TERADAT SANTIVIVUT

Roundhill Innovation-100 0DTE Covered Call Strategy ETF (BATS:QDTE) is a covered call that writes daily options and pays weekly dividends on Nasdaq 100 index (QQQ). I covered this fund in a recent article titled QDTE: A New Fund That Writes Daily Options And Pays Weekly and the fund seems to have had a shift in its strategy since then, and I believe it’s worth looking at the fund once again in light of its new strategy.

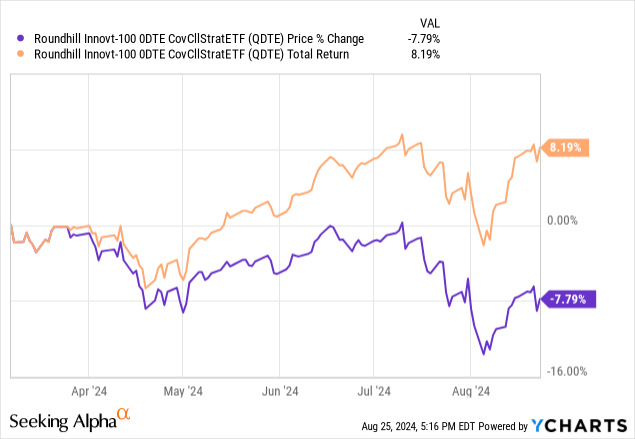

Before we dive into the fund’s new strategy and its implications (both positive and negative), first let us look at the fund’s recent performances. The fund has only been around for a few months and so far, it delivered 8.2% in total returns while it saw a NAV decay of -7.8% in terms of price action. All in all, investors made money at an annualized rate of 20% since the fund’s inception, which is not bad at all. More impressively, if you look at the fund’s performance in the recent weeks, you will notice that it had a good V-shape recovery after an initial drop in early August, just like the overall market did. It’s very rare for covered-call funds to participate in a V shape recovery after the market dips since their upside is totally capped by the covered calls they sell, so it’s impressive that this fund did it.

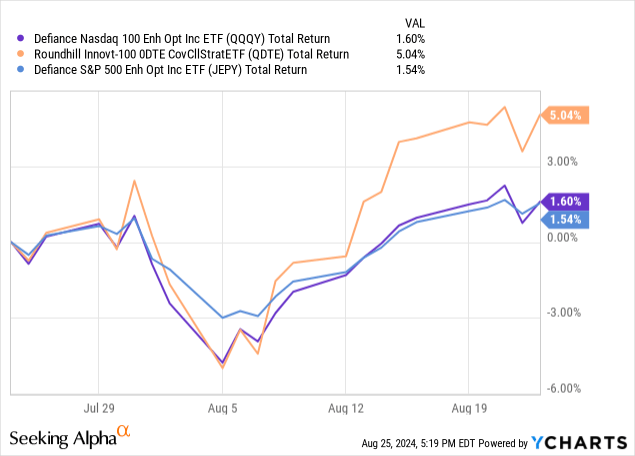

This is especially more impressive when we compare the fund’s performance in the last month against some of its peers using a similar strategy of selling daily options such as QQQY (QQQY) and JEPY (JEPY) both of which failed to capture most of the upside in the recent V-shape recovery we saw in the markets recently whereas QDTE actually captured most of it if not all of it.

This could be the result of a recent strategic shift in the fund. This is a newly created actively managed fund, and it’s typical for these types of funds to have a strategic shift over time as they tweak their plays and see what works and what doesn’t. As a result of recent changes, there are 2 things this fund does differently from other daily covered call funds. First, it started writing calls on the day of expiration, not the day before. Second, it started buying deeply in the money calls instead of buying actual shares or doing synthetics like how YieldMax funds do.

Let’s talk about the first one. The fund actually writes covered call options on the day they expire. So it starts the day without any call options written and writes them after the market opens at 9:30. It has one big obvious advantage. On days when the market opens with a big gap up, the fund is able to capture all of that upside that occurs at the open. If the market climbs 1.5% overnight and gaps up at 9:30 am, this is where the fund will write its 0dte option after already having captured the upside. It works especially great if the market gaps up and tops in the early morning and slowly starts fading during the day, which means the fund will be able to capture both the morning’s gap up, as well as, option income from the decay during the day.

But this also comes with a disadvantage. On those rare days when the market opens deeply red and recovers back throughout the day, the fund will open deeply red and won’t be able to capture the upside, so it may result in a loss. For example, let’s say the market opens down -2% and recovers in a V-shape recovery and finishes the day flat. Since the fund would have written its daily call when the market was down significantly, it wouldn’t have captured most of the upside that happened after that. On a positive note, if the market opened down -2%, VIX would have been up sharply, which means those option contracts written by the fund would have been rather juicy.

Also, keep in mind that the fund is missing out on overnight decay in options by waiting to write them on the day of expiration. In theory, an option that has an expiration date of next day will lose most of its time value overnight by the time the market opens so by the time this fund sells that day’s options, most of the option’s time value has already decayed, but that’s a risk the fund is willing to make if it means it can capture upside on those green days where the market opens with a gap up.

The second part of the fund’s strategy shift comes from buying deeply in the money calls instead of buying Nasdaq shares in order for its covered calls. This strategy is also known as “poor man’s covered calls” or “diagonal calendar spreads”. Basically, you buy an option contract with an expiration of several months to a year away that’s deeply in the money to simulate ownership of that stock and write shorter term calls against it such as daily, weekly or monthly.

For example, let’s take QQQ, which this fund is based on. The current price of QQQ is $480, so you buy QQQ $350 options that will expire by next March. This will cost you $141 per contract or $14,100 as opposed to buying 100 shares of QQQ which would have cost you $48,000 so it saves you money. Then you start writing weekly QQQ $485-490 calls to capture some upside as well as take advantage of time decay, which should be a profitable trade if QQQ is rising slowly, staying flat or dropping slowly.

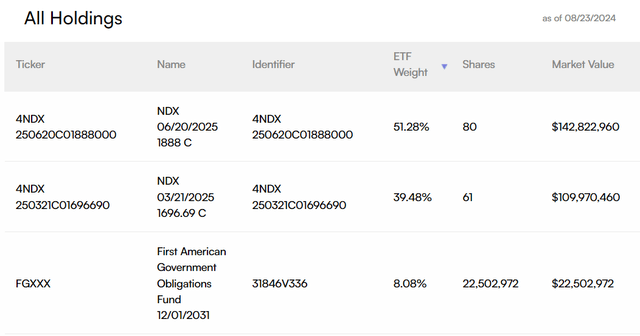

Now let’s move from theory to practice. Below are the fund’s current holdings. Notice that it’s holding 80 NDX (Nasdaq 100 index) 1888 calls expiring in June 20th of 2025 and another 61 NDX 1696 calls expiring in March 2025. The third holding of the fund is a bond fund, which it uses as collateral and parking excess cash to generate additional income. Notice that the fund doesn’t have any options sold at the moment because it sells them when the market opens and closes its position shortly before the market closes. The fund has $142.8 million in the first contract and $110 million in the second contract.

QDTE Holdings (Round Hill Investments)

This set up allows the fund to participate in most upside in Nasdaq without buying up actual Nasdaq shares or futures, which saves it a lot of money and possibly allows it to leverage its money, but it comes at a risk. If Nasdaq were to drop below these strike prices, the fund could virtually lose all of its holdings and drop to almost zero. This is assuming that the fund won’t adjust or move its positions, which it could.

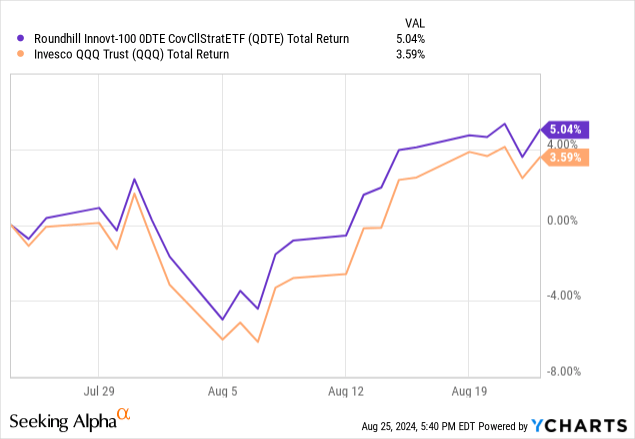

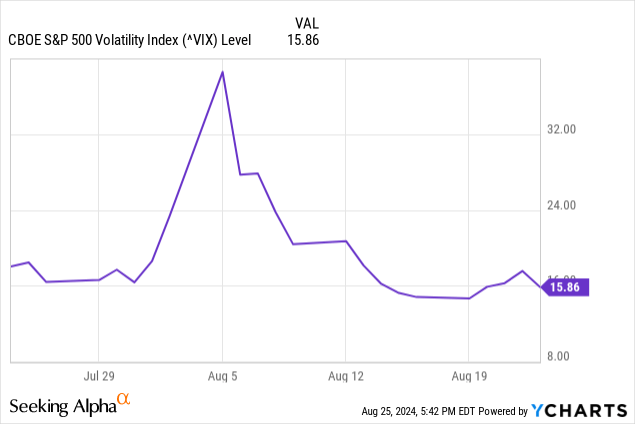

Here is an interesting thing though. Earlier this month, when Nasdaq took a big dip, this fund didn’t drop as much as Nasdaq did. In fact, it outperformed slightly. Part of this came from the contracts it sold, which created a buffer, but there is another thing that helped the fund as well. When Nasdaq took a dive earlier this month, VIX rose significantly, which meant that the value of the call options held by the fund actually held up pretty well even when Nasdaq itself was dropping significantly.

Everybody knows that when VIX rises, option prices rise significantly, which allows covered call writers to write juicier contracts, but many people don’t realize that a rise in VIX also helps their call options which they hold as collateral. This is one of the reasons this fund performed so well in the last few weeks.

If we suddenly had a market crash, Nasdaq would crash badly, but the fund’s Nasdaq calls might hold up their value unless they were really close to expiration because their IV would rise up significantly to offer a pretty nice buffer, which is exactly what happened last week.

But like I said above, the strategy is not without its risks either. If Nasdaq started to drop slowly without causing VIX to rise, it could cause this fund’s call options to drop in value significantly. They could even drop to zero if the Nasdaq started bleeding out slowly and the fund didn’t adjust its positions. I’d like to think that in a situation like that the fund would take some defensive actions to protect its positions from a total collapse since it’s an actively managed fund, but you can’t always be 100% sure of that.

In short, the fund’s new strategy might actually work very well if you are bullish on the overall market but might be an added risk if the market were to start rolling down, especially in a slow fashion that doesn’t trigger VIX to rise significantly. The fund itself is not using leverage per se, but it’s having a similar effect, as it’s using more buying power than it normally would by holding Nasdaq call options instead of Nasdaq shares. All in all, this is a bullish bet that will pay handsomely in a bull market, but you need to be cautious during a bear market. If you are overweight QDTE, you might even want to buy some protective puts that are out of money.