The Financial Conduct Authority has issued a warning – and FSCS protection is in place

Approximately 16,000 policyholders have been left in the lurch after a Gibraltar-based motor insurance firm serving UK customers went into administration in October last year. As part of the administration process, the joint administrators officially terminated the remaining insurance policies on December 1, alerting customers that they would be left without cover.

On October 14, Premier Insurance Company Limited (Premier Insurance), primarily selling motor policies to UK individuals and small businesses, was put into administration following an application to the Supreme Court of Gibraltar. It subsequently ceased issuing new policies in January 2025, meaning the final ones will expire by the end of this month.

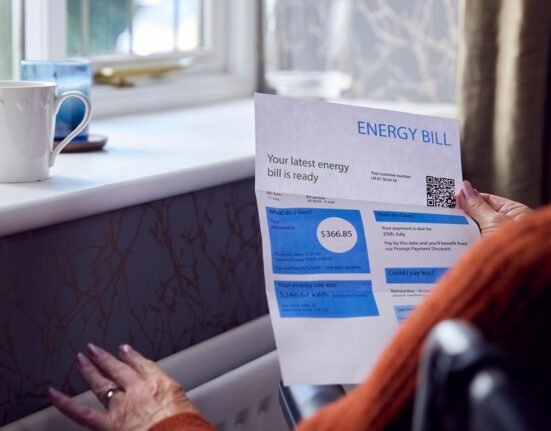

In a recent update published on January 15, the Financial Conduct Authority (FCA) cautioned that all customers currently have motor insurance cover. However, the type of policy held may affect the level of coverage for certain claims.

Regulated by the Gibraltar Financial Services Commission (GFSC), Premier Insurance operated in the UK on a freedom-of-services basis, which means some UK customers hold policies with the company. Policies were sold in the UK through various insurance brokers via the firm’s UK-based intermediary, Premier Underwriting Ltd.

In October, Freddie White and Bradley Chadwick from Grant Thornton were appointed as joint administrators for the company, reports the Express. Customers have been notified about the steps they need to take and are being strongly encouraged to secure new insurance without delay.

Policies terminated on December 1, 2025, and the FSCS only covers losses rather than the full policy value, according to Which?. Eligible UK customers of Premier Insurance are safeguarded by the Financial Services Compensation Scheme (FSCS).

The FCA’s most recent update states: “For all customers, your policy will not be renewed when it comes to an end.

“This means you’ll need to arrange new insurance before your current cover expires to make sure you stay protected.”

It continues: “If you’re affected, your broker will contact you directly to discuss options for arranging alternative cover.

“Motor insurance is compulsory. It is an offence to use your vehicle without it.

“Make sure you have valid insurance cover for your vehicle – if you are not sure if your cover is affected, contact your broker.

“If you need help to secure cover, you may wish to contact your existing broker or the British Insurance Brokers Association (BIBA) who can provide details of brokers that may be able to help you.”

Operating a vehicle without insurance is against the law.

Even for a single day, driving without cover can get you into serious trouble.

If you’re caught, you could be hit with penalties including a £300 fine, six penalty points and an unlimited fine plus driving disqualification if the matter reaches court.

Police also have the power to seize and possibly destroy your vehicle.