It comes as the state pension is set to rise by an even bigger amount than previously thought after a key figure used in the triple lock was revised

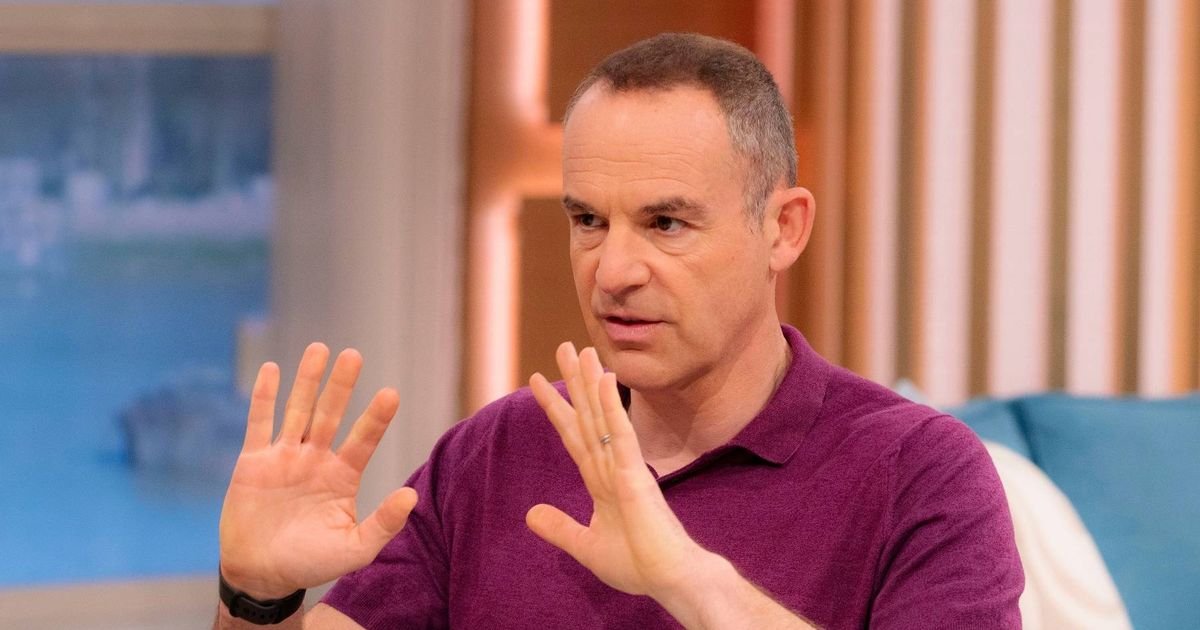

Martin Lewis has warned how “many more” older Brits will soon pay tax on their state pension for the first time from April 2027.

The state pension is set to rise by an even bigger amount than previously thought after a key figure used in the triple lock was revised.

Under the triple lock guarantee, the state pension increases every April in line with whichever is the highest of earnings growth in between May to July, inflation in September, or 2.5%.

Wage growth for May to July was originally thought to be 4.7% but in an update last week, the Office for National Statistics (ONS) revised this figure upwards to 4.8%.

Inflation is currently sat at 3.8% so this means wage growth is likely to be the figure used for the triple lock. The next inflation level will be released this Wednesday and economists predict it will increase to 4% – its highest level for 21 months.

This means the full new state pension should increase from £230.25 a week to £241.30 in April 2026. This will take someone on the full new state pension to £12,548 – which is only £22 below the personal allowance.

This is the amount you can earn tax-free each year. In a post published on X, MoneySavingExpert.com founder Martin Lewis explained in September when the figures were initially announced, how this means more people will pay tax on their state pension income.

Martin Lewis said: “So as state pension income is taxable, that means without any question the following year (unless something changes), those on the full new state pension with no other income will for the first time pay tax on it (as it will rise a minimum 2.5% and personal allowances are frozen).”

However, these figures are only for people claiming the full amount of the new state pension. Your state pension entitlement is based on your National Insurance record you can need 35 years of contributions to get this full amount.

If you have fewer years of contributions, you will receive less state pension when you reach retirement age. You get the new state pension if you’re a man born on or after April 6, 1951, or if you’re a woman born on or after April 6, 1953.

If you’re a man born before April 6, 1951, or a woman born before April 6, 1953, then you will be claiming the old basic state pension, which is less than the new state pension.

The old basic state pension should increase from £176.45 a week to £184.90 from April 2026. Again, this is the full amount you could get, but it depends on your National Insurance record.