Alistair Berg

Recently, I came across the ProShares S&P 500 High Income ETF (BATS:ISPY) that sells daily covered calls on the S&P 500 Index. I also read a fellow Seeking Alpha analyst’s review of the fund and how it has outperformed the JPMorgan Premium Income ETF (JEPI) since its inception (Figure 1).

Figure 1 – ISPY has outperformed JEPI since its inception (Seeking Alpha)

Unfortunately, being a stickler for details, I found this review lacking as it did not explain why the ISPY ETF may be better than the JEPI ETF. So this article represents my understanding of the ISPY ETF and what scenarios might see it outperform JEPI.

In my opinion, ISPY has outperformed JEPI since its inception because its use of daily options resets its performance cap daily, allowing the ISPY ETF to capture more of the index’s rally since December 2023.

However, by the same token, ISPY should underperform in down markets, as its premiums received will provide less cushion than the JEPI.

Since I have a bearish view on equity markets currently, I would recommend investors stay away from the ISPY ETF for now.

Fund Overview

The ProShares S&P 500 High Income ETF seeks to replicate the investment results, before fees and expenses, of the S&P 500 Daily Covered Call Index. This index tracks the performance of a long position in the S&P 500 Index combined with a short position in S&P 500 Index daily call options. The index utilizes out-of-the-money (“OTM”) S&P 500 Index call options having one day to expiry when sold.

The ISPY ETF does not actually trade the call options. Instead, it gains exposure to the sale of daily call options using a swap agreement with large investment banks. Figure 2 shows ISPY’s portfolio holdings, which consist of a large notional swap position combined with stocks replicating the S&P 500 Index and a small S&P 500 Index futures position for daily cash management.

Figure 2 – ISPY portfolio holdings (Author created from proshares.com)

Portfolio Returns

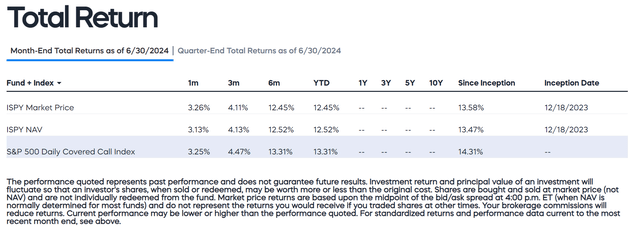

Since inception, the ISPY ETF has delivered solid returns, with YTD returns of 12.5% to June 30, 2024 (Figure 3).

Figure 3 – ISPY has delivered solid returns (proshares.com)

In fact, as shown in Figure 1 above, the ISPY ETF has significantly outperformed the larger, and more well-known JEPI ETF, with 9.1% total returns from inception to August 5th, compared to 5.2% for JEPI and 11.3% for the S&P 500 Total Return Index.

ISPY Benefits From Daily Reset

In my opinion, the reason ISPY has outperformed JEPI has to do with its use of daily call options instead of JEPI’s use of monthly options in a rising market.

Readers may recall that one of my main criticisms of the covered-call strategy is that it trades away upside returns beyond the option strike price in exchange for upfront premium income.

Historically, this upside capping can be quite costly. For example, the S&P 500 Index has significantly outperformed the CBOE S&P 500 BuyWrite Index (an index that writes 1-month slightly OTM options, similar to the JEPI ETF) over the long run because of this upside returns capping (Figure 4).

Figure 4 – S&P 500 Index has significantly outperformed traditional BuyWrite indices (proshares.com)

The BuyWrite strategy lags because once the price of the stock index goes above, and stays above, the strike price of the sod call options, the BuyWrite strategy essentially foregoes participation in the stock market rally for days, or weeks, until the call options expire.

A daily covered call strategy may result in a better returns profile in an up-market as the option strikes (and hence the returns cap) are reset daily. This may allow the strategy to participate in the asset’s appreciation each day, up to the strike price.

Additionally, selling call options every day may act as a rebalancing mechanism for maintaining the desired balance between premiums received and payouts for ‘busted’ options.

But Beware Down Markets

While the ISPY may outperform JEPI in an upmarket, I believe the opposite may be true in a down market, as the premiums received upfront are typically less for daily options, so there is less cushion during drawdown periods. For example, from March 28 to April 19th, the most recent market drawdown, the ISPY ETF declined 4.9% compared to JEPI’s 3.6% decline and a 5.4% decline for the S&P 500 Index (Figure 5).

Figure 5 – ISPY underperformed JEPI from March 28 to April 19, 2024 (Seeking Alpha)

Similarly, since July 16th, the ISPY ETF has declined 7.9% compared to 3.4% for JEPI and 8.4% for the S&P 500 Index (Figure 6).

Figure 6 – ISPY has underperformed JEPI since July 16th, 2024 (Seeking Alpha)

In both scenarios, we can see that ISPY closely tracks the S&P 500 Index during drawdown periods. So choosing between JEPI and ISPY depends on one’s view of the equity market’s direction.

Distribution Is Attractive

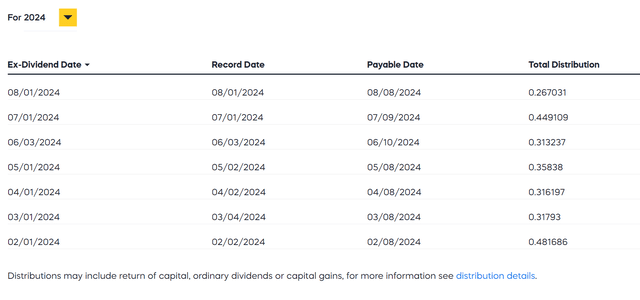

With respect to distributions, ISPY pays a variable distribution that is dependent on its premium received. YTD, the fund has paid $2.50 / share or an annualized yield of ~8.4% (Figure 7).

Figure 7 – ISPY has paid $2.50 / share in distributions YTD (proshares.com)

This is comparable to JEPI’s trailing 12-month yield of 7.5% (Figure 8).

Figure 8 – ISPY distribution vs. peers (Seeking Alpha)

Elevated Valuations Gives Me Pause

If there is to be one knock against the ISPY ETF, it would have to be equity valuations. In my opinion, the S&P 500 Index is currently trading at some of the highest Fwd P/E valuations outside of the 2000 dot-com bubble, so forward equity returns may be poor (Figure 9).

Figure 9 – S&P 500 is trading at elevated valuations (yardeni.com)

As we saw in recent weeks, when valuations are stretched, it does not take a lot to change the market’s direction and cause a large drawdown.

Since ISPY will likely underperform in down markets, I am hesitant to recommend the ISPY ETF at the moment.

Conclusion

The ProShares S&P 500 High Income ETF is an innovative ETF that writes daily OTM covered-call options on the S&P 500 Index to generate an attractive distribution yield to investors.

The ISPY ETF’s daily call options strategy has allowed the ETF to outperform peers since its inception, as it is effectively resetting the returns cap daily. However, in a down market, the ISPY ETF will also underperform, as its premiums received will have less cushion for drawdowns.

Since I have a negative view of the equity markets due to their elevated valuations, I would not recommend the ISPY ETF at this time.