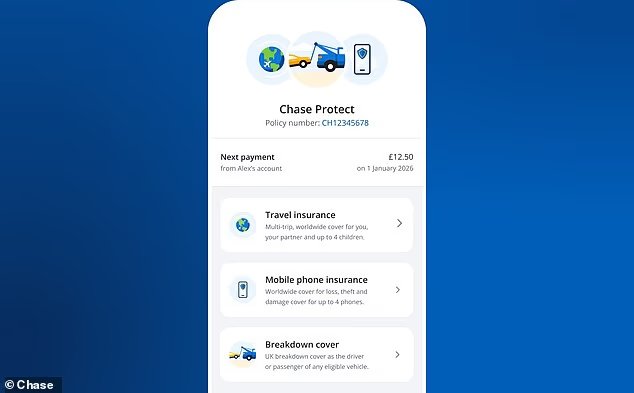

- The deal includes travel, mobile phone and AA breakdown cover

Chase customers will now be able to get travel insurance, breakdown cover and phone insurance through their banking app.

The JP Morgan-owned bank has ventured into the insurance market with the launch of Chase Protect, which will be available as an add-on for current account customers.

They will be able to get a bundle consisting of worldwide travel insurance, mobile phone insurance and AA breakdown cover for a fixed monthly price of £12.50.

Chase Protect is being rolled out to the bank’s 2million UK customers in stages from today.

Customers will able to purchase and manage insurance cover, and submit any claims, through their banking app.

Chase bank has launched Chase Protect, an insurance bundle, through its current account

What does the Chase insurance cover?

The travel insurance element includes multi-trip cover for the policyholder, their partner, and up to four children. It is provided by Collinson Insurance.

It covers trips up to 31 days, providing up to £20 million in emergency medical expenses, up to £5,000 cancellation cover per person and up to £2,000 baggage cover per person.

The mobile phone insurance, provided by Assurant, protects policyholders against loss, theft, damage and technical faults worldwide.

It will pay up to £2,000 per claim for repair or replacement, and cover replacement accessories up to a value of £250. Up to four claims can be approved in a 12-month period.

Vehicle breakdown insurance with AA offers UK-wide breakdown cover with up to four roadside callouts for breakdowns more than 400 metres away from home per year. It offers recovery to the nearest garage to the breakdown.

Harish Iyer, head of insurance at Chase, says: ‘By bringing together essential insurance coverage in one easy-to-manage bundle, we’re helping make protection more convenient and better value – all via the Chase app.’

Is it worth getting Chase insurance?

Whether Chase’s deal is worth it depends on your own circumstances, and what you need from your insurance.

Andrew Hagger, founder of personal finance website MoneyComms says: ‘To see if it’s better than others on the market you need to drill down into the detail and compare the level of cover, as well as exclusions and any excess charges – particularly on the phone insurance.’

Nationwide’s Flex Plus account also provides a similar deal including travel, breakdown and mobile phone insurance for a more expensive £18 a month – but Hagger says the auto cover is more comprehensive.

Andrew Hagger says: ‘On the face of it £12.50 per month for the three insurance packages looks quite competitive.

‘But the Nationwide breakdown cover includes breakdown at home in your garage or driveway, which Chase doesn’t. Also, the Nationwide policy covers breakdowns in Europe as well as the UK.

‘Nationwide’s breakdown cover is very comprehensive with the Flex Plus breakdown insurance covering account holders in any eligible vehicle they’re travelling in, whether as a driver or passenger. It also covers all eligible vehicles you own, even if you’re not travelling in them.’

As with any packaged bank account, it’s not worth the money unless you take advantage of all the benefits and insurance cover it provides.

If you go on holiday to Europe once a year and don’t own a car, for example, it will likely work out cheaper to take out separate insurance as and when you need it rather than paying £150 per year.

Beware of double insurance, too, if you have an existing insurance policy elsewhere which might overlap with part of Chase’s cover. This rarely means you get two payouts, and can prove a headache if you need to make a claim.

Chase bank accounts also come with 1 per cent cashback for the first year of having the card on debit card spending on groceries at the shops, everyday transport on local rail, bus and ferries and fuel and electric vehicle charging points. You can earn up to £15 a month in cashback.

SAVE MONEY, MAKE MONEY

4.4% cash Isa

4.4% cash Isa

Trading 212: 0.8% fixed 12-month bonus

£100 cashback

£100 cashback

Transfer or fund at least £10,000 with Prosper

.jpg)

4.49% cash Isa

.jpg)

4.49% cash Isa

Includes 12-month boost for new customers

£2,000 cashback

£2,000 cashback

1% cashback up to £2,000 when transferring

Sipp transfers

Sipp transfers

Get between £100 and £3,000 cashback

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence. Terms and conditions apply on all offers.