Overview of Recent Transaction

On October 14, 2024, Saba Capital Management, L.P. (Trades, Portfolio), a prominent investment firm, strategically increased its holdings in New Germany Fund Inc (NYSE:GF) by acquiring an additional 1,049,819 shares. This transaction, executed at a price of $8.71 per share, reflects a modest trade impact of 0.03% on the firm’s portfolio, bringing its total shareholding to 1,049,819 shares, which now constitutes 6.44% of the company’s outstanding shares and 0.15% of Saba Capital’s portfolio.

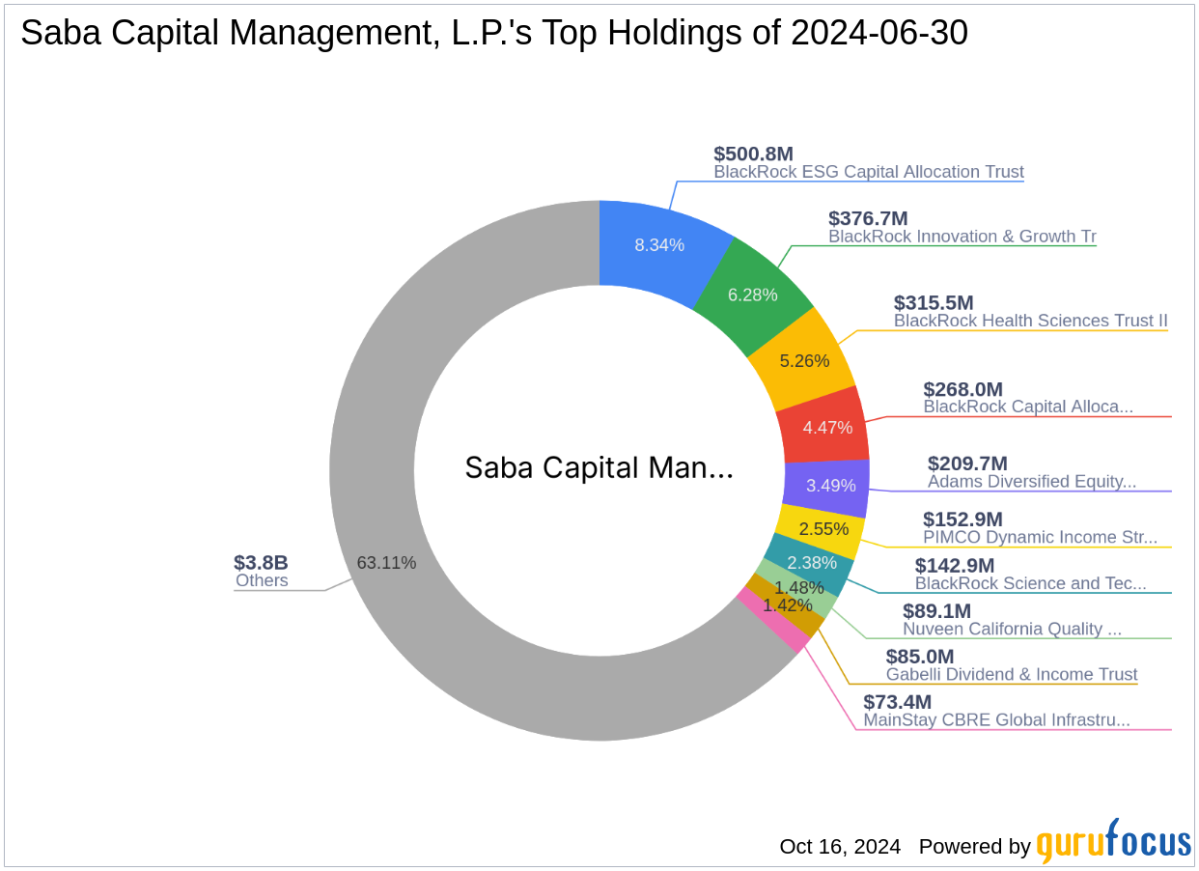

Profile of Saba Capital Management, L.P. (Trades, Portfolio)

Based in New York, Saba Capital Management, L.P. (Trades, Portfolio) is renowned for its sharp focus on alternative investment strategies. The firm operates from its headquarters at 405 Lexington Avenue and manages an equity portfolio worth approximately $6 billion, with significant positions in financial and communication services sectors. Its top holdings include Adams Diversified Equity Fund Inc (NYSE:ADX), BlackRock Capital Allocation Trust (NYSE:BCAT), and others, showcasing a diversified approach in high-value investments.

Strategic Significance of the Acquisition

The acquisition of shares in New Germany Fund Inc aligns with Saba Capital’s strategy to diversify and strengthen its investment in the asset management sector. This move is particularly strategic, considering the fund’s focus on German equities, which may offer unique growth opportunities amidst varying market conditions.

Introduction to New Germany Fund Inc

New Germany Fund Inc is a US-based, non-diversified closed-end management investment company focusing on long-term capital appreciation through investments in mid-market German equities. The fund operates across diverse sectors including industrials, IT, and consumer discretionary, among others, with a market capitalization of approximately $141.659 million.

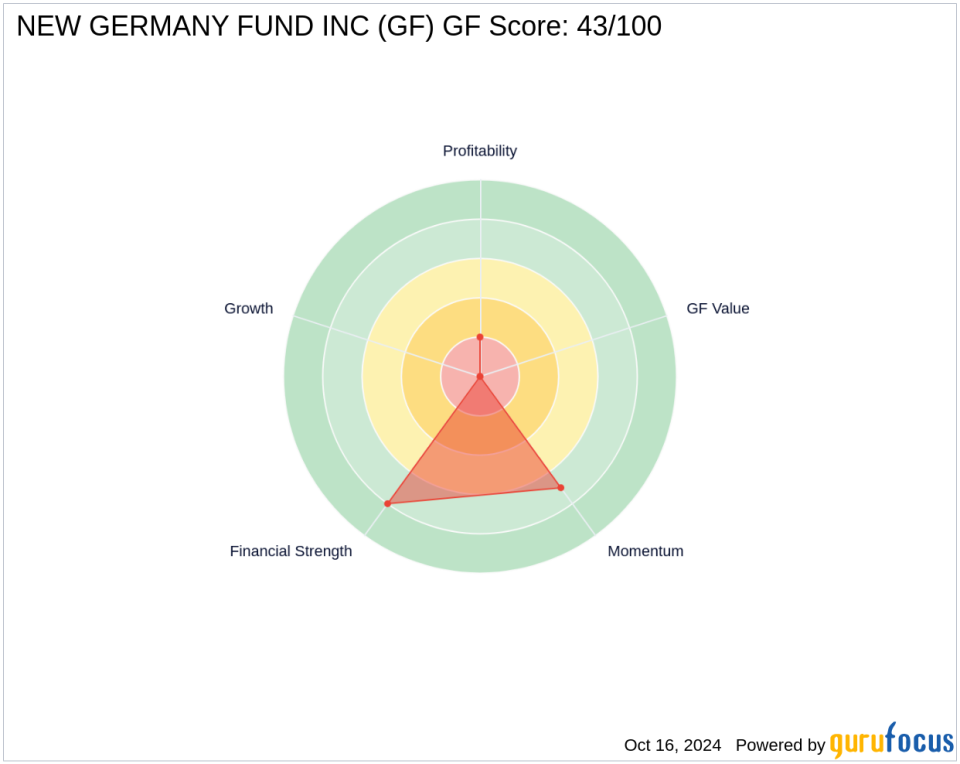

Financial and Market Performance

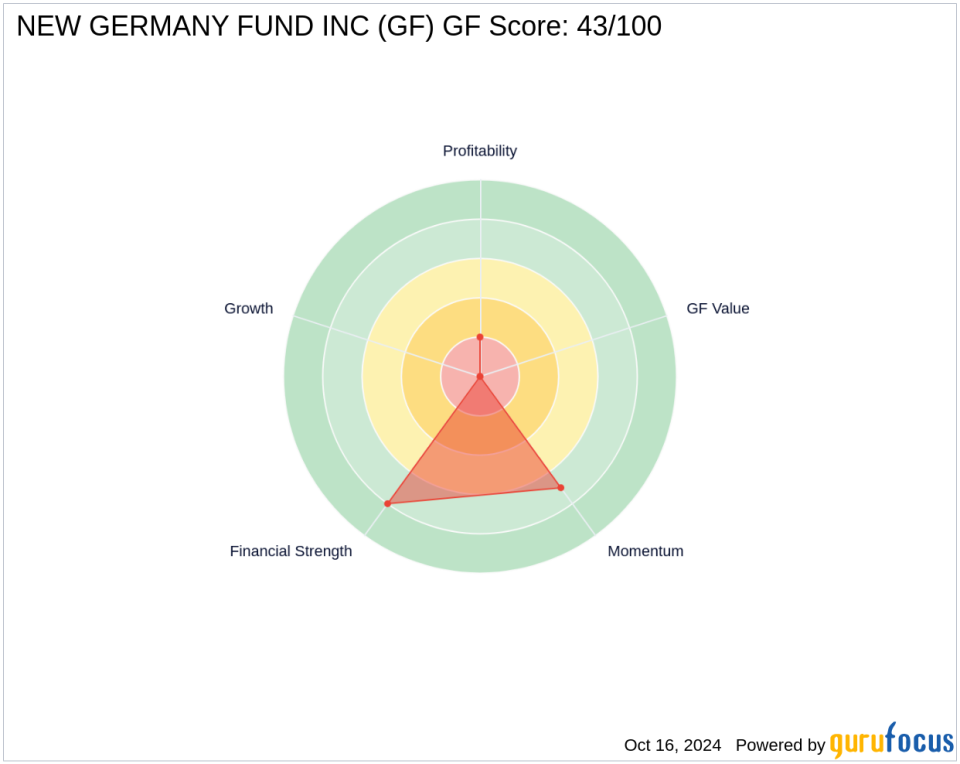

Despite a challenging market environment, New Germany Fund Inc has a GF Score of 43/100, indicating potential concerns about its future performance. The fund’s financial strength and profitability ranks are low, with significant declines in revenue over the past three years. The stock’s year-to-date performance shows a slight decrease of 0.06%, with a notable drop of 60.5% since its IPO.

Comparative Market Position

Saba Capital Management now holds a significant position in New Germany Fund Inc, making it one of the major investors in the company. This position is crucial as it allows Saba Capital to potentially influence the fund’s strategic decisions and growth trajectory.

Investment Outlook and Challenges

The future performance of New Germany Fund Inc poses both challenges and opportunities. The fund’s focus on German equities could capitalize on recovery in the European markets, but it must navigate significant headwinds such as its current profitability issues and overall market volatility.

Conclusion

Saba Capital Managements recent acquisition of shares in New Germany Fund Inc represents a calculated enhancement to its diverse portfolio. While the investment carries potential risks due to the fund’s current financial health, the strategic exposure to the German market could yield long-term benefits, aligning with Saba Capital’s robust investment philosophy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.