House prices have fallen across the south of England, according to the latest figures from Halifax.

The mortgage lender revealed that three regions saw prices fall in November.

London has been worst hit by the downturn, with prices in the capital falling 1 per cent over the past year.

However, in prime areas the falls have been even sharper with Land Registry figures showing prices have fallen by double digits in some London boroughs. For example, in the City of Westminster, average prices are down more than 14 per cent in the 12 months to September.

The surrounding counties have also seen prices dip. In the South East prices are down by 0.3 per cent on average, and in the East of England they have dipped 0.1 per cent.

However, further north, in Scotland, Wales and in particular, Northern Ireland, continue to see house prices go higher.

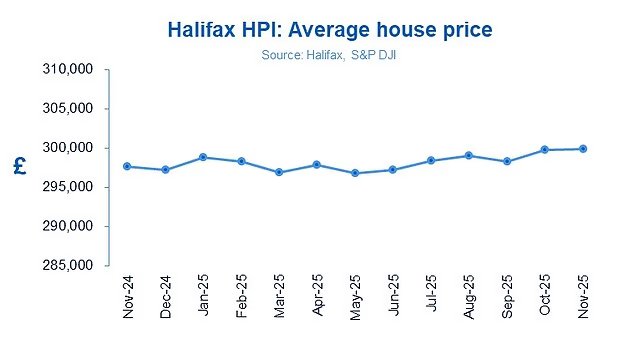

Big picture: despite falls in the South East, overall average house prices were broadly unchanged in November, edging up by £138 compared to October

The North West of England recorded annual house price growth of 3.2 per cent, followed by the North East with growth of 2.9 per cent.

Average homes in Scotland are up 3.7 per cent year-on-year while in Northern Ireland prices are up 8.9 per cent compared to last year.

Overall, it means average house prices were broadly unchanged in November, edging up by £138 compared to October, according to the latest figures from Halifax.

It means the typical UK home has edged up to another new record high and now costs £299,892.

Compared to this time last year, prices are only up 0.7 per cent, according to the mortgage lender, the weakest annual growth since March 2024.

Amanda Bryden, head of mortgages at Halifax, said it had been ‘one of the most stable years for the housing market over the last decade.’

‘Even with the changes to stamp duty back in spring and some uncertainty ahead of the Autumn Budget, property values have remained steady,’ said Bryden.

‘While slower growth may disappoint some existing homeowners, it’s welcome news for first-time buyers.

‘Comparing property prices to average incomes, affordability is now at its strongest since late 2015.

‘Taking into account today’s higher interest rates, mortgage costs as a share of income are at their lowest level in around three years.’

Heading lower: Compared to this time last year, prices are only up 0.7%, according to Halifax the weakest annual growth since March 2024

Will there be a post Budget bounce?

With homes starting to look more affordable when compared to incomes and with mortgage rates expected to continue falling, many agents and mortgage brokers are confident the market will bounce back in 2026.

Mortgage rates have been steadily improving over recent weeks.

Today, Nationwide Building Society cut rates across a number of its mortgage deals.

Britain’s biggest mutual will now offer rates starting from 3.58 per cent, the first time it has offered a fixed mortgage rate lower than 3.6 per cent since September 2022.

Amy Reynolds, head of sales at Richmond estate agency Antony Roberts, is optimistic prices will rise next year.

‘The post-Budget bounce is real and even works when a Budget is in late November,’ said Reynolds.

‘Our Saturday diaries are full for all our offices and our most expensive properties have had a new lease of life with viewings booked for most of them and even a second viewing on one already.’

Buying agent, Jonathan Hopper of Garrington Property Finders says there is a sense that the ‘shackles are finally off.’

He added: ‘With the Bank of England expected to cut interest rates again before Christmas, the prospect of cheaper mortgages, coupled with property prices that have softened substantially in London and the commuter belt could help the market get 2026 off to a healthy start.’

Not all property agents are so convinced, however. Tom Bill, head of UK residential research at Knight Frank said, ‘Clarity has now returned, but an array of tax rises, which include an income tax threshold freeze, will increasingly squeeze demand and prices.’