Kanoke_46/iStock via Getty Images

Introduction

This is an initiation article on Tidewater Inc. (NYSE:TDW), an offshore support vessel (OSV) owner and operator based out of Houston, TX, which has been operating since 1956 and since 1970 as a public company.

OSVs provide a variety of services for offshore oil, gas, and wind operations. These ships are relatively small but mighty, featuring powerful engines, work capacity, and even towing capabilities. They carry vital people and supplies like fuel, cement, and heavy machinery to and from offshore operations.

Tidewater is the largest global OSV operator, more than 50% bigger by vessel number than its closest competitor, totaling more than 200 ships across a few significant categories:

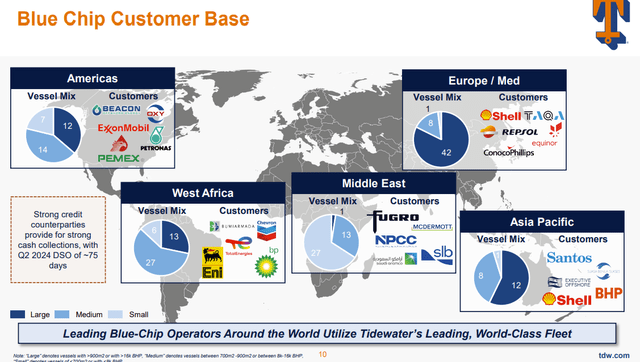

The company operates across the globe, serving blue-chip customers like Exxon, Chevron, Shell, Equinor, Eni, BP, and more:

I first invested in TDW around September 2023, adding on pullbacks with the majority of my position built in November of 2023. With price appreciation, the equity has become a top 5 position in my portfolios. I’ll share my theses and thoughts below. Thank you in advance for reading!

Right Industry, Great Operations: Momentum Should Continue

As readers of my prior articles will know, I believe many resource industries are experiencing significant secular tailwinds. Due to perhaps decades of underinvestment, favorable demographics, higher interest rates, and more, I believe inflation and higher commodity prices are here to stay. We just exited a 40-year period of deflation, and I do not think it’s crazy to expect inflationary trends to continue through the rest of this decade and beyond.

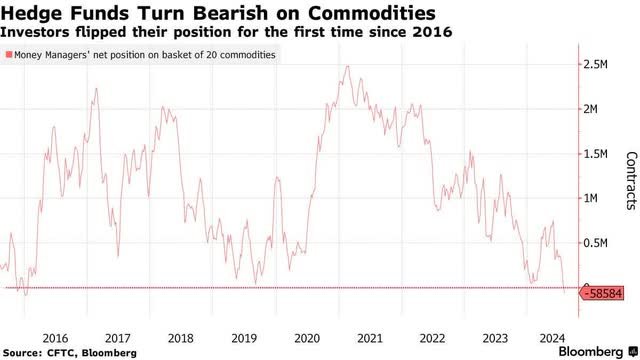

Energy is a primary cause of and will also be a primary beneficiary of these trends, and oil, gas, and wind all have significant roles to play. And while these topics have become more discussed, I think there is plenty of skepticism and evidence that these are still not “crowded” or “consensus” trades. In fact, CFTC data actually shows an incredibly bullish position for these ideas! “Fast money” hedge funds have become net bearish on commodities again, for the first time since 2016:

2016 was pretty much the bottom of the last real cycle for commodities. If we start another “cycle” from here, resource companies should do fantastically well.

Offshore’s Advantages:

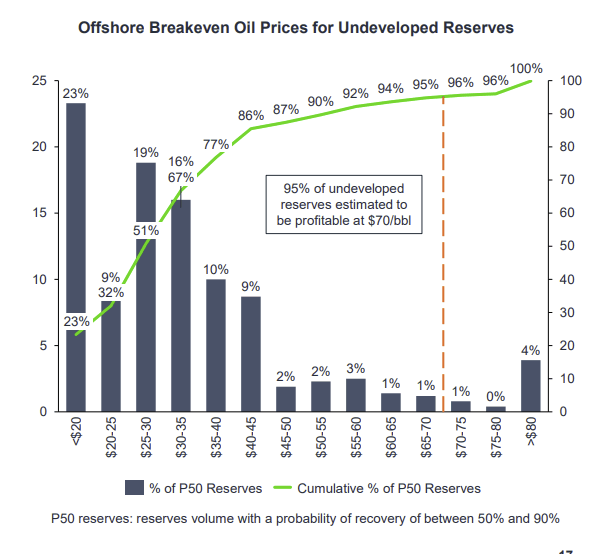

As a category, offshore resource segments are demonstrating several advantages over their onshore counterparts. Offshore oil projects, for example, are now widely believed to have lower breakeven prices (~most under $50-$55 USD), much longer and steadier production profiles, and lower “social license” / NIMBY problems than many onshore projects. There has been much discussion of this recently, and Rystad Energy has put out a couple of impressive charts regarding these economic differences:

Offshore wind has similar advantages, including better wind profiles, proximity to population centers, and potential for future developments like floating wind. Unless or until significant technological breakthroughs occur, I expect offshore oil, gas, and wind investment to outpace onshore over the next several years and beyond.

OSV Industry Specifically:

The OSV industry will of course closely follow the offshore oil and gas segment, and does closely correlate with oilfield services in general. The OSV industry last peaked in 2014, and has since gone through a long and significant bear market, bringing significant capital losses, industry consolidation, and a lack of appetite for fresh investment.

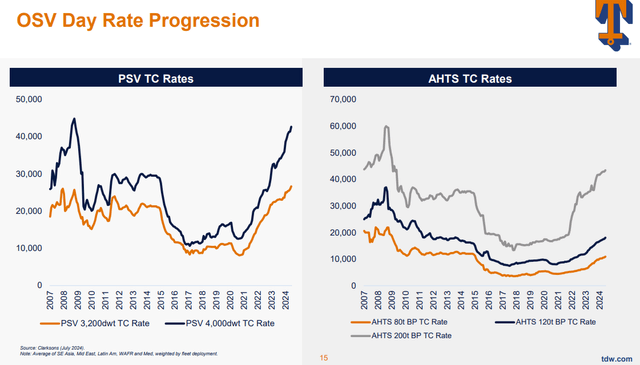

As the saying goes, “low prices cure low prices,” and as a result of this last downturn, the industry began bottoming around 2018. Over the last 2.5 years, supply has remained muted, but stable and increasing demand has caused utilization rates and revenues to stage a furious comeback. Below you can see global day rates for TDW’s two major ship types, platform supply vessels (PSVs) and anchor-handling tug supply vessels (AHTSs) taking off:

Indeed, rates are climbing toward or past their 2014 peaks, and some are even attacking 2008 levels! This has been a monumental and dramatic turn of events for the OSV industry, which I expect to continue along with oil and oilfield services for the foreseeable future.

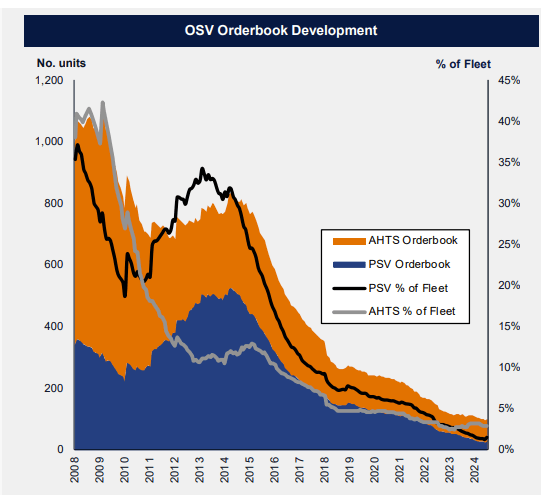

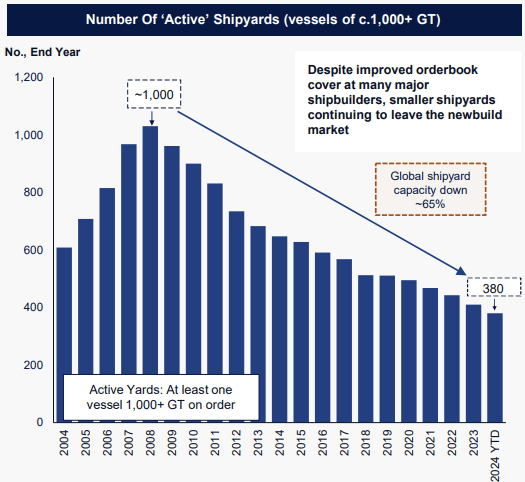

No Supply Response:

Just as low prices cure low prices, however, high prices usually cure high prices. An obvious risk to all the bullish factors I have described above would be increased supply from new ships entering the market. However, this simply isn’t happening. The industry’s order book, one of my favorite data points in shipping industries, is near zero. In addition, the entire shipping supply chain, here represented by active shipyards, has shrunk over the last decade+:

Company Presentation Company Presentation

This gives me great encouragement for the durability of this “cycle” and TDW’s increasing cash flows. Even if the industry were to wake up tomorrow and want to order tons of new ships (unlikely), it would take several years for these to hit the water and begin affecting operators / the supply side. I think a significant newbuild scenario remains unlikely as global allocators are still wary of energy investments, and I would imagine definitely do not want a 20+ year commitment to the industry.

Great Operations:

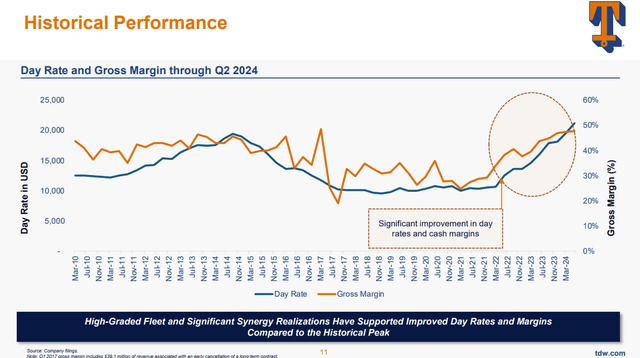

As a result of the above industry factors, coupled with TDW’s market-leading position, the company in 2024 has begun earning record-high day rates for the first time in a decade. TDW’s contract length is approximately 18 months, so as old, expiring contracts are replaced with new, higher current rates, we can expect their revenues, profits, and cash flows to increase and look like the PSV rate chart above under the “OSV Industry Specifically” heading. Indeed, TDW’s financials are confirming this trend:

I want readers to take a moment here to note TDW’s profit margins and operational excellence shown in the chart above. Management has positioned the company extremely well over the last several years, waiting out the downturn and “out-earning” the market. In only 2.5 years of industry rebound, with some of their vessels still on older, cheaper contracts, the company has already earned higher profit margins than 2014!

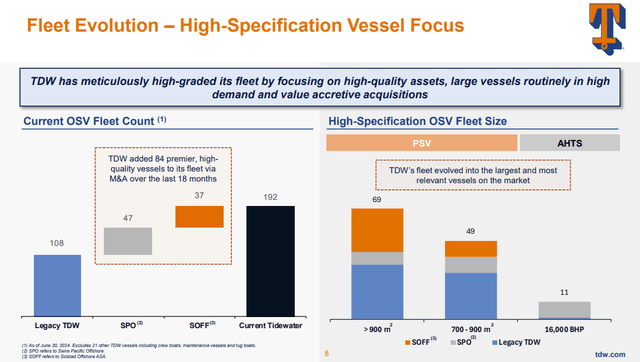

This is partially due to effective operations and cost management, but also the result of TDW’s industry consolidation and fleet “high-grading.” Over the past two years, the company has made two large acquisitions (Swire Pacific Offshore and Solstad Offshore), boosting its fleet size by ~80% and aligning its fleet toward larger, more up-to-date, and more in-demand ships:

This has clearly benefited the company with things like economies of scale, higher dayrates, and better contract negotiations. Until proven otherwise, I believe management is a “value-add” and investors can have confidence investing alongside them.

Valuation Still Healthy, Plus Share Repurchases and/or Accretive Acquisitions

With all of the bullish factors above, and the general “forward-lookingness” of the market, TDW has already run significantly from its COVID and cycle bottom lows in 2020. During the COVID crash, TDW traded around $5. At the current ~$90 per share, TDW has already gone up +1800%!

Normally, a company that has gone on such a run is not a prime candidate to buy, and investors might actually be able to consider shorting such a stock. However, TDW’s industry, financial, and operational strengths make me think this is anything but a “typical” situation. And in well-performing businesses with secular tailwinds, prior appreciation does not necessitate poor forward returns.

In fact, TDW here reminds me strongly of an article I wrote on CONSOL Energy (CEIX) back in February 2023, when I wrote “CONSOLidation, Still Time to Buy”. At that point, CONSOL had already run something like 1700% from its COVID bottom, but I said then investors could use a recent dip / sideways action to purchase shares. Since then, CEIX has run ~80% and I think is still headed much higher.

Newbuild Valuation:

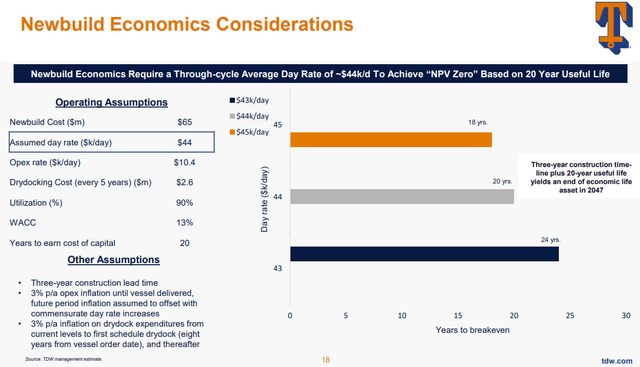

One way to evaluate a shipping company’s value is to look at “newbuild cost,” the amount a new financier would have to pay today to order new ships. Along with current revenues, projected costs, and useful life, we can evaluate how current ships on the water “stack up” to a proposed newbuild. Given some basic / standard industry assumptions, we can see current asset values are roughly on par with the price of a theoretical newbuild:

While I think the actual appetite for newbuilds is low, and most financiers do not want to take 20-year risk on an oil and gas investment, we can see that relatively standard assumptions show the company has not reached any significant levels of euphoria or over-valuation.

Financial Metric Valuation:

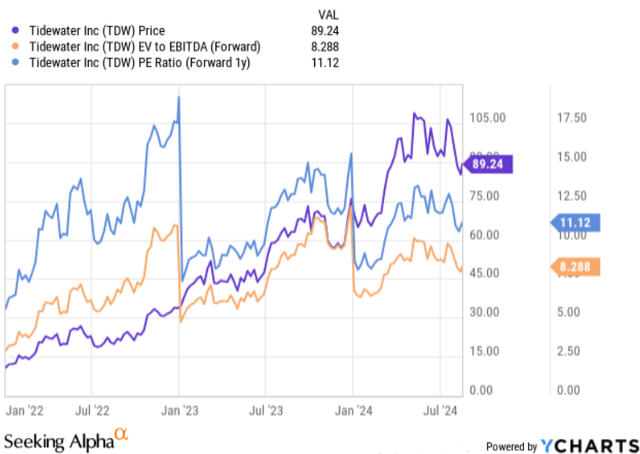

In addition, we can look at much simpler ways to evaluate the company. The company’s forward P/E ratio and forward EV/EBITDA ratio have pretty much remained identical over the last two years, even in the face of 75% price appreciation during this timeframe!

Essentially, this means most / all of TDW’s 75% gains over two years have come directly from earnings, NOT any kind of dramatic increase in valuation or multiples. And at a forward P/E of 11 and an EV/EBITDA of ~8, the company does not seem significantly overvalued.

Share Buybacks, Accretive Deals:

Finally, as TDW’s revenues, profits, and cash flows should continue upward over the coming years, management knows the industry is in more “capital harvesting” mode than “building” mode. As such, they’ve committed to using their cash in proven, investor-friendly ways such as buybacks and accretive deals. From the Q2 call a couple weeks ago:

Analyst:

“It seems like you’re going to generate significant free cash flow over the next 12 to 18 months. And just your thoughts around what you would deploy that capital into? Would it be share repurchases? Or would you just kind of build cash or maybe pay down debt, et cetera? Just your thoughts around uses for that free cash flow?

Quintin Kneen, President and CEO:

Well, we’re not going to build cash. We’ll certainly keep cash as necessary for liquidity and so forth. I don’t think that we are over levered at this point in the cycle. So as a result, that cash is either going to get deployed into value-accretive acquisitions that we were just talking about, if we can get them done or we were returning that money to shareholders.

Prior readers will know I place a strong emphasis on capital-friendly strategies and management teams, as I believe this limits downside for my investments and can lead to significantly positive price performance.

Technical Analysis – A Bit Complex, But Bullish

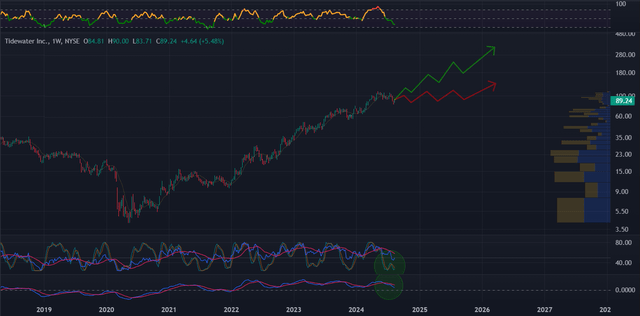

While I do not think any form of analysis is perfect or self-sufficient, I use technical analysis as a tool to help guide my investments. I believe TA can help investors look for good entry/exit points and also envision how investments may move going forward. I want to emphasize briefly these are not exact predictions, but simply use the tools of momentum, volume, price action etc. to create potential scenarios. The results from my prior articles have seemed to be pretty useful. Below is my TA on the TDW chart:

Weekly, with notes below:

- The money flow indicator (top panel) is now in the “green” buying area. While this has technically made a lower low, money flow is a bit more volatile, so this is not too concerning for me.

- The price chart simply shows that TDW is currently in a “dip” area. Pretty much every single “dip” since mid-2020 has been a good opportunity to accumulate. Fundamentals are strong, so I do not see any reason for this to deviate.

- The regular RSI with stochastic overlay (3rd panel) looks pretty strong to me. The stoch looks ready to turn upwards and the RSI is pretty much hanging out in positive territory without any significant scary negative deviations.

- The TSI (4th panel) is a less volatile momentum indicator, and it is also “hanging out” in the positive zone. This looks pretty healthy to me.

Given all the above factors, my proposed “paths” or general confidence intervals make me think TDW could see $150 by early next year in a bullish scenario, even hitting $200 by mid-2025. A more muted or bearish scenario sees TDW needing more consolidation in time, but still reaching the ~$115 area multiple times next year. In this more negative scenario, investors could trade around their positions or simply buy on “dips.”

Yearly, with notes below:

It’s pretty rare a company has been around long enough that we can use a yearly chart with indicators! I’ve put projections on where I think a few of these instruments can go.

- The money flow indicator (top panel) looks like it is ready to break out to the highs again. It never capitulated lower even in this last extended bear market, which is a very bullish sign.

- Price looks like it is ready to continue higher for several of the coming years! This is a “trending” stock and during a resources cycle it should continue to do well with relative ease – look what it did in the 1970s, the last period of sustained inflation.

- The RSI and Stochastic RSI (3rd panel) are pretty much at rock bottom levels and look ready to rebound. This should provide TDW continued “fuel” for the coming years.

- The TSI momentum indicator (bottom panel) looks “okay” to me here. It will take 2-3 years for the TSI to cross its orange signal line, which could mean TDW will need a year or two to cool off at the end of this decade. On the other hand, it could also mean TDW really is set up to have a very extended, years or decade-plus long cycle as the TSI crosses into positive territory and stays there.

The yearly cycle shows me a potential upside scenario where TDW reaches toward $300 in the coming few years, eventually aiming for $500+ in several years. In a more bearish scenario, TDW still looks like it has significant upside, but can stall out around ~$175 before needing some more consolidation. While long-term charts are useful to view broad trends, fundamentals and corporate events like acquisitions often impact securities more heavily than technicals on these timeframes. I think the adage about the market being a “weighing machine” in the long run is quite applicable here.

Risks

Every investment has risks, and TDW has a few obvious ones I think investors should be aware of:

- Shipping and energy are notoriously volatile industries: Investors wanting to participate in TDW should be willing to endure downside volatility to achieve longer-term gains.

- The security has run significantly from its lows: I discussed valuation above and why I believe TDW still has upside, but the old maxim is “buy low, sell high.” I think investors wanting to sail with TDW can potentially “buy medium, sell very high” in a couple years or beyond, but an investment here is not quite a fire sale if investors prefer those methods.

- Laid–up Vessels: As dayrates have increased so significantly recently, there is a risk that some of the sidelined, or “laid-up” vessels from prior cycles could come back into the market. Management and industry personnel don’t seem to think this is a big issue as many of these vessels are older and would require significant reactivation costs to get going again, but I do still want to point this out.

- Global recession, deflation, etc.: While I think this seems less likely, and think resource-linked stocks can still do well in a recessionary environment, any type of global crash event, risk-off event, or period of deflation would, of course, affect TDW as well.

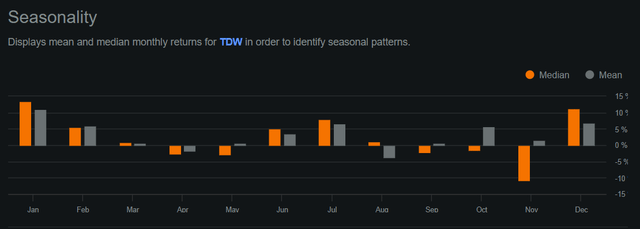

- Seasonality: Seeking Alpha’s seasonality profile is a useful tool, and unfortunately says that now is just an “okay” time to buy TDW. If investors are wanting to nail a bottom or use a more conservative strategy, they could perhaps add some now and fill out their positions over the next few months before enjoying a more typical upswing starting in December. I do not know if I will have the time to write another article before December, which is why I am rating TDW as a Strong Buy currently. Investors could also see today as a “Buy” and upgrade their thoughts to “Strong Buy” in a ~couple months.

Summary and Closing

In summary, I think TDW is a compelling investment with very good potential for the next several years and perhaps beyond. While I may trade some in and out depending on market conditions, I can easily see the company being a part or even cornerstone of my portfolio for many years to come.

I think TDW also offers a unique investment profile for today’s environment. This is definitely an “inflationary” play, and I think investors can use TDW to get upside exposure to the resources and shipping industries, which also often inversely correlate with things like technology stocks. That alone may be a reason for certain investors to look into adding TDW to their portfolio.

I always say in my articles that no one person can know everything, unforeseen events can always occur, and I can always be wrong. Please do not make decisions based on any one other person’s viewpoint, including mine. As always, consider what’s best for your risk tolerance, time horizon, and overall portfolio before making any financial decisions. It’s possible TDW is not appropriate for you at all.

Thank you very much for reading and your attention! If you care to leave your thoughts or questions below in the comments, please do. I try to be active there and think there is often a lot of value added there as well.