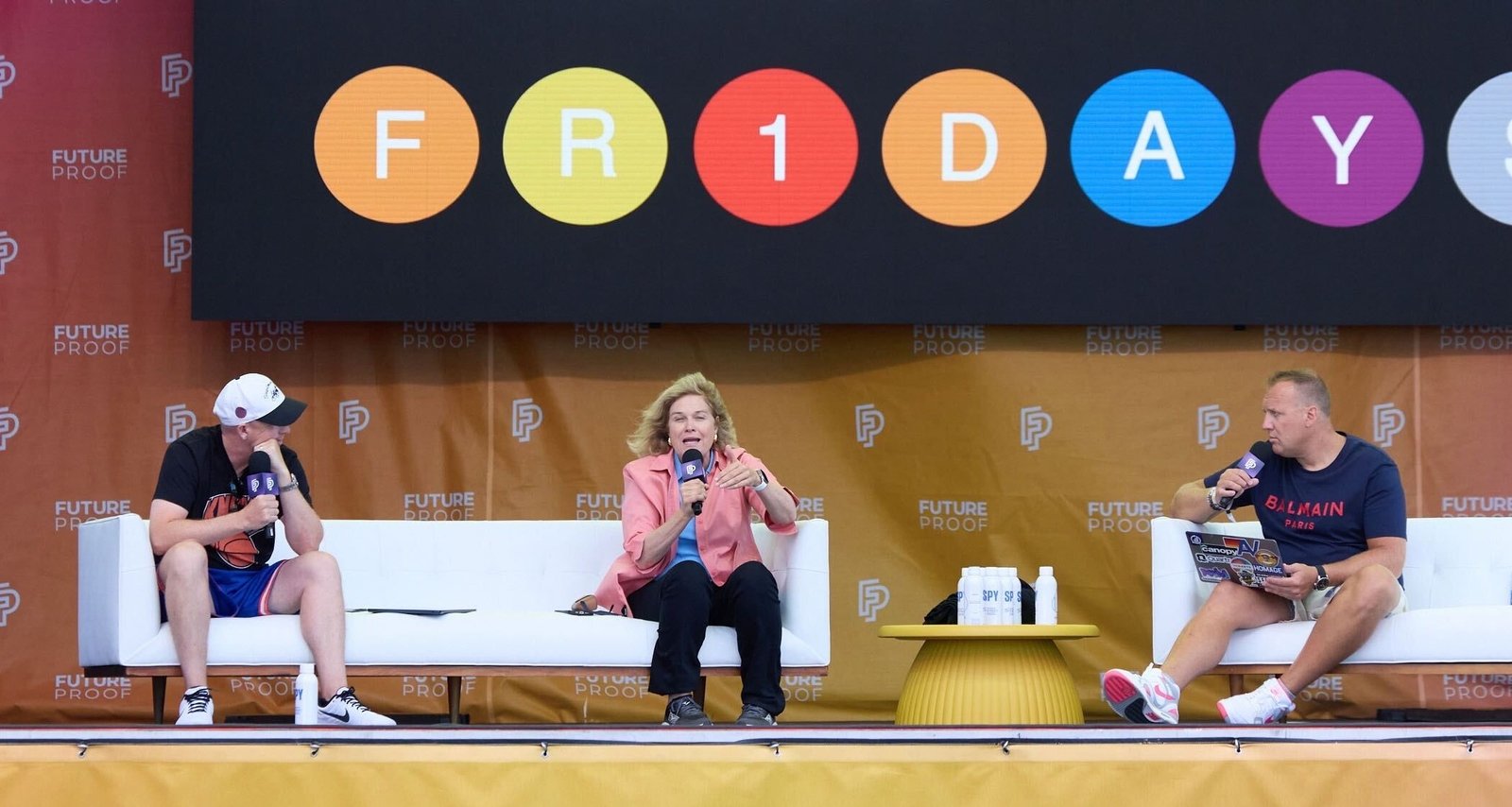

(left to right) Michael Batnick, Jenny Johnson, Josh Brown; source: Future Proof Festival

“The most important decision you make is the team you put together,” Jenny Johnson, CEO of Franklin Templeton, told the audience during the event.

The 2025 Future Proof Festival is underway, and a number of themes have begun to emerge, both in panel discussions and one-on-one conversations. Three standout panels on day one explored the evolving state of wealth management, Federal Reserve policy, and leadership. These discussions painted a vivid picture of where the industry is headed — from diversification and wealth transfer to rate cuts, artificial intelligence, and the growing importance of trust.

Fed Policy and the economic outlook

Rob Kaplan, currently vice chairman at Goldman Sachs, and former Federal Reserve Bank of Dallas, addressed the latest underwhelming jobs report during his session with the Bloomberg podcast hosts of Odd Lots, Joe Weisenthal and Tracy Alloway. While a potential recession may be looming, Kaplan was measured: “The job market is weak, but it’s not falling off a cliff.” He predicted the Fed would likely cut rates by 25 basis points, not 50, due to inflation still running above target levels.

Kaplan pointed to structural pressures: tight immigration policy reducing labor supply, tariffs raising costs, and an “AI data center power boom” straining the grid, he said. “We’re behind China in having enough power to fund the AI explosion,” he warned, calling for investment in geothermal, modular nuclear, and transmission infrastructure.

Asked whether Fed policy is truly restrictive given markets near all-time highs, Kaplan explained the tension: “The Fed’s job is to adjust policy based on the current economy, not the bet markets are making for two or three years out.” He acknowledged risks of inflationary energy costs, but said weak labor markets were forcing the Fed’s hand: “They really don’t want that.”

Kaplan also drew contrasts between the US and China. While American firms focus on hyperscalers, Chinese businesses are diffusing AI broadly into retail and services. “They’re further along because their margins are lower — they need to cut costs,” he said, suggesting US firms could learn from that pressure to adopt efficiency-enhancing tools.

Trust and transformation

Jenny Johnson, CEO of Franklin Templeton, joined the Compound & Friends hosts, Michael Batnick and Josh Brown, to discuss Johnson’s leadership approach and rise to her role within the company. Johnson stressed that trust is the foundation of her firm’s success. Having overseen 11 acquisitions in five years, she said the firm looks for “the three Cs: clients, collaboration, and continuous improvement.” Without those cultural anchors, integration falters.

Johnson sees scale as essential in an AI-driven era: “If you’re an asset manager and you don’t have scale in this world of AI, you’re going to be left behind, because you won’t have the data to train your models.” She pointed to Franklin Templeton’s acquisitions of Canvas (direct indexing), Benefit Street Partners (private credit), Clarion (real estate), and Lexington Partners (private equity secondaries) as building blocks for meeting client demand.

Alternatives, she argued, are the next big wave for the wealth channel. “No advisor needs to be convinced their clients should have alternatives. The question is: how?” She highlighted secondary private equity as especially attractive, offering diversified, discounted portfolios with shorter time horizons than traditional buyouts.

But Johnson cautioned against one-size-fits-all solutions. “Suitability depends on the client,” she said, underscoring the importance of advisors in guiding allocations. Education, again, is critical: “Don’t just look at the product and put it on the platform. Ask what the manager is doing to help you educate clients.”

Reflecting on leadership, Johnson shared her philosophy of the “four Ps”: people, passion, purpose, and persistence. “The most important decision you make is the team you put together,” she said. “Love what you do, describe it with purpose, and be persistent—because you’re going to fail, and you just have to get back up.”

The State of investment management

What is the single biggest client need in 2025?

For Andrea Lisher, Head of Americas, Client at J.P. Morgan Asset Management, the answer to this question, offered by Bloomberg host Denitsa Tsekova, was simple: “Diversification. Old, tried and true diversification.” She noted that unbalanced portfolios have drifted heavily into large-cap growth, leaving trillions in cash on the sidelines. “2025 has been like the year of revenge for diversification,” she said, with international markets outperforming the US by more than 1,000 basis points.

Kristie Feinberg, President and CEO, Manulife John Hancock Investment, emphasized that advisors are still asking the same question — how do I grow my business? — but the answers are shifting. “It’s about holistic planning, the impact of AI, and access to new vehicles like private markets,” she said.

(Left to right: Andrea Lisher, Jaime Magyera, Kristie Feinberg, Denitsa Tsekova)

For Jaime Magyera, head of BlackRock’s U.S. Wealth Advisory business, the dominant theme was outsourcing. With 30,000 advisors already using BlackRock’s custom and model solutions, she argued that firms increasingly want fewer partners who can do more. “Outsourcing is the number one request,” she said, because it frees advisors to focus on client relationships and growth.

The panel also tackled the great wealth transfer, with $84 trillion set to change hands by 2045. Lisher highlighted the need for education — both for families and advisors — pointing out that “70% of women change their financial advisor once their spouse passes away.” Feinberg added that business succession is another critical gap: while most private business owners plan to sell in the next two decades, only 5% have a written plan.

The conversation turned to younger investors. Magyera noted that millennials and Gen Z — set to inherit nearly half the world’s wealth — are heavily influenced by technology and social media. “Eighty percent would rather invest in Bitcoin than stocks and bonds,” she said, citing BlackRock’s launch of a spot Bitcoin ETF to meet this demand. Yet Lisher reminded the audience that the real challenge remains: “The most important thing isn’t going to be the hot fad. It’s getting people to save and invest early.”

Both Magyera and Feinberg stressed the importance of engaging women and underserved investors. Magyera observed that women now control half of global wealth but remain underserved by advisors. “When women are served, their confidence rises dramatically,” she said. Feinberg argued for more financial literacy across generations: “You don’t know what you don’t know. Education has to start much earlier.”