Investors with significant funds have taken a bearish position in New Fortress Energy NFE, a development that retail traders should be aware of.

This was brought to our attention today through our monitoring of publicly accessible options data at Benzinga. The exact nature of these investors remains a mystery, but such a major move in NFE usually indicates foreknowledge of upcoming events.

Today, Benzinga’s options scanner identified 11 options transactions for New Fortress Energy. This is an unusual occurrence. The sentiment among these large-scale traders is mixed, with 18% being bullish and 63% bearish. Of all the options we discovered, 10 are puts, valued at $1,053,345, and there was a single call, worth $69,337.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $10.0 and $25.0 for New Fortress Energy, spanning the last three months.

Analyzing Volume & Open Interest

In terms of liquidity and interest, the mean open interest for New Fortress Energy options trades today is 1852.88 with a total volume of 17,614.00.

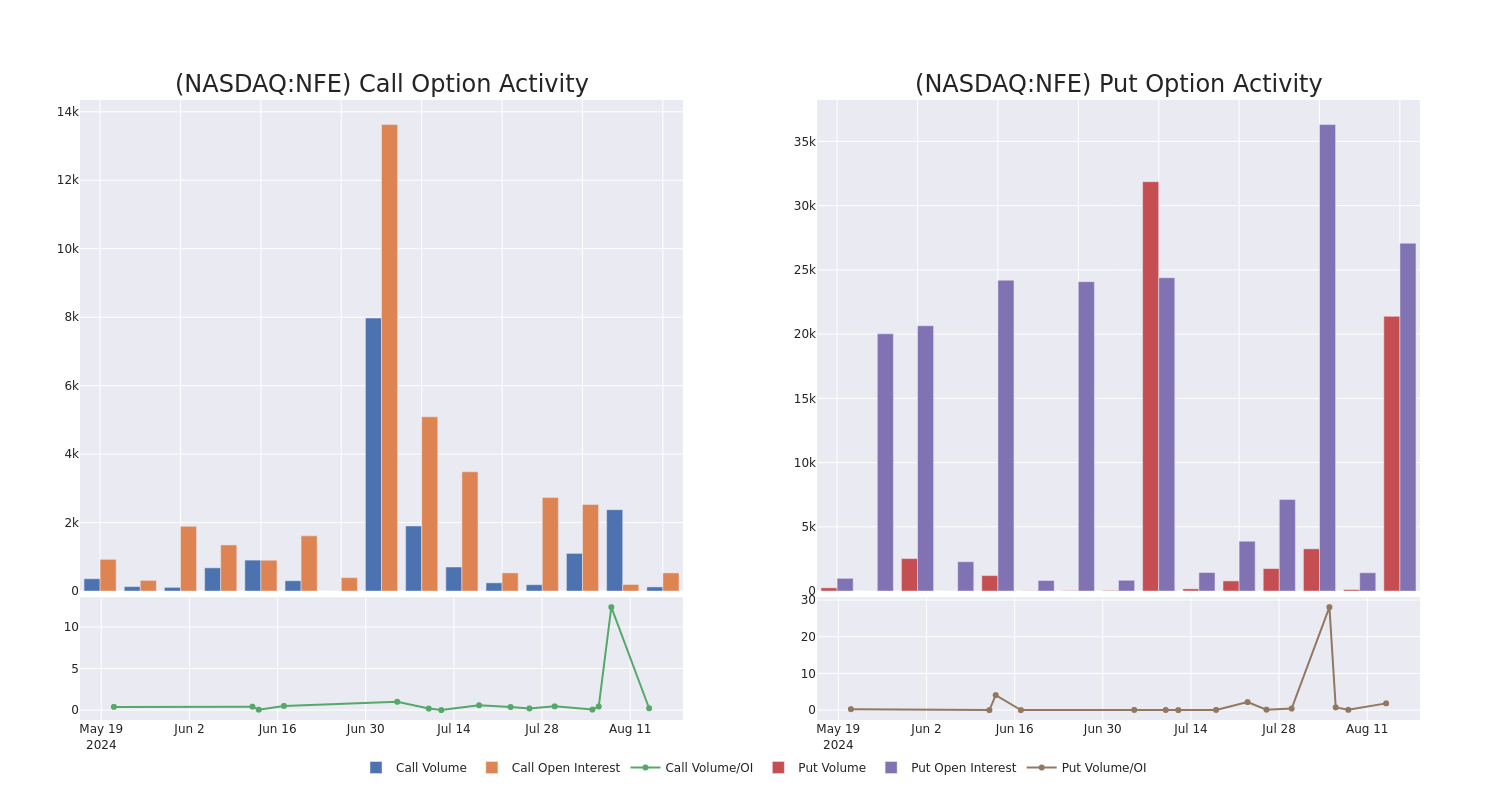

In the following chart, we are able to follow the development of volume and open interest of call and put options for New Fortress Energy’s big money trades within a strike price range of $10.0 to $25.0 over the last 30 days.

New Fortress Energy Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NFE | PUT | TRADE | NEUTRAL | 11/15/24 | $1.65 | $1.3 | $1.45 | $12.00 | $268.1K | 10.0K | 5.0K |

| NFE | PUT | SWEEP | BEARISH | 10/18/24 | $1.15 | $1.0 | $1.0 | $12.00 | $216.8K | 0 | 2.1K |

| NFE | PUT | TRADE | BEARISH | 10/18/24 | $0.45 | $0.1 | $0.35 | $10.00 | $174.9K | 50 | 5.0K |

| NFE | PUT | TRADE | BEARISH | 10/18/24 | $0.35 | $0.25 | $0.35 | $10.00 | $174.3K | 50 | 5.0K |

| NFE | CALL | SWEEP | BULLISH | 12/19/25 | $5.8 | $5.0 | $5.64 | $10.00 | $69.3K | 259 | 127 |

About New Fortress Energy

New Fortress Energy is an integrated gas-to-power company. Its business model spans the entire production and delivery chain from natural gas procurement and liquefaction to logistics, shipping, terminals, and conversion or development of a natural gas-fired generation. It has invested in floating, liquefied natural gas vessels to both lower the cost of acquiring gas while securing a long-term supply for its terminals. Its segments include terminals and infrastructure, or T&I, and ships.

After a thorough review of the options trading surrounding New Fortress Energy, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of New Fortress Energy

- Currently trading with a volume of 3,899,516, the NFE’s price is down by -3.33%, now at $13.05.

- RSI readings suggest the stock is currently may be oversold.

- Anticipated earnings release is in 82 days.

What Analysts Are Saying About New Fortress Energy

In the last month, 4 experts released ratings on this stock with an average target price of $20.75.

- Maintaining their stance, an analyst from Deutsche Bank continues to hold a Hold rating for New Fortress Energy, targeting a price of $26.

- Consistent in their evaluation, an analyst from Stifel keeps a Buy rating on New Fortress Energy with a target price of $17.

- An analyst from Barclays persists with their Equal-Weight rating on New Fortress Energy, maintaining a target price of $19.

- Consistent in their evaluation, an analyst from Deutsche Bank keeps a Hold rating on New Fortress Energy with a target price of $21.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest New Fortress Energy options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.