(Bloomberg) — Dubai-based Magellan Capital Holdings Ltd. is set to launch a $700 million multistrategy hedge fund next month that will rank among the largest debuts in the United Arab Emirates.

Most Read from Bloomberg

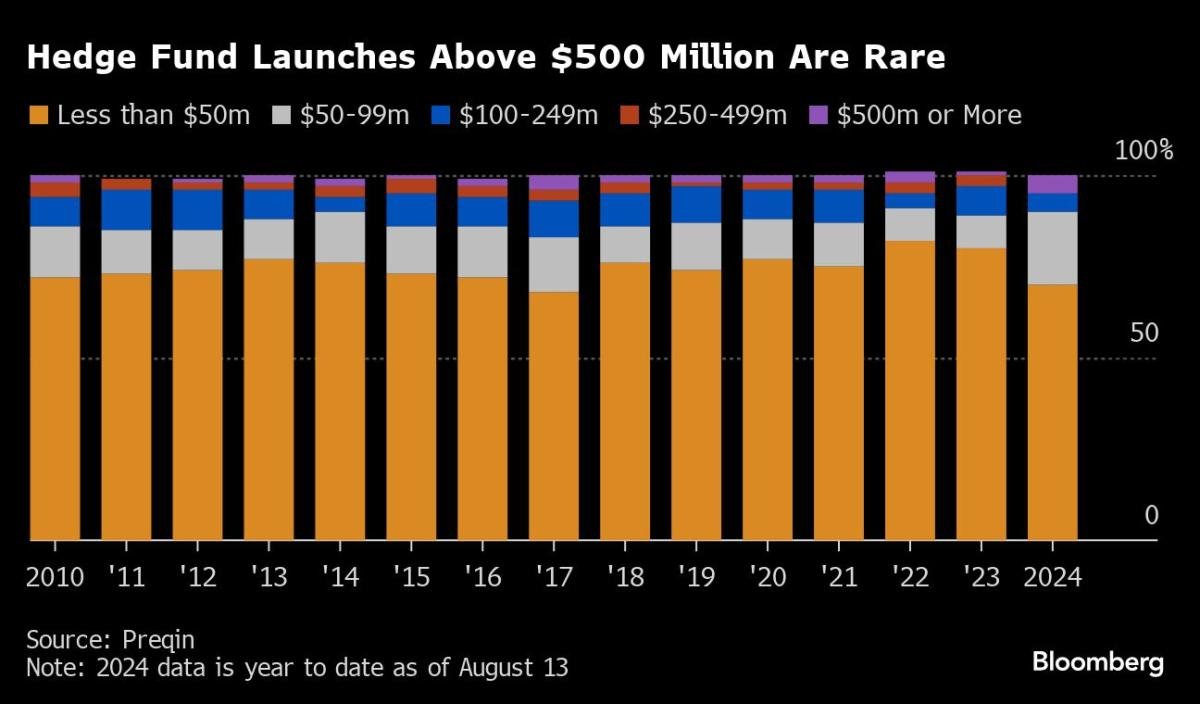

The fund will run equity and credit strategies, according to Britney Lam, head of long-short equities for the firm. Magellan’s size is notable, given just 5% of hedge funds globally launched with $500 million or more this year, according to industry tracker Preqin.

Its seed capital comes from the family wealth of Hassan El Ali, who founded Zakher Marine International and sold it to a unit of UAE state-energy firm Abu Dhabi National Oil Co. two years ago.

“Once the track record is established — in around 12 months — we will begin speaking to key allocators,” Lam said, including family offices and sovereign funds in the region. “I want to be prudent and make sure the investment process is in place before bringing in too much external capital,” she said.

The launch further bolsters Dubai’s reputation as a hub for hedge funds. The Middle Eastern city hosts local offices of 37 global hedge funds that oversee at least $1 billion, of which 25 were set up after 2022, according to data provider With Intelligence.

With offices in Dubai, Abu Dhabi and London, Magellan has doubled headcount in the past year to more than 20 staff across its public and private markets operations. Key hires include Valery Kazak, who previously worked at Sova Capital in London and will oversee emerging markets fixed income, according to Lam.

The Zakher Marine sale provided $1.1 billion for Magellan to invest, Chief Investment Officer Ahmed Omar said in June when the firm agreed to pay more than €700 million for Danish Ship Finance. Magellan raised $360 million the following month in a bond offering to help fund the acquisition.

The firm’s name echoes others that have referenced Ferdinand Magellan — a Portuguese explorer who was the first to circumnavigate the globe more than 500 years ago — to denote a global focus. Peter Lynch ran the Fidelity Magellan Fund for years, while Australian fund manager Magellan Financial Group Ltd. has $25 billion under management.

New from Bloomberg: Get the Mideast Money newsletter, a weekly look at the intersection of wealth and power in the region.

Lam is a two-decade industry veteran, specializing in inter-sector pairs trading across a universe of around 200 tech and consumer-focused companies and their suppliers in the US and Asia. The strategy relies on taking long positions in certain companies while shorting direct competitors, or finding arbitrage opportunities between producers and their suppliers.

“We have to be very strategic,” said Lam, who previously worked at Ovata Capital in Singapore. “Because I’ve known these companies for more than 20 years in some cases, it’s about knowing how accurate my numbers are versus the consensus.”

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.