The insurance-linked securities (ILS) fund sector has delivered its strongest October returns on-record in 2025, as the group of ILS funds tracked by the ILS Advisers Fund Index reported an average performance for the month of 1.44%.

The record October 2025 performance came on the heels of the highest single month of ILS fund returns reported by this Index ever, as once all the data was in September 2025 saw a stunning average ILS fund return of 2.26%.

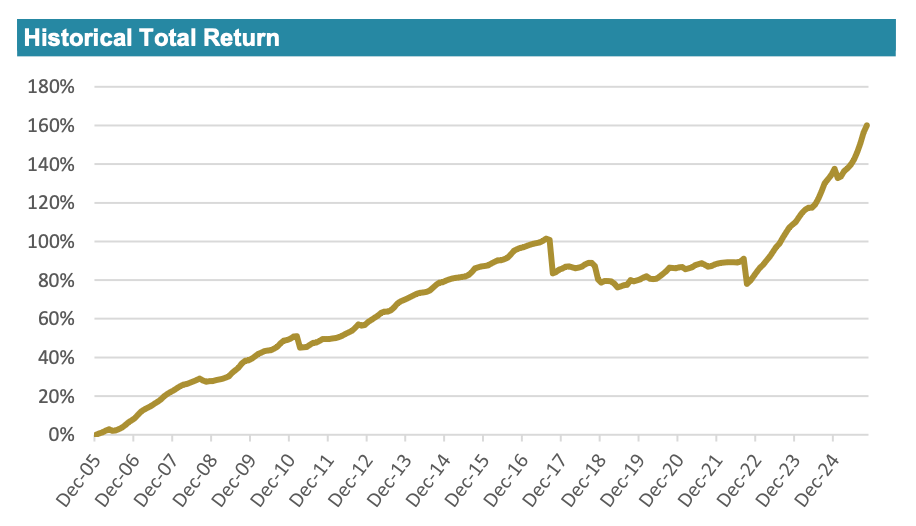

With the average ILS fund return of 1.44% for October 2025, based on 94% of the ILS funds tracked having reported for that month, the ILS Advisers Fund Index now sits at a 9.47% return for the first ten months of the year, already the fifth highest annual return on-record.

Making ILS fund performance even more impressive for October, is the fact it was not a loss free month for the catastrophe bond side, given hurricane Melissa and the triggering and payout of Jamaica’s cat bond.

In addition to which, ILS Advisors also reports that one of the ILS funds it tracks was negative for the month.

Meaning October’s 1.44% gain could have been even higher without those negative effects. The monthly return may also rise once the final fund reports are in, as was seen in September.

Explaining October 2025’s ILS fund performance, ILS Advisers noted that the private ILS strategies that invest across the range of reinsurance and retrocession instruments once again outpaced the pure cat bond funds’ performance.

“Despite the natural catastrophe activity, ILS funds delivered solid returns in October,” ILS Advisers explained.

“Pure cat bond funds as a group posted a 0.93% gain for the month, while funds incorporating private ILS strategies were up by 2.02% on average.”

Private ILS fund returns have now caught up with pure cat bonds for the year-to-date and are now expected to finish the year ahead as a group.

With 34 of the ILS funds tracked by the Index having reported October 2025 returns so far, 33 of these were positive while just the one was negative.

The range of performance was wide with the worst performing ILS fund down -0.52%, but the best performing ILS fund delivered an impressive 4.93% positive return for the month, once again demonstrating the diversity available across ILS fund strategies.

In delivering a 9.47% average ILS fund return for the first ten months of the year, 2025 is running at the third-highest return for this stage of any year since the inception of the Index, trailing only 2024 and 2023.

November is expected to see the Index annual return reaching double-digits and becoming the fourth best performance for any year on-record.

You can track the ILS Advisers Fund Index here on Artemis. It comprises an equally weighted index of 36 constituent insurance-linked investment funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond investment space.