A quiet crisis inside the family office

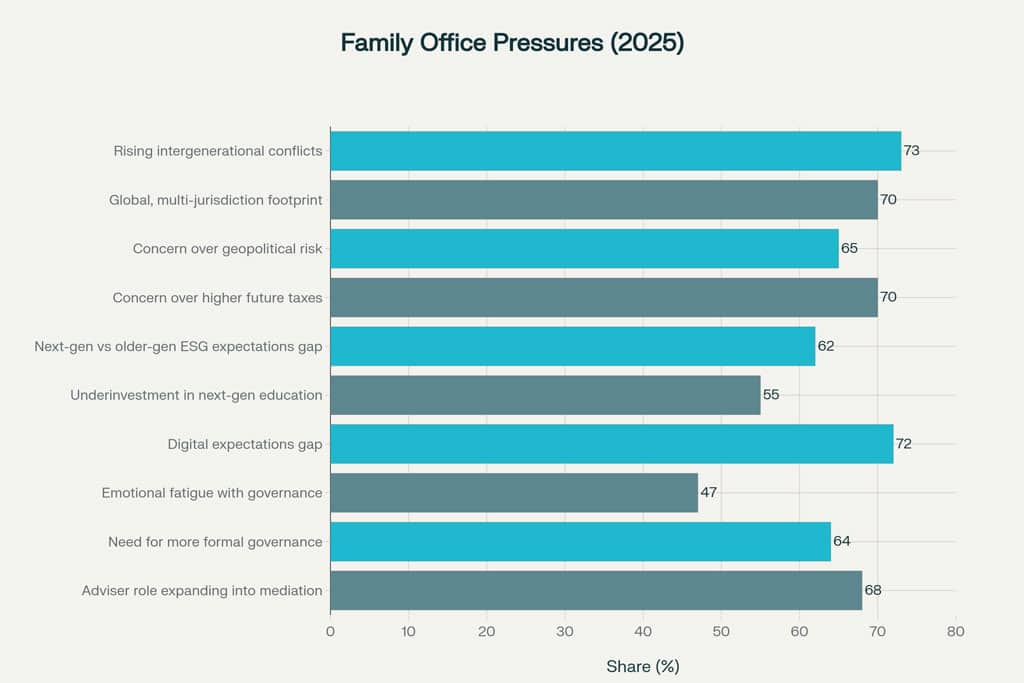

The modern family office looks more sophisticated than ever, yet many are sitting on a quiet crisis. Investment processes, reporting, and structures have professionalized, but disputes among family members are rising, not falling. The core issue is that governance has evolved faster on paper than in people.

Over the next two decades, an estimated $83.5 trillion is expected to change hands globally, primarily from baby boomers to Gen X, millennials, and Gen Z. That transfer is not merely financial; it is a transfer of power, values, and narrative control. In this environment, advisers are pulled into roles that look less like traditional wealth management and more like crisis management and relationship brokerage.

Generational wealth transfer and diverging expectations

The first fault line is generational. Younger heirs are arriving with a different sense of what capital is for and how it should be used. They want wealth aligned with values, not just a number on a statement. ESG, impact, and climate resilience show up not as peripheral “side pockets,” but as central tests of whether the family’s money reflects their identity.

At the same time, many older principals remain sceptical of ESG or view it primarily through the lens of risk management and reputation. What one generation sees as a moral obligation, another sees as an optional overlay. The fight is often not about allocations at the margin; it is about what “good stewardship” even means.

Women heirs and a shift in power

The second fault line is gender. Much of the impending wealth will first move between spouses and then down the generations, placing women at the centre of the family’s financial decision-making. This is already changing the composition of investment committees, philanthropy boards, and family councils.

Yet most family offices continue to underinvest in education and structured engagement for women and next-gen leaders. Training budgets, governance programmes, and exposure to complex decisions often lag behind the scale of assets being transferred. The result is a structural mismatch: families are creating more female and next-generation principals without giving them the same decade-long apprenticeship founders once had.

From money management to expectation management

For many family offices, the real work now lies in managing expectations, not just portfolios. Core services—asset allocation, manager selection, tax and reporting—still matter, but they are no longer sufficient. Disputes increasingly originate in questions such as:

- Who gets access to what information, and when?

- Who has a real voice in setting strategy, not just a ceremonial seat?

- How are disagreements surfaced and resolved before they become crises?

When these questions are left vague, even a well-run investment platform cannot compensate. Families that do not deliberately design how power, information, and responsibility flow will find those issues decided informally—often in ways that feel unfair to at least one generation.

Global mobility and cross-border complexity

Today’s ultra-wealthy families are structurally global. Siblings and cousins are spread across continents, with multiple passports, properties, and businesses spanning several legal systems. This adds layers of tax, regulatory, and estate-planning complexity that strain even robust structures.

But the deeper problem is fragmentation of identity. A family that started as a tightly knit local dynasty can, within two generations, become a loose network of global citizens whose main shared asset is a balance sheet. When there is no longer a common country, language, or lived experience, the family office becomes the primary institution holding the story together—or failing to.

Governance: from rigid constitutions to living systems

Governance has been the go-to answer: family constitutions, charters, voting rules, and formal councils. In theory, these provide clarity and continuity. In practice, rigid, one-off documents often fail in the face of changing lives and rising emotional fatigue. A constitution that cannot flex as new spouses, blended families, and far‑flung heirs appear will eventually be ignored.

The emerging model is a living system: governance that is reviewed regularly, adjusts to demographic reality, and incorporates structured forums for disagreement. Family councils, philanthropy committees, and investment boards can become effective bridges across generations—but only if they sit inside adaptable frameworks with clearly defined escalation paths and sunset clauses for outdated rules.

The digital expectations gap

Digital transformation has opened another front. Many family offices still run on a mix of legacy systems, spreadsheets, and static PDF reports. Younger heirs, by contrast, expect the same real-time, app-based experience they enjoy with top-tier private banks, brokers, and fintech platforms.

For them, access to information is not a mere convenience; it is a sign of respect and trust. When reporting is opaque, delayed, or selectively distributed, it signals that authority remains concentrated in the hands of a small inner circle. Bridging this gap requires more than software procurement. It demands a coherent policy on data rights, cybersecurity, and what “transparency” means in a family where interests may not always align.

Advisers as mediators, therapists, and translators

All these dynamics converge on the adviser. The archetype of the ultra-wealthy adviser used to be the investment guru or tax architect. Increasingly, the most valuable advisers are those who can also:

- Mediate disputes before they harden into permanent fractures.

- Coach younger heirs on responsibility, risk, and public scrutiny.

- Translate between generational languages—founder pragmatism and next-gen purpose.

Elite families now lean on advisers not just to pick managers and structure vehicles, but to facilitate off-sites, design educational journeys, and help articulate a shared vision of what the wealth is supposed to do in the world. Emotional intelligence and cultural fluency are becoming as important as technical credentials.

The new meaning of wealth: freedom and pressure

Perhaps the most profound shift lies in how younger generations define wealth itself. For many, the ultimate luxury is control over time: the ability to work on what they want, where they want, with whom they want. Wealth equals optionality.

Yet that freedom lives alongside a corrosive culture of comparison. Heirs raised with smartphones and social media have grown up under two simultaneous spotlights: the private expectations of a powerful family and the public narrative around inequality and privilege. It is common to see anxiety, imposter syndrome, or a sense of purposelessness in those who inherit large fortunes without inheriting a clear role.

What elite leaders, investors, and policymakers should do

For CEOs, fund managers, and policymakers who intersect with these families, three shifts matter. First, treat family dynamics and governance as material risk factors, not soft issues. The sustainability of capital pools, investment mandates, and philanthropic commitments increasingly depends on whether the next generation feels engaged rather than trapped or sidelined.

Second, build multi-disciplinary advisory capacity. The ultra-wealthy will reward advisers, banks, and firms that can integrate legal, financial, and human dimensions into a single offering. That means hiring coaches and mediators alongside portfolio managers and tax specialists, or partnering with firms that can.

Third, recognise that the $83.5 trillion wealth transfer is also a reputational and political event. The way this money is governed will shape public perceptions of legitimacy—around taxation, philanthropy, and influence. Boards, investors, and policymakers who ignore that context risk misreading both the opportunities and the backlash.

In this environment, the family office is no longer just a private investment vehicle. It is a laboratory for how power, money, and meaning will interact at the very top of the global wealth distribution. Advisers who can navigate both spreadsheets and emotions will be the ones who truly earn their seat at the table.

Key dynamics in ultra-wealthy family offices

| Dimension | Trend / Insight | Strategic implication for leaders |

|---|---|---|

| Generational wealth transfer size | Approx. $83.5 trillion expected to change hands over coming decades | Long-duration mandates; planning must span 20–30 years |

| Primary age cohort transferring | Ageing baby boomers | Accelerating need for succession and control handover |

| Core inheriting cohorts | Gen X, millennials, Gen Z | Different values, risk appetites, and expectations |

| Role of women | Women set to control a growing share of UHNW assets | More women on investment and philanthropy committees |

| Conflict incidents | Rising disputes despite more professional offices | Expectation management becomes a core advisory task |

| Education spending | Underweight vs. importance of next-gen readiness | High ROI from structured education and leadership programmes |

| ESG expectations (next gen) | Strong interest but recently more selective | Need for disciplined, data-backed impact strategies |

| ESG expectations (older gen) | Often secondary to returns | Requires translation between values and performance |

| Digital access expectations | Younger heirs demand real-time dashboards and mobile access | Technology and cybersecurity become central to trust |

| Reporting style | Tension between minimalist and data-rich approaches | Segment reporting by audience; avoid one-size-fits-all |

| Geographic footprint | Families increasingly span multiple jurisdictions | Cross-border legal, tax, and regulatory expertise is non‑negotiable |

| Identity cohesion | More “global citizens,” weaker shared local roots | Need for deliberate narrative and shared purpose |

| Governance tools | Constitutions and councils common but often rigid | Shift toward living, regularly reviewed frameworks |

| Decision-making rights | Often concentrated in founder or small inner circle | Planned dilution of control critical to avoid post‑founder chaos |

| Philanthropy | Growing vehicle for next-gen expression | Use structured philanthropy to align values and build skills |

| Adviser role | Expanding from portfolio to people and process | Value migrates to multi-disciplinary, emotionally intelligent teams |

| Data governance | Patchy clarity on who can see what and when | Formal data-rights policies needed for trust and compliance |

| Public scrutiny of wealth | Rising political and social attention on UHNW families | Reputation risk embedded in all major capital decisions |

| Social media influence | Constant comparison amplifies stress for younger heirs | Mental-health and communications support increasingly relevant |

| Liquidity vs. legacy | Tension between diversification and preserving core assets | Structured liquidity events with clear rules and timing |

| Business vs. financial wealth | Shift from operating businesses to financial portfolios in some families | Risk of losing shared mission if business no longer the anchor |

| Family office size | Range from lean teams to institutional-scale structures | Smaller offices at higher risk of overload and missed soft issues |

| Outsourcing | More functions outsourced to banks and multi-family offices | Coordination risk; need for a clear “chief of orchestration” |

| Education format | Mix of ad hoc briefings and emerging formal curricula | Advantage to families that treat this as a continuous process |

| Definition of wealth | Increasingly framed as freedom, time, and purpose | Advisory conversations must address life design, not just returns |