Cinefootage Visuals

Centrus Energy (NYSE:LEU) is arguably one of the most important nuclear energy companies in the Western world at the moment, as it began operations at its HALEU (High-Assy Low-Enriched Uranium) facility in Piketon, Ohio, in October 2023, making it the first and only NRC-licensed HALEU production facility in the United States. This is the first U.S.-owned, U.S.-technology uranium enrichment plant to begin production since 1954.

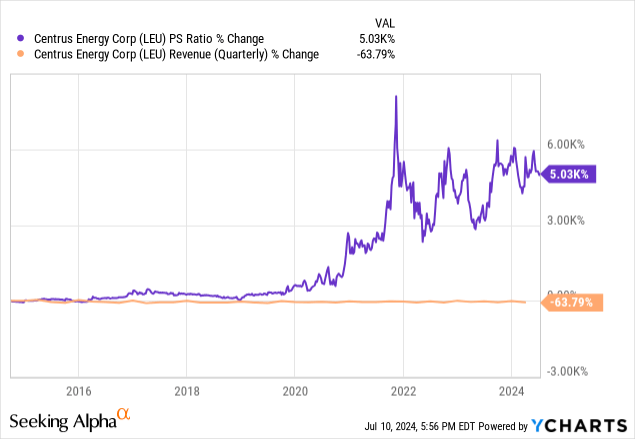

However, in my opinion, the market has been aware of this opportunity for quite some time now, and the stock has gained 1,338% over the past 5 years at the time of this writing. Yet, over the past 3 years, the gain has been a much lower 66%, which succinctly outlines how the majority of this prior deep-value and growth investment has played out considerably already. In my opinion, investors are likely to achieve 1Y or 2Y alpha based on momentum, but this stock might not considerably beat the S&P 500 over the next 10+ years due to the present valuation. Despite this, there are certain long-term and near-term catalysts that could result in high returns for Centrus shareholders. However, this all depends on how large the U.S. demand for nuclear energy is moving forward, which also depends on which president is elected, Trump or Biden, in November 2024.

Operational Analysis

Centrus is currently the only U.S.-owned enricher of Uranium, with roots tracing back to the Manhattan Project. The company has secured significant contracts and funding from the DOE to develop and produce HALEU, including a $150 million cost-shared award in 2022.

While its current production capacity is a modest 900 kg of HALEU per year, management has plans to scale production significantly—with the right funding, it could scale to produce 6,000 kg of HALEU annually within 42 months.

An opportunity has presented itself in that Russia currently holds approximately 44% of the world’s uranium enrichment capacity, but Centrus is positioned to take over the U.S. market as geopolitical tensions have affected Russian imports.

The U.S. DOE is investing heavily in nuclear infrastructures to support clean energy goals and reduce greenhouse gas emissions. Nuclear Energy is notably supported by both Biden and Trump. Around the world, nuclear power is expected to break global power output records in 2025.

The Biden administration has demonstrated strong support for nuclear energy as part of its clean energy strategy—for example, significant funding has been provided through the Inflation Reduction Act, the Bipartisan Infrastructure Law, and the ADVANCE Act. Biden’s administration has committed to reducing U.S. greenhouse gas emissions by 50-52% below 2005 levels by 2030 and achieving net zero by 2050. As Nuclear energy is a crucial part of this strategy, Centrus is likely to continue to be a large beneficiary.

Alternatively, Trump has a reduced emphasis on clean energy and has historically been less supportive of non-fossil energy programs. His administration might scale back initiatives like the DOE’s Loan Programs Office, which supports nuclear energy projects. Trump has mentioned his support for nuclear, but his administration is likely to roll back many of Biden’s climate policies. I think a Trump administration could actually have less of an accretive effect on Centrus than a Biden administration, purely a result of a less wide emphasis on clean energy. Trump has also outlined Project 2025, which mentions a significant build-up of nuclear weapons, which could divert focus and resources away from nuclear energy projects.

In my opinion, in the short term, a Biden presidency would be better for Centrus shareholders, but I am not sure that Biden will be reelected, and I think what is hopeful is that even in a rollback of many of Biden’s policies from his term by Trump, nuclear energy is still likely to have a significant place in the federal budget under Trump’s presidency. Furthermore, over the long term, I think that nuclear power has the potential to continue to be highly emphasized, but growth expectations should be moderated. The International Atomic Energy Agency projects that global nuclear capacity could increase by 10% in its high-case scenario by 2050 compared to current levels. These moderate growth concerns are also relevant because there is an average construction time of 14.5 years from planning to operation, which may slow rapid expansion. Nuclear Energy is expected to contribute about 14% of global electricity by 2050, up from its current 10% market share, so massive growth is unlikely, and because the deep value and even moderate value in the investment is no longer present, I think investors should realize that this stock may not beat the S&P 500 over the long term unless unpredictable shifts happen in green energy strategy, for example, governments beginning to much more heavily emphasize nuclear over solar.

Financial & Valuation Analysis

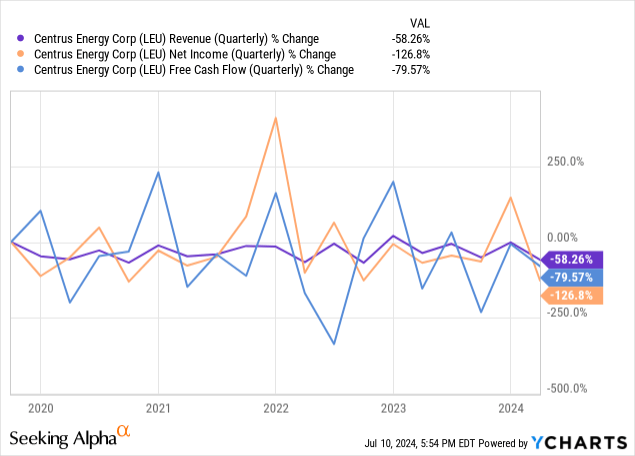

Despite the current increase in sentiment surrounding Centrus over the past 5 years, the stock has actually lost revenue, free cash flow, and net income. Therefore, I consider much of the gains in the stock price to be somewhat speculative, and while I can see that the stock would have been very appealing 10 to 5 years ago, I think now the value opportunity no longer exists, and I do not expect the company to be a high-growth investment, so I question whether allocating capital is wise.

The company has a price-to-sales ratio of 1.36 as a 5Y average; today, it is 2.21 (‘TTM’). Investors who bought in 2014 got the stock for a PS ratio of 0.07, and even as far back as 2019, the PS ratio was an incredibly low 0.31. Therefore, shrewd investors bought into this opportunity 4 or 5 years ago, in my opinion. Now, I don’t think there’s a very big opportunity, neither in growth nor in valuation.

The company also has a lot of debt, with an equity-to-asset ratio of just 0.05, significantly hampered by a high portion of unearned revenue. In addition, its debt-to-equity, including lease obligations, is 5.04. Both of these points mean that the company’s short-to-medium term growth is likely to be hampered by substantial pre-paid future project agreements, as well as servicing debt, which could mean that it has less ability to fund expansion. In short, its capital structure at current is not conducive to long-term profitability, and this is another reason why I am not a fan of Centrus as a medium-term or long-term investment.

In my opinion, the factors outlined above indicate an investment that has received popular appeal over the last few years, which I largely attribute to media coverage and government-backed programs supporting nuclear adoption, but the underlying financials of the business are not that attractive, and I think early investors were in the investment for deep value, which has now passed. If I was an early investor 5-10 years ago, I would now be looking at selling my stake. As I outlined in my operational analysis above, I do not think that Nuclear has the long-term growth trajectory to sustain long-term alpha without a significant undervaluation, which is not present in Centrus at this time.

That being said, 2 Wall Street analysts have a 1Y consensus price target of $69, indicating roughly a 64.3% upside from the present price of $42. Therefore, I think there is likely to be a high level of short-term momentum still available in the investment, but in my opinion, I consider this speculative because I think these gains would drive the investment into overvalued territory. That is why I am staying out of Centrus and not investing at present levels, despite the short-term upside, because I believe it will later face downside volatility and then stabilize toward more moderate price growth.

Risk Analysis

Based on my research, the major competitors to Centrus in Uranium enrichment and HALEU production include Urenco, which is one of the largest uranium enrichment companies globally, which is already licensed to enrich up to 6% U-235 in the UK and is planning to apply for a 10% limit in the USA; it operates plants in the UK, Germany, Netherlands, and the USA. There is also Orano, which operates the George Besse II plant in France, and it is also preparing to enrich up to 6% U-235 by 2023 and planning for license limits of 10%. Rosatom is a Russian state-owned corporation with the largest enrichment capacity globally; it can provide higher enrichment levels than 5% U-235.

- Urenco has a production capacity of around 18.6 million SWU/year.

- Orano has a production capacity of around 7.5 million SWU/year.

- Rosatom has a production capacity of over 27 million SWU/year.

SWU stands for Separative Work Unit, which is a measure used to quantify the amount of work required to separate isotopes of uranium (U-235 and U-238) to produce enriched uranium.

In my opinion, the competitive landscape is more fierce than it would first seem, and although a stronger emphasis on domestic uranium as a result of limitations on Russian imports as a result of geopolitical tensions is likely to bolster the near-term results for Centrus, as well as its lead in U.S. regulatory approval, I think the long-term growth horizon is still further limited by the presence of notable competitors vying for market share in an industry that in my opinion will still remain a niche part of renewables despite its growth prospects; I think solar will retain the leading position in clean energy over the long term. In other words, I think it is going to take more than a ban on Russian imports of uranium to boost Centrus into a long-term growth stock that could beat the S&P 500.

In 2023, approximately 12% of the annual uranium imports to the U.S. originated from Russia. While Centrus Energy is likely to see a boost in demand from this, 12% will be shared among competitors. That being said, the ban unlocks $2.72 billion to ramp up domestic uranium fuel production. The long-term CAGRs and alpha Centrus can provide at the present valuation almost all depend on how aggressively the domestic U.S. economy and the West stress nuclear as a dominant form of energy provision. The current estimates show that nuclear is unlikely to take one of the leading spots in renewable energy provision, with this taken by solar, but as the efficiency of nuclear power becomes more tangible, I think current estimates could shift. Therefore, there is a chance that this investment is still a long-term CAGR opportunity, but I think it could take 10-15 years to really play out and investing now is way ahead of the curve and takes massive changes in catalysts, which are somewhat speculative, to succeed. However, the investment could result in high alpha if shifts in government policy and energy strategies change in favor of nuclear over solar. Again, this is somewhat speculative, but I believe it could take place. That being said, I think this sentiment is already priced into the stock, which is made evident in the high increase in the firm’s valuation, but continued instability in top and bottom line growth, with a lot of contraction, making me skeptical that it is worth allocating to right now. If the company was offering deep value, I would absolutely allocate for the long-term growth catalysts which could be latent and unknown by the market right now. However, I think speculative investors have already picked up on the future growth in Nuclear, pricing Centrus unreasonably. Therefore, I am staying on the sidelines for now.

Conclusion

In my opinion, Centrus does not offer enough of a value opportunity to make it a risk-mitigated exposure to long-term nuclear power growth in the United States. Considering the company’s past results and the massive increase in market sentiment over the past 5 years, I believe there are better investments that are undervalued and have not yet gained such substantial momentum in the market. I believe it is likely that nuclear power will gain more traction over the next 10-15 years, but through 2050, I think it will remain a smaller portion of the total energy supply than many would hope. I think solar energy is going to be the dominant form of clean power provision. Although this could change, predicting nuclear’s outsized growth is speculative, in my opinion, and as there is not enough margin of safety in the stock price, I think the likelihood of the investment beating the S&P 500 over the next 5-10 years is relatively low.