This represents an increase of about 3.3% year-on-year, marking the first notable rise in exposure after a prolonged period of decline

Infographic: TBS

“>

Infographic: TBS

Norway’s sovereign wealth fund, the world’s largest investment fund, has modestly increased its equity exposure in Bangladesh after six years, even as it exited holdings in Beximco Pharmaceuticals and Singer Bangladesh, citing company-specific risks and limited scope for diversification in the local market.

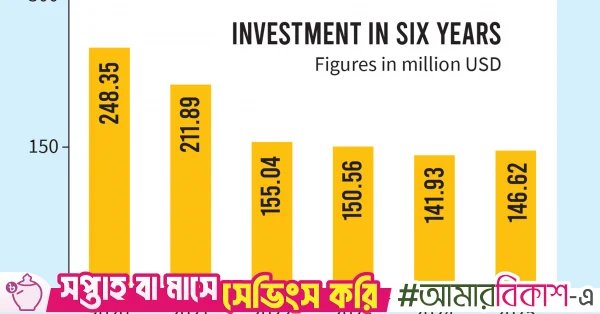

According to data from Norges Bank Investment Management, which oversees the fund – formally known as the Government Pension Fund Global, its total investment in Bangladesh stood at $146.62 million at the end of June 2025, up from $141.93 million in 2024.

Infographic: TBS

“>

Infographic: TBS

This represents an increase of about 3.3% year-on-year, marking the first notable rise in exposure after a prolonged period of decline.

The fund’s investment in Bangladesh had peaked at $248.35 million in 2020 before falling steadily over the following years amid market volatility, regulatory constraints, volatile forex market and economic uncertainty.

The latest figures indicate that while the fund increased its overall exposure, it reshuffled its portfolio by raising stakes in some companies and fully exiting others.

Infographic: TBS

“>

Infographic: TBS

As of June 2025, the fund held a 5% stake in BRAC Bank, unchanged from a year earlier, while its ownership in Square Pharmaceuticals rose to 2.38% from 2.24%. Stakes in City Bank and Prime Bank also increased marginally, with Prime Bank seeing a more notable rise to 4.88% from 3.73% a year earlier.

The fund also raised its holdings in MJL Bangladesh and added a new position in Marico Bangladesh, while maintaining stable exposure to Grameenphone, Bangladesh Submarine Cable, Olympic Industries and Walton.

At the same time, the Norwegian fund completely exited Beximco Pharmaceuticals, where it previously held a 0.47% stake, and Singer Bangladesh, where its ownership stood at 1.15% in 2024.

Infographic: TBS

“>

Infographic: TBS

A managing director of a brokerage firm handling foreign portfolio accounts said the exit from Beximco Pharma was largely driven by prolonged legal and regulatory uncertainty surrounding the company’s board restructuring, following the arrest of its vice-chairman, Salman F Rahman.

The unresolved situation, he said, raised governance concerns that made the stock less attractive for a long-term institutional investor like the Norwegian fund.

The withdrawal from Singer Bangladesh was attributed to a different set of challenges.

The brokerage executive said the company has been burdened by high debt following an aggressive expansion drive, while business growth has lagged amid intense competition from local players. These pressures weakened the company’s financial outlook and reduced its appeal for foreign investors focused on sustainability and long-term value creation.

In contrast, the fund increased exposure to companies that demonstrate relatively stable earnings, stronger governance and sustainable or innovative business models.

“The fund prefers companies that can grow steadily and withstand macroeconomic shocks,” the executive said, noting that the higher investment signals selective confidence in Bangladeshi stocks despite political and economic uncertainty.

Market participants see the overall rise in the fund’s Bangladesh exposure as a positive signal for the local capital market, particularly at a time when foreign portfolio investment remains subdued.

However, they caution that the scope for further diversification is limited due to the relatively small number of high-quality, large-cap stocks that meet the investment criteria of global institutional funds.

Another managing director of a brokerage firm noted that while the fund had increased its investment by June, it trimmed some holdings later in the year, particularly in BRAC Bank, Square Pharmaceuticals and a few other stocks.

He said such adjustments are common as the fund prepares its year-end financial statements and rebalances portfolios in line with global allocation strategies.

Analysts said the fund generally follows FTSE equity country benchmarks, though final decisions are based on internal assessments.

Bangladesh had previously been excluded from FTSE indices due to the imposition of floor prices on stock movements. Although the Bangladesh Securities and Exchange Commission has gradually lifted most of those restrictions since January last year, floor prices remain in place for shares of two companies, which continue to be excluded from the FTSE index.

Since entering the Bangladeshi market in 2015, the fund has maintained long-term positions in a handful of core stocks, including BRAC Bank, City Bank, Grameenphone and Square Pharmaceuticals.

According to analysts at Brummer & Partners, which manages the fund’s local portfolio, the sovereign wealth fund has not repatriated any returns from Bangladesh since its initial investment. Instead, all earnings have been reinvested in the market.

They added that due to slower investment activity in recent years, a significant amount of idle capital had accumulated within the Bangladesh portfolio.

The recent increase in exposure reflects a gradual reinvestment of that capital, even as structural challenges in the market continue to limit the pace and scale of future inflows.