Former Republican Cincinnati State Rep. Tom Brinkman was against the sale of the city-owned Cincinnati Southern Railway for $1.6 billion, which voters approved last November.

So he’s pivoting. Brinkman, who lives in Mount Lookout, filed paperwork with the city of Cincinnati Tuesday that indicated he plans to gather signatures for a charter amendment that would put $600 million of the sale money toward property tax relief for Cincinnati homeowners.

The charter amendment seeks to take the $600 million out of the fund and transfer it to a property tax relief fund, which would gain interest. Then the fund would automatically pay city property taxes for Cincinnati property owners until the fund is gone. It would not include voter-approved property taxes like school levies or levies for the Cincinnati Zoo or Cincinnati and Hamilton County Cincinnati Public Library.

Brinkman, who is running for Hamilton County auditor against Democrat Jessica Miranda, would need to collect 8,786 valid signatures for Cincinnati City Council to vote on it by Sept. 6.

‘Shouldn’t taxpayers directly get something?’

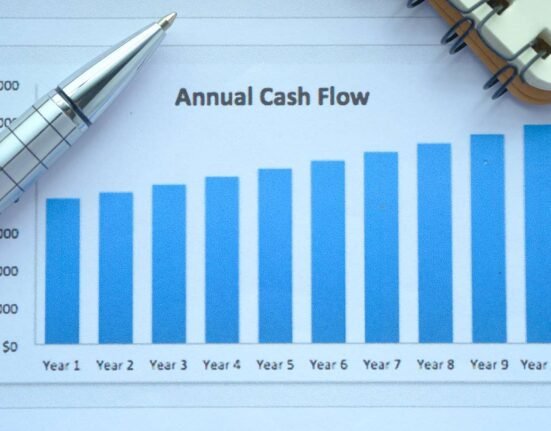

Money from the railroad sale was used to create a trust fund, from which investment money will be used each year to repair infrastructure. Estimates show the city could reap $50 million to $80 million a year from the fund.

“We lost the campaign against selling the railroad,” Brinkman told The Enquirer. “Property taxes paid for the railroad 150 years ago so shouldn’t taxpayers directly get something?”

Brinkman estimated the fund would last between 15 and 20 years.

“The people who got really hurt by property tax assessment are the working poor, the middle class,” Brinkman said. “This would be a lot of relief for them. It would be a tremendous savings for people who didn’t give up on the city. It is for the people who are the rock of the city.”

Is this really about the auditor’s race? No, Brinkman said. He said this is about giving taxpayers the money they deserve from the sale.

This would be Brinkman’s 11th charter amendment campaign since 1991, with him never failing to get the needed signatures. However, the charter amendments haven’t always passed.

Would the idea be legally viable?

To circulate a petition, the person seeking the change needs the signatures of five registered city voters. This has the signatures of Brinkman, Republican Hamilton County Commissioner candidate Adam Koehler, West Side residents Pete Witte and Amber Kassem and Northside resident Sarah Wolf, who runs the Facebook group, Hamilton County Homeowners United, which seeks to give a voice to people who need property tax relief. Koehler and Witte were among those opposed to the railroad sale.

It’s unclear if the amendment supersedes the legal structure of the railroad sale. The state legislature had to approve the sale and language in the approval says the money must be spent on maintaining current infrastructure. Brinkman pooh-poohed that and said the details can be worked out later if needed. This ballot initiative, he said, is about what voters want.

Anyone seeking a ballot petition must turn the petition language in to the city’s clerk of council before circulating them.

Cincinnati Southern Railway Board President Paul Muething Tuesday said he had not heard about the proposed change. Muething, a lawyer, said state law might need to be amended to pave the way for a change in how the money is spent.

Pureval: Railroad sale was expressly to pay for infrastructure

Although the initiative would only impact Cincinnati residents and be voted on by Cincinnati voters, the idea comes at a time when Hamilton County property owners have been hit with higher property taxes.

Cincinnati Mayor Aftab Pureval, who appeared in television ads for the railroad sale and championed it on the campaign trail last year, said more vetting would need to be done “to understand the potential impacts.”

“But what we do know is that the funds from the railroad sale are needed, and the trust fund has been established, to address the hundreds of millions of dollars in deferred maintenance of our existing infrastructure,” Pureval said. “That was the express purpose of the sale, and restrictions on spending were codified into law for a reason.”

A property tax assessment last year resulted in, on average, property taxes in Hamilton County increasing 28% while total taxes increased about 12%, according to January figures released by the Hamilton County auditor.

In March, Councilman Mark Jeffreys created a property tax relief task force, which is developing recommendations to provide financial relief in Cincinnati. Jeffreys had suggested $50 million the city set aside for pandemic-related earnings tax rebates be put toward property tax relief, but that idea has never come to a vote.

What the petition says:

Section 1. Establishment. There is hereby established a Property Tax Relief Fund to be funded, administered, and utilized as set forth herein.

Section 2A. Funding. No later than 14 days after the effective date hereof, the board of trustees of the Cincinnati Southern Railway shall transfer $600 million to the city of Cincinnati which shall, in turn, place said funds into the Property Tax Relief Fund.

Section 2B. Investment Income. The City of Cincinnati may invest the funds of the Property Tax Relief Fund and any income as result of said investments shall be deposited in the Property Tax Relief Fund.

Section 2C. Funds Restricted. All funds within the Property Tax Relief Fund may only be administered and utilized as set forth herein. The city of Cincinnati may not transfer or otherwise dispose of any funds within the Property Tax Relief Fund except as expressly provided herein.

Section 3A. Full Property Tax Relief.No later (than) 14 days after the effective date hereof, the city of Cincinnati shall ascertain from the Hamilton County auditor the amount of dollars the City of Cincinnati is to receive from the forthcoming semi-annual tax assessment on real property. The City of Cincinnati shall, within 15 days of the receipt of said amount, pay to the Hamilton County treasurer from the Property Tax Relief Fund said amount which shall be credited towards the real property tax owed to the City of Cincinnati from each owner of real property within the City of Cincinnati.

Thereafter, the City of Cincinnati shall ascertain from the Hamilton County auditor the amount of dollars the city of Cincinnati is to receive from each ensuing semi-annual tax assessment at least 45 days prior to the sending of property tax bills by the county treasurer. The city of Cincinnati shall, within 15 days of the receipt of said amount and provided the Property Tax Relief Fund has sufficient funds to pay said entire amount, pay to the Hamilton County treasurer from the Property Tax Relief Fund said amount which shall be credited towards the real property tax owed to the City of Cincinnati from each owner of real property within the City of Cincinnati.

Section 3B. Partial Property Tax Relief. If the Property Tax Relief Fund does not have sufficient funds to pay the entire amount provided for in Section 3A, then the City of Cincinnati shall pay to the Hamilton County treasurer all available funds from the Property Tax Relief Fund. Said payment from the Property Tax Relief Fund shall be credited pro rata towards the real property tax owed from each owner of real property within the City of Cincinnati.

Section 4. Termination. Upon the depletion of all funds with the Property Tax Relief Fund, the city of Cincinnati shall terminate or close out the Property Tax Relief Fund.

Section 5. Self-Executing. The provisions herein shall be self-executing, but the Cincinnati City Council shall have the power to enact ordinances necessary and proper to ensure the implementation of the provisions herein.

What the railroad ballot language said:

Shall the Cincinnati Southern Railway Board of Trustees be authorized to sell the Cincinnati Southern Railway to an entity, the ultimate parent company of which is Norfolk Southern Corporation, for a purchase price of $1,600,000,000, to be paid in a single installment during the year 2024, with the moneys received to be deposited into a trust fund operated by the Cincinnati Southern Railway Board of Trustees, with the City of Cincinnati as the sole beneficiary, the moneys to be annually disbursed to the municipal corporation in an amount no less than $26,500,000 per year, for the purpose of the rehabilitation, modernization, or replacement of existing streets, bridges, municipal buildings, parks and green spaces, site improvements, recreation facilities, improvements for parking purposes, and any other public facilities owned by the City of Cincinnati, and to pay for the costs of administering the trust fund.