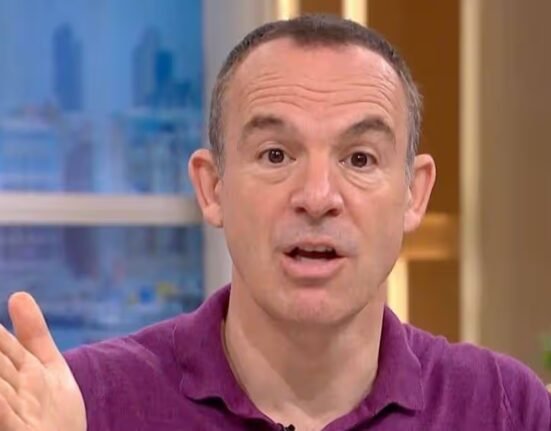

Broadview Mayor Katrina Thompson at an event in 2022. She said she’s collaborating with a team of residents and experts from the Illinois Municipal League to examine Illinois property tax statutes before presenting policy recommendations to state lawmakers. | File

Friday, August 9, 2024 || By Michael Romain || michael@wearejohnwilk.com

At a town hall in Broadview on Aug. 1, Broadview Mayor Katrina Thompson said property owners in the south and west suburbs should mobilize to push state lawmakers to address the high property tax burden in those communities.

“When you look at the group of people most impacted by these [tax] increases, they’re in Black and Hispanic communities,” Thompson said at the town hall in Broadview’s Village Hall, 2350 S. 25th Ave.

“It’s the same situation in the South Suburbs,” she said. “The writing is on the wall for us to get behind something and to put something in place that we can present in an educated and professional manner. And we go together as a group to tell our story.”

In June, Cook County Treasurer Maria Pappas’ office released the Tax Year 2023 Bill Analysis, which showed that the median tax bill jumped a record 20% in the south and southwest suburbs.

“The biggest increases in homeowners’ tax bills occurred in 15 south suburbs where taxes soared 30% or more,” Pappas’ office announced. “Of those 15 suburbs, 13 have mostly Black populations. In two towns, Dixmoor and Phoenix, the median tax bill more than doubled.”

In the Proviso Township area, the biggest increases in the median residential property tax bill were in Northlake (24%), Melrose Park (21%), Broadview (18%), Maywood (17%), and Berkeley (17%). Four of those five suburbs are predominantly Black or Hispanic.

In the South Suburbs, government leaders like Harvey Mayor Christopher Clark called for mayors to hold their local tax levy increases at 0%. At the same time, Park Forest Mayor Joseph Woods said his village has been pressuring Cook County Assessor Fritz Kaegi’s office. Woods told WTTW he wants “to really make sure that [Kaegi’s people] see what we see. To see the inconsistency, to see the lack of uniformity” in assessments.

In June, Kaegi blamed the Cook County Board of Review (BoR), in part, for the residential property tax bill increases. His office released data showing that the BoR routinely lowered commercial property tax assessments when owners appealed, indirectly shifting the tax burden onto homeowners.

At the Aug. 1 town hall in Broadview, Cook County Board of Review Commissioner Larry Rogers, Jr., pushed back, pointing out the 4,400 errors Kaegi’s office made on assessments and exemptions in the south and southwest suburbs. Rogers urged homeowners to appeal their property taxes with the Assessor’s Office and the Board of Review and to file certificates of error if they think their property was overassessed.

“He’s hurting everybody,” Rogers said about Kaegi. He will misrepresent to you what we do with businesses. He’ll raise a business’s assessed value by $10 million. They’ll appeal with us, and we may reduce it by $5 million, so they’ll still get a $5 million increase, but he’ll say we reduced taxes by $5 million. No, we just didn’t get them the $10 million you over-assessed.”

Rogers, Jr. echoed Thompson about the possible need for collective action.

“I think right now, it’s at a breaking point where people need to demonstrate how upset they are,” he said. So one thing raised yesterday was marching down to Kaegi’s office with white shirts saying ‘Cap Kaegi’. Cap his increases or stop the raise—whatever you want to say.”

Thompson called on residents to come together and present proposals for property tax reform at the state level. For instance, Assessor Kaegi has criticized the state’s method of relying heavily on property taxes to fund schools.

“The greatest inequity of all, really, is that choice made by our state to so underfund school districts and then put the onus on communities to raise the resources themselves to educate their children,” Kaegi told Crain’s Chicago Business last year.

“Two-thirds of property taxes are for schools, and figuring out how we finance schools in a way that doesn’t put all the burden on property is a really important thing to have in a more equitable economy,” Kaegi said.

In May, Kaegi’s office hosted a panel discussion on a new book called “The Black Tax” by Andrew Kahrl, a University of Virginia history professor.

In his book, Kahrl cites research showing that, nationwide, “the assessed values of properties in Black and Hispanic neighborhoods are 10 to 13 percent higher than those of properties in predominantly white areas within the same jurisdictions, forcing the median African American homeowner in the US today to pay an extra $300 to $390 annually in property taxes, with those families at the widest end of the assessment gap paying up to $790 more in taxes annually.”

At a regular board meeting on Aug. 5, Mayor Thompson said she’s collaborating with a team of residents and experts from the Illinois Municipal League to examine Illinois property tax statutes before presenting policy recommendations to state lawmakers.

“There’s a lot of systemic racism in housing, but we have to unpeel the law to find a solution,” Thompson said.

“Achieving meaningful reform in our property tax system requires a collective effort. Bandaid fixes are no longer sufficient for addressing the challenges we face in Broadview and across Proviso Township. By working together and advocating for comprehensive reform, we can strive for a more equitable and sustainable tax system that benefits all members of our community.”