Coloradans enrolling in individual health insurance plans in 2025 will see an average increase of 5.6%. Small-group employers — defined as those with 99 or fewer employees — will have an average increase of around 7%.

These final rate increases, announced by Colorado’s Division of Insurance on Thursday, represent lower increases than in previous years.

“What we’re seeing this year is a little bit lower rate increases in general, which is a good thing,” said Adam Fox, deputy director of the statewide nonprofit advocacy group Colorado Consumer Health Initiative. “Still, we can’t sugarcoat that increases still cause pain and challenges for consumers.”

While the finalized rates still represent an increase on the previous years, the state has made recent policy changes to help curb these spikes.

“From our perspective, what we see is that the state-level policy efforts are helping to control health insurance rates,” Fox said. “But, ultimately, we still want and need to see more from the healthcare industry to control costs.”

These policy changes include the creation of Colorado Option plans in 2023 to create a lower-cost option for individuals and small employers.

In 2025, the average increase for Colorado Option plan premiums is 4.6%, compared to an average of 6.1% for non-Colorado Option plans. Eighty-four Colorado Option plans are being offered by providers to individuals in 2025, along with 278 non-Colorado Option plans.

It also includes impacts of the state’s reinsurance program, which was created by a 2019 bill. The program helps reduce the impact of significant or higher-cost claims on overall premium increases through state subsidies.

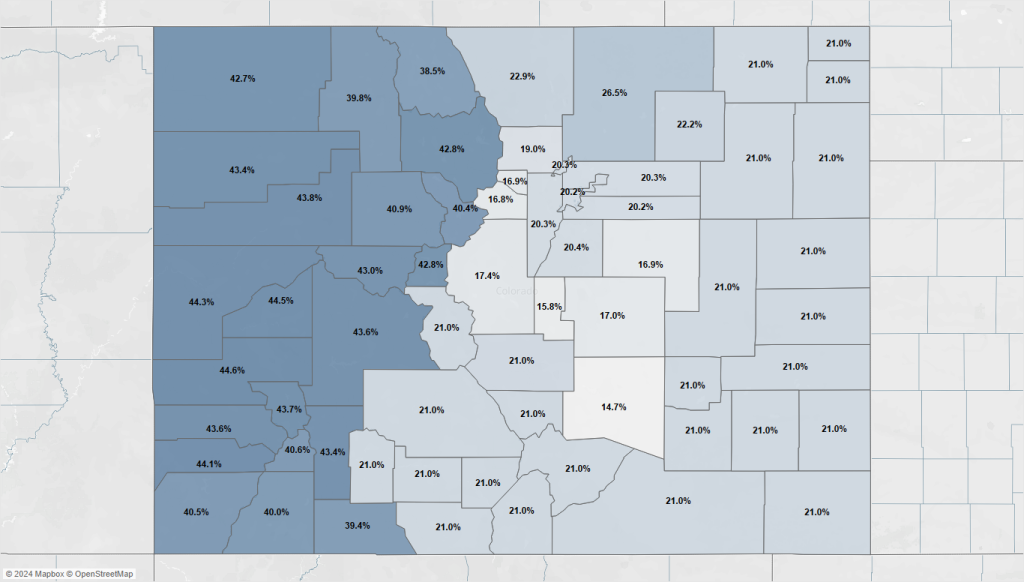

In 2025, on average, insurance premiums would be around 24% higher without this program, the state reports.

These savings are even higher in Colorado’s rural counties, saving around 41% in Eagle County, 44% in Garfield County, 43% in Grand and Pitkin counties, and 40% in Routt and Summit counties.

“In some of the more rural areas or mountain areas where you just don’t have as big a risk pool, essentially, those high-cost claims really have a much more substantial impact on the premiums, so insurers aren’t able to spread sort of those high-cost claims across a bigger risk pool,” Fox said.

In covering some of those more significant claims, reinsurance helps curb the “more substantial swings in the rates based on claims,” he added.

While the average increases for individuals and small employers are closely aligned with the preliminary premium rates proposed in July, the state reported that this year’s review process “saved Coloradans over $15 million.”

For individual plans, Anthem — the largest carrier in Colorado — has the smallest average rate increase over 2024 premiums at 0.1%. For small employers, however, it has the greatest increase at 11.9%, still lower than its proposed increase of 14.43%.

Denver Health Medical Plan has the highest increase for individual plans at 15.8% — higher than the 8.58% it previously proposed — followed by Rocky Mountain HMO with an 8.4% increase. The rates for Cigna, Select Health and Kaiser Foundation Health Plan are all increasing between 7% and 8%.

The lowest rate increase in the small group market was 3.6% from Kaiser Permanente. Kaiser Foundation, United Healthcare Insurance Company and United HealthCare of Colorado will increase by 7%, 5.1% and 6.7%, respectively.

Historically, while rural and western parts of Colorado see higher premiums, rate increases can vary from year to year. In 2024, the state average increase was 9.7% for individual premiums. In the Western rate region, which includes all Western Colorado counties except for Mesa County, the average increase was 9.5%.

In 2025, the individual premium increases are expected to increase by an average of 4.5% in Summit County, 3.4% in Eagle County, 2.5% in Routt County, 7% in Grand County, 7.4% in Garfield County, and 7.4% in Pitkin County.

For small employers, the average increase will be 8.7% in Summit, 9.2% in Eagle, 7.9% in Grand, 8.1% in Garfield, 10.2% in Routt and 7.1% in Pitkin.

Open enrollment begins on Nov. 1 for Colorado’s individual and small group health insurance plans. More information on the 2025 plans, premiums and financial assistance will be available Oct. 22 on Connect for Health Colorado, the state’s marketplace for health insurance.

“It’s really important to always look at your options and shop around, especially if they’re purchasing through Connect for Health Colorado because, in many cases, they can avoid premium increases or potentially find savings,” Fox said.

Open enrollment for Medicare is underway

Open enrollment for Medicare — the federal coverage program for individuals over 65 or younger individuals with a disability — began on Oct. 15 and will end on Dec. 7.

Traditional Medicare coverage — run by the federal government for hospital stays and outpatient services — does not change year to year. However, there are changes to Medicare Advantage plans — run by private insurance providers — and prescription drug plans. Enrollment for Advantage plans accounts for around 50% of Medicare enrollees.

In September, the Centers for Medicare & Medicaid Services reported that on average, Advantage premiums are expected to decrease by an average of $1.23 in 2025. Prescription premiums, under Medicare Part D plans, are also expected to decrease by an average of $7.45 in 2025.