UK financial services must “consider the disconnect” between the numbers of women in the advice profession who would strongly recommend it as a career, and the number of women who would not consider it.

This is one of the key findings from a landmark study by the newly-formed Womens’ Wealth Alliance, which sought to understand the levels of career support, development and flexibility across UK financial advice.

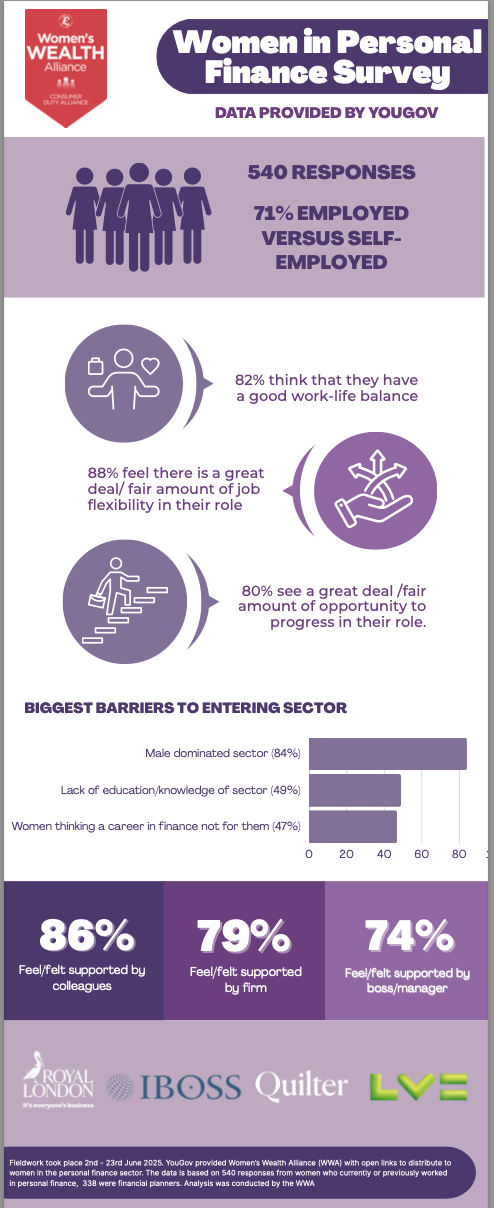

The Women in Personal Finance study 2025 was carried out in June by YouGov and with the support of IBOSS, LV=, Royal London and Quilter.

The research analysed 540 responses from women who currently or previously worked across financial planning, mortgage and protection advice, financial coaching, academy members and apprentices, paraplanning, compliance, T & C and support roles.

The data . . . shines a light on the huge value of a diverse, healthy and future-fit personal finance profession

Of the 338 who were financial planners, 93 per cent were enthusiastic, saying they would recommend the role to other women.

But among those who either worked outside of financial services only 36 per cent said they might consider becoming a financial planner, while more than half — 56 per cent — said a career in planning was not for them.

When asked what were the perceived barriers preventing them from becoming financial planners, 84 per cent said it was still seen as a male dominated sector.

Following this, 49 per cent said they believed there was still a lack of education/knowledge of the sector in general.

Positive picture

This contrasted sharply with the responses from those who were already planners.

Their comments revealed a positive picture of personal finance advice as a place for women to succeed in their career journeys, with high average levels of satisfaction around flexibility, support and career opportunities.

Vanessa Barnes, chartered financial planner and chair of the WWA, said there was “strong endorsement of the financial planning role for women”.

However, as almost half of those outside this role said they would not consider it, she said it would be “interesting to explore this disconnect in more detail”.

She said the WWA “strongly believes data-led responses are vital to attracting and advancing more women within personal finance.

“This is echoed by the FCA’s latest data request, where it has added questions on percentages of women in specific roles and of female clients, in recognition that we need an advice sector that is representative of the clients it serves.”

Barnes added: “Although this research was initially aimed at women in personal finance, it’s really important that the sector acknowledges that this data is not just relevant to the development of women’s careers but shines a light on the huge value of a diverse, healthy and future-fit personal finance profession that can respond to the Government’s growth objectives.”

When it came to experiences of working in the sector, the women surveyed, who currently or previously worked in a wide range of roles across personal finance, reported high levels of support in the workplace.

Calling all women in personal finance – we want your voices to be heard

The majority said they feel/felt supported by their colleagues (86 per cent), while 88 per cent of women surveyed said there was a great deal/ fair amount of job flexibility in their role.

Moreover, 80 per cent of respondents said there was a great deal /fair amount of opportunity and encouragement to progress in their career.

In terms of what respondents said would be most useful to women to develop or further their career in UK financial services, the top three requests were:

The survey admitted financial planning had its issues; for example, some open-ended responses in the survey showed experiences of feeling overlooked in favour of male colleagues, lack of flexibility around childcare and even harassment, which the WWA is keen to tackle.

However, these experiences appeared to be minority.

The WWA, which will shortly be appointing a board, is also planning to publish a White Paper in the autumn.

This will offering an in-depth review of the data and qualitative research taking place over the summer, including case studies and mapping out future workstreams and recommendations.

Who’s in the working group?

The current WWA working group comprises:

-

Vanessa Barnes – Chartered Financial Planner at Hannay Wealth LLP and Chair of WWA

-

Emma Bull – Head of Engagement, Consumer Duty Alliance

-

Ruth Handcock OBE – Chief Executive Officer, Octopus Money

-

Simoney Kyriakou – Editor, FT Adviser

-

Ranila Ravi-Burslem – previously Intermediary Distribution Director, Scottish Widows and Embark Group

-

Anna Sofat — Chair of One Loud Voice for Women

simoney.kyriakou@ft.com

Have your say in the comments section below or email us: ftadviser.newsdesk@ft.com