Justin Paget

Enphase Energy (NASDAQ:ENPH) reported 2Q24 results that were slightly below expectations, but I think this was largely aligned with recently reduced buyside expectations.

Most importantly, we received confirmation that channel inventory is now normalized as of the end of 2Q24.

There was a positive surprise in the US as sell-through came in better than expected as demand improved.

That said, the 2Q24 results were below expectations largely due to Europe weakness, but the company continued to show relative strength compared to competitors, which likely means that Enphase Energy is gaining market share in Europe.

The guidance for 3Q24 was also below expectations, but management appears confident in the revenue ramp in the second half of the year as the channel inventory is now in the rearview mirror.

Lastly, the ability to maintain a resilient gross margin and positive free cash flows despite the industry downcycle is due to cost reduction programs materializing, with further possible upside from IRA credits.

All in all, this set of results by Enphase Energy shows that the worst may be behind the company, and while the residential solar industry trends remain lackluster in the near-term, the company remains well positioned with its strong market position, resilient gross margins and free cash flow profile, and new product launches.

I have written on Enphase Energy extensively on Seeking Alpha, which can be found here.

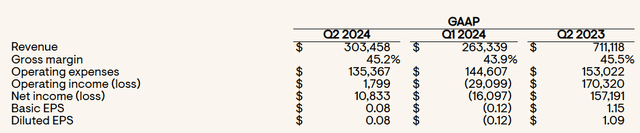

2Q24 results

2Q24 results were mixed in my view.

2Q24 non-GAAP EPS came in at $0.43, missing consensus expectations of $0.49.

Revenue for 2Q24 came in at $303.5 million, which was down 57% from the prior year, missing consensus expectation by a marginal 2%.

Encouragingly, gross margins remain resilient despite the lower volumes.

Non-GAAP gross margin with net IRA benefit came in at 47.1%, beating the consensus expectation of 44.2%. Non-GAAP gross margin excluding the net IRA benefit is 41%.

Most importantly, the channel inventory finally returned to normal levels at the end of 2Q24, with a $92 million reduction in channel inventory and $396 million of total end market sell-through.

In the US, revenue increased 32% sequentially as under-shipments declined and NEM 3.0 demand stabilized, with surprise in California sell-through pivoting to growth.

Europe revenue was flat sequentially, while sell-through was flat or moderately up. Europe was driven, in my opinion, by market share gains as the Europe residential market remains relatively weak.

Storage shipments for 2Q24 were 120 megawatt hours, up 59% sequentially and 46% from the prior year, at the higher end of the guidance range and above estimates.

The company continues to generate positive FCF, with $117 million in 2Q23, and continued executing on its $1 billion share repurchase program, repurchasing $100 million at an average price of $112.02 per share during the quarter.

Summary of Enphase Energy 2Q24 earnings (Enphase Energy)

Outlook

Management is guiding for revenue to be between $370 million to $410 million and expects to ship between 160 and 180 megawatt hours of IQ batteries.

At the midpoint, the 3Q24 revenue guidance is $390 million, or 3.5% below consensus expectations. In my opinion, while the guidance for 3Q24 is below consensus, as explained below, the guidance is likely conservative and thus de-risked.

My 3Q24 forecast as shown in the valuation section is $403 million, which is just 3% higher than the midpoint of the 3Q24 guidance.

By geography, management expects a seasonal slowdown in Europe, while its US business should see incremental improvement.

The company is now more than 85% booked to the midpoint of its 3Q24 revenue guidance, with the current backlog the healthiest backlog position the company has had in the last year.

Enphase Energy also saw customer demand grow by 5% in 2Q24 relative to 1Q24.

Put together, I think this demonstrates an improving demand outlook and that things are starting to look better than before.

When asked about whether the company expects to return to the $450 million to $500 million of normalized revenue, management stated that they are very optimistic about achieving that in the second half of 2024 despite the 3Q24 guidance.

In fact, management went further to state that they are embedding some conservatism and risk into the 3Q24 guidance, which does help de-risk 3Q24 further. Management even commented that their 3Q24 bookings are the healthiest they have been in a year, and the over 85% booked figure is also conservatively stated after removing some risks in that number.

Market trends by geography

In terms of revenue mix by geography, US revenues made up 65% of the total 2Q24 revenues, while international revenues made up 35% of the total 2Q24 revenues.

The company also provided detailed sell-through details, although this will be the last quarter that such data will be provided, given the normalization of channel inventory.

Management reiterated that there will no longer be de-stocking in 3Q24, and that it has ended in 2Q24. Given that the channel is now balanced, management does not see a need to report sell-through details and only if they do not have a balance in the channel will they report about under-shipment or over-shipment.

First, let’s talk about the US.

Enphase Energy’s 2Q24 US revenues were up +32% compared to the prior quarter. This is in stark contrast to the -34% sequential fall in revenues from the US we saw in 1Q24.

In the US, sell-through was up +8% in 2Q24 compared to the prior quarter. Likewise, this was a huge improvement from the sell-through in the US, falling by -23% in 1Q24.

The US market is then split into non-California and California states.

For non-California states, overall sell-through was up +7% in 2Q24 compared the 1Q24. This is an improvement from the prior quarter, when sell-through was down -21% in 1Q24.

The microinverter sell-through was up +6% and the batteries sell-through was up +10%.

For non-California states, I think it was largely expected that we could see some form of stabilization in 2Q24, so the fact that overall sell-through pivoted to growth was a nice surprise. Both microinverters and batteries contributed to the improvement in sell-through for non-California states in 2Q24.

For California, overall sell-through was up +7% in 2Q24 compared to the 1Q24. This is an even bigger improvement from the prior quarter, where sell-through was down -30% in 1Q24.

Within California, microinverter sell-through was flat, while batteries sell-through was up +14% from the prior quarter. The strong battery performance in California was due to high NEM 3.0 battery attach rates, which I will address next.

For California, I think the consensus was that there is more uncertainty here as to when the stabilization will occur. With microinverter sell-through being flat in 2Q24, this suggests that the California microinverter business is stabilizing. The strong growth in sell-through for batteries in California as a result of NEM 3.0 is also encouraging, as the company is seeing the benefit of the NEM 3.0 transition as well. I think that the fact that California business stabilized in 2Q24 was a nice little surprise.

The company also shared that as of last week, 60% of its California installations were NEM 3.0, and in turn, these NEM 3.0 installations have a high battery attach rate of more than 90% compared to NEM 2.0 systems. Enphase Energy also shared that their internal data showed that half of the NEM 3 systems installed are using Enphase batteries.

As a result, this has a direct consequence to Enphase Energy’s revenue profile, as its average revenue per NEM 3.0 system is approximately 1.5 times the average NEM 2.0 system. This means that the more NEM 3.0 systems it installs, the faster the California business revenue will stabilize. As a result, management’s expectations are that the growing NEM 3.0 systems in California should stabilize revenues in the second half given the revenue per system dynamic.

In fact, in the US, the company’s battery inventory level suggests that its battery business is doing well. Enphase Energy typically keeps around eight to ten weeks of battery inventory as a standard. In the US, the batteries are very tight in the channel now and the company is running on less than eight weeks of inventory. This is of course a good problem to have, as long as the company can ensure sufficient inventory to installers.

All in all, with the 2Q24 sell-through data for California and the transition to NEM 3.0 benefiting Enphase Energy, I think the California business, which was one of the worst hit, is stabilizing.

In terms of market share, Enphase Energy’s microinverters and batteries continue to have a stable market share based on internal and third-party data.

Let’s now talk about Europe.

In Europe, Enphase Energy’s 2Q24 revenues were flat sequentially.

Overall sell-through in Europe was up +3% in 2Q24, compared to 1Q24. Microinverter sell-through was flat, while batteries sell-through was up 18% in 2Q24.

The company has three key markets in Europe: the Netherlands, France, and Germany.

Sell-through in the Netherlands was down -15% in 2Q24 compared to 1Q24. This worsened from the –4% fall in sell-through in the Netherlands in the prior quarter. The weakness was due to regulatory uncertainty, challenging solar demand. That said, management is seeing battery demand grow as dynamic electricity rates become more prevalent in the Netherlands. As a result, Enphase Energy launched the IQ energy management software in the Netherlands in 2Q24 to allow their installers to offer an Enphase system that can deliver healthy payback even without NEM.

Sell-through in France was flat in 2Q24 compared to 1Q24. This builds on the increase in sell-through by 13% in the prior quarter. The company is launching multiple new products in France in 2024, like its third-generation battery, IQ EV chargers and IQ energy management software in France later in the year, which should help spur demand in the market.

Sell-through in Germany was up +7% in 2Q24 compared to 1Q24. This builds on the increase in sell-through by +28% in the prior quarter. Likewise, the company launched new products in Germany like its three-phase battery backup solution and IQ balcony solar kit.

Unlike the US, the company only recently entered into some Europe markets, like the UK, Italy, Spain, Belgium, Luxembourg, Switzerland, Austria, Sweden, which remain underpenetrated. As Enphase Energy launches more of its microinverters, batteries, EV charters, software into these markets, I expect growth to continue for some time as the company continues to scale its sales and support in these markets.

Lastly, let’s now talk about Asia.

Asia remains a small but fast-growing market for Enphase Energy.

For example, revenues in India doubled from the prior year as it introduced its IQ8 family of microinverters.

Apart from India, the company is seeing strong momentum in Thailand and Philippines.

Additional domestic content benefits

By 4Q24, I expect Enphase Energy to have the minimum requirements for domestic production for its US-based microinverter manufacturing.

Currently, the company has US-based microinverter manufacturing capacity for printed circuit boards (“PCBs”) and electrical parts which provide about 18% out of the required 40% of a customer’s bill of materials that are required to be domestically produced in order for the customer to qualify for an Investment Tax Credit adder of 10% of the system value.

With a few other parts to be manufactured domestically, like the fasteners and rails, which account for 26% of the bill of materials, the customer would qualify for the credit.

By the end of 3Q24, ENPH intends to add microinverter enclosure manufacturing capacity, which when combined with a production kicker included in IRS guidelines, would result in ENPH’s product contributing 36% of the bill of materials, allowing the customer to more easily qualify for the adder.

Because SolarEdge is only expected to have similar capabilities in early 2025, Enphase Energy will have a temporary advantage over SolarEdge in 4Q24.

From early 2025 onwards, both Enphase Energy and SolarEdge should have an advantage over string inverter competitors, given string inverters without module-level power electronics (“MLPE”) only contribute a maximum of 7.6% to the bill of materials.

As a result, lease PPA and commercial asset owners are able to qualify for the domestic content bonus credit as a result of Enphase Energy’s US-made microinverters.

This credit is valuable for customers, given it makes up 10% of the overall project cost.

As a result of the domestic content advantage, I see an upside to 4Q24 numbers in terms of market share and gross margin.

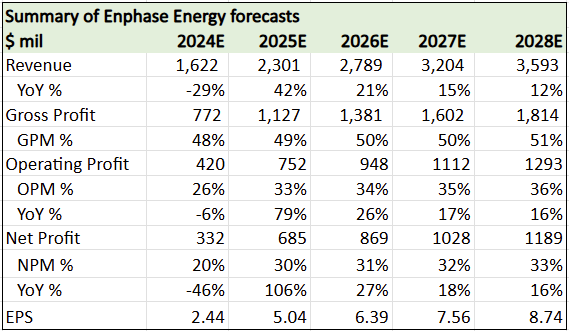

Valuation

I am reiterating my financial forecasts for the forecast period, given I have already revised the forecasts down in the last earnings review and that they currently reflect the current outlook for the company.

As highlighted above, my 3Q24 forecast is $403 million, which is somewhat in-line with the guidance for the quarter.

Summary of my 5-year financial forecasts for Enphase Energy (Author generated)

As the financial model remains the same, the intrinsic values and price targets are reiterated.

My intrinsic value for Enphase Energy is $136, which is based on the discounted cash flow model.

Some key assumptions include a terminal multiple of 20x and cost of equity of 12%.

My entry price for Enphase Energy is $109, which is at a 20% discount to the intrinsic value. The 20% discount to the intrinsic value is to ensure sufficient margin of safety when entering a position.

I reiterate my 1-year and 3-year price target for Enphase Energy of $135 and $194, respectively.

The 1-year price target is based on 30x 2025 P/E discounted back by one year, and the 3-year price target is based on 30x 2027 P/E. I think these multiples are reasonable because Enphase Energy has an average normalized cycle P/E of 35x for the past seven years, and it is at a premium to its closest competitor, SolarEdge due to the asset light business model, and better execution at managing the downturn.

That said, it does look like these price targets could be conservative if Enphase Energy continues to execute well or if the markets strengthen more than expected.

Conclusion

I think Enphase Energy’s 2Q24 was by no means a great result.

What it did help is provided certainty for the future.

Before the 2Q24 results, investors were still uncertain as to when the channel inventory will normalize, and whether it will get delayed given the weakness we have seen in Europe and other competitors.

With channel inventory now normalized, and rates to be cut in the near future, it only takes an upturn in the residential solar demand for the company to post strong growth once again.

Until that happens, the company continues to expand into new markets, invest in its business and grow US manufacturing capabilities.

2Q24 was a signal that we should see better times ahead.