Global energy needs are set for a significant surge in the coming years. The International Energy Agency (IEA) is forecasting global electricity demand to rise this year by its fastest rate since 2007, while consulting firm McKinsey projects that world electricity demand will more than double by 2050, from 25,000 terawatt-hours (TWh) to between 52,000 and 71,000 TWh.

That skyrocketing energy demand is in clear conflict with climate targets, which means natural gas (NGU24) is expected to benefit from its status as a “bridge fuel.” In its latest annual report, energy giant Exxon Mobil (XOM) confirms that more than 50% of energy demand is still met by oil (CLV24) and natural gas. Meanwhile, the Gas Exporting Countries Forum (GECF) expects natural gas demand to rise by 34% and account for roughly 26% of the energy mix by 2050.

As natural gas remains a vital source of energy, with demand projected to grow, strategic investments in natural gas stocks can be a profitable move for investors now. To that end, let’s shine a light on one key natgas player in Europe, which also offers exposure to solar and wind power.

About Equinor Stock

Equinor (EQNR) was established in 1972 as Statoil, a Norwegian state-owned oil and gas company. It is a global energy company that operates across the value chain, from exploration and production to refining, marketing, and trading. The company’s primary focus is on oil and gas exploration and production, renewable energy, and carbon capture and storage. The company’s market cap currently stands at $79.8 billion.

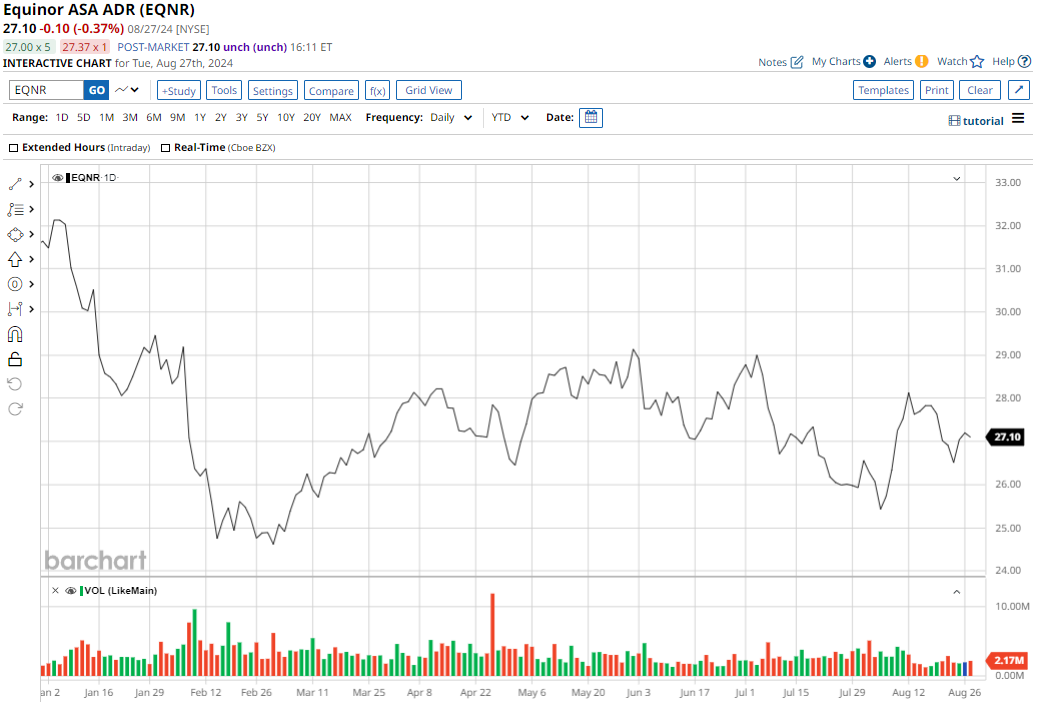

EQNR stock is down 14.4% on a YTD basis, faring better than the 24% decline in natural gas prices this year. The lackluster price action means that Equinor stock trades at reasonable valuations, with the price/earnings (P/E) ratio of 8.71 suggesting that now is a good time to buy the shares at a discount.

Equinor stock pays a regular quarterly dividend of $0.35 per share, or $1.40 on an annualized basis. That’s a forward dividend yield of 5.16% at current levels, which is more generous than the energy sector median of 4.24%.

However, EQNR also rewards shareholders with extra cash, which means investors received $0.35 in ordinary dividends and $0.35 in extraordinary dividends for Q2. As a result, the trailing 12-month dividend yield is much higher, at 9.92%.

A European Energy Powerhouse

Europeans are heavily dependent on natural gas to fulfill their energy needs after the cut-off of supply lines from Russia. Moscow’s gas giant, Gazprom, was supplying just over one-third of all European natural gas prior to the Ukraine invasion, but Equinor has now taken over supplying almost all of that gas.

In 2023, out of the more than 109 billion cubic meters of natural gas that Norway exported to Europe last year, roughly two-thirds was marketed and sold by Equinor. Additionally, the company has signed a long-term contract to supply Germany with 10 billion cubic meters of natural gas every year from 2024 to 2034. This is about one-third of Germany’s industrial demand.

Equinor Eyes Growth Initiatives

Equinor is actively expanding its operations in both the oil and gas and renewable energy markets. Based on a strong long-term demand outlook for oil and gas in Norway, EQNR plans to invest up to $6.6 billion annually in the Norwegian Continental Shelf by 2035. In renewable energy, Equinor targets a significant expansion of 12-16 GW of installed capacity by 2030, compared to less than 1 GW last year.

However, EQNR is being strategic about where it invests. The company has pulled out of offshore wind projects in Spain, Portugal, and Vietnam recently due to rising costs, and is carefully watching proposed taxation changes in the UK before plowing ahead with an offshore oil project in Britain.

Solid Q2 Fundamentals

In Q2 2024, Equinor’s revenues increased by 12% from the previous year to $25.5 billion, surpassing the consensus estimate by $861.83 million. EPS slipped by 5% from last year to $0.84, but still outpaced the consensus estimate. Over the past 10 years, Equinor has grown its revenue and EPS at a CAGR of 6.1% and 4.86%, respectively.

Cash flow from operating activities came in at $1.6 billion, as the company ended the quarter with a cash balance of $8.6 billion. Although its total debt of about $33 billion is high, Equinor is one of the very few energy companies with an AA rating.

Production activities remained strong in the quarter. Total equity liquid and gas production for the quarter was 2,048 mboe/day, up 3% from the prior year. Similarly, power generation rose 14% from the prior year to 1,083 GWh, with renewable power generation rising an impressive 90% in the same period to 655 GWh.

How Do Analysts Rate EQNR?

Overall, analysts rate EQNR stock a “Hold,” which is a modest improvement from “Moderate Sell” just one month ago. Out of 10 analysts covering the stock, 2 have a “Strong Buy” rating, 4 have a “Hold” rating, 1 has a “Moderate Sell,” and 3 have a “Strong Sell” rating.

Equinor’s mean target price on Wall Street is $31.12, indicating an upside potential of about 14.8% from current levels.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.