Discount broker Robinhood Markets (NASDAQ: HOOD) has quickly established itself as an important force in the brokerage industry. Offering free trades, for example, led to a massive change in the way brokers competed on cost. The stock has been getting investor attention lately, and it more than doubled over the past year, even after a large pullback during the market swoon.

Is that pullback an opportunity, or does it highlight a potential risk with Robinhood?

From a big-picture perspective, Robinhood is a discount broker. But it is more than that and has done an impressive job of expanding its reach. Robinhood now offers users stock, options, and cryptocurrency trading, select banking services, prediction markets trading, retirement investing, and more. In the fourth quarter of 2024, the company’s assets under custody rose 88% year over year to $193 billion. There were multiple drivers of this. One was new deposits, and the other an even bigger one, was the increase in the value of the securities its customers own.

That’s great, but there’s one more number here that has to be kept in mind. The average customer account size was just $7,700. That’s not a very big number, but it makes logical sense. Robinhood is an attractive option for investors who are relatively new to investing. However, it is important to note that the company didn’t actually hold its initial public offering until after the bear market and recession brought on by the coronavirus pandemic.

These two facts are noteworthy, and you need to keep them both in mind as you assess the stock. The reason for that is the fact that Wall Street has a very short memory. The big news right now is that Robinhood had a really good year in 2024. Revenue increased 58%, and earnings per share came in at $1.56, up from a loss of $0.61 in 2023. The company is doing great right now.

Robinhood has achieved great success, and it has opened up the world of investing to a new cohort of people who previously weren’t investors. But it hasn’t lived through a really bad market as a public company yet. So, Wall Street has no way of knowing what will happen when, not if, there is a deep downturn. The market correction in early 2025 is nothing compared to, say, the Great Recession, which had investors worried that the entire financial system would collapse.

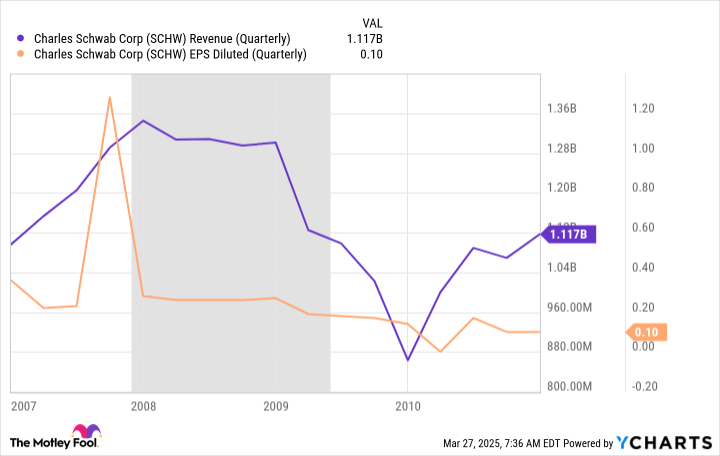

Discount broker Charles Schwab (NYSE: SCHW) did live through that period. Its revenue and earnings both took a notable hit, which makes complete sense. The same is highly likely to happen to Robinhood when it faces similar adversity. However, there are some differences between these two companies.