ASX Limited (ASX: ASX), the Australian Securities Exchange, reported financial results for the fiscal year ending June 30, 2024, with record operating revenue of $1.03 billion, despite a dip in net profit after tax by 3.4% to $474.2 million.

The company’s earnings were affected by higher operating expenses, largely due to investments in regulatory commitments and technology modernization. ASX announced a dividend payout ratio of 85% of underlying NPAT, with a total dividend of $2.08 per share.

Key Takeaways

- ASX achieved a record operating revenue of $1.03 billion for FY ’24.

- Net profit after tax decreased slightly by 3.4% to $474.2 million.

- Total dividend declared was $2.08 per share, with a final fully franked dividend of $1.068 per share.

- Operating expenses increased by 14.7% mainly due to investments in regulatory commitments and technology modernization.

- Revenue from listings declined by 1%, with initial listing revenue down 13% and secondary revenue decreasing by 7%.

- Markets business revenue increased by 7.9%, with futures and OTC revenue up by 12.3%.

- Technology and data business segment saw a revenue increase of 5.9%.

- Securities and Payments business revenue decreased by 1.1%.

- ASX plans to continue investing in technology, regulatory commitments, and exploring new opportunities such as carbon futures.

- The company anticipates total expense growth of 6% to 9% and operating expense growth of 4% to 7% for FY ’25.

- Capital expenditure for FY ’25 is projected to be between $160 million to $180 million.

Company Outlook

- ASX expects to invest in cloud services and data platforms in FY ’25.

- The company is looking to expand its environmental futures product offering and explore the concept of a carbon exchange.

- There is potential for growth in the debt market and plans to launch debt market activity services.

- ASX anticipates a return of IPO activity and increasing interest in listings.

- The company is focused on cost management and expects FY ’25 total expense growth of 6% to 9% and operating expense growth of 4% to 7%.

- ASX aims to improve their employee experience and develop an outcomes-focused culture.

Bearish Highlights

- Securities and Payments revenue declined due to lower trading activity and fewer IPOs.

- Net profit after tax decreased by 3.4% compared to the previous fiscal year.

Bullish Highlights

- ASX’s balance sheet remains strong with an S&P long-term rating of AA-.

- The technology and data business segment experienced revenue growth driven by demand for equities and futures data.

- The markets business generated increased revenue, particularly from futures and OTC markets.

Misses

- The company reported a decline in revenue for listings due to lower market capitalization.

- Total expenses for the year increased significantly, mainly due to investments in regulatory commitments and technology modernization.

Q&A Highlights

- ASX executives emphasized their focus on cost management, with significant annualized savings and cost reductions.

- The potential impact of competition in settlements and clearing was discussed, along with future funding of Sympli.

- Updates on technology projects, including the OTC clearing upgrade and the futures clearing platform, were provided, but details were limited.

- The introduction of zero data expiry options in Australia was discussed as a potential revenue opportunity.

- The company is exploring pricing for futures and option contracts and the central clearing of bond and repo markets.

In summary, ASX demonstrated resilience with record operating revenue while navigating increased expenses due to strategic investments. The company remains committed to enhancing shareholder value and leveraging opportunities for future growth, particularly in technology, regulatory compliance, and new market services.

Full transcript – None (ASXFF) Q4 2024:

Helen Lofthouse: Good morning, and welcome to ASX’s Results Briefing for the Financial Year Ending 30th of June 2024. Thank you for taking part in this virtual presentation. I hope you’re well wherever you’re joining us. My name is Helen Lofthouse and I’m the Managing Director and CEO of ASX. I’m pleased to be presenting these results today, along with ASX’s Chief Financial Officer, Andrew Tobin. I’d like to acknowledge the Gadigal People of the Eora Nation, who are the Traditional Custodians of the country where I’m speaking today and we recognize their continuing connection to the land and waters and pay our respects to Elders past and present. And we extend that respect to any First Nations People joining us today. I’d like to begin today by addressing Wednesday’s announcement regarding the civil proceedings filed by ASIC against ASX Limited. This is in relation to certain statements made by ASX in February 2022 regarding the previous CHESS Replacement project. As I said on Wednesday, we recognize the significance and the serious nature of these proceedings and are now carefully reviewing and considering the allegations. I appreciate that you may have more questions about this situation. But as this is an ongoing legal matter, I am limited in any further comments I can make at this time. We play a critical role in the Australian financial system and are committed to delivering for our customers and shareholders. And despite this setback, I’m proud of the strong progress that we’re making as an organization as we work towards our 5-year strategy and delivering our vision of a New era ASX. So, now let’s turn to our FY ’24 results. Today’s presentation will cover 3 areas and then Andrew and I will take your questions. I’ll begin with highlights from the FY ’24 results. Then Andrew will provide a more detailed view of our financial performance, including each line of business and I’ll then update you on our strategic priorities for the period ahead and provide some observations on the market outlook and its implications for ASX, and we’ll finish with Q&A. So, let’s begin with the FY ’24 highlights. At our Investor Forum in June, I gave you an update on our progress as we move into the second year of our 5-year strategy. We understand that delivery is a key focus for our shareholders. And in FY ’24, we have delivered in many areas. We delivered record operating revenue in FY ’24, demonstrating the quality of ASX’s businesses and the value that they create for the markets in which we operate. And this was offset by an increase in operating expenses as we continue to invest in activities to meet our regulatory commitments and our technology modernization program, which are the focus areas for Horizon 1 of our strategy. I’ve been pleased with what these investments have delivered in FY ’24, which further enable us to be dynamic and respond to the needs of our stakeholders. We play a key role in promoting financial system stability through the licenses that we hold as well as the markets and clearing and settlement facilities that we operate. This is a privilege and foundational to ASX and to shareholder value. And we’ve made good progress in delivering on our regulatory commitments in FY ’24. Our regulatory deliverables have included a series of special reports and significant uplifts in our stakeholder and regulatory engagement in the past year. ASX is underpinned by technology and we’re continuing to build sustainable, secure and resilient technology. And this requires investment also in our capability to deliver key projects and we made good progress in FY ’24. And I’ll go into some of the specific achievements in the year and what we intend to deliver in FY ’25 later in the presentation. And finally, we delivered a series of expense management initiatives in FY ’24 as part of the ongoing cost-conscious approach to the way we run our business. This included a targeted restructure, which helped to ensure that we’re carefully prioritizing the most strategic and efficient outcomes for ASX. We’ve also generated a further annualized saving of approximately $5 million through reducing our use of consultants and process improvements, which Andrew will talk about in more detail shortly. Turning now to our financial highlights. We delivered $1.03 billion of revenue in FY ’24, which is a record for ASX and achieved in a challenging year for equity markets. Our diversified business model supported the revenue performance where the decline in listings and securities and payments was offset by growth in our markets and technology and data businesses. Total expenses were up by 14.7% compared to FY ’23, which is within our guidance range. And this expense growth was primarily driven by investment in our focus areas of regulatory commitments and technology modernization as well as some one-off costs in the period. We expect a growth rate of between 6% and 9% in FY ’25 as a result of the business efficiency actions that we’re taking. And underlying net profit after tax or NPAT, decreased by 3.4% to $474.2 million, while statutory NPAT increased substantially, given that the prior corresponding period included the loss from the derecognition of the previous CHESS Replacement project. ASX’s dividend payout ratio of 85% of underlying NPAT is in the middle of our range with the board determining a fully franked final dividend of [ $1.068 ] per share, bringing the FY ’24 total dividend to $2.08 per share. And we reported underlying ROE of 13% for the year, which is within our medium-term target range. So, let’s move now to some specific delivery highlights for FY ’24. At the Investor Forum in June, we provided our indicative technology road map, setting out the delivery sequencing for our major projects and we’ve been delivering against this road map in FY ’24. So, let’s begin with our trading project. For cash market trading, we rolled out an update of ASX Trade in March, which provided technology upgrades and new services focused on increasing resiliency for the market. And for trading networks, we replaced the infrastructure in our data center, which delivered a series of upgrades for data services critical to our customers. Work continues on the CHESS Replacement project. And in FY ’24, we appointed TCS as our product partner and Accenture (NYSE:) as our delivery partner. This project has a unique set of challenges, including its importance to a large and diverse group of stakeholders. We want to work closely with market participants and we have a significant consultation process in place to facilitate this. This includes a highly engaged CHESS Replacement Technical Committee and Business Committee as well as the advisory group for cash equities clearing and settlement. And all of these forums help to ensure effective engagement with the market. We completed consultation on Release 1 of CHESS Replacement and has received feedback that the industry is broadly supportive of a phased implementation of the project on the basis that this approach will allow participants to see some of the benefits of this project earlier while managing delivery risk. Earlier this year, we also published an industry white paper seeking input on a potential move to a T+1 settlement cycle. This month, we released a public consultation paper on Release 2 of CHESS Replacement as well as a summary of feedback received on the T+1 white paper. We’re also delivering for our customers by launching new products in response to market demand. As an exchange, we have an important role to play in supporting the economy’s transition to net zero. And this is one of the structural tailwinds driving the long-term growth of ASX. We’re uniquely positioned to offer the products, connectivity and price transparency to operate fair and transparent derivatives markets to support our customers as they look to hedge transitional price risk. And as foreshadowed at our Investor Forum in June, our markets team have added environmental futures to our product ecosystem alongside electricity derivatives. And we’re also intending to launch Wallumbilla gas futures on Monday, the 19th of August. And this product has been developed with a working group of over 25 organizations, reflecting strong demand from our customers. In technology and data, we continue to develop new ways to support our customers as the way that they consume data continues to evolve. In FY ’24, we saw increasing demand from our customers to integrate ASX content into emerging analytical applications and machine-based consumption models. We also added new market participants to our technical services ecosystem centered on the Australian Liquidity Centre. As you can see, FY ’24 was a busy year for us, and we remain focused on delivery going into FY ’25. I’ll now hand over to Andrew to talk through the detailed financials for our full year results.

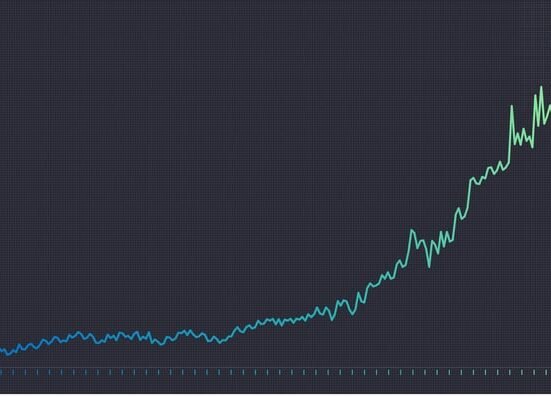

Andrew Tobin: Thanks very much, Helen, and good morning, everyone. As Helen has already mentioned, our FY ’24 financial results demonstrate the resilience of ASX’s diversified business model. The underlying and statutory profit for FY ’24 was $474.2 million, with the underlying profit after tax down 3.4% compared to FY ’23. However, ASX’s statutory profit after tax was significantly higher, given the comparative period included the derecognition charge of the capitalized costs associated with the CHESS Replacement project. Statutory profit increased from $317.3 million in FY ’23 to $474.2 million in FY ’24. Operating revenue for FY ’24 was $1.03 billion, which was an increase of 2.4% compared to the prior corresponding period and was a record for ASX for a financial year. Total expenses for the period were $429.5 million, up 14.7% on PCP and within our guidance range. Net interest income was up by 8.3% to $76.7 million, supported by higher net interest received from ASX’s cash balance, offset by lower collateral interest due to the decrease in average participant collateral balances. The increase in expenses relative to the revenue outcome resulted in our EBIT margin falling from 62.9% in FY ’23 to 58.5% this period. The 3.5% decline in earnings per share to $2.448 is consistent with the trend in underlying net profit after tax. Underlying return on equity generated in the year was 13% compared to 13.4% in the PCP, reflecting the decline in underlying NPAT. Now turning to the business unit revenue outcomes. The total listings revenue was 4.8% lower than PCP at $208.2 million. Annual listing fees make up over half of total revenue for listings and are driven by market capitalization, which is set at on 31 May each year. Lower market capitalization in May 2023 impacted FY ’24 revenue, resulting in a decline of 1% to $107.2 million. As you may be aware, we recognize the revenue derived from initial and secondary listings over 5 years and 3 years, respectively, and so the revenue outcomes reported mainly reflect prior period activity. This is shown in the bar chart on the slide. The uncertain macro environment has contributed to lower initial and secondary capital raising activity. Initial listing revenue recognized in FY ’24 was $20 million, down 13% from FY ’23 and secondary revenue was $72.8 million, down 7%. Total net new capital quoted for the year was $27.8 billion, up 94.8% from FY ’23 and was primarily driven by dual listings on our market. Moving now to the markets business. This business generated revenue of $315.4 million, up 7.9% compared to FY ’23. Futures and OTC revenue of $237.9 million was up 12.3% on FY ’23 supported by a 14.9% increase in total futures volumes driven by global interest rate volatility in the period. Strong revenue growth — strong growth, I’m sorry, was observed across all major products, including 90-day bank bill futures and 3- and 10-year treasury bond futures with traded volumes up 23%, 15% and 16%, respectively. Commodities revenue also increased, primarily driven by higher trading activity in electricity derivatives as a result of volatile electricity prices. Cash market trading revenue was $60.3 million, down 4.7% on PCP, impacted by a 6% reduction in the average daily on-market value traded. This was partially offset by options traded value, which was up by 5.7% and derives higher fees. ASX’s share of on-market cash market trading averaged 88% for the year, which is marginally down from 88.8% in FY ’23. Equity options revenue was $17.2 million, down 0.6%, reflecting lower trading activity. Index options volumes, which attract higher fees were down 5.3% on PCP, and this was partly offset by higher single-stock option volumes, up 5.6%. Now, looking at the technology and data business. This business had another strong period with revenue of $255.1 million, increasing by 5.9% compared to FY ’23. Information Services generated revenue of $156.3 million, up 7.9%, supported by strong growth in demand for equities and futures data in the year. Technical Services was also up with revenue coming in at $98.8 million, 2.9% more than FY ’23. Growth in customer infrastructure and connections at ASX’s data center drove this revenue increase with a number of customer cabinets growing slightly to 391. The number of service connections between data center customers increased by 3.9% to 1,399 connections by the end of the financial year. And finally, moving on to our fourth business segment, Securities and Payments. This business generated revenue of $255.6 million, down 1.1% compared to FY ’23. Issuer Services revenue was $58.1 million, down 4.9%, impacted by a decline in the average number of unique security holdings, resulting in lower subscription fee revenue. Subdued levels of trading activity and a reduced number of new IPOs also adversely impacted revenue in the period. Equity post-trade services revenue declined by 4% to $129.4 million compared to FY ’23. The total on-market value cleared for the year was $1.4 trillion compared to $1.5 trillion in FY ’23 and dominant settlement messages volumes fell by 1.5% in the period, primarily due to lower levels of equity market activity. Austraclear generated revenue of $68.1 million, up 9% compared to last year. It saw a 1.3% growth in holding balances to just over $3.1 billion at 30 June and a 5.7% increase in transaction volumes. The Austraclear revenue also includes the net operating contribution from Sympli, ASX’s property settlement joint venture. Sympli reduced its cost base in the year due to the uncertainty around the pathway to interoperability. While New South Wales and Queensland have expressed interest in proceeding with interoperability, Sympli awaits further information from governments and regulators before potential pathway forward and time line becomes clear. ASX’s share of Sympli’s operating loss was $10.8 million compared to a loss of $14.9 million in FY ’23, representing a 27.5% reduction. Turning now to expenses. Total expenses for the year were $429.5 million, up 14.7% on PCP and within our guidance range. Total expenses were 5.4% lower in the second half of FY ’24 compared to the first half as we started to see the benefits of our expense management initiatives and a reduction in one-off regulatory expenses. The FY ’24 figure reflects the growth in expenditure required to meet the group’s regulatory commitments and technology modernization road map during the year. And in addition, we observed inflationary pressures impacting our expense line, particularly around technology license fees. We also saw a significant increase in administration expenses and the ASIC supervisory levy. The largest growth in expenses was in relation to employees where expenses were up by 21.1%, with permanent and contractor headcount increasing from 1,050 in FY ’23 to 1,193 at the end of FY ’24. As you can see from the chart at the bottom of the slide, there was a reduction in the number of employees related to operational activities going into FY ’25, which demonstrates our focus on workforce optimization. The growth in project-related headcount primarily relates to our technology modernization program. We reiterate our total expense growth guidance provided at our Investor Forum in June. We expect FY ’25 total expense growth to be between 6% and 9% compared to FY ’24. This growth is primarily driven by ongoing technology-related costs related to Horizon 1 of our 5-year strategy, including software licensing and equipment. Going into FY ’25, we have achieved annualized savings of approximately $5 million by reducing the usage of consultants and process improvements around employee recruitment. This is in addition to the approximately $11 million of annualized savings in FY ’25 from our targeted restructure announced earlier this year. We expect a steady step-up in depreciation and amortization in the years ahead as prior period CapEx spend starts to amortize and various technology systems transition into production. Excluding D&A, we expect operating expense growth of between 4% and 7% for FY ’25, significantly lower than the FY ’24 growth rate as we see further benefits from our expense management program. We are continuing our cost-conscious approach in FY ’25 and expect to make further progress on workforce optimization, primarily through reducing use of consultants and other process and procurement opportunities. Net interest income consists of net interest earned on ASX’s cash balances and net interest earned from the collateral balances lodged by participants. Total net interest income for the year was $76.7 million, representing an increase of 8.3% compared to the PCP. Group interest income of $41.7 million was up 39% and was driven by higher investment returns due to the higher average cash rate increasing short-term interest rates during the period. Financing costs include interest payable on our $275 million bond and costs related to our short-term bank facilities. In FY ’24, these costs were $10.6 million. Net interest earned on the collateral balances was $35 million, down 14.2% compared to FY ’23. This reflects a reduction in the average collateral balance from $11.9 billion in FY ’23 to $10.7 billion this year. These balances declined early in FY ’24 following a significant adjustment to margin requirements for interest rate derivative products. Balances steadily grew during the year as activity in these products increased. And the net investment spread on these balances remain consistent at 10 basis points due to the significant levels of excess capital in the financial system. The average participant balances subject to risk management haircuts declined from $8.1 billion in FY ’23 to $6.8 billion for the year, with lower collateral balances being the main driver of this fall. The excess cash in the financial system is expected to persist, but we are seeing early signs of improvement in the market following the unwind of the term funding facility. As at 31 July 2024, participant balances of $13.1 billion and balances subject to risk management haircuts of $9.1 billion was significantly higher than the FY ’24 average and this has created a positive start to FY ’25 for net interest on collateral balances. ASX’s balance sheet continues to be strong and positioned conservatively with an S&P long-term rating of AA-. And as I mentioned earlier, we raised a $275 million corporate bond in February this year to provide flexibility to our balance sheet. From a shareholder return perspective, underlying ROE for the year was 13%, down 40 basis points compared to FY ’23, reflecting the lower reported underlying profit in the year. Underlying ROE was 13.3% in the second half of FY ’24, up from 12.6% in the first half as the organization benefited from expense management initiatives and a reduction in one-off costs in that period. The Board has determined a final fully franked dividend of $1.068 per share or 85% of underlying earnings per share, reflecting the midpoint of the dividend policy to pay out 80% to 90% of underlying NPAT, and this takes the total dividend to $2.08 per share fully franked. Our CapEx for FY ’24 was $136.3 million compared to $98.7 million in FY ’23, reflecting the increased investment in the major projects on our technology road map. We reiterate the guidance provided at our Investor Forum of CapEx spend of between $160 million and $180 million a year from FY ’25 to FY ’27 before starting to reduce. We expect an average depreciation and amortization schedule of 7 to 10 years for these major projects once they go live. So in summary, the record operating revenue we reported in FY ’24 reflects the strength of ASX’s diversified businesses. We will continue our cost-conscious approach to expenses as we balance the investment requirements of our Horizon 1 focus areas with Horizon 2 growth opportunities and we are focused on returns for our shareholders as illustrated by our medium-term ROE target range of 13% to 14.5%. And with that, I will now hand back to Helen. Thank you.

Helen Lofthouse: Thanks, Andrew. I’ll now provide an update on our strategic priorities for FY ’25 before finishing with our outlook and guidance. As I mentioned earlier, we’re still in Horizon 1 of our 5-year strategy. We have more to do to ensure that we’re protecting long-term shareholder value and positioning ourselves to capture future growth opportunities. And this means that we’re deliberately prioritizing the majority of our investment and effort into our great fundamental strategic pillar and particularly, our key focus areas of regulatory commitments and technology modernization. In FY ’25, we’ll continue to embed uplifts identified in the special reports that we published last year as well as any findings from our annual Financial Stability Standards assessment that we understand the RBA will publish in the next few months. And doing this helps to build a better ASX as we continually strengthen our frameworks and capability. A few weeks ago, ASIC published a consultation paper on proposed rules to facilitate outcomes that are consistent with a competitive environment in cash equities, clearing and settlement. And these rules are provided for under the competition in clearing and settlement legislation that I spoke about at our Investor Forum. This legislation provides powers to ASIC to make rules in relation to clearing and settlement services and gives the ACCC, the power to resolve disputes regarding access to these services. In the coming months, we’ll also be releasing a consultation paper to receive stakeholder feedback on certain aspects of our cash equities clearing and settlement pricing policy. More broadly, we support competition in clearing and settlement as we believe that we provide a compelling offering. In terms of technology modernization, we’ll continue to deliver against our road map, which I’ll recap in more detail shortly. Importantly, we’re also investing in our platforms and capability to support this delivery. And for example, we’re exploring the use of cloud services to support the scale and resilience of our applications and improving the accessibility of our data platform to leverage our rich data sets and create new products for our customers. In terms of business efficiency, Andrew has already talked about our expense management initiatives for the year ahead. We’ll continue to invest in our people, bringing new talent and deepen our expertise. And we’re investing in process simplification and automation to reduce operational costs and allow our people to focus on activities that add value to our markets and customers. In terms of customer-driven activities, our suite of carbon futures went live in late July and will shortly be adding gas futures to our environmental product ecosystem. And these products are designed to support our customers in the net zero transition, as I mentioned earlier. And although, it’s early days and new futures products can take time to build momentum, we’re particularly excited about these products, which have been launched in response to strong market demand. We see a great opportunity to serve debt market participants with data services in addition to our existing services in the equities and derivatives markets. Austraclear is the registry and settlement system for the vast majority of Australian dollar-denominated fixed income instruments. And as such, it’s a primary repository of local fixed income market data and insights. And we see significant potential for growth here, having launched our first debt market reference data services in FY ’23. And we’ll be following this up with debt market activity services in the first half of FY ’25. These new product launches are part of the broader growth strategy that we outlined at the Investor Forum. We see good opportunities to support the net zero transition by seeking to further expand our environmental futures product offering and by working with a clean energy regulator to explore the concept of running a carbon exchange. As a data-rich environment, we see significant opportunities to broaden and upgrade the data and access options that we make available across ASX’s activities to support our customers. And all of these opportunities are supported by the ongoing growth of the Australian capital base as it drives activity across our markets. Turning to our One ASX strategic pillar. Our people and culture remain an important focus for me. We have highly specialized people at ASX with deep expertise in what we do. And we want to continue to nurture the best of what ASX has while also developing our people as we execute on our strategy. The New era ASX is about having a vibrant and inclusive culture that inspires growth with empowered and engaged teams. We know that our people are proud of what we do at ASX and the important role we play in the Australian economy. And our recent employee engagement survey show that 90% of our people understand how their role contributes to the ASX vision and strategy. We’re aiming for an outcomes-focused culture that is centered on customers and supported by our performance management framework and refreshed organizational values. During FY ’25, we’ll be investing in our people leaders to ensure that they’re enabled to both lead and deliver on our strategy. And we’re also taking steps to improve our overall employee experience in terms of how our people do their work, including investing in the processes and tools that they use. We presented this indicative technology delivery road map at our Investor Forum in June. And this road map sets out logical windows to implement key stages of each major project. It’s subject to regular review as part of our iterative planning process to manage interdependencies and stakeholder input. And as I mentioned earlier, we’ve made good progress in FY ’24. And in FY ’25, our focus will be progressing the major projects shaded in blue on this chart. So, let’s start with the trading project. Service Release 15 for cash market trading will deliver a number of important benefits, including the removal of what’s referred to as the opening auction stagger and we’ll seek to better align ASX with other major global exchanges. And it will introduce a new post-close trading session to provide the market with additional execution opportunities. For ASX 24, our derivatives trading platform, Service Release 4 will deliver changes to help support liquidity during the bond roll period and to improve technical resilience ahead of the move to a new platform. We intend to upgrade our networks, including the customer endpoints to simplify the solution for our customers and provide significantly increased resiliency. And we’re planning to implement these changes in alignment with the trading platform upgrades that I just mentioned, which will be more efficient for our customers. Finally, for CHESS Replacement, we’ll continue to progress work on Release 1. As I mentioned earlier, for Release 2, we’ve published an industry consultation paper seeking market feedback and this will assist in finalizing the scope and approach of the releases and we’ll also resist in developing the industry work plan. We expect to determine and communicate the indicative plan and estimated cost for Release 2 in the December quarter of 2024, following this industry consultation. We are delivering, but also appreciate that there’s still plenty of work for us to do in modernizing our technology. We are progressing this program, which prioritizes safe implementation and operation. This road map has been staged to allow us to build capability and delivery confidence along the way and manage the impact of the changes for ASX and industry participants. So, turning to outlook. We’re starting to see signs of a return of IPO activity with the listing of Guzman y Gomez being a recent high-profile example. And we continue to see increasing levels of interest and activity from companies considering a listing. We expect that the more stable macroeconomic conditions may be supportive of an increase in listings activity, although ongoing geopolitical instability may impact sentiment. July cash market trading activity was in line with the same period in FY ’24 for what’s typically a quiet month due to the holiday period. Total net new capital quoted was down in July, following several large de-listings due to the conclusion of long-running M&A activity, including Boral (OTC:) and CSR. And notwithstanding these recent de-listings, net new capital quoted on ASX increased by approximately $15 billion in the 12 months ending July 2024. The changing interest rate environment is driving growth in our interest rate futures activity, which we expect to continue. And we’re also seeing activity move further across the curve as the market takes a view on longer-term interest rates. As I’ve discussed today, we continue to see an increase in demand for our data and connectivity services. And we’re working with our customers to meet emerging areas of demand with a focus on making our services easier to license and consume. And we’re also finalizing the development of new data products to add to our growing information services proposition. Moving now to guidance. We reiterate the guidance provided at our Investor Forum in June. We expect FY ’25 total expense growth of 6% to 9% with operating expense growth guidance of 4% to 7%, reflecting the expense management actions we’re taking. FY ’25 capital expenditure will be between $160 million and $180 million and is expected to remain at this level until FY ’27, primarily to support our technology modernization program before starting to reduce. We have the capital management flexibility in place to support this CapEx profile and this includes a dividend payout ratio range of 80% to 90% of underlying NPAT and a $275 million corporate bond raised earlier this year. And finally, we’re focused on the underlying ROE as the key performance metric driving the organization. We delivered a result at the lower end of our target range this year and we’ll continue to focus on total expenses and revenue opportunities. In conclusion, FY ’24 was a busy year for us, and I’m proud of what we’ve delivered. And FY ’25 is about continuing to listen to our customers and delivering our 5-year strategy. Thank you, and I’ll now invite questions.

Operator: Thank you. [Operator Instructions] Your first question comes from Julian Braganza with Goldman Sachs.

Julian Braganza: Maybe just the first one on pricing. Can you maybe just talk to some of the material pricing changes that you’ve implemented and just sort of the benefit that will come through the FY ’25 numbers, maybe just on listings and information services? And I know you’re sort of planning to release the pricing policy on settlement and clearing. So, maybe if you can provide any color on that, that would be great, but maybe just the other businesses.

Helen Lofthouse: Thanks for the question, Julian. Yes. So look, on pricing, we regularly review pricing for most of our services. So typically, we will review and if appropriate, implement changes, for example, to listings pricing, that’s typically from the beginning of July. And the cycle for technology and data pricing review is typically from the 1st of January. So, we’re in the process of reviewing that piece at the moment. So, I don’t have any specific numbers for you on that at this point, but I guess it continues to be an area of review. And obviously, we take into account a number of factors when we consider what’s appropriate pricing, international benchmarks, the value that we’re continuing to add as we invest in resilience and new services and CPI and various other factors as we do that.

Julian Braganza: And then maybe just on — maybe just on cost. Can you just clarify the [$5 million] savings that you’ve identified there, is that incremental just to your previous guidance? And if so, I just wanted to understand if there’s anything offsetting that into ’25, given you’ve changed your expense guidance? And then secondly, just clarifying that the just in light of the ASIC action, just any implications of a cost as well on the regulatory cost side in 2H ’25, set of risks there.

Andrew Tobin: Thanks, Julian. I may grab that question. So firstly, the $5 million that we referred today is another illustration of our focus on cost management across the organization. We called out specifically around reduction in consultant spend and some procurement opportunities that we’ve sort of seen benefits come through this period. Both of those things, so the $11 million in terms of annualized savings and the $5 million are included in the sort of the expense guidance that we’ve reconfirmed today, the 6% to 9%. Your question in relation to regulatory costs, it’s too early to speculate on the ASIC case at this point in time. So, we’ve restated guidance today. We’re comfortable with that guidance.

Helen Lofthouse: Thanks, Julian.

Operator: Your next question comes from Andrei Stadnik with Morgan Stanley.

Andrei Stadnik: Can I ask my first question just around the pricing for futures and option contracts. I think you showed in one of the later slides that it moved from [149] last year to [145] in FY ’24. Can you talk a little bit about the drivers behind that?

Helen Lofthouse: Yes. Look, I don’t have all of the detail in front of me. But generally, I’d say that would be driven by like as we’ve seen increased volumes in the interest rate futures, particularly what you’ll start to see is that some customers will also then be hitting some of the volume rebates so that with the additional volume, you’ll start to get a slightly lower average fee per trade coming in.

Andrei Stadnik: Great. Can I ask my second question just around some of the RBA consultation around central clearing of bond and repo markets is something to consider that in the near to medium-term future? But what’s your view on this? And how should we think about size and the potential revenue opportunity here for the ASX?

Helen Lofthouse: Thanks, Andre. Yes, so the central clearing of bonds and repos is certainly something that we’ve been discussing with a number of our customers for a little bit of time, actually. So, it is something that we’re actively looking at and evaluating. I think it’s too early to be able to quantify that in terms of overall revenue opportunity at this point, though, I’m afraid.

Andrei Stadnik: And can I ask a final third question. Look, slightly different, right, but what are your thoughts on 0 data expiry options and introducing them to Australia? Like they’ve seen very strong uptake in some parts of the U.S. What’s your view on how they could be introduced to Australia?

Helen Lofthouse: Yes. Thanks, Andre. I’d have to say I don’t have a particular view right now, but I’ll definitely be passing your questions through to the derivatives team and have them and check in whether they’re having a mull over that. I’m sure they will be contemplating that. So, maybe there’s more to come there.

Operator: Your next question comes from Ed Henning with CLSA.

Ed Henning: A couple from me. Just firstly, on your cost guidance and obviously, you’ve got increased CapEx coming through as well. Can you just talk about the increase in D&A beyond ’25, obviously, as your CapEx continues to increase and the roll on and off of projects, how we should think about that? Should it be similar levels that you’re seeing in ’25 kind of go through ’26, ’27 or does it step up materially? How should we think about that growth in D&A is the first question?

Andrew Tobin: Thanks very much, Ed. I’ll grab that one. We’ve talked about this at the Investor Forum as well. So, we’ve today, sort of, highlighted or reconfirmed our guidance of 6% to 9%. And excluding depreciation, 4% to 7% for the year ahead. We haven’t provided any further formal guidance beyond FY ’25. But we’ve also talked about sort of the depreciation profile of those major projects, those technology projects. We’ve called out 7 to 10 years is sort of the average depreciation period and they won’t start to amortize until those actually — those new platforms or projects become live. And so you can get an idea from our technology road map as to when we’re delivering those projects and when the start of that depreciation will begin, I suppose. And then there’s a bit of an elongated sort of depreciation profile attached to those. So, I suppose what I can say is that it will be a sort of a gradual step-up in that depreciation profile over the coming years.

Ed Henning: And when do you — with the projects you’ve got on at the moment, when do you see peak D&A, D&A charge?

Andrew Tobin: We haven’t provided any further guidance around that. Hopefully, we’ve given you enough sort of indicators around that sort of 7 to 10 years amortization period and the technology road map.

Ed Henning: Yes. Okay. Secondly, you just talked about competition consultation paper on cash equities clearing. Can you just touch a little bit more on that? And basically, because you haven’t launched or CHESS hasn’t come through, how could someone come and compete in settlements of clearing when CHESS, the new CHESS hasn’t been delivered yet? And why would you do it?

Helen Lofthouse: Well, I think bear in mind, Ed, with the approach from regulators, it’s both about enabling the conditions for competition, should competition emerge but also trying to make sure that the service that’s being provided for customers is provided on a basis that as if there were competition in place. So bear in mind, ASX is not a legislative monopoly in this area and never has been. But you’re right, there isn’t currently competition in place. But the focus of some of the proposed rules that you can see is really making sure that we are still listening to stakeholders very carefully, making sure that pricing is transparent and provided on a fair and reasonable and non-discriminatory basis and things like that to try and make sure that even in the absence of competition that the services are provided in an appropriate way.

Ed Henning: Okay. And just one last one. Just on Sympli, can you just run through your criteria to continue to fund losses or more so invest more money in that business? And how long are you willing to, I guess, wait potentially before pulling the pin if the can continues to get kicked down the road on interoperability or potentially not even happening?

Helen Lofthouse: Yes. Thanks for the question, Ed. Look, I think it’s a little bit early on that question. What I would say is that we continue to see e-conveyancing as a really attractive market opportunity. It’s a significant market and it’s one where we think that they absolutely still is a strong case for a very customer-focused competitor in that market, which we are confident that Sympli can provide. There obviously has been some uncertainty from Anzac about the interoperability timings. It’s good to see that both New South Wales and Queensland governments have expressed a desire to still pursue that. And so the Sympli team continue to work with them to try and firm up the interoperability approach and timings. But I would also note that the — obviously, in light of the extended period and the uncertainty, the Sympli cost base did get reduced significantly last year to reflect that time line.

Ed Henning: Do you have any indicative anticipation of when New South Wales and Queensland might come up with some sort of resolution? Or is there a paper due? Or is there something due? Or — and are they waiting for the federal government? Or is it just doing it themselves?

Helen Lofthouse: I don’t have any more detail for you at this point, but the Sympli team are certainly working with both the New South Wales and the Queensland government to figure that out.

Operator: Your next question comes from Simon Fitzgerald with Jefferies.

Simon Fitzgerald: Helen, just on the technology road map and the sort of 4 key platforms that are either looking for upgrades or to be replaced, the technology road map gives us a good sort of time line in terms of FY ’25 and FY ’26 in terms of the various releases. Could you give us a comment of whether any of those projects at this point in time might be running behind schedule?

Helen Lofthouse: Look, it’s an indicative plan. And what it tries to show you is what we think are the logical windows for implementation for those various releases. And at this stage, we’re working towards that plan and comfortable with it.

Simon Fitzgerald: And at the Investor Day, you talked about the OTC clearing upgrade that, that was planned for implementation for FY ’25. Is that still the case, I imagine?

Helen Lofthouse: Yes, we’re still working towards that plan.

Simon Fitzgerald: And then just on the futures clearing platform, I was just hoping to get a bit of an update in terms of the design and implementation process when you think you’ll get to the end of that to be able to make some sort of announcement about how you’re going to go with the replacement side of that?

Helen Lofthouse: Yes. Thank you. Look, it’s a little bit early on that one right now. So, the team is sort of working through a lot of that detail at the moment, but there will be further updates at the right time to give the market more transparency on those questions.

Simon Fitzgerald: And then with the potential move to T+1, I know we talked a little bit about this at the Investor Day, it was brought up as well, is there any sort of business impacts that you can think about if we did move to a T+1? And I’m just trying to think about whether participants could actually run down margins with the clearinghouse at a lower level because there’s essentially a day less in terms of that settlement profile.

Helen Lofthouse: Yes. Look, it’s an interesting question, Simon, because T+1 is quite complex and has a range of different impacts, some positive, some negative. We’ve done — and we’ve modeled up the margin impact and it’s actually overall a bit less than you might imagine because of course, at the moment, the margining looks at the worst of the 1 day or 2 day moves and there have been some pretty significant 1 day move. So actually, it’s not that big a saving for Australia, but there are other benefits. But of course, there are other challenges and potential costs for the market as well, including question mark about securities lending processes, upgrades needed to systems to have pre-matching processes in place that kind of thing. But I would encourage you to take a look at the T+1 white paper and then the response that we published to that because that actually goes into quite a lot of the detail on all of those questions. And then the — we published a summary to sort of give an idea of sort of what all of the feedback on that was.

Simon Fitzgerald: Okay, we’ll have a look at that white paper.

Helen Lofthouse: Thanks, Simon.

Operator: [Operator Instructions] Your next question comes from Siddharth Parameswaran from JPMorgan.

Siddharth Parameswaran: A couple of questions, if I can. Firstly, just following up on the question earlier around margins on the derivatives segment. Helen, I think you’re flagging that you expect the strength to continue on fixed income futures into next year. If that does come through, if we see further growth, would that mean further pressure on the margins? Would that mean more rebates? Or would that — I just can’t remember exactly how it works. Is it the change from 1 year to the next? So, the extra rebate — the level of rebates won’t be higher or yes, I mean, if you could just help us understand what’s likely to happen to the margins if this continues to be growth?

Helen Lofthouse: Yes. So, maybe just for anyone else who’s listening, I’d just distinguish between sort of margins that we take as kind of initial margin for the risk exposures. Those are very separate. I think you’re really pointing towards what the fees are and what the average fee per trade is, which — and as one of our previous callers mentioned, the average fee has gone down very slightly. And that can be because you’ve got more customers getting volume discounts. So, we do have a scale of volume discounts that are available as people trade larger and larger quantities. It can also be — I should add it can be because of the product mix as well because the fees are different for different types of futures products. Some of our lowest fees are on the interest rate derivatives. So, as you see the interest rate derivatives grow, that just can — it’s obviously incremental revenue, but it can have an impact on the overall fees. So, I’d say said then to your question, at the margin, as you see growth in the interest products, at the margin, you might have a few more clients switching into a few more getting slightly higher volume rebates. So, your sort of marginal revenue might be slightly smaller, but it is still incremental.

Siddharth Parameswaran: Okay. So, not a major change from this year. Okay. That’s clear. If I could just ask about some of these new IT programs that are about to be implemented over the next couple of years. Are there any revenue implications? I mean, I think you talked about removing the open option stagger and I think some changes on the derivative side as well to support liquidity. If you could just comment on if there is — if there are any revenue implications from some of these IT rollouts and which way they might work?

Helen Lofthouse: We certainly do see areas where these technology changes will support growth. And your examples that you called out, they’re great examples where we think that supporting the effective functioning of the market is helpful and makes the market easier to use and more attractive for a wider range of participants. And yes, potentially, we might see some additional volume from, for example, the post-close trading opportunity. I’d say nothing specific to call out in terms of sort of material numbers to really highlight. But of course, as well as focusing on resilience and making sure we’ve got a secure and sustainable long-term technology platform. We’re also very focused on trying to make sure that we can be more responsive to our customers and that we can really have the flexibility to drive some growth opportunities there. So that’s certainly a goal and a conscious thought process as we work on our technology modernization.

Siddharth Parameswaran: Okay. Just my final question, Helen, I asked 6 months ago, just what the plan was to get back to your target ROE range. And it seems like you won’t be there next year. You said the main focus was cost, but there seems to be reasonable cost growth and obviously, D&A will still pick up again quite materially for a while. Just wondering what is the — how do you get back to that ROE target range?

Helen Lofthouse: Well, you’ll see that we have got back to our ROE target range actually with the full year FY ’24 result, which we’re very pleased about. And certainly, the second half ROE was slightly above the bottom end of that range as well. So really, ROE is a function of revenue and costs, as you know, and we’ll continue to have a strong focus on both of those, both in terms of responding to our customers and driving growth opportunities as well as continuing a very cost-conscious approach and making sure that we are thinking about efficiency in our business.

Siddharth Parameswaran: The comment — sorry, the question was about ’25, ’25 and onwards. Yes.

Helen Lofthouse: Yes. And really, the answer is the same, right? It’s a continuing focus on both revenue and being very cost conscious in our approach to running our business.

Operator: The next question comes from Nigel Pittaway.

Nigel Pittaway: Just first of all, on sort of revenue. I mean I was just wondering whether you expect any of the new product initiatives. So, carbon futures, gas futures, debt market, data, et cetera, to contribute materially to revenue in the near to medium term? And which of those initiatives does have the greatest potential to be a material contributor?

Helen Lofthouse: Look, at this stage, Nigel, obviously, we are — we’ve made our estimates about what we think the opportunities are there and to make sure that we think there’s a good business case there. We will — at this stage, we don’t really have any additional detail to disclose on those. But to the extent that any of them do become material, we would be disclosing that. Andrew, anything you want to add.

Andrew Tobin: I think that’s right. It’s a combination across our various products, Nigel. We’ve talked in the past that tech and data, particularly, there’s a significant opportunity there as a thematic and we’re continuing to pursue that thematic.

Nigel Pittaway: So, nothing particularly tangible at this stage, okay. Secondly, just on the IPO pipeline, I mean, obviously, you’ve expressed some optimism about that and the macroeconomic stability is something that you’ve mentioned. I mean, is there anything in particular you think companies are waiting for and before they decide to list? And if we do get that trigger, are you expecting it sort of to be a sort of gradual build? Or do you think there’ll be some kind of rush at a certain time? How are you thinking about that moving forward?

Helen Lofthouse: I guess I’d have a couple of comments about that, Nigel. I mean, recognizing that I certainly don’t have a perfect crystal ball. So, I more sort of observe what we see. Firstly, globally, we’ve observed a cyclical low for IPO activity over the last couple of years. That’s not particularly unusual. IPOs do tend to go through a cycle. And in what — certainly in FY ’23 was a rapid rate of interest rate increases. It’s really not unusual for that to create some of those cyclical challenges in IPOs. But we’re certainly very conscious that IPO is a question of confidence as well, right? So — the — for a business owner, the decision to go to IPO is one of the biggest decisions they’ll make for their business and choosing the right time is something that’s really important to them. I think we can see that the macroeconomic environment in Australia is much more stable now. And we think that, that is conducive. We’ve obviously seen some good successful IPOs recently, which I think are encouraging. We see a good level of inquiry and activity from companies at the moment. And we hear the same from the various advisers in the market who would be talking to IPOs as well that they’re also getting a much higher level of inquiry and interest at this stage than they have done for some time. So, I think add all of those things together and those are the things that are making me feel positive about the opportunity ahead of us, predicting the exact timing is much more difficult.

Nigel Pittaway: And then maybe just a couple of very quick questions. I think probably more Andrew questions. But just in terms of the — what you were saying about the excess cash in the system. I mean, do we take it from those comments that you’re not really seeing any change to that 10 basis point spread anytime soon, firstly? And then just secondly, there weren’t any one-offs this time, which I presume reflects the fact you’ve made no compensation payments, just on the expected timing of those and whether you’ll still be treating those as one-offs when they do occur?

Andrew Tobin: Sure, Nigel. So firstly, on the interest rates, so 10 basis points is what we’ve seen over the last couple of years. And we’ve started to see some early signs of change there, but I would note there’s still $207 billion in the system, if you like, in the ESA accounts. The peak was $450 billion. The term funding facility is rolled off, but there’s still $207 billion sitting there at the end of July. So, a little way to go, but we are seeing some early signs, but we’re not expecting sort of a dramatic change probably over the next 6 to 12 months. In relation to the one-off items, you’re referring to the significant items there. And I think you’re calling out the CHESS partnership program. And just to sort of recharacterize your positioning of that, that’s not a compensation payment. It’s a forward-looking payment around the partnership program on the new CHESS project. We haven’t recognized any expenses in this current period. But the balance of the incentive pool, there’s about $37 million still to be expensed in the future. That will pretty much be tagged to Release 2 of CHESS. And so we’ll sort of come out with some more indicative timing around that as that CHESS 2 Release comes out in that December quarter. So, future periods to come.

Operator: [Operator Instructions] There are no further questions at this time. I’ll now hand back to Helen Lofthouse for closing remarks.

Helen Lofthouse: So, thank you. That concludes today’s presentation of ASX’s FY ’24 results. Thank you very much for joining us today.

Andrew Tobin: Thank you.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.