Mayank Gosar, a Mumbai-based chartered accountant and insurance consultant, says the January-March period is ‘target season’. “Insurance companies and banks chase numbers. Cold-calling intensifies, pressure on staff mounts, and underwriting guidelines tend to loosen. Everyone is meeting annual targets,” he says.

The pressure turns into millions of calls, messages, and people being sold products they don’t need. Mis-selling in insurance isn’t new. What’s worrying is how normal it has become.

Yashwant Kumar Yadav

City: Surguja, Chhattisgarh

Age: 44 years

Year of incident: 2020

WHAT HAPPENED

Kumar was approached by a telecaller, who claimed he was eligible for a loan, but was told that buying multiple insurance policies was a mandatory requirement for approval. He ended up purchasing several policies that did not align with his income or financial needs. He later recovered the premium by writing to Bima Bharosa.

Kushal Singh Bora

City: Thane, Mumbai

Age: 85 years

Year of incident: 2022

WHAT HAPPENED

Bora was persuaded by a bank relationship manager to shift his fixed deposit into multiple insurance-linked products that were presented as safe, high-return investments. Large sums were locked into 10 long-term policies unsuitable for his age and financial profile. His daughter, Kavita Bist (left), helped him get the refund by taking necessary steps.

Financial traps

In 2020, Yashwant Kumar Yadav was not looking to buy an insurance policy but secure a loan. A telecaller promised him an interest-free Rs.6-lakh loan. The only condition: he had to take a few insurance policies which were ‘mandatory’ for paperwork, and would be “adjusted against the loan later”.

Within hours, multiple life insurance policies from Edelweiss, HDFC and Bharti AXA were issued in his name. Yadav never signed any proposal form. He later discovered that his signatures were forged. The contact details on record were incorrect, so he never received the proper policy documents or verification alerts. By the time he realised something was amiss, the free-look period had lapsed.

ET Wealth reached out to all three insurers, who said that the issue had now been resolved. In its response, HDFC Life confirmed, “We continue to be guided by our value of customer centricity in terms of meeting business objectives or managing any customer complaints and enhancing customers’ experience with us. With this in mind, each customer complaint we receive is treated on priority and resolved by following our agile processes.” It added that the case “was resolved with this approach, thereby offering a suitable and timely resolution to the customer”.

Yadav fits into a pattern that is becoming common. Databases consisting of mobile numbers are prone to leakages. Gosar says, “Even though we have data protection laws, customer data is easily available in the open market. Telecallers get this data and keep pitching products.”

The scale is big

According to the Insurance Regulatory and Development Authority (IRDAI) Annual Report for 2024-25, released last month, India recorded 26,667 complaints of mis-selling and unfair business practices in insurance, nearly 14% year-on-year jump. In total, there were around 1.2 lakh life insurance grievances in 2024-25. Mis-selling alone accounted for around 22%. This means that over one in five complaints received by IRDAI today relates to people being sold the wrong product. Even this figure may be conservative.

Hansa Research, a market research company, told ET Wealth that in a study it had conducted in March 2025 among 3,500 health and life insurance buyers, nearly three out of five respondents reported experiencing some form of mis-selling. Around 30% said they had cancelled a policy because they believed it was mis-sold. Most of the respondents never approached the regulator.

High commissions and less punitive actions lead to some going overboard “It’s not about a few bad people,” Gosar says. “This is how the system is designed. Everyone has targets. Even a bank teller has sales targets. Performance, promotions, incentives, everything is linked to how much business you’re going to generate.”

The commission structure makes this worse. In a 2025 survey of 1,655 bank relationship managers (RMs) by 1 Finance, nearly 57% admitted that their superiors had asked them to sell or mis-sell financial products to customers, even when these were unsuitable.

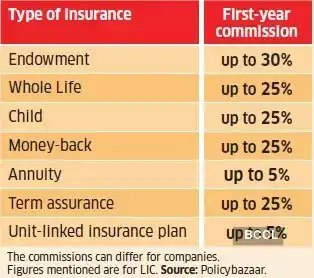

A large portion of the commission on traditional life insurance policies is earned in the first year itself. According to Policybazaar, this commission can reach 30% of the first year’s premium, and decline over the years. This means the seller’s financial reward is front-loaded, while the customer’s risk is long term. “There is no strong incentive for the seller to care whether a customer stays invested for long,” Gosar explains. “The money is already earned.” So, many policies are discontinued early because customers realise it is expensive, complicated, or unsuitable for their goals. What makes this more troubling is that mis-selling is not limited to unknown agents or cold calls. It increasingly happens through institutions that customers trust.

Problematic institutions

Kavita Bist’s experience shows what this looks like. Her father Kushal Singh Bora, an army veteran, had parked his retirement savings in fixed deposits (FDs). She said an RM at a large private bank approached the family with what sounded like a better option. The FD funds were diverted to 10 regular premium life insurance policies with Aditya Birla Sun Life Insurance (ABSLI). The total premium paid crossed Rs.41 lakh in that year.

Bora, 85, suffers from impaired hearing and declining cognitive ability. He was unlikely to fully comprehend the nature of the product, making his consent and disclosures at the time of sale deeply questionable. “OTPs were generated without his knowledge and the policy documents were never delivered. Some policies were issued in the names of other family members without their consent, with premiums paid from my father’s account,” says Bist. When the renewal notices arrived, the family realised that most of their savings had been locked into long-term insurance products they never asked for. ET Wealth’s request to ABSLI for comments was unanswered at the time of going to print.

“This is where mis-selling becomes dangerous,” says Shilpa Arora, Founder & Chief Operating Officer of Insurance Samadhan, a firm that helped Bist fight this dispute and get a refund. “Senior citizens have idle savings, limited financial literacy, and high trust in banks. They become natural targets in a system focused on immediate revenue.”

However, banks are among the largest distribution channels for insurance in India. This is where things get complicated. “When you go for a loan or even a simple bank service, insurance gets bundled,” Gosar says. “Sometimes it’s termed ‘mandatory’. Sometimes it’s framed as a discount.”

Customers are often told they will not get a loan, a locker, or, in some cases, even a basic bank account without buying a policy. There is no regulatory rule that makes insurance compulsory for these services.

In fact, the Reserve Bank of India (RBI) and IRDAI strongly condemn this practice, but many customers are unaware. Gosar explains, “People are in urgent situations. It could be a home purchase, medical expense, or business need. They don’t want delays. So they agree.” This is exactly what happened with Bora, and it is happening quietly across thousands of bank branches every day.

Take the case of 25-year-old Delhi-based Neha Mahajan (name changed), who visited a public sector bank branch to open a savings account. The RM told her it was mandatory to buy a one-time accident insurance cover with an annual premium of Rs.2,000. “I already knew that purchasing insurance isn’t mandatory. Plus, I had health insurance,” she says. When she tried to explain this, the RM said she would need to speak to the branch manager, who later refused to open the account unless she bought the policy. What Mahajan didn’t realise was that banks often back off when customers ask for such demands in writing; the account might even have been opened if she had stood her ground. “I wanted to file a complaint, but the process felt cumbersome, so I just went with a different bank,” she adds.

A key reason grievances are on the rise is that victims often don’t know what to do next. “They keep calling the agent, assuming the same person who sold the product will fix it,” says Arora. That rarely works. In nearly 99% of cases handled by her firm, customers have not approached the insurer’s grievance redressal officer (GRO) or filed a complaint on IRDAI’s Bima Bharosa portal.

“They don’t even know these systems exist. They waste months emotionally broken, instead of 14 days to get it fixed,” she says.

For instance, if a policy is sold over phone, insurers must retain call recordings for three years. In case of a dispute, customers have the right to demand the recordings. “We often challenge insurers to produce the sales call,” Arora says. “When they can’t, getting refunds becomes easier.”

Another aspect is financial underwriting. “Premium should broadly be affordable relative to income,” she explains. “If someone earns Rs.4 lakh a year and is paying Rs.6 lakh in premiums, that is a clear violation. The insurer is responsible for checking whether the customer can realistically sustain payments,” she adds. In Bora’s case, this mismatch formed the backbone of the complaint.

Mis-selling traps to watch out for

The ‘loan approval’ trap

Customers searching for personal or business loans are told they must buy an insurance policy to get the loan approved. Telecallers or bank staff promise low-interest loans, but ask the customer to purchase a long-term policy as a ‘processing requirement’. The insurance premium is often presented as a part of the loan process, but no such rule exists. Small business owners and first-time borrowers are especially vulnerable.

‘Lapsed policy recovery’

Customers are told that their old insurance policy has accumulated bonuses or unclaimed money. Callers claim to be from government bodies or insurance authorities and say they can help ‘recover’ this amount. To release the money, the customer is asked to buy a new policy, which is supposedly temporary and will be cancelled later. In reality, there is no recovery. The new policy becomes another long-term commitment.

‘Guaranteed returns’

Agents promise unusually high or ‘assured’ returns on traditional insurance plans. Customers are told their money will grow at a fixed rate of 8-11% or that their investment will grow manifold after a few years. Such guarantees are not permitted, but are often made verbally. These pitches are common in bank branches and among relationship managers.

‘Job or income promise’ trap

At times, customers are promised jobs, or monthly income in exchange for insurance purchase. Sales agents claim that purchasing a policy will make the customer eligible for employment schemes, rental income, or government-backed projects. These claims have no basis in reality.

‘Same product, better returns’

Customers are told that one insurer’s product is ‘the same’ as another, but offers higher returns. Often, elderly customers are told that well-known brands are interchangeable and that switching policies will improve outcomes. In reality, product structures and charges vary widely.

Insurance plans & commission structures

The premium for term insurance plans is the lowest. Even if the commission is 25%, it would translate to lower income for the agent. Hence, they are more motivated to sell plans with highest premiums.

Regulators are struggling

On paper, India has a detailed grievance framework in insurance. If even after reaching out to an insurer’s GRO and then filing a complaint on Bima Bharosa doesn’t work, you may approach the insurance ombudsman. When it comes to mis-selling, complaints usually have a higher chance of resolution on Bima Bharosa than with the ombudsman, which has its own limits.

“Many ombudsmen are retired bureaucrats, not insurance specialists. They are not able to understand the system well. At hearings, insurers arrive with lawyers and compliance teams. The policyholder usually arrives alone,” adds Arora.

Gosar says regulators mostly act after the damage is done. “There is no real investigation into patterns. No one is asking which banks or agents keep generating mis-selling complaints year after year.”ET Wealth reached out to Life insurance Council on this issue, but they refused to comment.

The uncomfortable truth

Mis-selling is not ending anytime soon. “The system is too sales-driven. Everyone is evaluated on numbers. As long as this structure exists, mis-selling will persist,” Gosar says.

There is no single trick that guarantees safety, but there are a few principles that drastically reduce risk. Never rely on verbal promises. Ask for everything in writing. Never sign blank forms. Never rush a financial decision because someone says it is urgent. If a product claims to give guaranteed returns, and worse, seems to be generous, be suspicious. If something feels wrong after purchase, act immediately.

“The industry is taking mis-selling very seriously and trying to simplify products for better understanding. However, if someone feels that a policy is a mismatch for their goals, be sure to exercise freelook cancellation, which is usually 30 days after receiving the policy documents. Then your refund will be initiated,” cautions Atri Chakraborty, COO, IndiaFirst Life.