The wealth management market offers significant opportunities due to rising demand for digital solutions, AI-driven advisory tools, sustainable investments, and cross-border services. Key trends include personalized portfolio management, hybrid advisory models, holistic planning, and alternative asset allocation. North America leads, with Western Europe following closely.

Wealth Management Market

Dublin, Feb. 20, 2026 (GLOBE NEWSWIRE) — The “Wealth Management Market Report 2026” has been added to ResearchAndMarkets.com’s offering.

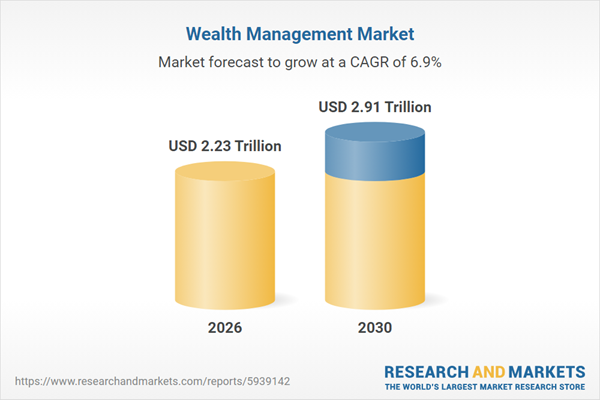

The wealth management market is demonstrating robust growth, with projections indicating an increase from $2.1 trillion in 2025 to $2.23 trillion in 2026, reflecting a compound annual growth rate (CAGR) of 6.3%. This upward trend is fueled by factors such as the rising number of high-net-worth individuals, expansive global capital market engagements, and a burgeoning demand for professional financial advisory services.

Looking ahead, the market is expected to reach $2.91 trillion by 2030 with a CAGR of 6.9%. Future growth will be supported by an enhanced demand for tailored digital wealth solutions, the integration of AI-driven advisory tools, and an increased interest in sustainable and ESG investments. Noteworthy trends include personalized portfolio management, hybrid advisory models, holistic financial planning, and alternative asset allocation strategies.

This flourishing market is also driven by positive economic indicators, such as the 2.1% annual GDP growth recorded in the US during the second quarter of 2023. Economic advancements create fertile grounds for wealth management by providing investment avenues and elevating asset values.

Major industry players are pioneering innovative solutions to meet escalating demands. Notably, Morgan Stanley introduced the AI-powered tool, AI Morgan Stanley Debrief, in June 2024. This GenAI tool, powered by advanced AI models and CRM integrations, automates meeting summaries, drafts client communications, and enhances workflow efficiencies, proving invaluable for advisors seeking to scale client interactions without sacrificing personalized service. This innovation reflects a wider industry shift towards using analytics and automation to boost advisor productivity.

The market is further augmented by strategic acquisitions and partnerships. For instance, Backbase BV’s acquisition of Nucoro Limited enables Backbase to offer comprehensive digital investment services, integrating capabilities such as robo-advisory and trading solutions.