Insurance companies are using satellites to inspect homes they are covering – and are getting some assessments wrong at customers’ expense.

The CSAA Insurance Group in California is one of many firms taking part in the practice, which is now commonplace within most companies, one expert said.

It sees insurers use aerial imagery garnered from satellites and drones to make decisions, in lieu of the human inspectors who once perused properties.

This has already spawned oversights in the cases surrounding at least two Golden State homeowners, who each spoke to The San Francisco Chronicle Saturday to complain about the recent phenomenon.

Both lost coverage thanks to alleged mistakes made during surveillance of their respective homes, showing how the practice, in addition to criticism calling it invasive, is imperfect.

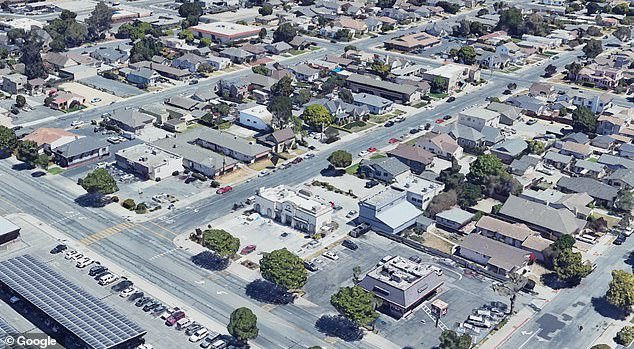

Aerial photography view east of Clarendon Heights in San Francisco. Such images are being used to make decisions when it comes to home insurance coverage, angering some residents

The practice is a growing trend in the industry, one expert in the field said – citing how his company, which records homes during flybys overhead, currently does business with nine of the top 10 national insurers

‘I got all the discounts for being a great customer, and then boom,’ explained San Francisco resident Jean Willard of how her previously loyal insurer dropped her this year after spotting a small amount of water pooled on her roof.

‘It’s just angering, it’s painful.’

While water pooling on a roof is sometimes a sign the structure is in poor shape, she conceded, in her case, it was actually the result of a storm.

Still, her insurer decided to pull coverage – leaving her home in San Francisco’s Clarendon Heights neighborhood home uninsured.

Her carrier, the Liberty Mutual subsidiary Safeco had decided not to renew her policy after more than 30 years, leaving her in the lurch for the first time.

The survey was done by satellite, a Safeco spokesperson confirmed to the Chronicle.

Willard went on to explain how she immediately called her roofer, and how she had a follow-up inspection done to show that the water was a one-time occurrence.

As she suspected, that survey found no water. She sent the resultant report to Safeco, hoping the results would exonerate her.

It sees insurers use aerial imagery garnered from satellites and drones to make decisions, in lieu of the human inspectors who once perused properties. Seen here, another aerial view of the neighborhood

This has already spawned oversights in the cases surrounding at least two Golden State homeowners, who each spoke to The San Francisco Chronicle Saturday to complain. Both lost coverage thanks to alleged mistakes made during surveillance of their respective homes, showing how the practice, in addition to criticism calling it invasive, is imperfect

However, the company’s response was not one that she had hoped for, she recalled to the Chronicle.

She said the company told her the puddles weren’t the only issue, with a rep pointing to aerial images showing algae or moss growing.

Also a sign of potential water infiltration, the firm used those snaps to uphold its previous diagnosis, dropping Willard as a client.

‘It’s important to fully understand the condition of a property, and advances in satellite imagery are useful to identify issues that we – and homeowners – otherwise may not know exist,’ a spokesperson went on to tell the Chronicle of such decisions.

The rep added how they could not comment on cases involving individual customers.

Willard’s roofer, meanwhile, told the paper that a small patch of moss had been removed – but that it was not large enough to pose any real concern. Her coverage was pulled nonetheless.

Continuing to cast light on the little-known practice, the Chronicle went on to speak to another Californian who recently had coverage for their home pulled thanks to the new technology.

He told the paper how he suddenly got a notice from his insurer, CSAA, after a fly-by – one canceling his coverage due to his property supposedly being littered with dying trees, broken-down cars, and broken shed.

‘I got all the discounts for being a great customer, and then boom,’ said one San Francisco resident of how her insurer dropped her this year after spotting some water pooled on her roof at her home in the area. ‘It’s just angering, it’s painful’

However, there was one major problem, he explained – none of the so-called obstructions were actually on his property.

Instead, the aircraft designed to get a handle on his Monterey County home had picked up obstructions on neighboring laws rather than his, due to his neighbors sharing the same street address – only differentiated by the letters A, B, and C.

If inspectors had visited the property in person, they would have noticed that, Herceg said, after speaking to an insurance agent that rightfully told him that aerial images could have been to blame.

A month later, after sending staffers the deed to his home, his coverage was reinstated, he told The Chronicle – but the experience still left a bad taste in his mouth, he said.

‘We were good customers, never missed a payment. But they’re so quick to jump to conclusions and not do due diligence and treat us that way,’ he said.

Meanwhile, back in August, Joan Van Kuren similarly said she was stunned when CSAA, her insurer for almost 40 years, made the move to drop her as a client due to ‘hazardous’ construction clutter they spotted in her yard with an aircraft.

CSAA told Van Kuren that their aerial images showed debris on the left side of her home back when renovations on the property were still being made.

With cases like this in mind, CEO of New York-based aerial imagery and data analytics firm EagleView Piers Dormeyer told the Chronicle this weekend that the majority of insurance companies use aerial images to make coverage decisions.

While water pooling on a roof is sometimes a sign the structure is in poor shape, she conceded, in her case, it was actually the result of a storm. Still, her insurer decided to pull coverage – leaving her home in San Francisco’s Clarendon Heights neighborhood home uninsured

Continuing to cast light on the little-known practice, the Chronicle went on to speak to another Californian who recently had coverage for their home in Monterey County pulled thanks to the new technology. He told the paper how he suddenly got a notice from his insurer after a fly-by

He explained how his own fleet EagleView planes fly across North America daily, and use information garnered during these flights to feed information to insurers and inform their decisions.

Such practices save insurers the cost and the potential liability of having human inspectors climb on homeowners’ roofs, the expert explained – adding that aerial images also make it easy for repeat checks on a home.

He added that the images are often taken from 4,000 to 10,000 feet in the air, and that the use of droves are largely reserved for inspections on claims that demand more detailed images of damage.

In those cases, homeowners should get notice from their insurance company as to not to be alarmed when a drone suddenly visits their home, he said – adding that in instances where the technology gets something wrong, the insurer should not be afraid to speak up.

‘These carriers aren’t looking for a reason to get rid of you as a customer,’ Dormeyer insisted.

‘It’s important to understand that these tools are helping enhance the experience for homeowners by helping them get restored more effectively.

‘[It should] also reduce the cost of quoting, which should have a positive impact, not a negative one.’

In their own statement, CSAA said the company always considers photos or reports submitted by the homeowner in addition to photos taken by the company – whether it be from a drone, satellite, or separate aircraft.

If inspectors had visited the property in person, they would have noticed the obstructions belonged to his neighbors, he said – after speaking to an insurance agent that rightfully told him that aerial images could have been to blame. Seen here, more satellite images of Salinas

The company also makes use of ‘aerial imagery captured by third-party, fixed-wing aircraft and satellites,’ the rep added – as the practice continues to face scrutiny.

Other experts say it is already more common than people think, with Amy Bach, executive director of the consumer advocacy nonprofit United Policy Holders, telling CBS News that homeowners do have certain rights if it happens to them.

Echoing Dormeyer’s sentiments, she said people should ask their insurer to send them the images that were cited in their policy cancellations, as insurers can also make mistakes.

‘Sometimes, those images are blurry,’ she told the station in August. ‘And so, you know, assuming that the image is showing a damaged roof when it really is just a roof that has a skylight or solar panels.’

Dormeyer added that his company currently does business with nine of the top 10 national home insurers.