Olga Druzhchenko

The first half of the year is over, and it has been a while since I’ve shared my top ten holdings in my closed-end fund portfolio. The ‘deals’ in the closed-end fund space aren’t quite like they were last year, but there are still opportunities in certain areas of the market. Discounts have narrowed quite materially since the start of the year.

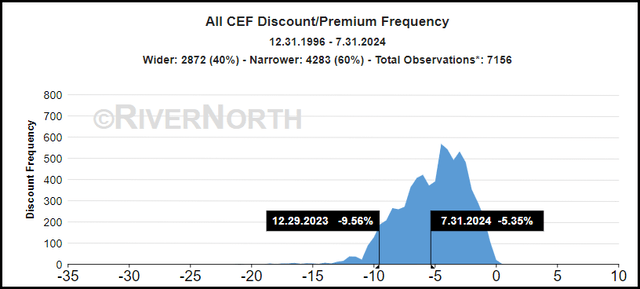

All CEF Discount/Premium Average (RiverNorth)

That said, 2022 and 2023 did see closed-end funds go to historically wide discount levels. Further, with market volatility starting to heat up with the mega-cap tech names starting to take a breather, we could see some discount widening as has often happened historically.

As a reminder, a CEF is not an asset class or a sector; it is simply a structure—a wrapper for other underlying securities spread across various asset classes and sectors. That means that there is likely some CEF or two that can fit in almost any type of investor portfolio, whether they are income or growth-focused investors. While they generally pay out high distributions to investors, monthly or quarterly, there are several tech-focused funds that some growth investors might find appealing. The distribution could simply be reinvested if growth is the real aim.

Top 10

Overall, I hold 42 positions (not counting cash) in my CEF portfolio. That is up from the 41 positions I held at the last update and is going in the opposite direction of me wanting to cut back the number of holdings a bit. The new position was abrdn Healthcare Investors (HQH), which I added very shortly after my prior top 10 updates. However, I didn’t take a massive position, so it won’t appear as a top position on this list.

With my main CEF portfolio, I tend to be a long-term investor and will hold some positions for years. I do rather limited trading/swapping, but when there is an opportunity, I will take advantage of it. After all, the discount/premium mechanic of the CEF structure is one of the main advantages that can be exploited, especially between swap pairs. Interestingly, we have each one of these three actions that took place since my previous update to touch on.

That includes making moves based on corporate actions, such as sidestepping rights offerings and participating in tender offers. So, it’s not a completely passive portfolio, but I could probably best describe it as semi-passive.

With that, this is how I ended up with so many positions; if there isn’t a clear reason to sell in terms of the discount/premium or a swap opportunity, then I often just stay invested. I don’t mind holding similar funds across different fund sponsors, as that means different managers that may outperform for a while but then underperform for a number of years and vice versa.

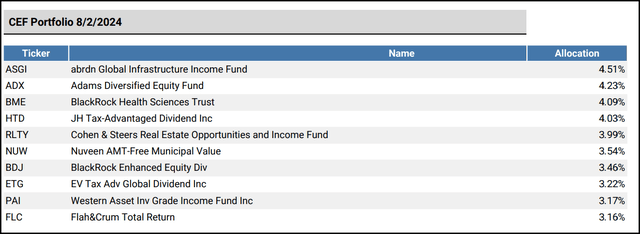

While I hold quite a few positions, my top ten make up 37.40%—up from the 36.52% previously.

With that, here is a look at my latest top ten.

Top Ten Holdings (Portfolio Visualizer)

The number one position here, #1 abrdn Global Infrastructure Income Fund (ASGI), remains my largest position. The weighting increased to 4.51% from 4.27%. I’ve even added to it when selling NXG NextGen Infrastructure Income Fund (NXG) in anticipation of the rights offering being announced. After selling NXG and putting some of that capital to work in ASGI, NXG did announce a rights offering.

I added back post offering, as I mentioned in my latest monthly closed-end fund buying series. However, I only started back with a rather small position in NXG—which is why it doesn’t appear as a top-ten holding anymore. Previously, NXG was the ninth largest position. That’s an example of sidestepping the rights offering and being more of an active investor in this portfolio.

As ASGI’s discount has narrowed materially thanks to an increase in the managed distribution policy to a rolling 12% of NAV, it still remains a decently attractive option in the infrastructure space, in my opinion.

#2 Adams Diversified Equity Fund (ADX) is a new top ten name, but not a new name to this portfolio. I’ve held it for a number of years. However, the other common corporate action that happens to CEFs is tender offers, which was what this fund announced along with a change in their own managed distribution policy as well.

As I recently touched on, again, in my latest monthly CEF buying series, I was growing this position to participate in this offer as the fund still traded at a sizeable discount to allow for some discount realization through this 10% tender offer at 98% of NAV. I actually had plans to go more aggressive, but with the market seemingly only rising higher and higher through most of this period, I cut back my ambitions.

With that said, that tender offer expired the day I wrote this, and I participated with 100% of my position. While the tender offer was for 10% of outstanding shares, as usual, not all investors participated. The proration ended up being nearly 30%. That meant, at least briefly, it stopped being my second largest position, but I bought all the shares back after. The TO purchase price ended up being $22.47, and I repurchased at $20.31—a pretty good deal.

#3 BlackRock Health Sciences Trust (BME) was a top ten holding before as my fourth largest position. I added to this name in April when it was plunging to a historically large discount. I’ve been well rewarded in the short term and plan to continue to carry this fund for the long term.

#4 John Hancock Tax-Advantaged Dividend Income Fund (HTD) is the swap opportunity that I mentioned above. Last year, I swapped HTD to John Hancock Premium Dividend Fund (PDT) because they cut their distribution, and the discount widened meaningfully relative to HTD, which is actually quite rare in the history of these two funds. It has tended to be PDT that trades at premiums while HTD trades at discounts regularly. That’s how I ended up with PDT as a top ten position when we last gave my top ten a look. However, the opportunity to swap back presented itself, and I took it—thus, HTD is back in my portfolio.

Along with ASGI and BME, other names that have remained top ten positions: #5 Cohen & Steers Real Estate Opportunities & Income Fund (RLTY), #7 BlackRock Enhanced Equity Dividend Fund (BDJ), #8 Eaton Vance Tax-Advantaged Global Dividend Income Fund (ETG) and #9 Western Asset Investment Grade Income Fund (PAI).

#6 Nuveen AMT-Free Municipal Value Fund (NUW) has become a large position in my portfolio along with PAI because I’ve been adding steadily now since going back to April 2023. As I’ve mentioned previously, the main idea of adding NUW and PAI to my portfolio was to de-risk but also participate in potential future rate cuts. I had started building these positions a while back, and it actually ended up being too soon, as I thought rates would be cut sooner. That said, we should be getting closer to those elusive rate cuts as the economy starts to slow down and with inflation continuing to trend in the right direction.

#10 Flaherty & Crumrine Total Return Fund (FLC) is also a new top-ten name and a new name to my portfolio. However, it isn’t really that new in terms of holding a similar F&C fund previously. It was also the result of having a swap opportunity in January of this year. I had held Flaherty & Crumrine Dynamic Preferred and Income Fund (DFP) and was looking to add exposure to these high-leveraged F&C preferred plays. While I would have been happy to add DFP, the discount for FLC was meaningfully deeper at the time. That prompted me to make the swap trade but then also add more to FLC. Further, I recently added a bit more to my FLC position in June as well, helping to push the allocation higher.

That leaves Cohen & Steers Quality Income Realty Fund (RQI) and Cohen & Steers Tax-Advantaged Preferred Securities and Income Fund (PTA) not accounted for, as they were previous top ten positions. I didn’t sell these positions or even trim them; they simply slipped to positions #11 and #12 with weightings of 3.14% and 3.10%, respectively. Along with holding RQI in this portfolio and another account, it remains my single largest CEF exposure overall.

Conclusion

Over the first half and one month of 2024, I made two swap trades from PDT back to HTD and DFP in favor of FLC. I also sidestepped a rights offering from NXG but added back to the position promptly after the RO expired. When selling out of NXG, I put some more cash to work in ASGI, increasing my already largest position.

ADX is my second largest position as of writing, but that will drop some after the tender offer wraps up, and we’ll see where that shakes out. I’m leaning towards adding the shares back post-tender, and I’m hoping for a post-tender slump that we often see. However, a change in the distribution policy might mitigate some of that event. The overall market starting to pick up in volatility is also putting pressure on shares of ADX, which, at this juncture, with the idea of buying shares once again, is also a positive.