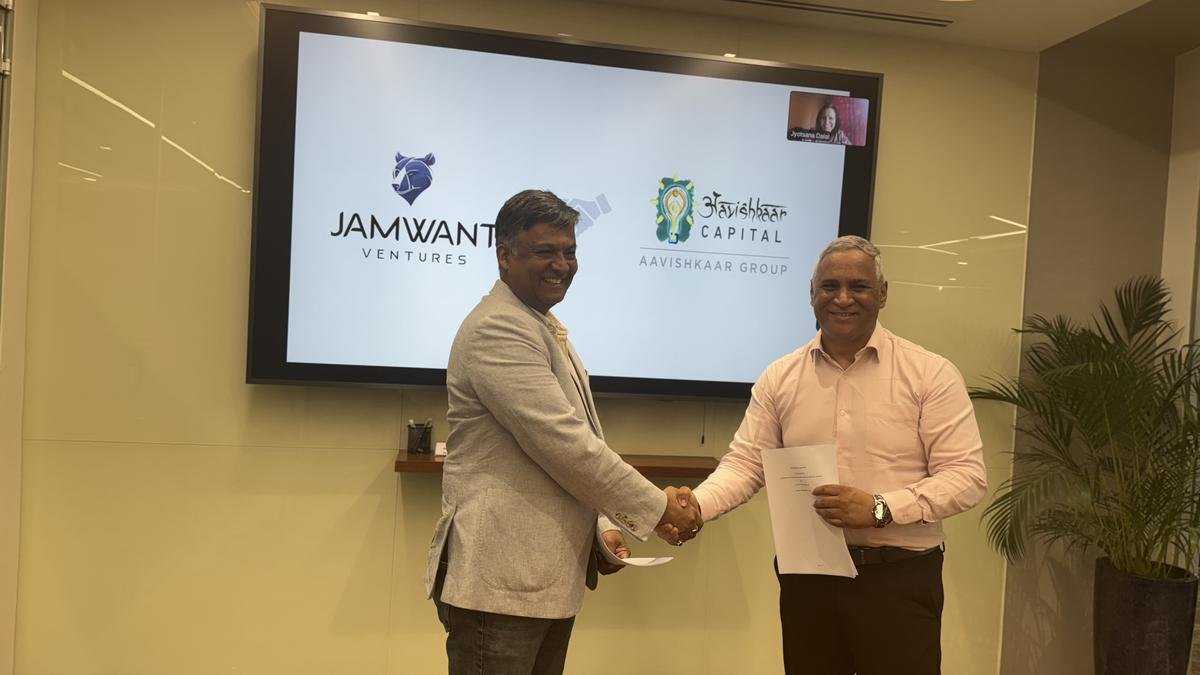

(Left) Cdr.Navneet Kaushik, Founder, Jamwant Ventures , (Right) Vineet Rai, Founder, Aavishkaar Group

India’s defense technology sector is witnessing unprecedented growth, transitioning from being a major importer to an emerging exporter of defense equipment. Jamwant Ventures, founded by retired naval officers with deep operational expertise, is launching its second fund in partnership with Aavishkaar Capital to back cutting-edge defense tech startups. In an exclusive conversation, Cdr. Navneet Kaushik (Founder, Jamwant Ventures) and Tarun Mehta (Partner, Funds & Strategy, Aavishkaar Capital) share insights into the fund’s strategy, India’s defense tech ecosystem, and what makes their approach unique.

Can you tell us about the new fund you’re launching with Aavishkaar?

Navneet- We’re looking at a ₹500 crore target corpus with a ₹250 crore greenshoe option. The fund will focus exclusively on deep tech with defense use cases. This is a significant scale-up from our first fund, Jamwant One, which was a ₹40 crore fund where we invested in six companies. What we realised was that capital was a constraint—while we were deploying small checks, others were coming in with larger amounts in the same companies. With this partnership with Aavishkaar, we now have both conviction and capital.

Why is now the right time for a dedicated defense tech fund?

Navneet- While defense has become a hot sector currently, we started Jamwant Ventures before Operation Sindoor because we saw significant gaps in the defense ecosystem. Over the last 10-15 years, India’s defense exports have grown 10-20 times. With the current geopolitical scenario, there’s no choice but to be Aatmabirbhar—self-reliant. When we talk about self-reliance, we’re not just talking about assembling boxes; we’re talking about creating technologies. World over, if you look at developed nations, they dominate tech, and much of that tech originates from defense—the internet, GPS, geospatial analytics. If you want technology leadership, you have to focus on defense and cutting-edge tech.

What sectors within defense tech are you targeting?

Navneet- We’re focusing on new materials, autonomous systems—which includes drones, underwater systems, and robotics—cybersecurity, sensors, and communication technologies. These are critical areas where India needs to build indigenous capabilities. For instance, drones for us aren’t just drones; they’re autonomous systems that can operate underwater, in the air-water interface, or as robotic systems. These are the building blocks for future technological development.

What’s your investment thesis and deployment plan?

Navneet: We’re targeting 15-25 startups with check sizes of $1-5 million. We prefer leading rounds where we add value and typically take board seats. The fund has a ₹250 crore greenshoe option. We’ll work with Indian institutional LPs and family offices initially, then potentially approach NRIs and foreign investors. We already have companies identified and plan to deploy within a year.

What differentiates Jamwant and Aavishkaar’s partnership from other defence-focused funds?

Tarun: Most funds entering this space are adding defence as a small slice of their broader portfolio. What makes us different is that Jamwant’s founding team comes from the user side—they’re former naval officers and operators who understand what the forces actually need. Aavishkaar brings institutional investing discipline, and Jamwant brings domain expertise. Together, that creates a powerful combination in a highly specialised field.

How are you engaging with DRDO, IDEX, and the government ecosystem?

Navneet: We’re already deeply integrated with the government ecosystem. Almost all the companies we’ve invested in have either participated in an iDEX challenge or have won one.

Published on October 9, 2025