Overview of the Recent Transaction

On September 30, 2024, State Street Corp made a significant addition to its investment portfolio by acquiring 1,827,359 shares of CenterPoint Energy Inc (NYSE:CNP), a prominent player in the regulated utilities sector. This transaction increased State Street Corp’s total holdings in CNP to 32,152,164 shares, reflecting a notable commitment to the energy company. The shares were purchased at a price of $29.42 each, marking a strategic move by the firm to bolster its investments in the utilities sector.

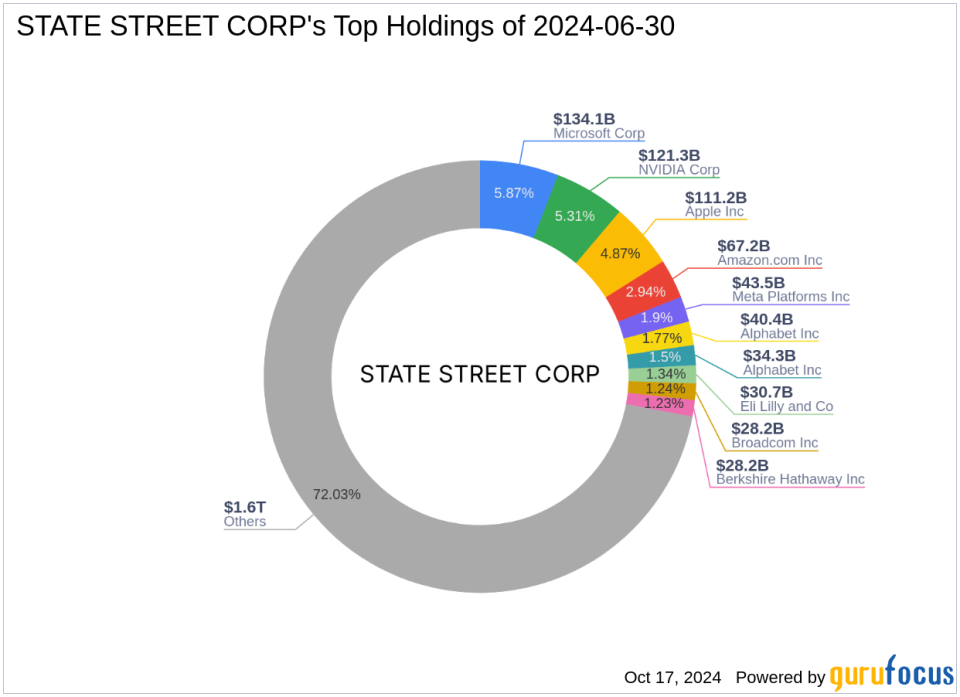

Profile of State Street Corp

State Street Corp, headquartered at One Lincoln Street, Boston, MA, is a global leader in investment management. The firm is renowned for its broad portfolio, which includes top holdings such as Apple Inc (NASDAQ:AAPL), Amazon.com Inc (NASDAQ:AMZN), and Microsoft Corp (NASDAQ:MSFT). With a focus on technology and financial services, State Street Corp manages an equity portfolio worth approximately $2.29 trillion. The firm’s investment philosophy emphasizes strategic market positions and diversified holdings to mitigate risk and capitalize on growth opportunities.

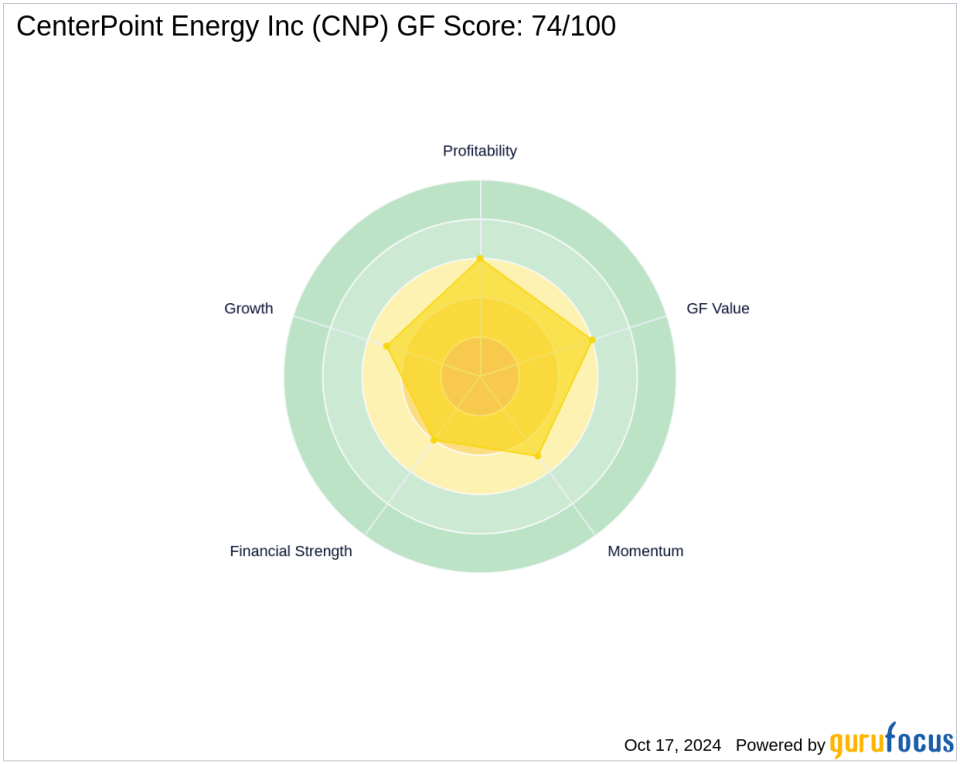

Introduction to CenterPoint Energy Inc (NYSE:CNP)

CenterPoint Energy Inc, based in the USA, operates a complex portfolio of energy-related services. The company’s business segments include Electric, Natural Gas, and Corporate and Other, providing essential services to over 6.5 million customers. With a market capitalization of $19.63 billion and a stock price of $30.125, CNP is a significant entity in the utilities sector. The company is currently evaluated as “Fairly Valued” with a GF Value of $28.15.

Analysis of the Trade’s Impact

The recent acquisition by State Street Corp has increased its stake in CNP to 4.90%, making it a substantial part of its portfolio with a position size of 0.04%. This move aligns with State Street’s strategy to enhance its presence in the utilities sector, reflecting confidence in CNP’s stable returns and growth potential.

Market Performance and Comparative Analysis

CNP’s stock has shown a year-to-date increase of 3.84% and a significant rise of 148.15% since its IPO in 1972. The stock’s PE ratio stands at 18.71, indicating a robust earning potential compared to industry averages. CNP holds a competitive position within the Utilities – Regulated industry, underscored by its comprehensive service offerings and strategic market presence.

Future Outlook and Broader Market Implications

Looking ahead, CNP is poised for steady growth, supported by its strong market fundamentals and strategic initiatives. The firm’s investment in CNP is likely to influence broader market perceptions, potentially attracting more investors to the utilities sector. This strategic acquisition not only enhances State Street Corp’s portfolio but also underscores its role as a pivotal player in influencing market trends and investment patterns.

In conclusion, State Street Corp’s recent acquisition of CenterPoint Energy shares represents a strategic enhancement of its investment portfolio, reflecting confidence in the utilities sector’s growth prospects. This move is expected to yield positive returns and strengthen State Street Corp’s market position, offering valuable insights for investors looking at utility stocks.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.