Fitch Ratings expects Hurricane Milton to cause between $30 billion and $50 billion in insured losses to push total industry losses in 2024 above $100 billion for the fifth straight year.

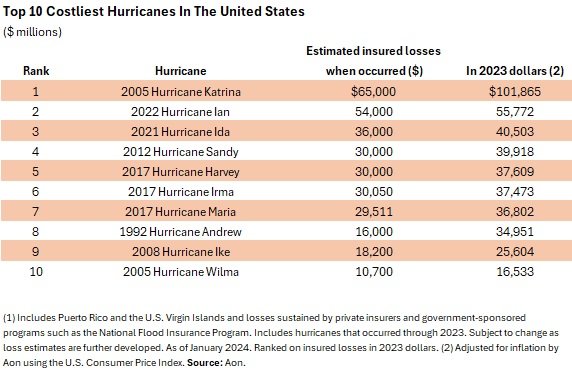

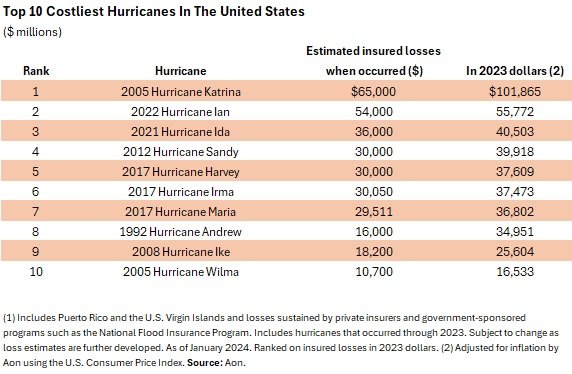

The range of losses expected by rating agency Fitch would put Hurricane Milton on the list as one of the costliest U.S. hurricanes for insurers. Losses at the high end of Fitch’s expectations makes Milton the third costliest hurricane ever—below hurricanes Katrina and Ian.

Fitch said it does not expect Milton to affect credit for its rated property/casualty insurers and reinsurers but Florida specialist insurers could be vulnerable if losses exceed reinsurance limits. Due to Milton’s timing so close to Hurricane Helene two weeks prior, higher demand of labor and building materials can increase insured losses by 20% or more, Fitch added.

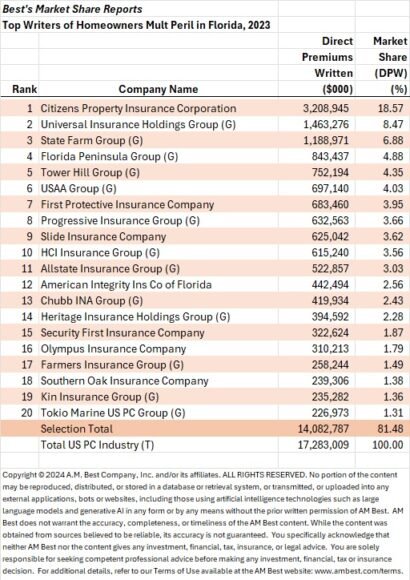

“The insurance losses will hit reinsurance attachment points, shifting a meaningful amount of losses to the reinsurance market, particularly from the Florida specialist companies with lower retentions,” Fitch said Thursday. Most national carriers do not own a substantial market share in Florida due to actions they’ve taken to manage exposure in the state over the last handful of years. Fitch said it does not expect losses to exhaust catastrophe reinsurance for most Florida-heavy underwriters.

The property market could harden depending on Milton’s losses and additional catastrophe losses experienced this year, but sizable property reinsurance increases seen in 2023 are unlikely “given the more adequate current pricing environment.” Fitch said.

Topics

Trends

Profit Loss

Market

Was this article valuable?

Here are more articles you may enjoy.

Interested in Market?

Get automatic alerts for this topic.