In the wake of two major hurricanes, Florida’s former Governor encourages the state to be more pro-active in bringing in insurance outfits as a way of lowering costs.

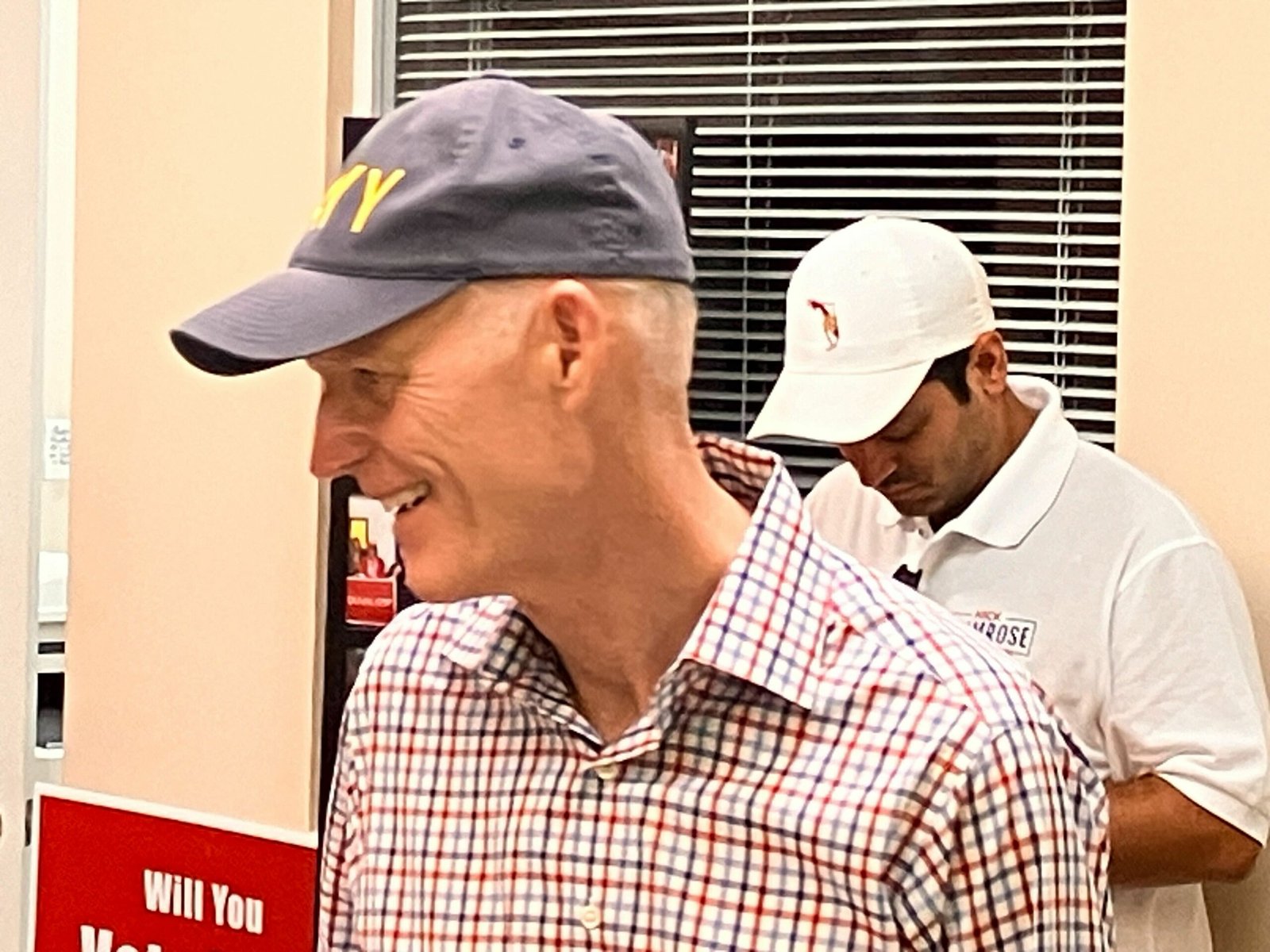

“Recruit more companies,” current Sen. Rick Scott urged during a Friday interview with Orlando’s WKMG.

“If you want prices to come down, you’ve got to do two things,” Scott said. “You got to recruit more companies, and then you’ve got to work with the insurance companies so that they can provide a product that the consumer can afford.”

While the losses from Hurricane Milton aren’t expected to be as bad as 2022’s Hurricane Ian, industry experts tell POLITICO to expect “double digit billion dollar” losses. Other estimates peg the eventual figure as high as $36 billion, with impacts in population centers far away from the center of circulation helping to drive that number up.

Scott hasn’t been shy about criticizing the insurance marketplace under Gov. Ron DeSantis, even though he’s kept the Governor’s name out of his mouth while slamming “skyrocketing” rates in the six years since the Naples Republican exited the Governor’s Mansion and moved to the Senate. Scott said last year that high rates were “bankrupting” the state and described the state’s insurance marketplace as a “disaster,” saying the departure of Farmers Insurance was a “wake-up call” to the state.

The state has an aggressive counter-narrative from a political appointee.

Michael Yaworsky, the head of the state’s Office of Insurance Regulation, pointed earlier this month to “continued strengthening of Florida’s property insurance market, which is contrary to the narrative that has been circulating about our industry in recent months,“ adding that OIR would “continue to work with all carriers in the state to bolster the significant progress that has been made and finish the year on a glidepath to sustained growth.”

Before Milton hit, 15 companies filed for rate decreases, and increases were lagging behind the previous year overall, at 1.6% year-over-year compared to 7% in the previous 12 months.

DeSantis said some days ago it was “too early” to guess at insurance impacts ahead of Milton. But ahead of Hurricane Helene, DeSantis said insurance in the state was in “good shape” with “57 companies filing either no increases or reduction in rates” and “people that are actually increasing their exposure in the state of Florida.”

Post Views: 0