The Montana Department of Revenue will soon be distributing its second round of property tax rebates to eligible Montana taxpayers as part of a property tax relief package that was signed into law in 2023.

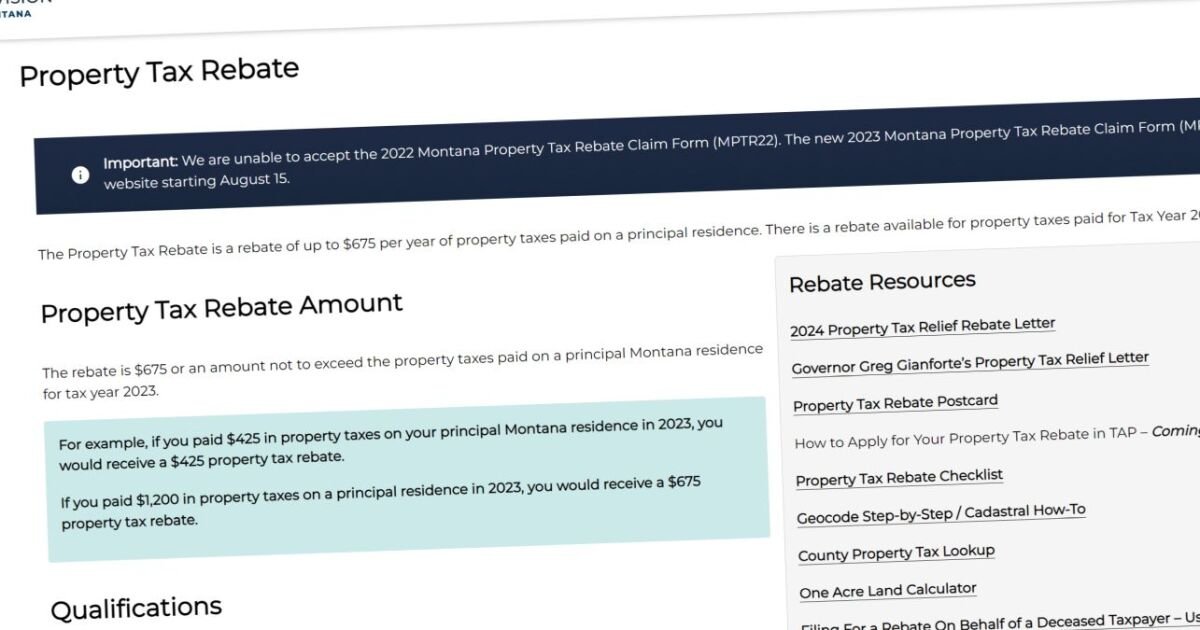

The property tax rebate is a rebate of up to $675 of property taxes paid on a principal residence.

To qualify, you must have owned and lived in a Montana residence for at least seven months of 2023 and paid the property taxes on that residence.

Properties owned by an entity and irrevocable trusts are not eligible for the rebate.

Montanans must apply for the rebate between August 15 – October 1, 2024. The fastest way for taxpayers to apply for the rebate is online. Claiming a property tax rebate online should take only a few minutes.

The Montana Department of Revenue has tools on the website to help taxpayers compile this information. MTN has also broken down some of the ways to find your property’s geocode.

The agency will begin accepting claims for the rebate for Tax Year 2023 on August 15, 2024 and all claims must be filed by October 1, 2024.

Rebates filed online will be issued within 30 days of filing a claim. Paper claims may take up to 90 days to process.

After your rebate is processed, allow at least 4 weeks for delivery before contacting us regarding your check. Rebate checks will be mailed to the taxpayer; direct deposit is not available.

Taxpayers should be on the lookout for suspicious or fraudulent activity during the property tax rebate application period.

For more information and a list of qualifications, visit the GetMyRebate website.