The surge in market volatility induced by global cues has spooked top brokers in India, with firms like Angel One, IIFL Securities and Geojit Financial Services taking steps to reduce any potential risk.

After assessing the spike in volatility across markets like Japan, South Korea and the US, Angel One has temporarily stopped financing fresh share purchases effective Tuesday under the so-called margin trading facility (MTF).

On the other hand, IIFL Securities and Geojit Financial Services have doubled margins for clients using MTF.

Mint has seen an email sent by Angel One to a client citing market volatility for virtually halting the facility. “Due to market volatility, there will be 100% margin for Margin Product effective 06-Aug-2024 till further notice to safeguard clients’ interest…”

A company spokesperson declined to elaborate as the listed company is in a silent period until 9 August.

Industry-wide practice

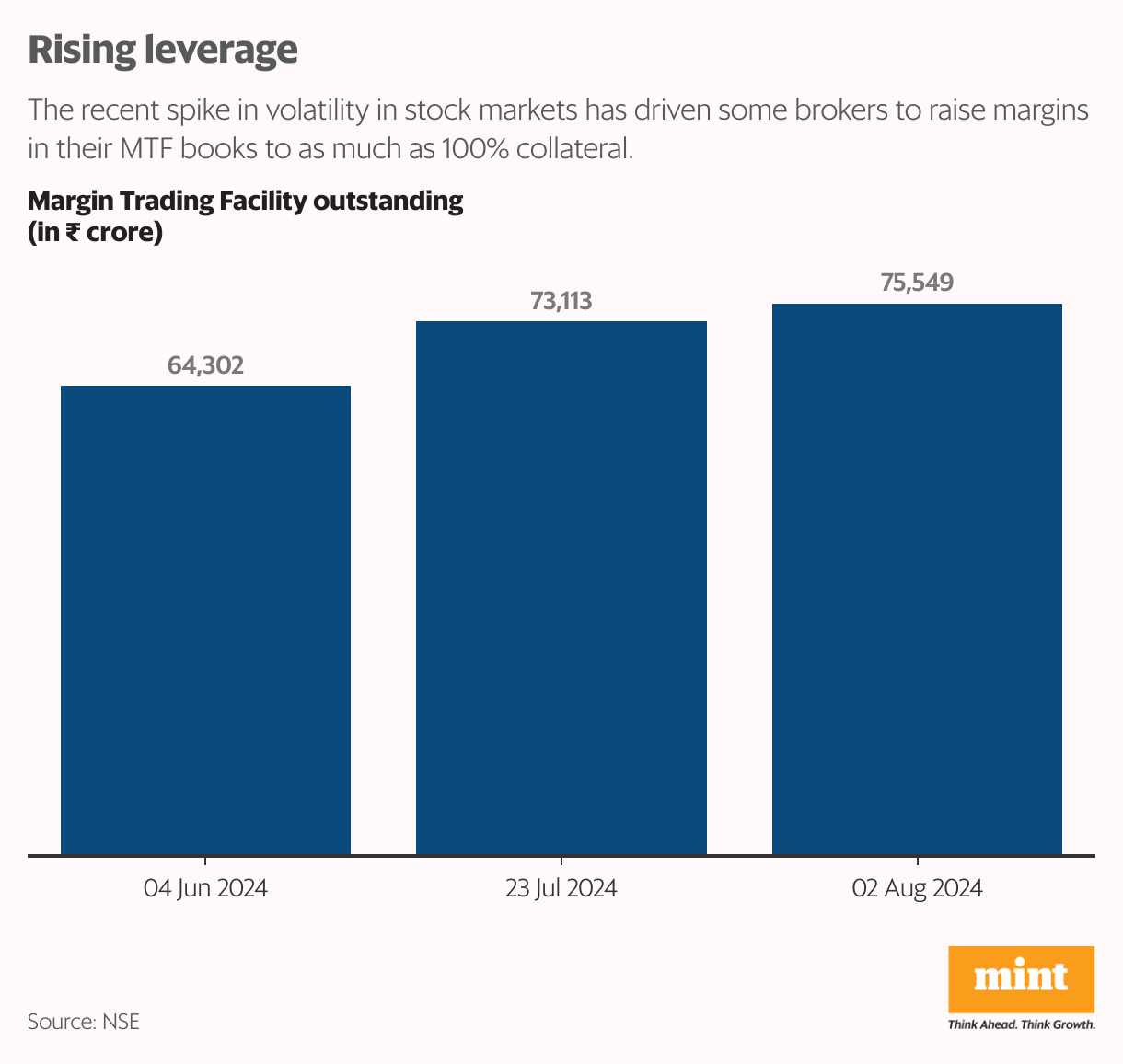

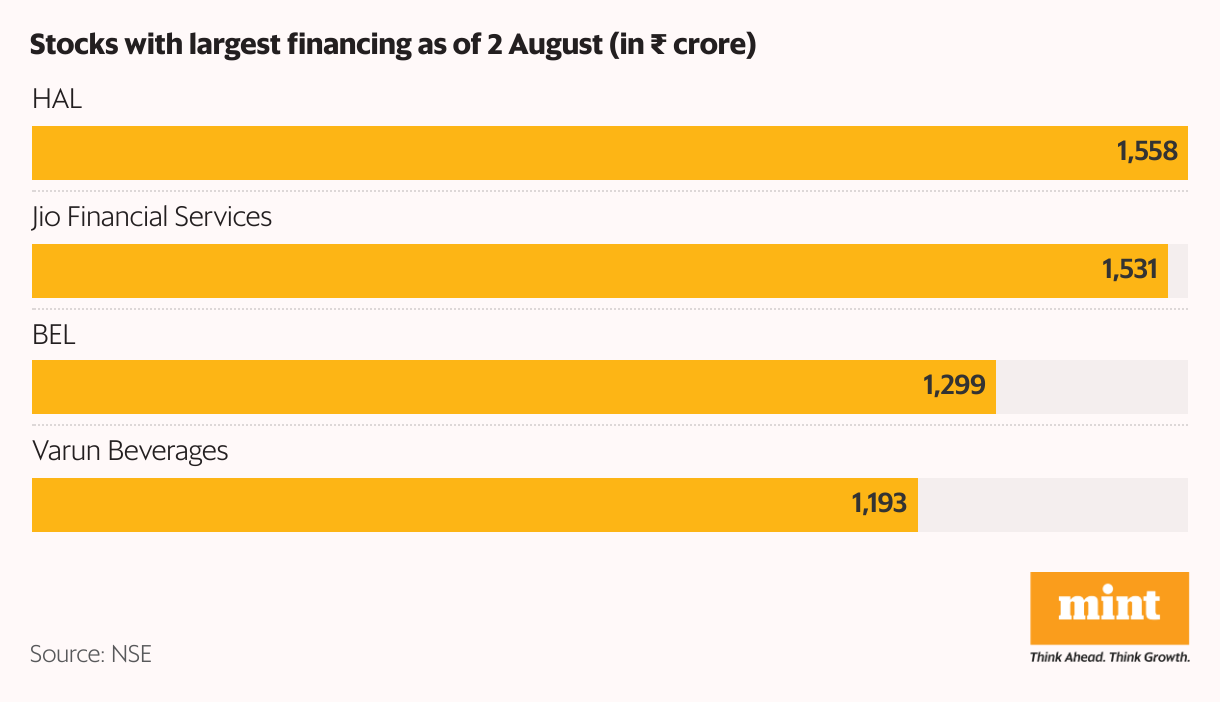

MTF is an industrywide practice. Shares worth ₹75,548.5 crore were financed by brokers as of 2 August, NSE data shows. A client, who puts up a margin of 20-40% , pays 12-18% interest to the broker to fund her shortfall. The tenor of the facility extends from a few weeks to a couple of months, say brokers.

Part of risk management, the margin paid is calculated as per a Sebi formula consisting of value at risk margin (VAR) plus three to five times the extreme loss margin (ELM) stipulated for each stock.

VAR provides for a worst-case loss in a portfolio of assets if an unforeseen event occurs. ELM is an additional margin to provide for losses beyond those predicted by VAR.

Meanwhile, IIFL Finance has begun increasing margins in phases effective 1 August. A company spokesperson said that as per exchange directions in July, over a thousand stocks were to become ineligible for being pledged as margin effective 1 August.

Also read | F&O trading: Do retail investors really need Sebi’s big brother oversight?

“Amid the rise in volatility, we have increased the margin on the ineligible stocks to 40% from 20% earlier to give clients with large positions time to substitute the collateral,” the spokesperson said, adding that the shortfall is met by IIFL so that it can be placed with the exchange’s clearing corporation.

“By November, we will be charging 100% margin on these stocks,” the spokesperson added.

Increasing margins

Geojit Financial Services, too, has increased the margin to around 40% from 20% ahead of Monday’s steep market fall, said Satish Menon, the company’s executive director (business).

“This is a risk management practice followed by brokers, especially during periods of high volatility,” Menon said. “It was done ahead of the 4 June election results, which saw Vix rise by almost 28% to 26.75 and even in the run up to the budget on 23 July as a matter of abundant caution.”

A 40% margin reduces the leverage to 2.5 times from five times earlier. Leverage means controlling an asset by putting up a fraction or a part of its value. For instance , a margin of ₹20 for a share costing ₹100 affords a client five times leverage.

The India Vix, which measures volatility, surged 42% to 20.37 on Monday after the Nifty tanked 2.7% to 24,055.7 in response to a 12% fall in Nikkei and an 8% fall in Kospi on fears of a recession in the US and yen carry trade unwinding after Bank of Japan increased a short term policy rate to 0.25% from 0.1% on 31 July.

This forced global investors leveraged by yen loans to liquidate positions across markets leading to a worldwide rout in stocks.

Volatility is a measure of risk defined as deviation from the mean.