Premiums have already risen by 15 percent during the first half of 2024, but they’re set to climb even higher, analysts claim

1 hour ago

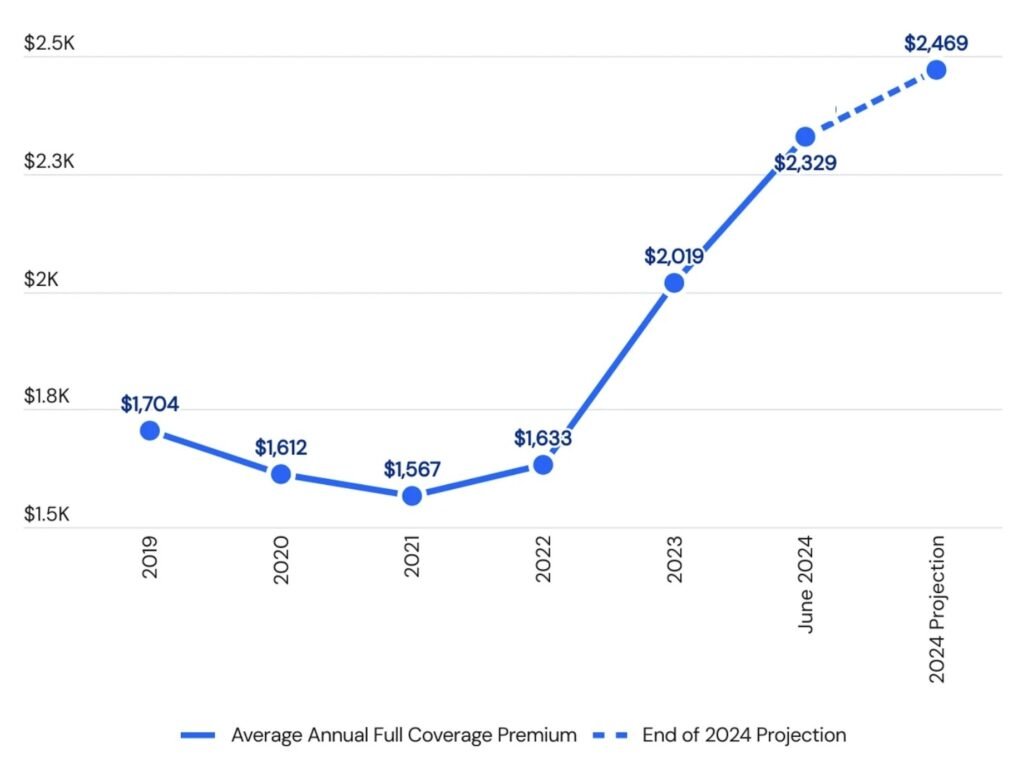

- Car insurance premiums will rise by 22 percent during 2024, industry analysts predict.

- Premiums have already jumped by 15 percent in the first half of the year, following a 24 percent full-year rise in 2023.

- A combination of higher vehicle prices and repair costs, weather-related claims and legislative changes are being blamed for the spike.

Get ready for a nasty shock the next time you need to renew your car insurance. Industry watchers say premiums have already risen by 15 percent during the first half of 2023 and will have climbed by a total of 22 percent by the end of the year.

For American drivers those rises follow an equally grim 2023 in which insurance costs leapt by 24 percent. Insurify calculates that the average full-coverage premium now costs $2,329, though in some states the total price could be more than 40 percent higher that that.

Related: $3M Koenigsegg And $27K Buick Have An Expensive Accident

Maryland has the highest insurance costs in America, coming in at $3,400 for the average full-cover premium, and that figure is expected to rise to $3,749 at the close of 2024. South Carolina is hot on its heels with an average premium of $3,366 (predicted to rise to $3,687), and New York grabs third spot with $3,325 ($3,484).

Drivers in New Hampshire enjoy the lowest premiums, their average totaling $1,000 right now, and only likely to increase to $1,053 by December. Maine ($1,209 / $1,263) and Vermont ($1,410 / $1,499) also look like great places to insure a car. But Insurify predicts that California, Missouri, and Minnesota could see car insurance costs increase by more than 50 percent in 2024.

The insurance industry puts the increases down to a multitude of factors such as the rising prices of new cars and the increasing costs of repairing cars of all ages, including new electric vehicles. A greater incidence of weather catastrophes, like flooding and hail, also pushes up premiums, as do regulatory changes.

Laws in South Carolina and Maryland place a greater burden of financial responsibility on insurance companies compared with legislation in other states. And having frozen insurance rates during the COVID-19 pandemic, California has allowed them to rise again, leading some firms to announce double-digit increases in an effort to improve profitability.