tumsasedgars

Thesis

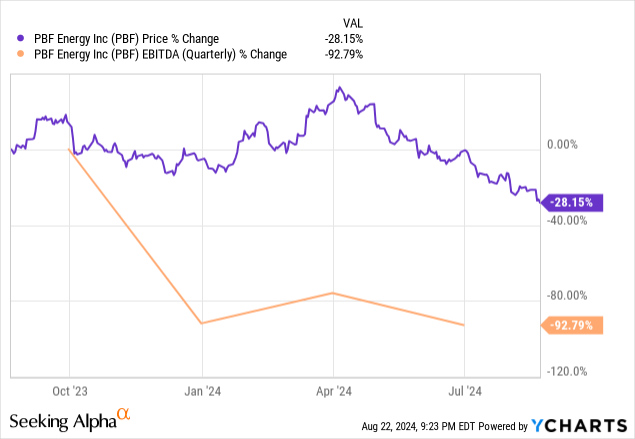

PBF Energy’s (NYSE:PBF) share price has been in steady decline since early April. Thus far the stock is down over 40% as the refining industry has entered a challenging period where crack spreads have dramatically compressed. Margins are now only a fraction of their 2022 and 2023 highs and the summer driving season has turned out to be a disappointment.

Earlier this month, PBF reported Q2 earnings that reported a loss of ($0.54/share). The weak refining market was compounded by turnarounds at the company’s Delaware City and Toledo facilities that were both extended by several weeks. The company maintained its $0.25/share dividend for the quarter while also buying back $100 million of its stock. This represents a yield of 3% but both the dividend and the share repurchases were financed out of the company’s cash reserves.

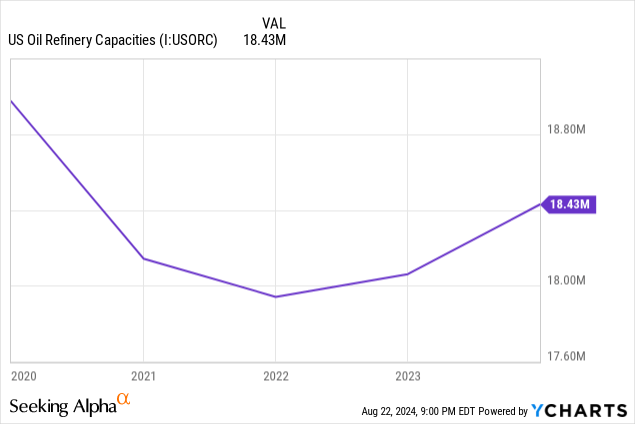

Moving forward, the refinery market faces headwinds both domestically and internationally. Capacity additions as well as increased utilization, have tipped the market into an oversupplied condition. Therefore, the tremendous margins seen over the last two years may be a thing of the past. This change results in a significant change in PBF’s valuation and dampens the value proposition of the investment.

I have downgraded PBF to a SELL on the basis that the company’s valuation is significantly degraded by falling earnings potential. This builds on my prior thesis that the market is simply unwilling to pay for PBF’s cash flows. Now that the tide has gone out for the industry as a whole, the market has even less reason to change.

Q2 Earnings Results

Many refiners were unpleasantly surprised with how Q2 evolved in what was supposed to be a higher margin quarter. PBF also had a poor quarter operationally that took the company into the red. The company reported a loss of $0.54/share which was mainly attributed to significant losses at the company’s Delaware City and Toledo facilities.

PBF Operations Map (Investor Presentation)

Both facilities were down for turnarounds that got extended by multiple weeks because of equipment issues. The company estimates the additional downtime cost $100 million. Had these issues not occurred, the company likely would have broken even or posted a small profit. By eliminating this one-time event, I project PBF could have earned between $0 and $0.05/share during the quarter.

Moving forward, the bulk of the company’s planned maintenance is complete. The last scheduled turnaround is set to take place at the Chalmette this fall. This project will complete the balance of the company’s $850 million capital spend budget for 2024 with $600 million spent thus far.

During the quarter the company returned $130 million between dividends and buybacks. Unfortunately, both the buybacks and the 3% dividend were financed out of cash reserves after running the quarter at an overall loss.

The Refining Outlook

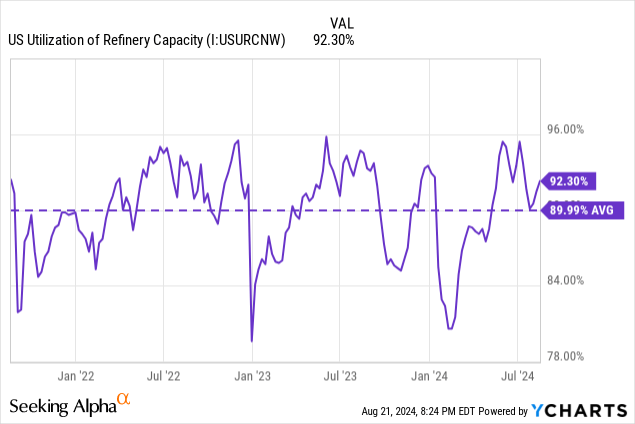

The second quarter saw record performance in the run rate of many refiners. Major producers such as Marathon (MPC) and Phillips 66 (PSX) reported utilization factors of 97% and 98% respectively. The additional supply into the market has depressed crack spreads in what is typically a strong quarter due to the summer driving season.

In response to the low margins, the industry has guided for significantly reduced run rates as we enter the fall turnaround season, and several producers pull up maintenance. Utilization is expected to be in the low 90% range in the third quarter. In a uniform fashion, all of the major producers expect this to result in improved margins moving forward.

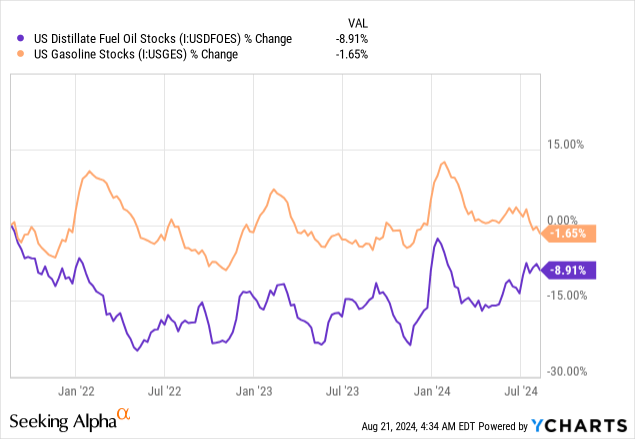

In the graph below, it can be seen that the slight late spring build up in gasoline stocks has mostly been consumed and is on a downward trajectory. However, diesel demand has been weak from inflationary pressures reducing trucking demand of consumer products, as well as a generally weak Chinese economy.

A true recovery in crack spreads will need some diesel participation now that peak driving season is in the rear view mirror.

International Factors

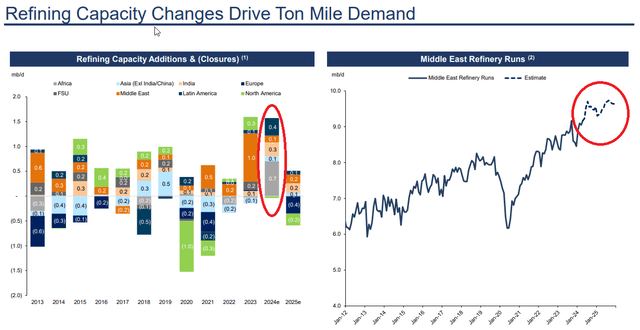

Internationally, the market has also had to endure headwinds from the ramp up of production from new facilities coming online in the Middle East. Nearly 1 million barrels per day of capacity was added to the market in 2023. These new refineries have taken some time to achieve full output, but the production gains are being reported in the international shipping industry.

Jacob Meldgaard – TORM (TRMD) CEO – Q1 Conference Call

A good example here is new refineries in the Middle East, where full impact on the region’s refinery runs is first expected in the second half of this year. This will boost the region’s export with a portion of this likely to travel around the Cape of Good Hope supporting further ton-mile development.

Additionally, in September of this year, the 650,000 barrel per day Dangote (Nigeria) refinery is expected to begin gasoline production in addition to the already operational diesel production. Currently the facility is operating at a capacity of 200,000 barrels/d. Assuming a similar delayed ramp to what has been observed in the middle east, I expect this refinery to slowly apply pressure to the international market as more product is introduced.

Future Capacity Additions (STNG Investor Presentation)

For context, the capacity additions in 2023 and 2024 are approximately 20% of total US capacity. The anticipated pull back in US utilization reduces the total increase in supply to about 10% growth over the 2023-2024 time span. These modest increases in supply make it increasingly likely that recoveries in crack spreads will be limited.

It also clearly indicates that the megacycle of the last two years is fully exhausted. The current environment looks to be more the future norm than just a one off. The market may prove to be materially better than Q2 moving forward, but not significantly. In my eyes, Q1 crack spreads look to be a healthy barometer for midcycle conditions.

Valero’s CEO went on record to call Q2 as the bottom of the cycle and projected that the market could improve moderately from here.

Gary Simmons – Valero (VLO) CO0 – Q2 Conference Call

And then it looks like some of the new capacity that came on in the Middle East really never made it to nameplate capacity until early this year. So we saw a bit of a step change in refining runs in the Middle East with a lot of that product making its way into Europe.

So some of that early in the year was masked with some of the drone strikes on Russian refining capacity. But the combination of higher refinery runs in the Middle East, a little sluggish economic activity in parts of the Atlantic basin allowed restocking of inventories in the region. So with that, we’ve obviously seen refinery margins weaken some.

As inventories tend to trend towards the five-year average, you would expect to see margin environment closer to a mid-cycle type margin environment. That’s kind of what we’re seeing.

It does feel as the market has found a bit of a bottom consultant data indicates at least earlier this week, hydroskimming margins in Europe and the Far East were negative, cracking margins in the Far East negative. And if that’s correct, and we found the bottom, it is what historically been a mid-cycle type refining margin environment, that’s — it’s actually pretty bullish refining going forward.

PBF Is Not My Refiner Of Choice

With the tide rolling out on the refining sector, differences in operating performance will be highly visible. PBF has two main investment flaws.

1. High operating costs.

2. Full exposure to the cyclicality of the refining industry.

In the chart below, you can see the smaller refiners are at a distinct disadvantage to achieving profitable operations. Every barrel produced by DINO and PBF costs $1.50-$2.00 more than larger peers Phillips 66 (PSX) and Marathon (MPC).

This is one of the leading reasons PBF has reported a negative EPS in two of the last three quarters.

10-Q Reports

Additionally, both PSX and MPC have significant earning power from other divisions within their companies. PSX has a large retail footprint as well as midstream and chemical businesses. MPC owns a massive stake in the midstream company MPLX that sends MPC $2.2 billion in distributions annually.

These features provide earnings floors when times get tough in the refining business. The combination of these two factors have allowed PSX’s and MPC’s earnings to decline at a much slower rate than PBF’s.

Changing Market Conditions Impacts PBF’s Valuation

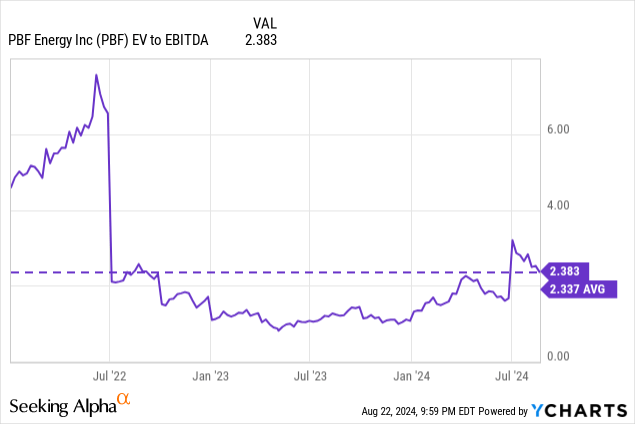

This new phase of the refined products market has large implications for the current valuation of US refiners. Over the last two years, one of the most appealing aspects of PBF was its extremely cheap valuation, often trading less than 2x on an EV to EBITDA basis.

Currently, EBITDA is dropping at a faster rate than the company’s share price. This causes PBF’s EV to EBITDA ratio to actually expand indicating the share price still has significant room to fall to return to historical valuations.

Valuation Scenarios

To determine where PBF’s stock may eventually land, I’ve developed three different scenarios to fully bracket potential market outcomes.

1. Q1 profitability is annualized. (Base Case)

2. H1 profitability is annualized with the addition of $100 million in EBITDA to remove the impact caused by the turnarounds at the Delaware City and Toledo Facilities. (Worst Case)

3. Q1 profitability annualized plus 10%. (Best Case)

| Annualized EBITDA | Current EV:EBITDA | |

| Scenario 1 | $1,161 Million | 3.40x |

| Scenario 2 | $748.8 Million | 5.27x |

| Scenario 3 | $1,277 Million | 3.1x |

Since the beginning of 2022, PBF’s EV to EBITDA valuation has averaged 2.3x. The graph below shows that is exactly where PBF sits today on a trailing 12 month basis. However, this includes $1.2 billion in EBITDA generation during Q3 of 2023 and does not accurately project future profitability.

Therefore, using any of the financial projections above, PBFs valuation is trading 1-1.5x turns higher than the historical average using scenarios 1 and 3. Scenario 2 shows the stock is potentially trading three turns higher in a worst-case scenario.

Using scenario 1 as the most likely forward looking performance indicator, and an EV to EBITDA ratio of 2.5x implies that the share price has the potential to fall another 25%. Even if the stock’s multiple was able to achieve a 3x valuation (which it has not since before the Russia-Ukraine war), investors would be looking at a 10-12% decline from current prices.

The technicals also indicate more near-term pain for PBF’s stock. The 50-day moving average is in sharp decline and recently dropped below the 200-day moving average. This indicates trading momentum is against the stock and there may be more downside to come.

Risks

To correct the downward trajectory of PBF’s stock, the supply of refined products will need to undergo a quick correction. This could be caused by hurricanes that interrupt multiple refineries in the gulf coast or by potential military action by Ukraine on Russian refineries.

Either of these events could disrupt the supply and demand balance and push crack spreads higher. PBF only operates one refinery in the Gulf Coast, making any potential hurricane impacts lesser than some of its peers.

Investor Key Takeaways

1. The refining megacycle is over. The continued addition of global capacity with recovering domestic inventories will limit the extent of any near-term recovery.

2. PBF is a disadvantaged producer from both an operating cost and diversification perspective.

3. Differing potential scenarios show that the stock is overvalued based on historical valuations and future earnings. This could lead to additional losses between 10-25% based on the different scenarios presented in this analysis.