How safe is your family’s wealth, your pension and any inheritance you hope to leave after the Budget?

To help you understand what the Budget really means for you, I’d like to invite you to join our special webinar: How to manage your wealth in uncertain times

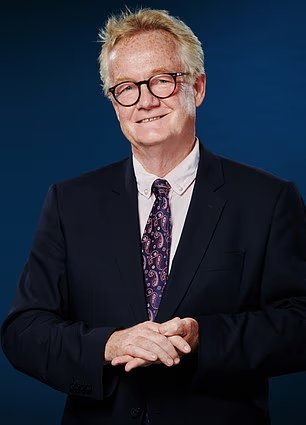

At midday on Wednesday 3 December, I will be joined by Michelle Holgate, director of financial planning at RBC Wealth Management, and the Daily Mail’s money editor at large, Jeff Prestridge, to discuss the essential things you need to know to protect and grow your wealth.

Simon Lambert is joined by the Daily Mail’s money editor at large Jeff Prestridge (left) and RBC Wealth Management’s Michelle Holgate (right) to discuss how to protect your wealth

The Budget has left people with a lot of questions. After months of speculation, Rachel Reeves finally revealed her plans for our finances, with headlines grabbed by tax raids on pensions, savings, investments, cash Isas and expensive homes.

And while the Chancellor cancelled the income tax hike that at one point was widely expected, she chose to embark on a huge stealth tax grab instead.

Yet, when it comes to protecting your finances, the important details from the Budget are not just about what was said but also what was left unsaid in parliament.

An inheritance tax attack on pension pots is rapidly approaching in April 2027, with the threat of double taxation for those who die after the age of 75.

Meanwhile, many savers are asking whether their pension tax-free lump sum cash will be safe in the future.

We will discuss the big Budget announcements, the devils that were hidden in the detail – and what people should think about to make the most of their income, wealth, savings, investments, pensions and inheritances.