Equity markets are consistently navigating volatility driven by multiple factors such as global macroeconomic developments, interest rate movements, geopolitical uncertainties, and more. While short-term market fluctuations are expected in equity investments, long-term investors often seek investment strategies that deliver consistent wealth creation with relatively low volatility.

An actively managed large-cap-oriented equity fund can play a key role in achieving this balance. One such option is the Axis Max Life Growth Super Fund II that is offered through ULIP offerings such as the Axis Max Life Flexi Wealth Advantage. Read on to know how active management, a disciplined investment framework, and a large-cap equity-oriented portfolio can help policyholders grow their wealth in the long term.

What is the Axis Max Life Growth Super Fund II?

Axis Max Life Growth Super Fund II is an actively managed, large-cap-oriented equity fund that will utilise the Nifty 50 Index as a benchmark. This fund aims to provide long-term capital appreciation by focusing on large-cap equity investments. So, this fund would primarily invest in companies with established businesses, strong fundamentals, and steady cash flows. Such companies are better equipped to deal with market uncertainties and have the potential to deliver consistent returns over different market conditions.

The fund is required to always maintain a minimum equity exposure of 80%. The remaining portion of the fund (up to 20% of investable assets) can be invested in various non-equity instruments such as government securities, corporate bonds, money market instruments, and cash.

Axis Max Life Growth Super Fund II will also have the option to utilise equity derivatives-based strategies for hedging and portfolio management. However, as per current IRDAI guidelines, this strategy cannot be utilised for the purpose of leverage. These derivative-based strategies can help the fund manager potentially reduce returns volatility further and manage downside risk better during uncertain market conditions.

Performance of the Axis Max Life Growth Super Fund II

Axis Max Life Growth Super Fund II is a new equity fund, so it has no historical performance data yet. However, the fund will follow an investment philosophy similar to that of the previously launched Axis Max Life UL Life Growth Super Fund, which is currently rated 4 stars by Morningstar. Moreover, both these equity funds have the same benchmark—the Nifty 50 Index.

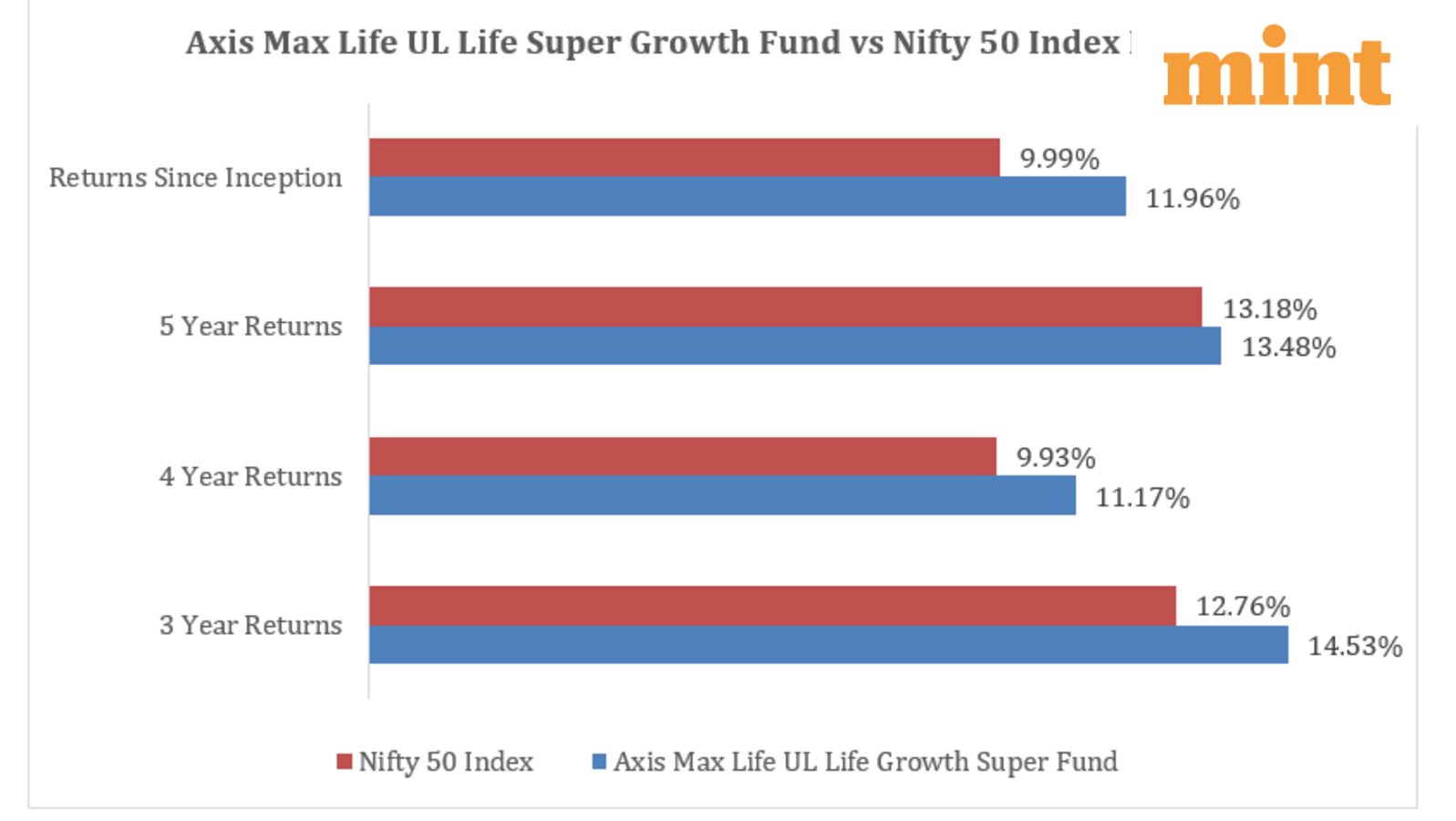

As a result, the historical performance of the Axis Max Life UL Life Growth Super Fund can serve as a proxy for the new fund’s potential long-term performance. The graph in the lead image illustrates the performance of the Axis Max Life UL Life Growth Super Fund versus the Nifty 50 Index over various time periods as of January 30, 2026.

The above data highlights the consistent outperformance of the Axis Max Life UL Life Growth Super Fund compared to its benchmark across various market cycles. This is one of the reasons why this fund is currently rated 4 stars by Morningstar.

While past performance does not guarantee future returns, this does indicate the long-term growth potential of the Axis Max Life Growth Super Fund II. Therefore, policyholders who choose to invest in the Axis Max Life Growth Super Fund II can look forward to the benefits of the fund’s active fund management strategies that focus on generating high long-term returns with reduced short-term volatility for investors.

How Will the Axis Max Life Growth Super Fund II Select Investments?

The Axis Max Life Growth Super Fund II will follow the established active investment philosophy of Axis Max Life Insurance. The experienced in-house fund management team at Axis Max Life Insurance will pick and choose reasonably valued large-cap companies with strong fundamentals, robust governance standards, and long-term growth potential to invest in.

The stock selection process for Axis Max Life Growth Super Fund II will involve both in-depth primary and secondary research. The research framework implemented would include financial analysis, management interactions, analysis of various economic sectors, and ESG due diligence. To conduct these tasks successfully, Axis Max Life’s research team actively tracks over 350 listed companies to help the fund manager make high-conviction investment decisions.

Key Investments of the Axis Max Life Growth Super Fund II

The portfolio management strategy of the Axis Max Life Growth Super Fund II is expected to mirror that of the previously launched Axis Max Life UL Life Growth Super Fund. Hence, the current portfolio composition of the Axis Max Life UL Life Growth Super Fund can provide insight into what the portfolio of the Axis Max Life Growth Super Fund II might look like.

The below table illustrates the top 5 sectors that the Axis Max Life UL Life Growth Super Fund was invested in as of 30 January 2026:

| Sector | Allocation (% of AUM) |

| Financial & Insurance Activities | 27.25% |

| Infrastructure | 14.48% |

| Mutual Fund – Liquid | 11.03% |

| Computer Programming, Consultancy & Related Activities | 7.80% |

| Manufacturing of motor vehicles, trailers & semi-trailers | 7.48% |

As can be seen, the fund portfolio features exposure to diverse sectors such as financial, infrastructure, manufacturing of vehicles, computer programming/consultancy, etc. This diversification can help mitigate sector-specific risk and help optimise the overall returns from the fund.

The top 5 equity holdings in the portfolio of the Axis Max Life UL Life Growth Super Fund as of 30 January 2026 are:

| Stock Name | % of AUM |

| Housing Development Finance Corp Bank | 7.92% |

| ICICI Bank Limited | 7.24% |

| Infosys Limited | 6.32% |

| Reliance Industries Limited | 6.21% |

| Bharti Airtel Limited | 5.98% |

As you can see, exposure of the fund portfolio to any specific company stock is limited. This can help to avoid concentration risk for investors. It also ensures that no single company disproportionately impacts portfolio performance.

Who Should Invest in the Axis Max Life Growth Super Fund II?

As per mandate, the Axis Max Life Growth Super Fund II must maintain at least 80% equity exposure in its portfolio. This high equity allocation is one of the key reasons for its “high” risk rating. While large-cap stocks tend to be relatively less volatile than mid-cap and small-cap stocks, investments in the fund will be subject to various equity investment risks, including market risk and short-term volatility risk.

That said, there are many groups of potential policyholders who may benefit from exposure to the Axis Max Life Growth Super II through ULIP offerings such as the Axis Max Life Online Savings Plan Plus. Some of these may include:

- ULIP policyholders with a long-term investment horizon seeking steady wealth creation

- Individuals seeking potentially less volatile equity investments in large-cap companies

- Policyholders seeking to leverage benefits offered by a professionally managed equity fund

- Individuals seeking to achieve long-term goals such as purchasing a residential property, saving for children’s education, or creation of a retirement corpus

- Individuals seeking the benefit of inflation-beating long-term returns offered by equity investments

Apart from the above-mentioned groups, there may be various other categories of individuals who may benefit by incorporating the Axis Max Life Growth Super Fund II into their current investment portfolio. Before investing, one should, however, evaluate whether the key features of this fund match their risk appetite, financial objectives, and investment horizon.

How to Invest in the Axis Max Life Growth Super Fund II?

The Axis Max Life Growth Super Fund II will be offered to current and new policyholders through various ULIP offerings such as the Axis Max Life Flexi Wealth Advantage Plan and the Axis Max Life Online Savings Plan Plus.

These plans offer the benefit of in-built life insurance cover and also allow policyholders to augment the protection of the base plan through various optional riders. The new fund offer (NFO) period for purchasing units of Axis Max Life Growth Super Fund II at ₹10 per unit starts on 17th February and ends on 3rd March 2026.

Snapshot of the Axis Max Life Growth Super Fund II

| Parameter | Details |

| Fund Name | Axis Max Life Growth Super Fund II |

| Risk Profile | High |

| Benchmark | NSE Nifty 50 |

| Asset Allocation |

|

| Fund Objective | This is primarily an equity-oriented fund. At least 80% of the fund corpus is always invested in equities. The remaining is invested in debt instruments across Government securities, corporate bonds and money market papers. |

Other Actively Managed Funds from Axis Max Life Insurance

Currently, Axis Max Life offers several actively managed funds to policyholders through its various ULIP offerings. Available options can also include other actively managed funds like the Diversified Fund, Sustainable Equity Fund, etc. The funds mentioned below are small AUM funds.

Axis Max Life India Consumption Opportunities Fund

The Axis Max Life India Consumption Opportunities Fund is an actively managed equity fund benchmarked against the Nifty India Consumption Index. Maintaining a minimum 70% allocation towards equities, the fund would primarily invest in companies operating in or closely related to India’s consumption-driven sectors. This is designed to aid the fund in capitalising on the long-term growth potential of domestic demand. The remaining 30% of the portfolio may be flexibly allocated towards various non-equity investment options such as corporate bonds, government securities, money market instruments, and cash.

Axis Max Life High Growth Fund II

This is an actively managed equity-oriented fund that is primarily focused on making mid-cap stock investments. Benchmarked against the Nifty Midcap Free Float 100 Index, this fund follows a growth-focused investment strategy. As per mandate, this fund will maintain a minimum equity allocation of 80%. The remainder of the portfolio can be flexibly invested in government securities, corporate bonds, and money market instruments, at the fund manager’s discretion.

Axis Max Life Smart Innovation Fund

Axis Max Life Smart Innovation Fund is an actively managed equity fund that aims to deliver long-term capital appreciation by investing in companies committed to innovation. The Nifty 500 Index will serve as the stock universe for this fund, and its performance will be benchmarked against the Nifty 500 Index. At least 70% of the fund’s investable assets will be allocated towards equities across various market caps. The remainder, accounting for up to 30% of the fund’s assets, may be allocated towards various fixed-income investments, such as government securities, corporate bonds, money market instruments, and cash.

Note to the Reader: This article has been produced on behalf of the brand by HT Brand Studio and does not have journalistic/editorial involvement of Mint.