insurance portfolio. Nonetheless, Old Republic has succeeded in delivering reliable and recurring results, fueled by steady underwriting performance.

Old Republic’s Q2 2024 Presentation

Recently, Old Republic posted its second-quarter results, with post-tax income of $91.8 million, representing a year-over-year reduction of 41%. On a year-to-date basis, post-tax income grew from $355.4 million to $408.6 million, benefiting from strong first-quarter results. Although I feel that the company is now fairly valued.

Solid Profitable Growth In Commercial Business Coupled With Strong Position In Title Insurance

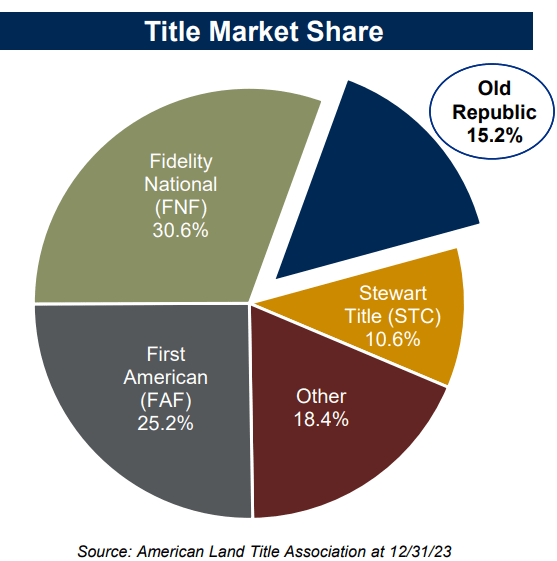

Founded in 1887 and incorporated in 1969, Old Republic is a Chicago-based holding company focusing on workers’ compensation insurance, title insurance, and commercial auto insurance. Old Republic is the third-largest title insurer, following Fidelity National and First American, which held 30.6% and 25.2% of the market in 2023, respectively.

Old Republic’s Q2 2024 Presentation

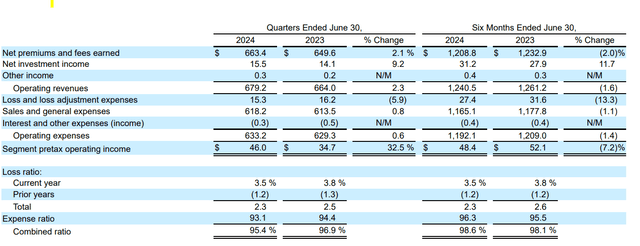

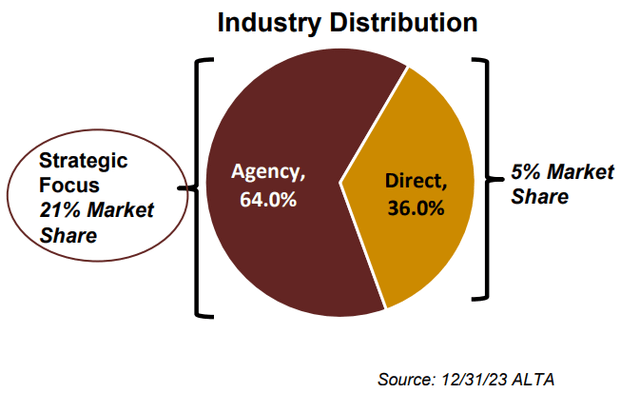

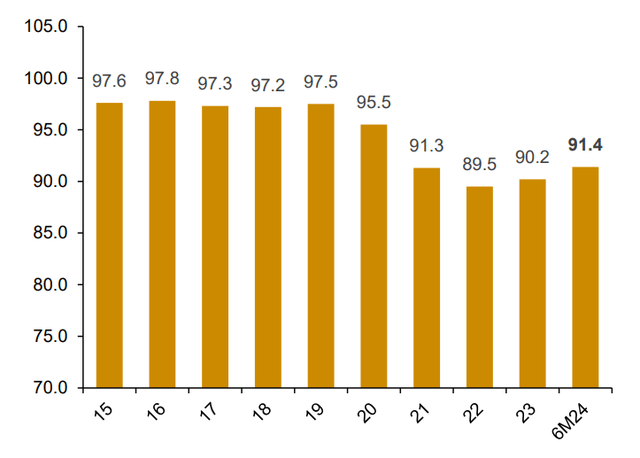

The title insurance market is mostly controlled by independent title agents, with high commission rates, resulting in an extremely high expense ratio (circa 90%).

Old Republic’s Q2 2024 Presentation

On the other hand, title insurance is a light-capital business with a consistently low loss ratio. Over the last 10 years, the average loss ratio was around 2.5%.

In 06M2024, the underwriting profit of the title insurance segment was $16.9 million, resulting from a year-to-date combined ratio of 98.6% and a premium and fees volume of approximately $1.2 billion.

Although the combined ratio for 06M2023 was lower at 98.1%, the sales and general expenses for the first six months of 2023 were impacted by the recovery of a $17.2 million state sales tax assessment, which reduced the corresponding expense ratio by 1.4 points. Excluding the extraordinary tax effects, the underwriting margin improved year-over-year.

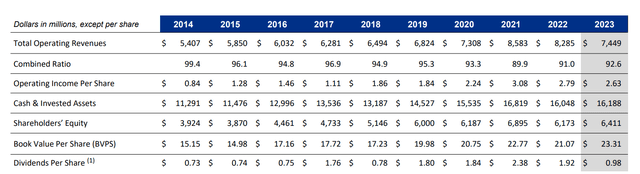

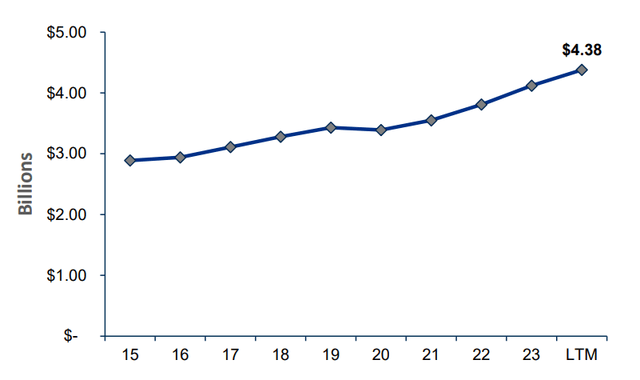

The second portion of the portfolio, the commercial insurance segment, is a capital-heavy and more competitive business influenced by the regular property and casualty market cycle, while title insurance is correlated with the real estate cycle. Although Old Republic remains a second-tier player in the general insurance business, the company has succeeded in combining growth with underwriting profits. From 2015 to 2023, the premium volume grew from less than $3.0 billion to more than $4.0 billion.

Old Republic’s Q2 2024 Presentation

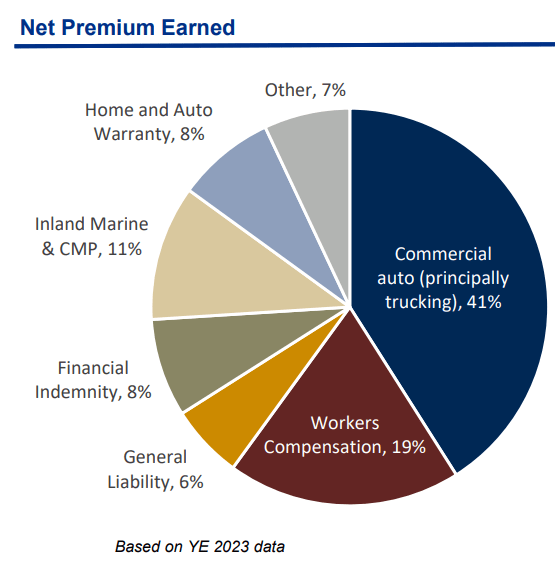

The insurance portfolio is mostly dominated by commercial auto and workers’ compensation coverages, which together represented 60% of FY2023 earned premiums.

Old Republic’s Q2 2024 Presentation

During the same period (2015–2023), the combined ratio never exceeded 98%. The long-term target of the company for this business ranges between 90% and 95%.

Old Republic’s Q2 2024 Presentation

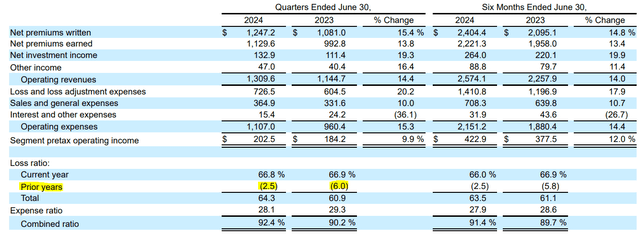

In 06M2024, the general insurance segment posted a combined ratio of 91.4%, marking a 1.7-point year-over-year deterioration, driven by lower prior-year claims development during the second quarter of 2024.

Although the underwriting margin of the commercial insurance segment was lower than one year ago in the same period, the segment still benefits from commercial momentum, materialized by double-digit growth (circa 15%) and a reduced expense ratio, benefiting from scale.

Looking ahead, the weight of the general insurance business in terms of earnings contribution is expected to increase. Based on the company’s targets and a FY2023 premium inflated by approximately 15% (due to tariff increases and new sales), the FY2024 pre-tax underwriting income of the general insurance business might range from approximately $206 million to $412 million.

Dividend & Share Repurchases

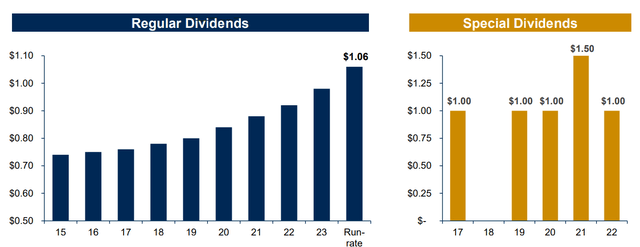

Well-esteemed as a dividend aristocrat, Old Republic has paid a cash dividend without interruption since 1942 (83 years), and it has raised the annual cash dividend payout for each of the past 43 years.

In addition to the quarterly dividend payment, Old Republic also declared special dividends, which generally amount to $1.00 per share.

Old Republic’s Q2 2024 Presentation

Furthermore, the company may repurchase shares when market conditions appear favorable for the company’s shareholders. During the second quarter of 2024, the company spent $410 million on share repurchases. In total, the company returned approximately $479 million to shareholders, comprising $69 million in dividends and $410 million in share repurchases during the quarter.

For the first six months, this resulted in total capital returned of approximately $744 million, including $141 million in dividends and nearly $603 million in share repurchases.

Debt Position

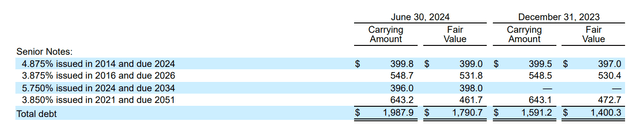

In 06M2024, mark-to-market debt amounted to almost $2.0 billion, a $500 million increase from December 2023.

It is worth noting that the company completed a public offering of $400 million in senior debt notes maturing in 2034. This issuance was completed in anticipation of the $400 million of 4.875% senior notes maturing in October of this year. Hence, the debt level is expected to decrease significantly at the beginning of the fourth quarter.

Book Value & Valuation

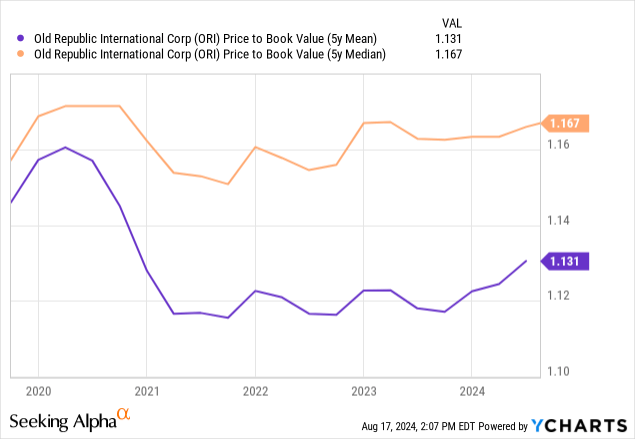

Over the last five years, the insurance carrier has typically been valued at around 1.1 to 1.2 times its book value.

Investors are generally willing to invest in Old Republic at approximately 11.5 times its earnings, based on the 10-year average price-to-earnings ratio.

As of 06M2024, the book value per share was $23.59, and the forward FY2024 post-tax earnings could reach around $0.8 billion. Based on the valuation metrics mentioned above, the intrinsic value of the insurance company is estimated to be approximately $25.90 to $28 per share, assuming the book value does not grow over the coming months. With FY2024 earnings of around $0.8 billion, potential investors and current shareholders might expect a fair valuation of $9.2 billion ($0.8 billion times 11.5), or a 3.8% potential upside based on the current market capitalization of about $8.86 billion.

Takeaways

Currently fairly valued, the company benefits from a strong position in the title insurance market, although potential headwinds in the real estate sector might impact profitability in the short to medium term. Aware of the earnings dependency on title insurance operations, the company’s management appears focused on driving solid commercial growth and profitability in the general insurance business.

Current investors are likely to enjoy gradual dividend increases and book value growth, supported by steady underwriting performance. However, from my perspective, I will not invest in Old Republic at this time, as there is no significant margin of safety.