The UK travel insurance market offers opportunities in increasing demand for tailored coverage due to rising traveler awareness and diverse travel needs. Digital transformation can enhance customer engagement but poses cybersecurity challenges. Insurers providing flexible, personalized plans backed by advanced tech are poised to succeed.

United Kingdom Travel Insurance Market

Dublin, Oct. 21, 2025 (GLOBE NEWSWIRE) — The “United Kingdom Travel Insurance Market, By Region, Competition, Forecast and Opportunities, 2020-2030F” has been added to ResearchAndMarkets.com’s offering.

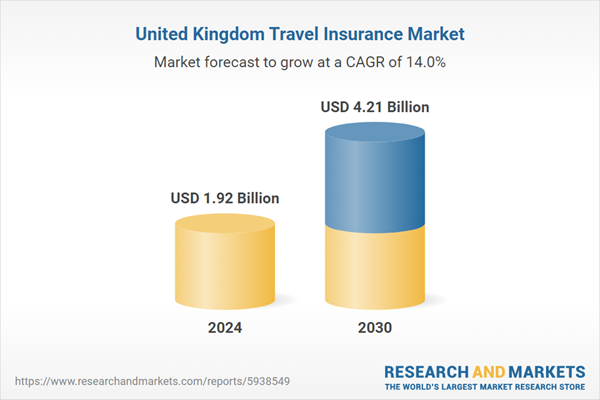

The United Kingdom Travel Insurance Market was valued at USD 1.92 Billion in 2024, and is expected to reach USD 4.21 Billion by 2030, rising at a CAGR of 14.04%.

The United Kingdom Travel Insurance Market is a robust and dynamic sector that provides travelers with financial protection and peace of mind when they embark on domestic or international journeys. Travel insurance offers coverage for a variety of unexpected events that can disrupt travel plans, including trip cancellations, medical emergencies, lost luggage, and other unforeseen incidents. The United Kingdom Travel Insurance Market is a well-established and competitive space. It offers a wide range of insurance products designed to meet the diverse needs of travelers, whether they are going on a short weekend getaway, a business trip, or an extended vacation abroad. These insurance policies aim to provide financial protection and assistance in case of unexpected events during travel. Inbound and outbound tourism to and from the UK increased in 2023 compared to 2022 but remained below pre-pandemic levels.

VisitBritain estimated 41.2 million inbound visits in 2024, slightly above pre-pandemic levels by 1%, and forecasts 43.4 million visits in 2025, reflecting 5% growth. While domestic tourism slightly declined in 2023, domestic spending still surpassed inbound spending. According to the Office for National Statistics, tourism directly contributed £58 billion (approx. $73 billion USD) to the UK economy and supported 1.2 million jobs in 2023, highlighting the sector’s ongoing importance despite recovery challenges.

Key Market Drivers: Increasing Awareness and Demand for Comprehensive Coverage

One of the primary drivers of the United Kingdom Travel Insurance Market is the increasing awareness among travelers of the importance of having comprehensive coverage. As people become more aware of the potential risks associated with travel, they are actively seeking travel insurance policies that can provide financial protection and assistance in times of need. The UK has a significant number of residents who travel internationally for business and leisure.