bjdlzx

Diamondback Energy (NASDAQ:FANG) reported a big leap in per share earnings growth to $4.66 from $3.05. Much of that gain came from a negative noncash derivative loss of $189 million in the previous fiscal year for the same quarter that did not (for the most part) repeat. However, income from operations improved to $1.156 billion from $1 billion. That represents a respectable 15% increase that is slightly better with roughly 1% less shares outstanding. That is going to compare very well with much of the industry.

The last article mentioned that the Endeavor acquisition would likely ensure future growth as earnings are reported. The current balance sheet shows both the debt, and the cash raised to pay for the acquisition once final approval is received. The net debt still presents a rosy figure, and Diamondback remains investment grade even with the acquisition on the way. Therefore, the story largely remains the same for this company with a very long history of successful acquisitions.

As an aside, when the acquisition completes, the net debt will rise. But the production will also increase on an accretive per-share basis.

This company has found a way to grow production per share while increasing its financial strength to investment grade and finding the ability to have returns to shareholders. That is going the extra mile like few companies are willing to do.

Shareholder Returns

Management declared a base dividend of $.90 per share while also declaring a variable dividend of $1.44 per share.

Diamondback Energy Return Of Capital History (Diamondback Energy Earnings Conference Call Slides August 2024)

The base dividend is growing very rapidly as a result of the successful acquisition program. This has been enabled by the long-term growth of cash flow per share (which will be shown next). As long as this management can find suitable acquisition targets in areas that it knows well, the growth record should continue. That likely means that the base dividend will likely continue to grow at a brisk rate, although the rate will be slower than it was in the past.

Similarly, the stock buyback program reduces shares outstanding to add a percentage or two to the growth rate. But then that stock often goes back out as part of an accretive acquisition that usually adds quite a bit more to the growth rate to keep the per-share earnings growing in the teens.

The result of this is a fantastic long-term cash flow growth record shown below that few can match.

Diamondback Energy Return Of Capital History (Diamondback Energy Earnings Conference Call Slides August 2024)

One of the secrets to the cash flow growth shown above is management’s ability to maintain the margin through the years as shown above through a combination of more productive acreage and cost improvements.

Note that the cash flow growth figure largely depends upon the sizable growth when the company was smaller. Now that the company is far larger, the compound growth rate will likely gradually slow to the 10% range over time. Still that rate, plus continuing technology improvements that periodically sweep the industry, should allow a growth rate in the teens. When that is combined with a dividend and share repurchases, the company could grow for a long time at a rate in the upper teens.

The second quarter report noted drilling times had improved roughly 10%. That is the kind of thing that adds a couple of percentage points to the growth rate from time to time. Similarly, the number of completions had also improved.

Operating Results

The net result of all of this is that production exceeded expectations to the point that the guidance for expected annual production is now slightly higher. Meanwhile, the costs of doing that are coming down.

Diamondback Energy Summary Of Second Quarter Progress (Diamondback Energy Earnings Conference Call Slides August 2024)

Probably the key ratio progress is the decline in the net debt ratio. It gives the company slightly more financial flexibility before the next acquisition completes in the third or fourth quarter.

Oil volumes are very important because natural gas prices in the Permian are extremely low (as the second quarter report shows). There is just far too much associated gas in the area for any producer to have any pricing power at all. The result is that well profitability is based upon oil production. What little producers get for natural gas is really not all that significant to decision-making at the current time.

Now, whether that changes as all the export ability comes online this fiscal year and next fiscal year is anyone’s guess. That would only aid profitability and cause still more acreage to become Tier 1 acreage.

Guidance Change

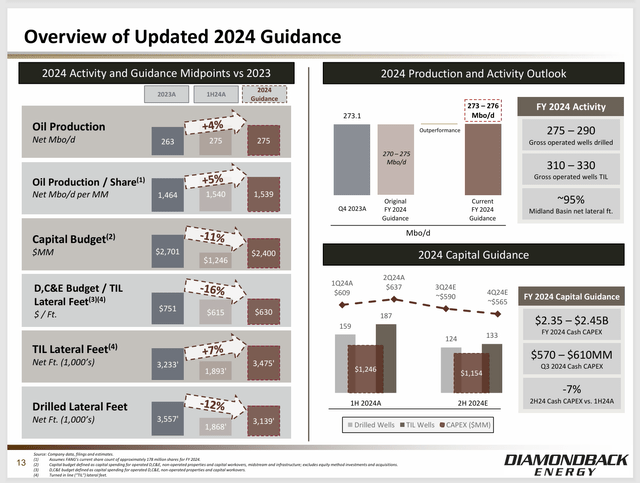

The company lost no time in reflecting the improvements in the second half guidance that upgrades the original capital budget.

Diamondback Energy Second Half Guidance And Updated Total Budget (Diamondback Energy Earnings Conference Call Slides August 2024)

All of the efficiencies that management stated was gained so far is now part of the second half guidance for the fiscal year. This has to be understood along with the idea that when the latest Endeavor acquisition completes there will be yet another guidance update.

The difference with this management is that management makes these improvements a bit easier for shareholders to follow. Commodity industries like this one have constantly moving sales prices that can dominate results and make it hard for shareholders to see anything other than the fast-moving sales prices. The kind of detail shown above, helps to change that conclusion.

Conclusion

Clearly the improvements that management makes in operations are adding a few percentage points to the already above-average growth rate. The next accretive acquisition should allow for a couple of years of growth in the teens just from the accretive nature of the acquisition.

The whole company strategy allows for a rapid growth in returns to shareholders through the growth of the base dividend, variable dividends and share repurchases.

The unusual aspect of the share repurchases is that they keep the next accretive acquisition from being as dilutive as it might be just by considering the additional shares outstanding. In this fashion, the share repurchases first add to company growth by reducing the number of shares outstanding. But then using those shares (that were repurchased) for another accretive transaction makes that transaction more attractive than it would be without the share repurchase program.

Overall, this remains a strong buy recommendation. The total return here is accompanied by a price-earnings ratio of about 10 based upon this year’s expected earnings. That is extremely low for a company that grows production per share in the teens (and sometimes 20%). The growth in the base dividend, the variable dividend, and the share repurchases make the total deal to a potential investor even better. This company is not slowing down anytime soon, either. Therefore, I would consider holding this stock until the story changes.

Risks

The company has a very long history of successful accretive acquisitions. Nonetheless, there is always a chance that the next acquisition would prove to be a disappointment. Here, the record of past acquisitions sharply reduces that chance. But it does not eliminate it.

Any upstream company is subject to the volatility and low visibility of future upstream prices. A sustained and severe downturn can materially affect the future of the company. This company has a goal of gaining as many locations as possible that are profitable below WTI $40. That is an extremely ambitious goal that the management usually meets. It also means much of the industry will be in dire straits before this company suffers during a severe and sustained downturn.

The loss of the services of key personnel could prove to be critical to a company like this.