Overview of the Recent Transaction

On September 30, 2024, State Street Corp made a significant addition to its investment portfolio by acquiring 151,365 shares of Diamondback Energy Inc (NASDAQ:FANG). This transaction increased State Street Corp’s total holdings in the company to 11,860,049 shares, reflecting a substantial commitment to Diamondback Energy as part of its diverse investment strategy. The shares were purchased at a price of $172.40, marking a notable move in the firm’s trading activities.

Profile of State Street Corp

State Street Corp, headquartered at One Lincoln Street, Boston, MA, is a prominent financial services firm known for its robust investment strategies that focus on long-term value creation. The firm manages a vast equity portfolio totaling $2,285.63 trillion, with top holdings in major technology and financial services companies including Apple Inc (NASDAQ:AAPL), Amazon.com Inc (NASDAQ:AMZN), and Microsoft Corp (NASDAQ:MSFT). State Street Corp’s investment philosophy emphasizes diversified risk management and growth through strategic market placements.

Introduction to Diamondback Energy Inc

Diamondback Energy Inc, trading under the symbol FANG, is a key player in the oil and gas industry, specifically focused on operations within the Permian Basin in the United States. Since its IPO on October 12, 2012, the company has shown robust growth and now boasts a market capitalization of $53.85 billion. Diamondback Energy is committed to sustainable and efficient energy production, maintaining a strong production mix that supports long-term profitability and shareholder value.

Financial and Market Analysis of Diamondback Energy

Currently, Diamondback Energy’s stock is priced at $183.96, closely aligning with its GF Value of $181.31, indicating that the stock is fairly valued. The firm’s financial health is underscored by a PE Ratio of 9.51 and robust growth metrics, including a Growth Rank of 10/10. Additionally, the company’s Return on Equity (ROE) and Return on Assets (ROA) stand at 21.00% and 11.60% respectively, reflecting strong profitability and asset management.

Impact of the Trade on State Street Corp’s Portfolio

This recent acquisition has increased Diamondback Energy’s position in State Street Corp’s portfolio to 0.09%, with the firm now holding 4.00% of Diamondback’s total shares. This strategic move aligns with State Street Corp’s broader investment philosophy, which favors significant positions in high-growth potential sectors such as technology and financial services, reflecting a balanced approach to sector allocation and risk management.

Sector and Market Considerations

State Street Corp’s investment strategy heavily emphasizes the technology and financial services sectors, which are considered pivotal to the firm’s overall market performance. The addition of Diamondback Energy shares complements this strategy by diversifying into the energy sector, which is expected to offer substantial returns amidst global energy demands and market dynamics.

Comparative Analysis with Other Gurus

Other notable investors in Diamondback Energy include Yacktman Asset Management (Trades, Portfolio). While State Street Corp’s stake is significant, it is essential to compare these holdings with other major investors to gauge market sentiment and potential sector movements.

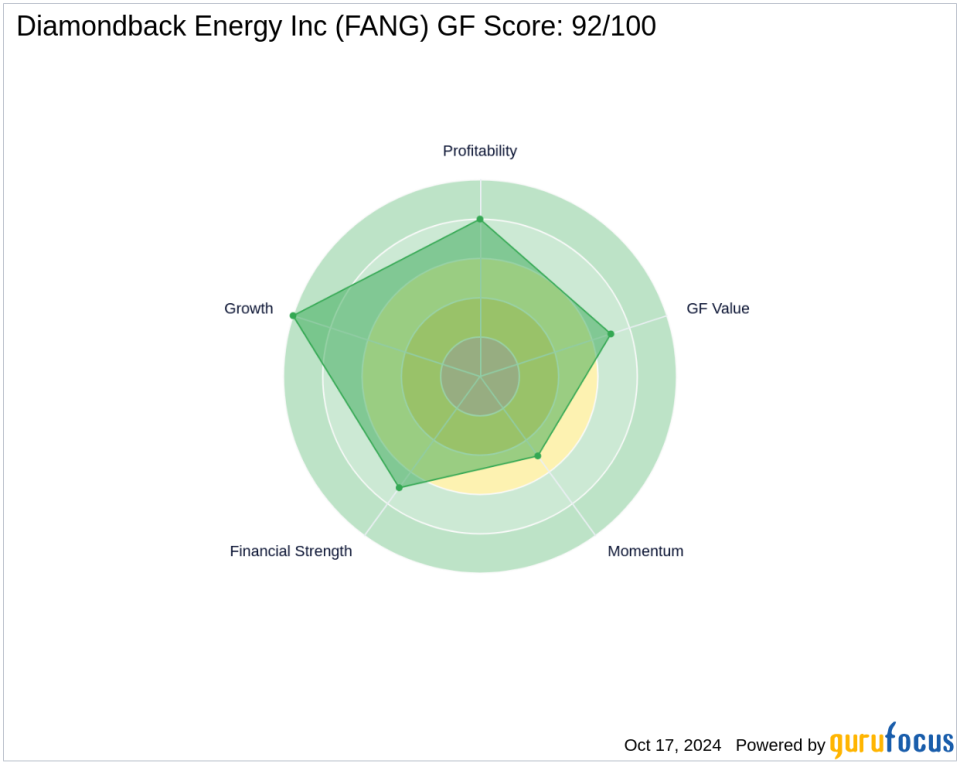

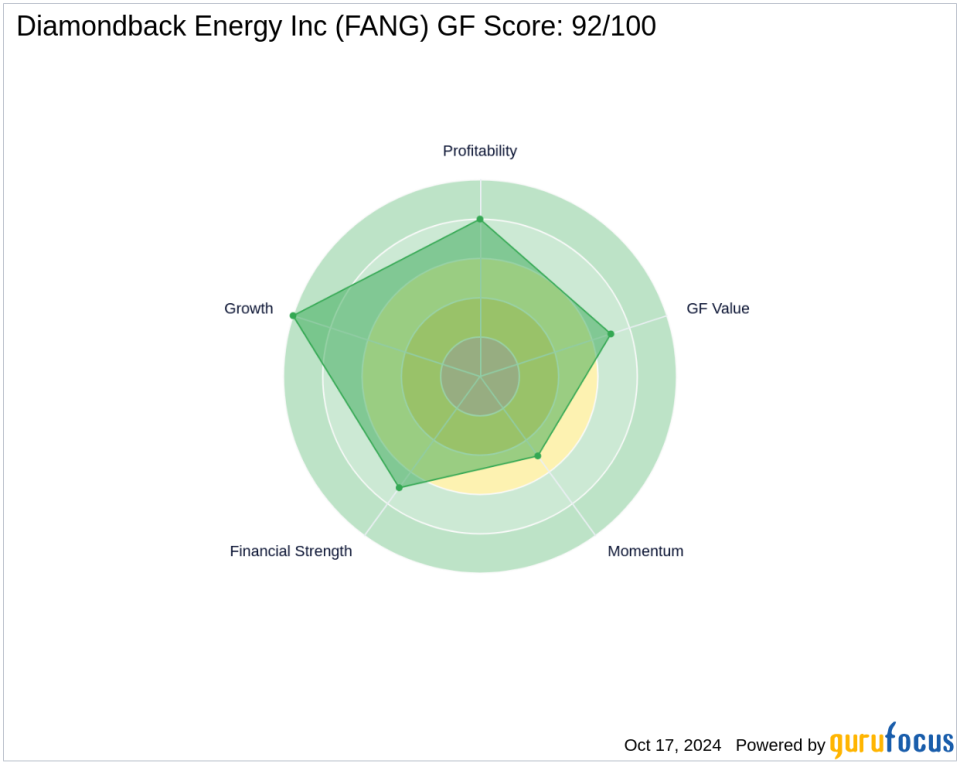

Future Outlook and Performance Indicators

Diamondback Energy’s future performance potential appears promising, with a GF Score of 92/100, indicating a high potential for outperformance. The stock has also shown a year-to-date price increase of 17.16%, with historical growth trends suggesting continued upward momentum. These indicators are crucial for investors looking to capitalize on robust earnings growth and solid market positioning in the evolving energy sector.

In conclusion, State Street Corp’s recent acquisition of Diamondback Energy shares is a strategic enhancement to its portfolio, reflecting a well-rounded approach to investment that balances immediate value with long-term growth prospects. This move is likely to influence the firm’s market standing and financial performance positively, aligning with its broader investment objectives.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.