da-kuk/E+ via Getty Images

To the partners of Optimist Fund,

In Q2 we were down ~2%.

The fund* is up ~4% since inception, ~17% year-to-date, ~37% in the last year, and 89% in the last 2 years.

We currently own 18 market leading companies that have the potential to appreciate ~5x+ over the next 5 years.

Turning this potential into reality is our number one focus.

|

% Returns |

Optimist Fund* |

Benchmark** |

|

2022*** |

-51.4% |

-17.5% |

|

2023 |

82.9% |

30.4% |

|

Q1 |

19.1% |

9.7% |

|

Q2 |

-1.7% |

1.3% |

|

2024 YTD |

16.8% |

11.1% |

Though the fund was down slightly in the quarter, in aggregate we were happy with the fundamental performance of our portfolio holdings.

Carvana (CVNA)

Q1 earnings were very strong growing revenue 17% year-over-year while adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) margins came in at 7.7%. For the quarter, Carvana was the fastest growing and highest margin automotive dealer in North America. Though Carvana’s shares are up another 150% this year, we continue to believe material upside remains. Our 5year target has increased to $750 and CVNA remains our largest investment.

Wayfair (W)

Q1 earnings for Wayfair were good in the context of a continued tough home goods retail environment. Revenue was roughly flat while margins continue to improve year-over-year. Q2 guidance called for accelerating revenue growth and continued margin expansion. The Wayfair thesis relies on the home goods market stabilizing alongside continued share gains, driving a material step up in free cash flow generation. We are waiting patiently for this inflection.

DoorDash (DASH)

DoorDash continues to grow at an impressive rate, delivering 23% revenue growth and 82% adjusted EBITDA growth. In Q1, the company didn’t beat guidance to the same degree as they had in past quarters which resulted in a ~20% share price decline in the quarter. This is not a long-term concern and as a result of the share price decline, we have been adding to the position.

Uber grew bookings, adjusted EBITDA and free cash flow +20%/ +82%/+148% year-over-year and provided strong guidance for Q2 implying the potential for a growth acceleration.

Even with strong quarterly results Uber’s shares declined mid-single-digit in the quarter which we believe was due to increased chatter about Tesla’s robo-taxi ambition. This is not something that concerns us and to hear our full thoughts on the matter you can listen to the Q&A portion of our recent webinar on Carvana, Wayfair and Uber here.

Smartsheet (SMAR)

Smartsheet reported robust quarterly results in June, beating expectations and raising their annual recurring revenue as well as free cash flow guidance for the full year. After Smartsheet grew revenue at a 52% CAGR from 20152022, the 2023-2024 period has slowed to ~20% due to a weakening macro environment. We believe over the next 18 months revenue growth can re-accelerate, as macroeconomic headwinds stabilize, and eventually improve.

Aggregate Portfolio Composition

Here are the top 10 holdings in our fund, comprising approximately 80% of the portfolio as of June 30th, 2024.

|

Carvana |

ACV Auctions |

|

Wayfair |

HelloFresh |

|

Uber |

Colliers |

|

DoorDash |

Monday.com |

|

Smartsheet |

Revolve |

Q1 Portfolio Changes

After buying Xponential Fitness in Q1 on the thesis that they were an underappreciated boutique fitness market leader, run by a talented founder with significant growth opportunity, the thesis evolved in a way that led us to exit the position.

In May, it was announced that another government agency was looking into the short report claims from 2023 that were already being investigated by the SEC. This drove the board to suspend Founder and CEO, Anthony Geisler, until the investigations were resolved to limit the distraction within the company.

A few days after the investigation and suspension was announced, Anthony decided to part ways permanently, resigning as CEO and stepping down from the board.

With Anthony’s permanent departure from the company, the thesis changed. We continued to believe the stock was tremendously undervalued but so too are the 18 other investments in our portfolio which are run by long tenured CEO’s we trust. Given this change of guard, we sold our shares and redeployed the proceeds in our existing core holdings.

In addition, we sold a small position we held in Asana (ASAN), and made a new investment in a founder-led, leading second-hand consignment marketplace, ThredUp (TDUP), which we will discuss in more detail in the future should it become a top 10 holding.

Every quarter we profile one of our holdings in more detail. This quarter we decided to discuss Monday.com.

Monday.com (MNDY)

Monday.com is a unique business.

They are a leader in the collaborative work management software industry, an industry dedicated to helping knowledge workers organize, manage and collaborate around work.

Smartsheet, another Optimist top 10 holding, is also a leader in this market. On the surface Smartsheet and Monday might sound like Coke and Pepsi, which would drive one to ask, “why do you own both?”, but the more one learns about both companies, you come to realize their distinct differences.

Smartsheet is predominately focused on expanding their relationships with existing enterprise customers in project management, whereas Monday views themselves as an app building platform where project management was the first of many applications. Smartsheet typically wins on being able to handle enterprise complexity, whereas Monday wins on ease of use.

In the last few years Monday has broadened their product offering launching Sales CRM, Monday Dev, managing software development workflows, and then late last year they announced a planned entrance into the service management market.

Because the markets both companies are competing in are large, underpenetrated, or in some cases distinctly different, we believe both companies long term growth and success are not mutually exclusive.

The Monday.com founders are exceptional.

Left: Founder and Co-CEO Roy Mann, Right: Founder and Co-CEO Eran Zinman (Source: Calcalistech.com/ctech/articles/0,7340,L-3909641,00.html)

From the initial product launch in 2014 to today, co-founders and co-CEO’s, Roy Mann and Eran Zinman, have done an exceptional job efficiently allocating capital to maximize shareholder value.

Before going public they raised $234 million of which ~$120 million was invested in the business. In 2023 Monday generated ~$165 million in free cash flow excluding interest income.

The above results are an exceptional return on invested capital and has driven Roy and Eran’s combined equity (~15% of the company) to be worth ~$1.9 billion.

The growth runway is large.

Though the founders have already built an incredible business, we believe we are still in the early innings of the Monday.com growth story.

Currently there are over 1 billion knowledge workers globally of which less than 50 million use a collaborative work management solution like Monday.com.

Spreadsheets, word documents, and email remain the tools the vast majority use to manage work. This presents an enormous growth opportunity for the collaborative work management software category.

On top of the enormous collaborative work management opportunity, Monday also addresses the CRM space with their sales and soon to launch service product which together add 10’s of billions of addressable opportunity.

The unit economics are attractive.

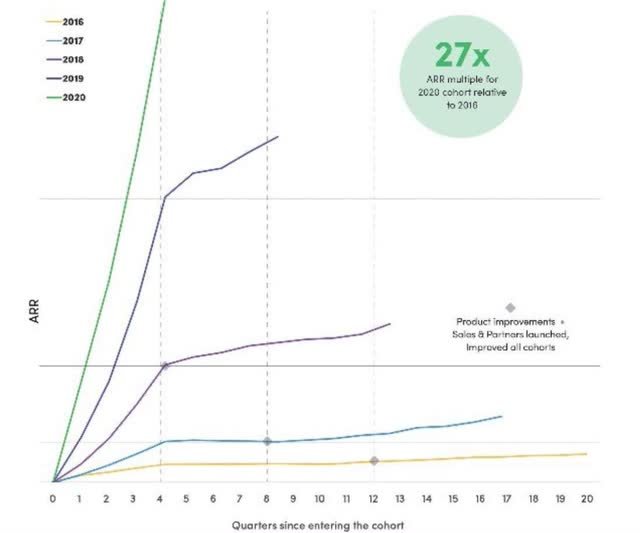

Monday breaks even on their customer acquisition spend (sales and marketing expense) in under 2 years and, more importantly, the cohort of customers they acquire, in aggregate, spend more money with Monday every year thereafter.

For example, if Monday spends $10 in sales and marketing to acquire customers, in year 1 they’ll make ~$5 of incremental contribution profit, in year 2 they’ll make $6, year 3 they’ll make $7, and continue to grow thereafter.

Below is a cohort graph demonstrating how Monday’s annual recurring revenue from customers acquired in each period continue to grow over time.

ARR = Annual Recurring Revenue, (Source: Monday.com 2021 Prospectus)

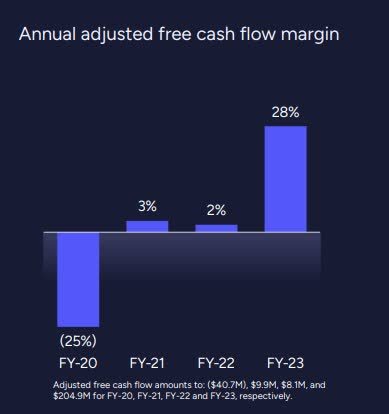

Monday’s attractive unit economics are further demonstrated by their nearly 30% free cash flow margins while sustaining 30%+ revenue growth.

Source: Monday.com Q1 2024 Investor Presentation Source: Monday.com Q1 2024 Investor Presentation

As the company matures and revenue growth slows to sub 20%, free cash flow margins should march past 40%, making Monday one of the highest margin, publicly listed software companies in the world. We believe Monday is significantly undervalued.

Based on our estimates, Monday.com is trading at ~23x 2025 free cash flow, which in our view, is a highly attractive valuation for a business growing revenue 30%+ while continuing to have material future margin expansion potential.

Our 5-year price target is $1,180, (a 5-year internal rate of return of ~40%) driven by revenue and free cash flow per share growth of 35%/37% and a target multiple of 40x EV/FCF.

Overall, Monday.com’s exceptional management, strong growth runway, robust unit economics, and attractive valuation make us optimistic about our investment in the company.

Closing Remarks

In aggregate, I am pleased with how our portfolio holdings are tracking and see a clear path to generating exceptional returns over the next 5 years.

If you have any questions, please don’t hesitate to reach out. We value your feedback and always make time for our investors. Thank you once again for your trust and support. Speak soon,

Jordan McNamee

Founder & Chief Investment Officer

|

Footnotes *Rates of return are for Class E lead series net of all fees and expenses for Optimist Fund to illustrate the historical performance of our investment strategy. **The Benchmark has a 50% weighting in the MSCI World Growth Index and a 50% weighting in the Russell Midcap Growth Index. The Benchmark is provided for information only and comparisons to benchmarks and indexes have limitations. Investing in global equities is the primary strategy for Optimist Fund but Optimist Fund does not invest in all or necessarily any of the securities that compose the Benchmark or the market indexes. Reference to the Benchmark and the market indexes does not imply that Optimist Fund will achieve similar returns. ***Fund start date was March 1, 2022. This report is neither an offer to sell nor a solicitation of an offer to buy any securities in any fund managed by us. Any offering is made only pursuant to the relevant offering memorandum together with the relevant subscription agreement, both of which should be read in their entirety. No offer to sell securities will be made prior to receipt of these documents by the offeree, and no offer to purchase securities will be accepted prior to completion of all appropriate documentation. The discussions in this report are not intended to be investment advice to any specific investor. Some of the discussions are based on the best information available to us, publicly or otherwise, but due consideration should be given to the fact that much of it is forward-looking or anticipatory in nature, which is inherently uncertain. Past performance of a fund is no guarantee as to its performance in the future. This report is not an advertisement, and it is not intended for public use or distribution. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.