Leonard Mc Lane

Over the past twelve months, we have covered a variety of dividend funds focusing on a variety of areas. Most recently, we spent time covering the behemoth Schwab U.S. Dividend Equity ETF (SCHD), looking deeper at the fund’s unparalleled growth history. We also covered the Fidelity High Dividend ETF (FDVV), which offers a tech-heavy dividend growth portfolio that closely mirrors the S&P 500 without non-dividend payers. We took a deep dive into dividend growth investing with the Vanguard Dividend Appreciation Index Fund (VIG), exploring the relationship between dividends and share price. For the most part, the discussion is positive as we highlight the benefits of investing in dividend-paying stocks through different indices.

On rare occasions, we come across something which doesn’t quite fit the bill. Every so often, a fund appears without a compelling value proposition. We struggle to categorize these funds and where they could fit outside of the core of an investor’s portfolio. One such example is the WisdomTree U.S. Quality Dividend Growth Fund (NASDAQ:DGRW).

We initially covered DGRW near the beginning of the year in an article titled “DGRW: A Dividend Growth Fund Needs A Growing Dividend.” This article provided a comprehensive overview of the fund including the portfolio, dividend history, and performance. More importantly, we dove into the underlying index, WisdomTree U.S. Quality Dividend Growth Index. For those unfamiliar with DGRW and the index, it would be helpful to refer back to this initial coverage which will provide a more comprehensive overview of the fund.

Today, we will revisit DGRW as a follow up to our previous coverage. Our initial article overviewed the fund and construction. In addition, we outlined a critical thesis around two reasons that the index was problematically constructed. First, the index has significant overlap with the S&P 500 with around half of the same top ten holdings. Second, and more importantly, DGRW has a subpar history of dividend growth, which will be the focus of today’s article.

DGRW’s Dividend Growth History

While dividend investing comes in a variety of shapes and sizes, there is usually a balance between income and growth. Current yield strikes a balance against forward growth and investors must choose where they fall on the spectrum.

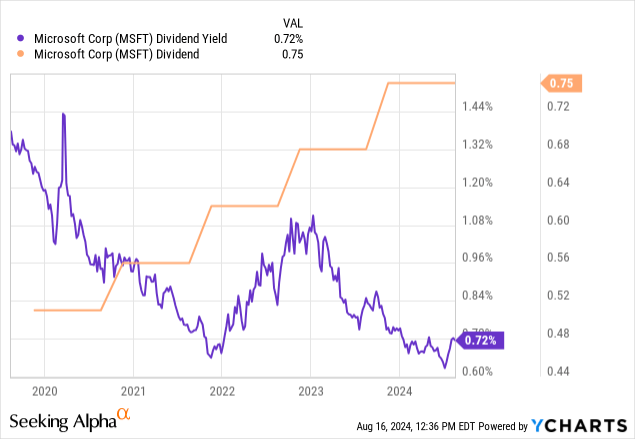

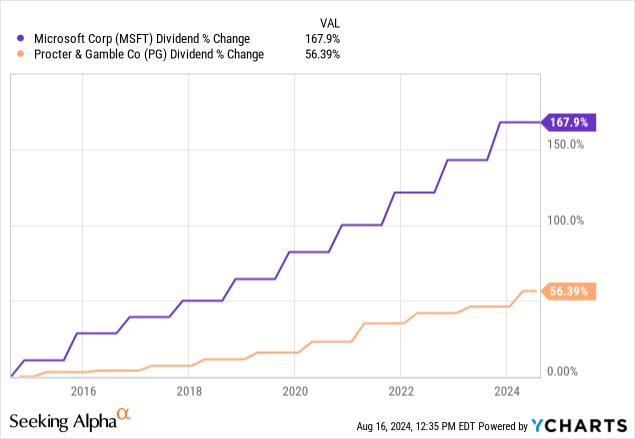

On one end, some of the lowest yielding companies have the most impressive dividend growth histories. For example, Microsoft is DGRW’s largest investment at 7.2% of the portfolio. MSFT’s current yield is just 72 basis points, but the ten year compound annual growth rate is over 10%. This means MSFT’s yield on cost rises faster and long term shareholders reap the benefits. Ten year investors in MSFT now have a dividend yield on cost of 6.6%

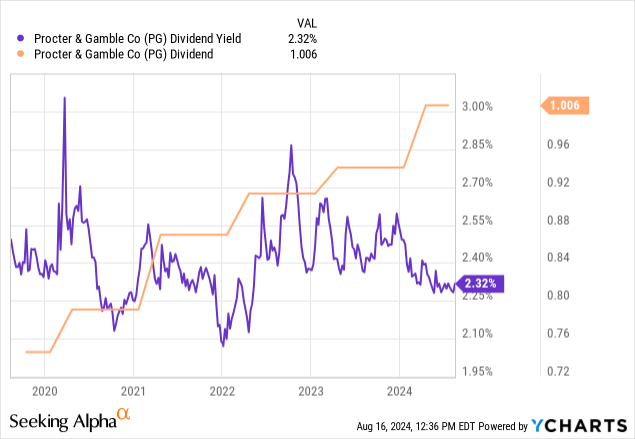

On the other hand, Procter & Gamble (PG) is also in the top ten holdings. With a current payout more than three times higher than MSFT, most dividend investors would turn their attention from MSFT to PG. The current yield is significantly higher, offering more income up front which satisfies a critical piece of the dividend investor puzzle. But time may take its toll. The ten year yield on cost for shares of PG is 4.8%, meaning an investment in MSFT has more income producing power ten years after purchase. This creates a balancing act between time horizon, risk tolerance, and other goals.

However, on a simpler level, it highlights the importance of growth. Over time, compounding has extraordinary power to grow income. Growing income also has other benefits for investors such as the power to fight inflation. Retirees may enjoy growing dividends as their income grows alongside the cost of goods and services. The consistency of this growth is also a key consideration, where year to year changes may be impactful.

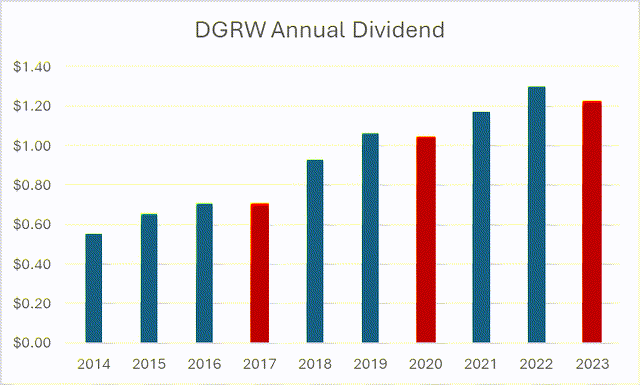

The consistency piece is where DGRW falls short. While DGRW pays a monthly dividend, which many investors find attractive, the long term growth has not met expectations. Most dividend index funds see their fund level distribution increase on an annual basis. This is an expectation of a successful dividend index, in my opinion. After all, we are investing in a dividend fund for income.

DGRW launched in 2013 giving the fund more than ten years of complete operating history. Since launch, the fund’s dividend has decreased three out of ten years, averaging a compound annual growth rate of 9.4% since the first complete year. This comes as a stark contrast to other indices which have grown their dividends annually over the same period.

REITer’s Digest

DGRW’s dividend declined in 2017, 2020, and 2023 creating a problematic trend of dividend variability, pointing back to the construction of WisdomTree’s proprietary index. The lack of consistency makes DGRW an unappealing dividend fund. The index’s construction is essentially an S&P 500 style index that eliminates non-dividend paying companies. While this creates a dividend paying fund, it lacks the concerted focus on dividend payments necessary to make the fund successful. In addition to the variability, DGRW falls short in another key area.

Expenses

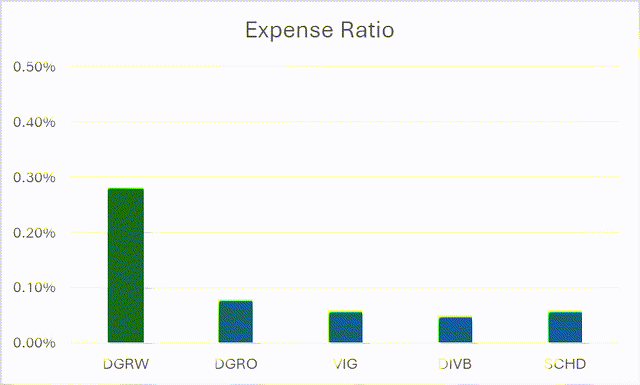

DGRW is an expensive exchange traded fund, charging 28 basis points of assets under management. While cheaper than traditional mutual funds, the cost considerably more expensive than other funds in the dividend growth category. Investors should questions whether the monthly dividend is worth added costs. DGRW falls near the bottom of its peer group in terms of the expense ratio.

REITer’s Digest

Funds such as the iShares Core Dividend Growth ETF (DGRO) or Vanguard Dividend Appreciation Index Fund (VIG) are competing funds with similar yields with expense ratios of 0.08% and 0.06%, respectively, making each option at least 20 basis points cheaper than DGRW. Each of the four competing funds listed above is more than 20 basis points cheaper than DGRW, reflecting the high expenses of the subject fund relative to the category average.

Having highlighted that DGRW falls short in terms of both dividend growth and expenses, we must assess our options. There are two distinct paths forward, one for the dividend die-hard and the other for more flexible investors.

Option #1: The Dividend Die-Hard

Some investors seek a dividend fund with an uncompromising focus on dividends and dividend growth. Those folks are often willing to put total return in the backseat for current income and the prospect of growing their income in the coming years. This category needs a dividend fund that is more reliable than DGRW.

Look no further than the Schwab U.S. Dividend Equity ETF (SCHD), one of the largest exchange traded funds of dividend paying stocks. SCHD is the only exchange traded fund that is indexed against the Dow Jones Dividend 100, an index of 100 dividend paying U.S. companies. This basket of 100 stocks has a traditional value tilt focusing on dividends. The largest holdings are currently Lockheed Martin (LMT) and AbbVie (ABBV), both of which have extraordinary dividend histories of their own. The portfolio also avoids technology almost entirely with no Magnificent 7 stocks in the top ten. This means that SCHD also has considerably less overlap with funds covering traditional indices such as the S&P 500.

SCHD’s dividend history is unparalleled. The fund currently yields 3.51% based on trailing twelve months dividend paid. The fund’s dividend has also grown by 11% annually over the past ten years, faster than DGRW’s dividend growth by almost 200 basis points. Over the past three years, SCHD’s dividend has grown by 9% annually, continuing the fund’s impressive track record of growth.

Currently, SCHD offers more initial yield than DGRW and has historically grown the dividend at a faster rate. Going one step further, SCHD’s expense ratio is just 6 basis points, around 22 basis points cheaper than DGRW. All things considered, SCHD makes for a considerably more attractive option for dividend-minded investors.

Option #2: The Open Minded

As we mentioned, one point of criticism for DGRW is the fund’s significant overlap with the S&P 500. DGRW holds 300 dividend paying stocks and around half of the top ten positions overlap with the S&P 500. This means that purchasing shares of DGRW into a portfolio that contains a core holding of an S&P 500 fund such as SPDR S&P 500 ETF (SPY) provides little diversification against the highly concentrated index.

For this reason, investors who place less priority on dividends may benefit from sticking closer to the index and buying shares of SPY. If a prospective investor is not prioritizing current yield or dividend growth, there’s little reason to limit their universe to a dividend fund. Instead, buying a cheaper fund that follows a better index could be a better option in the long run.

From a yield and growth standpoint, DGRW and SPY are surprisingly comparable. Today, DGRW and SPY have yields of 1.56% and 1.26%, respectively, based on trailing twelve month dividends paid. As expected, DGRW’s dividend has grown faster over the past years with a compound annual growth rate of 9.5%. SPY’s long term dividend growth rate trails at 6.7% per year over the past decade.

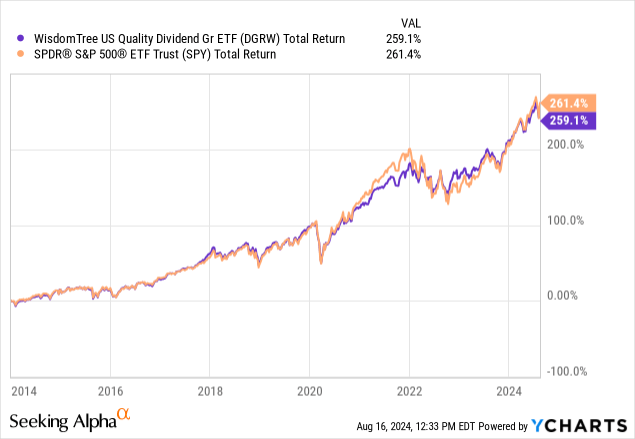

However, dividend growth does not necessarily mean superior returns. For the flexible investor, total return is likely more important than current income. Let’s compare the long term performance of these two funds, assuming dividends have been reinvested.

Since 2014, SPY has beaten DGRW’s total return by around 2%, meaning performance has been close. This is to be expected given the overlap of the two portfolios. Over this time frame, the expense ratio difference of each fund accounts for most of the difference in performance. Over the past twelve months, the story is similar. SPY has outperformed DGRW by around 3%, but both funds have performed well. For an investor who is not prioritizing dividends, DGRW has little value proposition beyond a traditional large capitalization index fund such as SPY. Saving money on expenses by using a cheaper option may be a wise decision.

Conclusion

DGRW is a unique dividend growth ETF paying monthly income. Over time, the fund has performed well, largely following the performance of SPY and the S&P 500. However, DGRW lacks a compelling value proposition outside of other large capitalization index funds. For those focused on maximizing their dividend income in the equity markets, alternatives such as SCHD have a better index. For those less focused on dividends, SPY or similar index funds can offer higher returns. With these considerations, DGRW lacks a place in the picture. The fund should continue to perform well alongside the market, but there is little reason for an investment considering the added expenses.